Solar Tax Rebate For 2024 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

1 How does the 2024 federal solar tax credit work The solar tax credit is a dollar for dollar reduction of what you owe in federal income taxes So if you owed 15 000 in income taxes and earned a 6 000 solar tax credit your tax liability would drop to 9 000 Will the tax credit increase my tax refund

Solar Tax Rebate For 2024

Solar Tax Rebate For 2024

https://media.citizen.co.za/wp-content/uploads/2023/03/small-business-solar.jpg

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

Solar Tax Credits And Rebates In Colorado

https://image.slidesharecdn.com/solarisesolar-210127113258/95/solar-tax-credits-and-rebates-in-colorado-3-1024.jpg?cb=1611747298

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

The 2024 program opening next year will unlock additional capacity for this robust demand Act the largest climate investment in history provides a 10 or 20 percentage point boost to the Investment Tax Credit for qualified solar or wind facilities in low income communities The goals of the program are to increase access to clean Sales taxes on eligible expenses How Will the Solar Tax Credit Save You Money The credit lowers your federal taxes So if you spend 24 000 on a system you can subtract 30 percent of that

Download Solar Tax Rebate For 2024

More picture related to Solar Tax Rebate For 2024

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance Tax credits for solar panels and other products can reduce purchase costs by upwards of 30 while also saving on monthly energy bills Best of all these upgrades save you money and our planet Making home upgrades for 2024 is a great way to cut your energy costs conserve energy reduce your carbon footprint and heal the planet for

The Federal Solar Tax Credit covers 30 of the following Solar powered equipment that generates electricity or heats water Solar power storage equipment for 2022 but a capacity of at least 3 kilowatt hours kWh is required beginning in 2023 Qualifying installation and labor costs Sales taxes paid for eligible solar installation expenses House Houseboat Mobile home Cooperative apartment

Solar Tax Credit Calculator NikiZsombor

https://www.credible.com/blog/wp-content/uploads/2021/07/Solar-tax-incentives-available-to-consumers-infographic.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

1

Income Tax Rebate Under Section 87A

Solar Tax Credit Calculator NikiZsombor

Missouri Solar Incentives StraightUp Solar

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

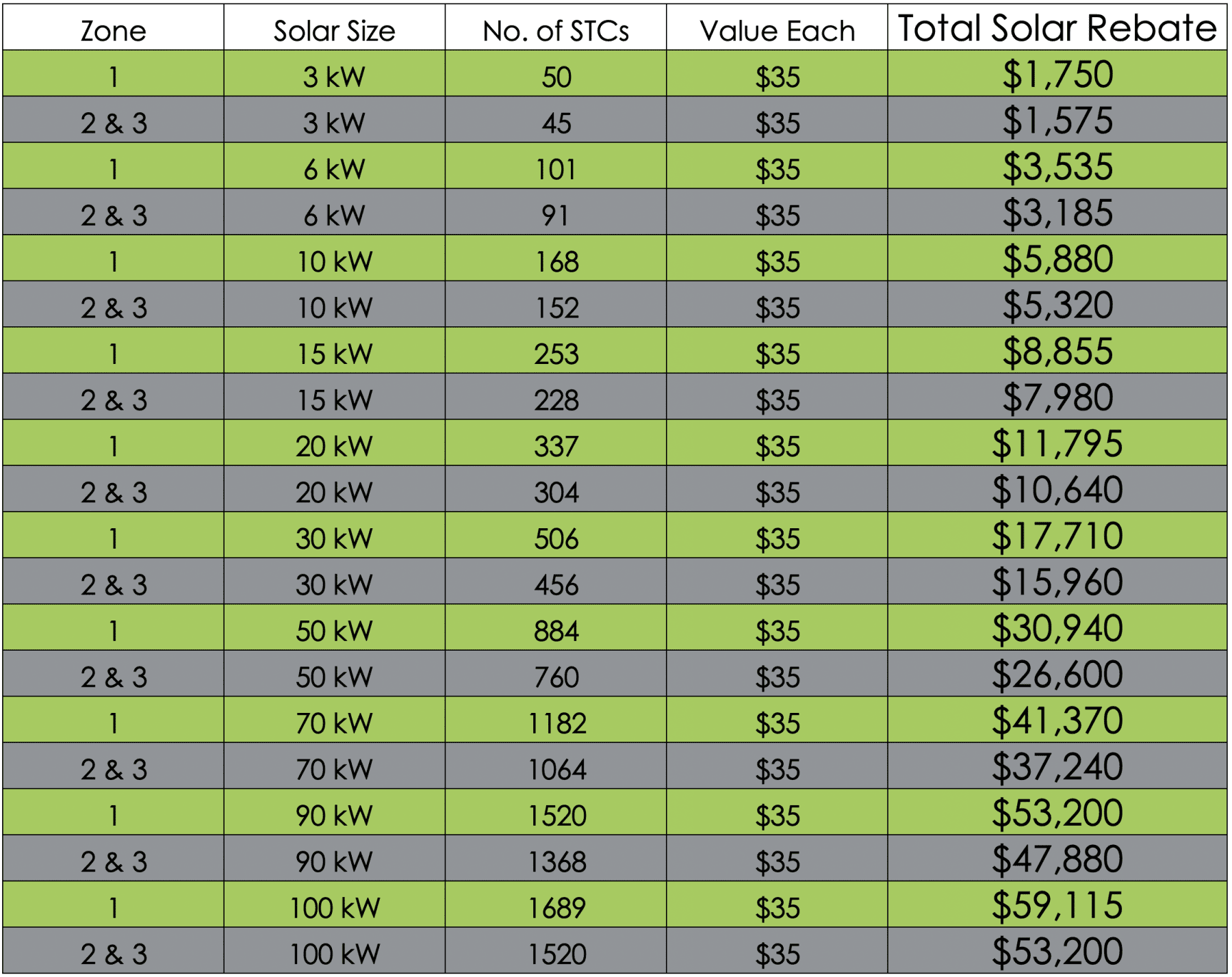

How Much Is The Solar Rebate In Queensland QLD GI Energy

Property Tax Rebate Pennsylvania LatestRebate

Best Tax Rebate Calculator In UK 2022 Business Lug

Solar Tax Rebate For 2024 - However starting in 2022 those who installed new solar panels or invested in an off site community solar project could get a tax credit of up to 30 percent through the Residential Clean Energy