Solar Tax Rebates 2024 The amount available for solar tax credits can vary depending on what you spent on the project and when you completed it Solar tax credit 2024 The solar panel tax credit for 2023 taxes

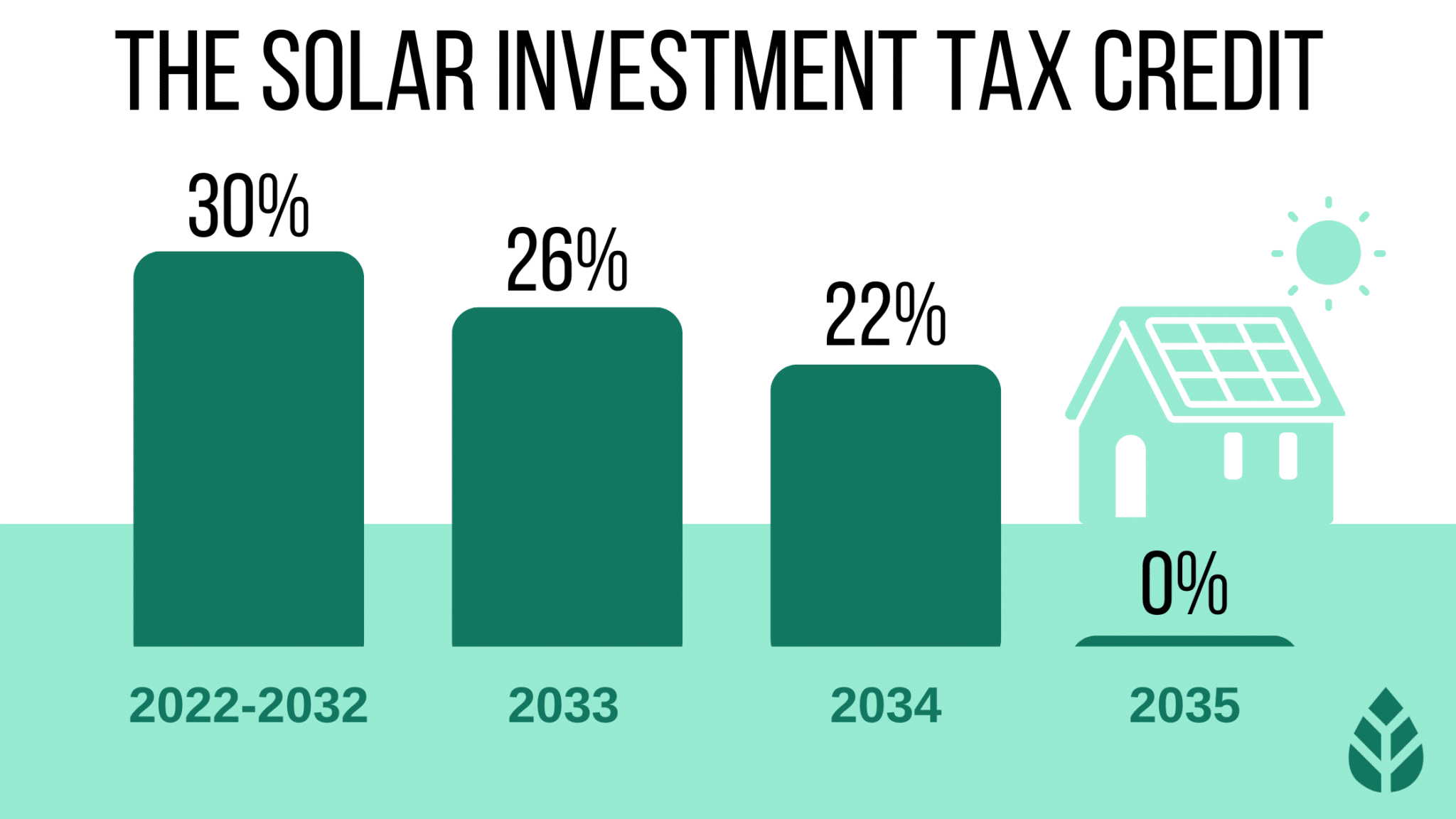

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 You may be able to take the credit if you

Solar Tax Rebates 2024

Solar Tax Rebates 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Complete Guide For WA Solar Panel Rebates 2023

https://www.empowersolaraustralia.com.au/wp-content/uploads/2023/05/d235aa88-c955-4234-ae4c-5b9c2f6a3814.jpg

Guide To Solar Incentives Tax Credits Leasing Rebates

https://www.edelmaninc.com/wp-content/uploads/2023/06/solar-tax-credits.png

The solar tax credit equals 30 of solar installation costs in 2024 The average solar installation costs around 20 000 and the typical tax credit value is about 6 000 The total value of the solar tax credit will depend on the solar installation cost The following table outlines estimated tax credit values for solar installations of The installation of the system must be complete during the tax year Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible

Federal tax credit The federal solar tax credit offers new solar owners in the United States a tax credit equal to 30 of costs they paid for their solar installation The tax credit is designed to step down to 26 in 2033 22 in 2034 then settle at a permanent rate of 10 for commercial solar installations and will be eliminated for homes Thanks to the new tax credits and rebates they ll come at a significant discount for qualified households Households with income less than 80 of AMI 840 rebate up to 100 of equipment and installation costs Households with income between 80 150 AMI 840 rebate up to 50 of equipment and installation costs

Download Solar Tax Rebates 2024

More picture related to Solar Tax Rebates 2024

Utilising Solar Rebates For Your Commercial Interests

https://www.13kuga.com.au/wp-content/uploads/2022/11/Solar-rebates-1200x784.png

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

Tax Rebates For Solar Power Ineffective For Low income Americans But Study Finds A Different

https://scx2.b-cdn.net/gfx/news/2022/tax-rebates-for-solar.jpg

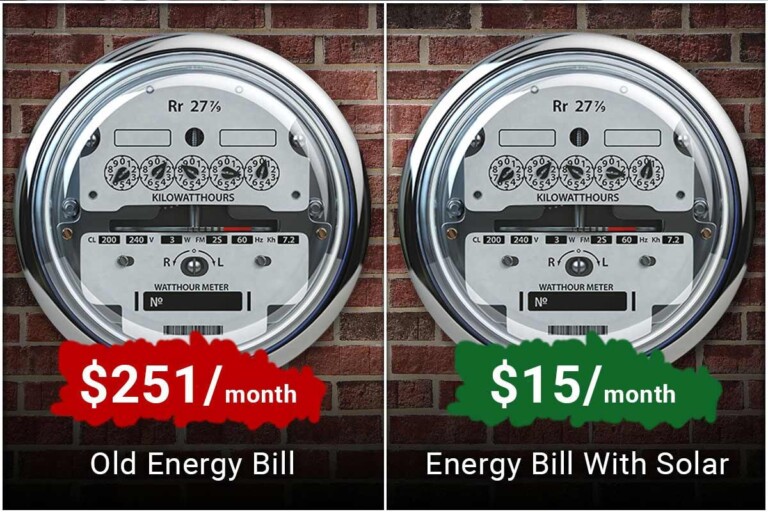

The credit lowers your federal taxes So if you spend 24 000 on a system you can subtract 30 percent of that or 7 200 from the federal taxes you owe You must take the credit for the year For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows 0 26 18 000 1 000 4 420 Payment for Renewable Energy Certificates

In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar system installations on residential property 2024 Intuit will assign you a tax expert based on availability Tax expert and A percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30

Tax Rebates Solar Company In Gilbert Arizona 85234

https://solarcompanygilbert.com/wp-content/uploads/2023/04/AdobeStock_167724086-1.jpeg

Solar Tax Credits And Rebates In Colorado

https://image.slidesharecdn.com/solarisesolar-210127113258/95/solar-tax-credits-and-rebates-in-colorado-3-1024.jpg?cb=1611747298

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The amount available for solar tax credits can vary depending on what you spent on the project and when you completed it Solar tax credit 2024 The solar panel tax credit for 2023 taxes

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

MA Solar Incentives 2022 Solar Tax Rebates Free Consultation

Tax Rebates Solar Company In Gilbert Arizona 85234

Texas Solar Incentives Tax Credits Rebates More In 2023

Government Solar Tax Rebates V2 The Price Chopper

Solar Tax Credits Rebates Missouri Arkansas

Solar Panel Rebates Incentives Grants Available In Alberta

Solar Panel Rebates Incentives Grants Available In Alberta

Illinois Tax Rebates For Solar Panels Electric Cars And Chargers Save Money And Environment

Solar Energy Rebates Incentives And Tax Credits Florida Independent

2023 Residential Clean Energy Credit Guide ReVision Energy

Solar Tax Rebates 2024 - The solar tax credit equals 30 of solar installation costs in 2024 The average solar installation costs around 20 000 and the typical tax credit value is about 6 000 The total value of the solar tax credit will depend on the solar installation cost The following table outlines estimated tax credit values for solar installations of