Solar Tax Rebate Count As Deduction Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

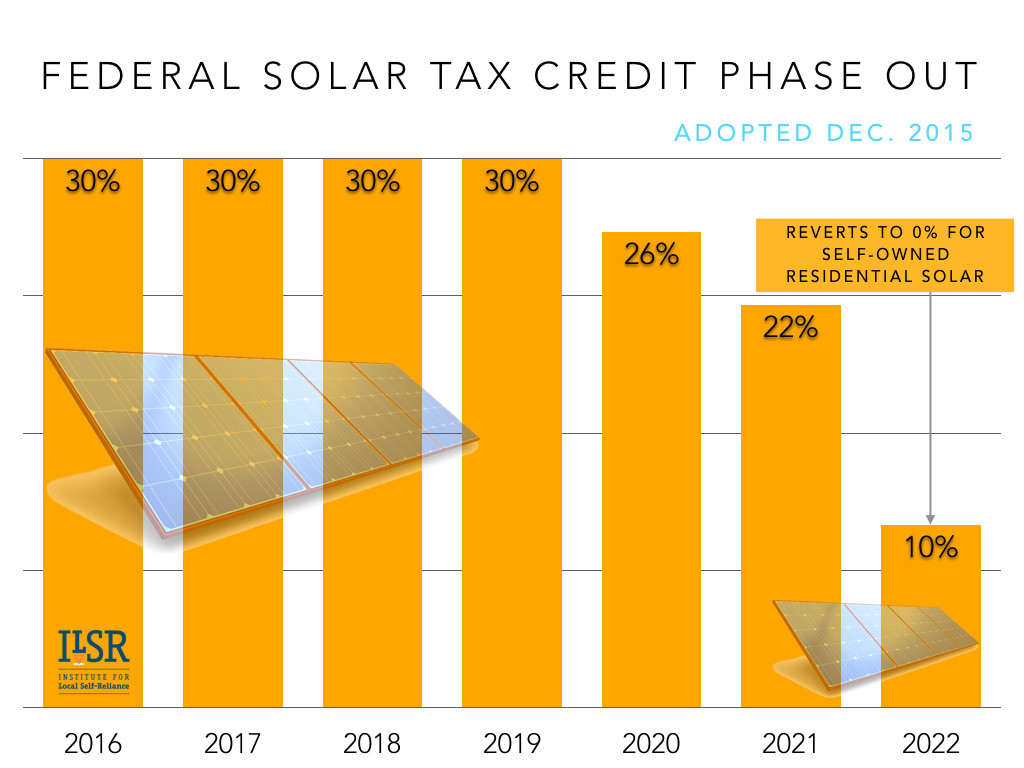

Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Solar Tax Rebate Count As Deduction

Solar Tax Rebate Count As Deduction

https://solarsme.com/wp-content/uploads/2023/06/tax.jpg

What The Solar Tax Rebate Means For Your Small Business

https://media.citizen.co.za/wp-content/uploads/2023/03/small-business-solar.jpg

2019 Texas Solar Panel Rebates Tax Credits And Cost

https://www.flaminke.com/wp-content/uploads/2019/10/rule-11-agreement-texas-beautiful-2019-texas-solar-panel-rebates-tax-credits-and-cost-of-rule-11-agreement-texas.png

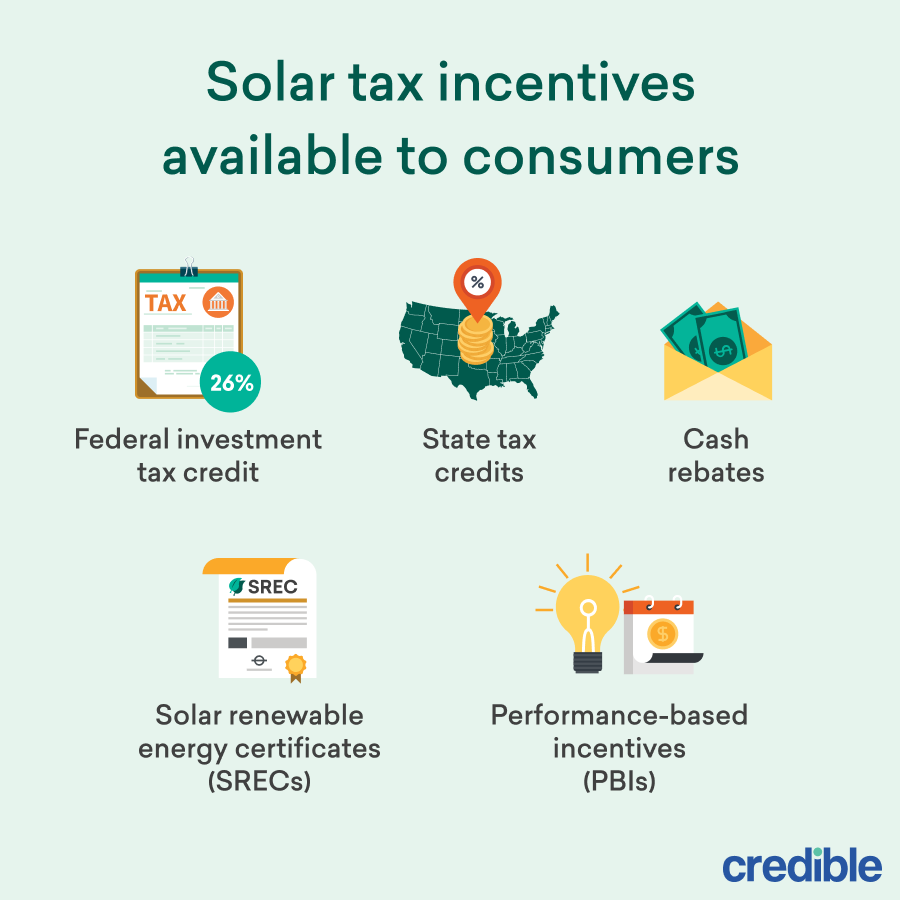

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing Web 7 ao 251 t 2023 nbsp 0183 32 When you purchase a solar photovoltaic PV system during the tax year you are eligible for a Federal Solar Tax Credit that you can claim on your federal income

Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Web 4 avr 2023 nbsp 0183 32 Discover the tax incentive programmes for renewable energy in South Africa including solar panel rebates for individuals and businesses Learn how to take

Download Solar Tax Rebate Count As Deduction

More picture related to Solar Tax Rebate Count As Deduction

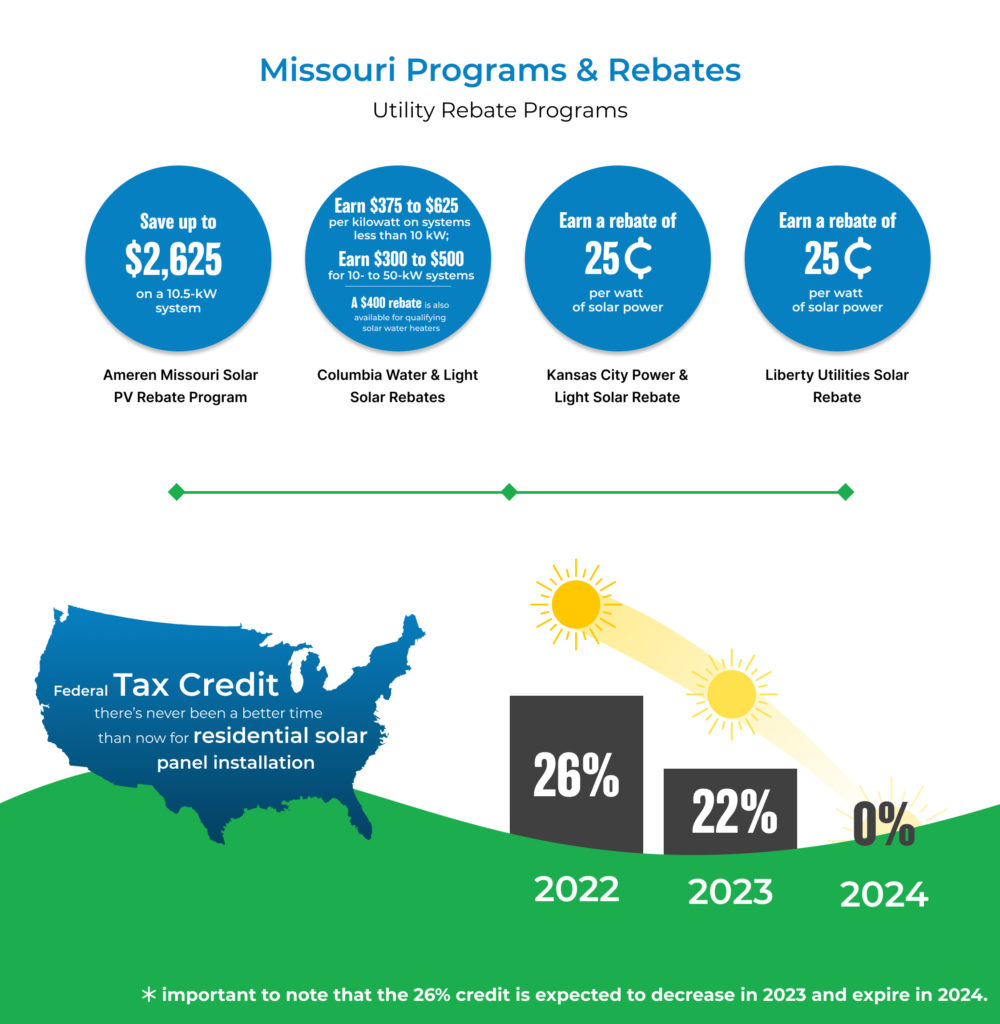

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

Congress Gets Renewable Tax Credit Extension Right Institute For

https://ilsr.org/wp-content/uploads/2016/01/federal-solar-tax-credit-phase-out-ILSR-2015-1024x768.jpeg

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2019/01/tax-credit-change-.jpg

Web 31 ao 251 t 2022 nbsp 0183 32 You ll receive a 26 tax credit if your system is installed before the end of 2022 22 credit if installed in 2023 This applies to the total cost of your system including contracted labor What Portable Web Individuals will be able to claim a rebate to the value of 25 of the cost of new and unused solar photovoltaic PV panels up to a maximum of R15 000 per individual For

Web In respect of photovoltaic solar energy of more than one megawatt a taxpayer is allowed a deduction of the costs to the taxpayer of the asset producing the electricity on a 50 30 20 basis In other words one is Web 8 sept 2023 nbsp 0183 32 The total cost of solar panels in California generally ranges between 15 000 and 25 000

FINANCE Archives Knowledge Reason

https://knowledgereason.com/wp-content/uploads/2023/06/Picture1-7-890x530.jpg

Solar Tax Credit Calculator KareenRoabie

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/solar-tax-credit-before-and-after-inflation-reduction-act-1024x1013.jpg

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

https://www.energy.gov/eere/solar/articles/sol…

Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed

Solar Power Incentives Rebates And Tax Credits Canada 2018

FINANCE Archives Knowledge Reason

NJ Solar Incentives Tax Credits Rebates Sunlynk

Affordable Solar Program Launched In New Mexico For Middle Class

Tax Rebates For Solar Power Ineffective For Low income Americans But

Solar Tax Credit Calculator NikiZsombor

Solar Tax Credit Calculator NikiZsombor

State of New Mexico Incentive Area Solar Energy Gross Receipts Tax

2019 Texas Solar Panel Rebates Tax Credits And Cost

Standard Deduction Tax Rebate EXPLAINED In New Tax Regime With

Solar Tax Rebate Count As Deduction - Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing