Sole Parent Tax Rebate Web 9 avr 2021 nbsp 0183 32 Parent solo 224 quelles aides ai je droit En France selon les derniers chiffres de l Insee datant de 2018 4 millions d enfants mineurs vivent avec un seul de leurs

Web You can only claim this base amount if you were a sole parent at any time during the income year and your usual place of residence is in a remote area of Australia or serve Web Find out how tax offsets can reduce the tax you pay Check if you are eligible for the low income tax offset LITO and the low and middle income tax offset LMITO Check if you

Sole Parent Tax Rebate

Sole Parent Tax Rebate

https://www.aph.gov.au/~/media/wopapub/senate/committee/clac_ctte/completed_inquiries/2004_07/welfare_to_work/report/d01_2_jpg.ashx

:max_bytes(150000):strip_icc()/ScheduleC1-7818321402c0410ba4c212ca697c6227.jpg)

What Is Schedule C Who Can File And How To File For Taxes

https://www.investopedia.com/thmb/QpnEUa7iSK-AXfNTbsyq_wev22Q=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScheduleC1-7818321402c0410ba4c212ca697c6227.jpg

Advice For Sole Parents Parental As Anything ABC Australia YouTube

https://i.ytimg.com/vi/SK37m2ZR3OQ/maxresdefault.jpg

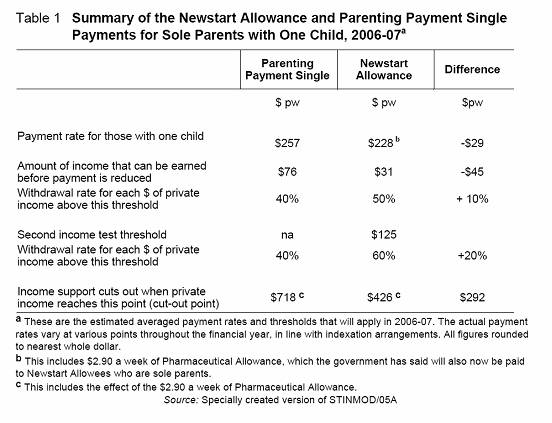

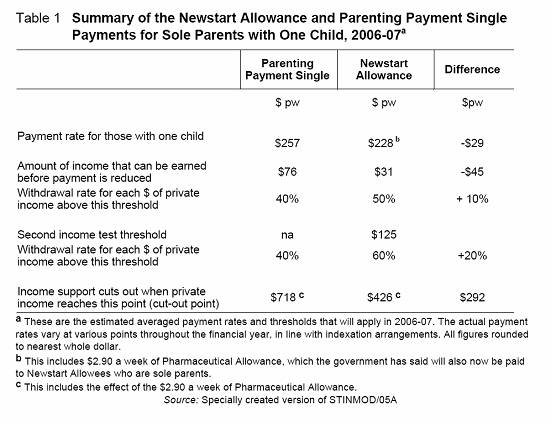

Web FACTS 1 Consideration has been given to the question whether a part year sole parent rebate under section 159K 2 may be allowed to a divorced or separated parent who Web 14 ao 251 t 2023 nbsp 0183 32 sole parent rebate Payments under the government s new tax package came into effect on 1 July 2000 At that time provisions related to FA were repealed from

Web Sole parents and couples including de facto couples are subject to family tiers For families with children thresholds are increased by 1 500 for each child after the first Web Seniors and retirees including self funded retirees may be eligible to claim a tax offset if you meet the conditions set out below However you can t claim this tax offset if you

Download Sole Parent Tax Rebate

More picture related to Sole Parent Tax Rebate

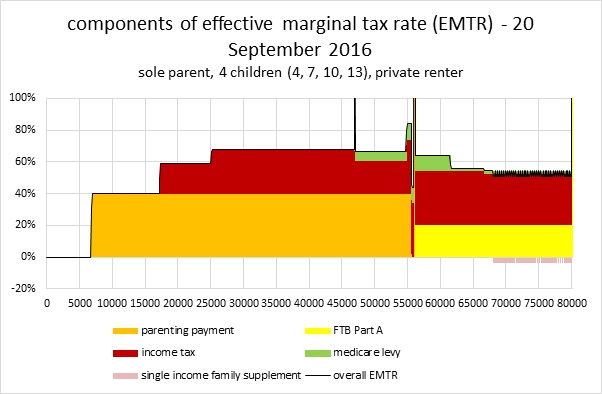

Does It Pay To Work The Case Of A Single Parent With 4 Children

https://www.austaxpolicy.com/wp-content/uploads/2017/01/Figure1SoleParents.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

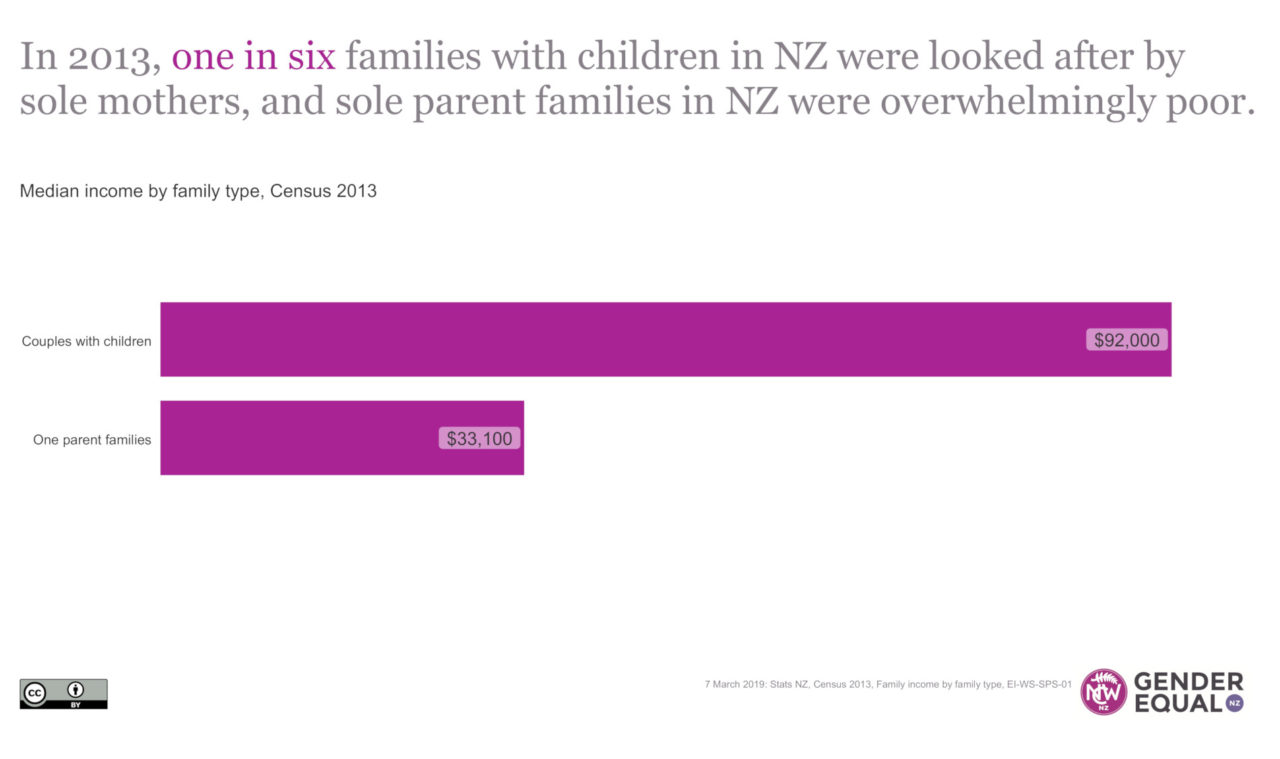

Sole Parents Need A Living Wage Gender Equal NZ

https://genderequal.nz/wp-content/uploads/2019/03/EI-WS-SPS-Draft-2019-03-07-Final-2-1-1280x759.jpg

Web 1 janv 2023 nbsp 0183 32 The sole earner and single parent credits increase by 232 Euro until 2022 220 Euro in each case for each additional child Web Increase to Parenting Payment Partnered rate from 20 September 2023 Payment rates It also depends on your and your partner s income and assets We update rates on 20

Web Child Student In order that the correct notional amount 376 for each Student under 25 and 376 for the first child under 21 and 282 for each subsequent child under 21 Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

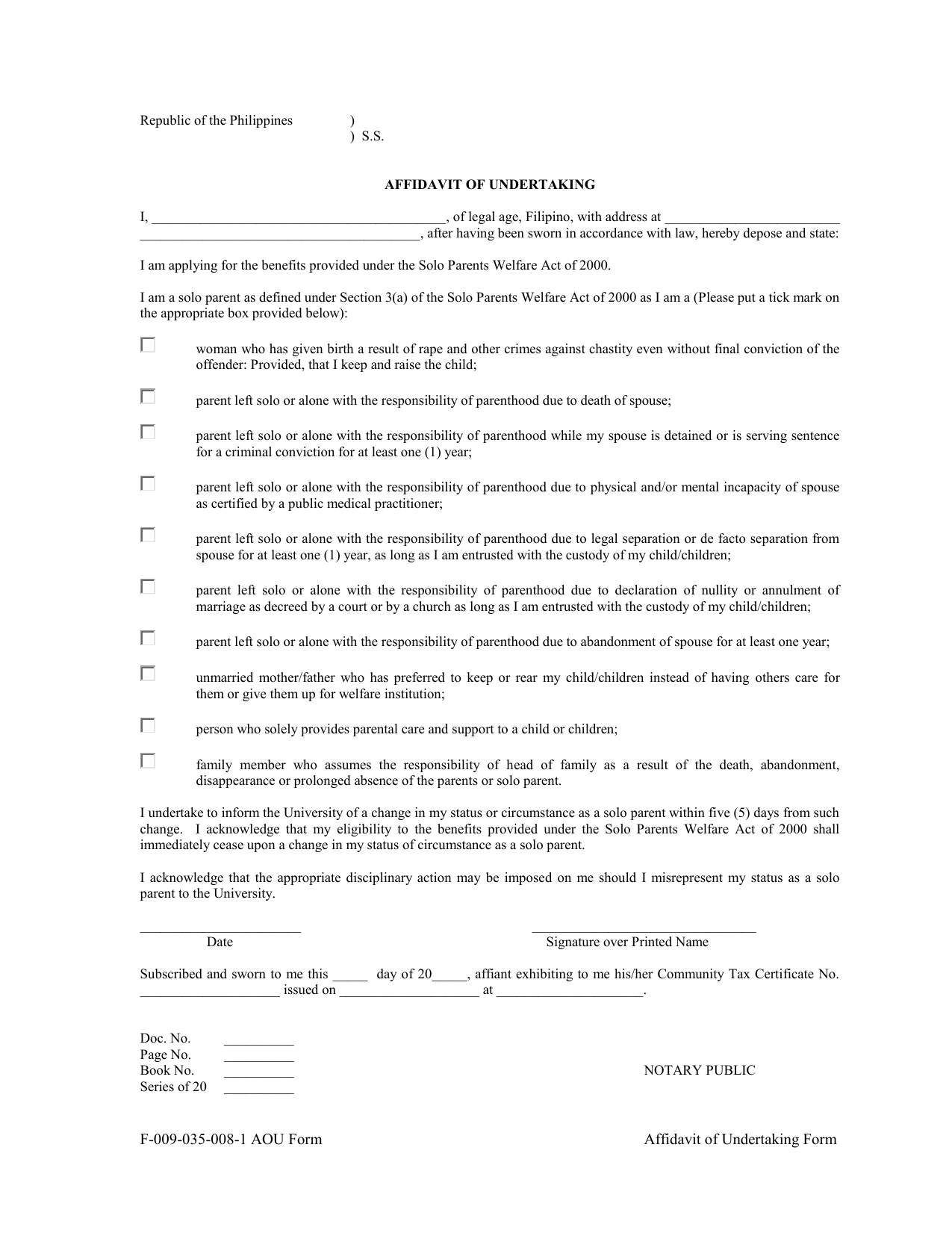

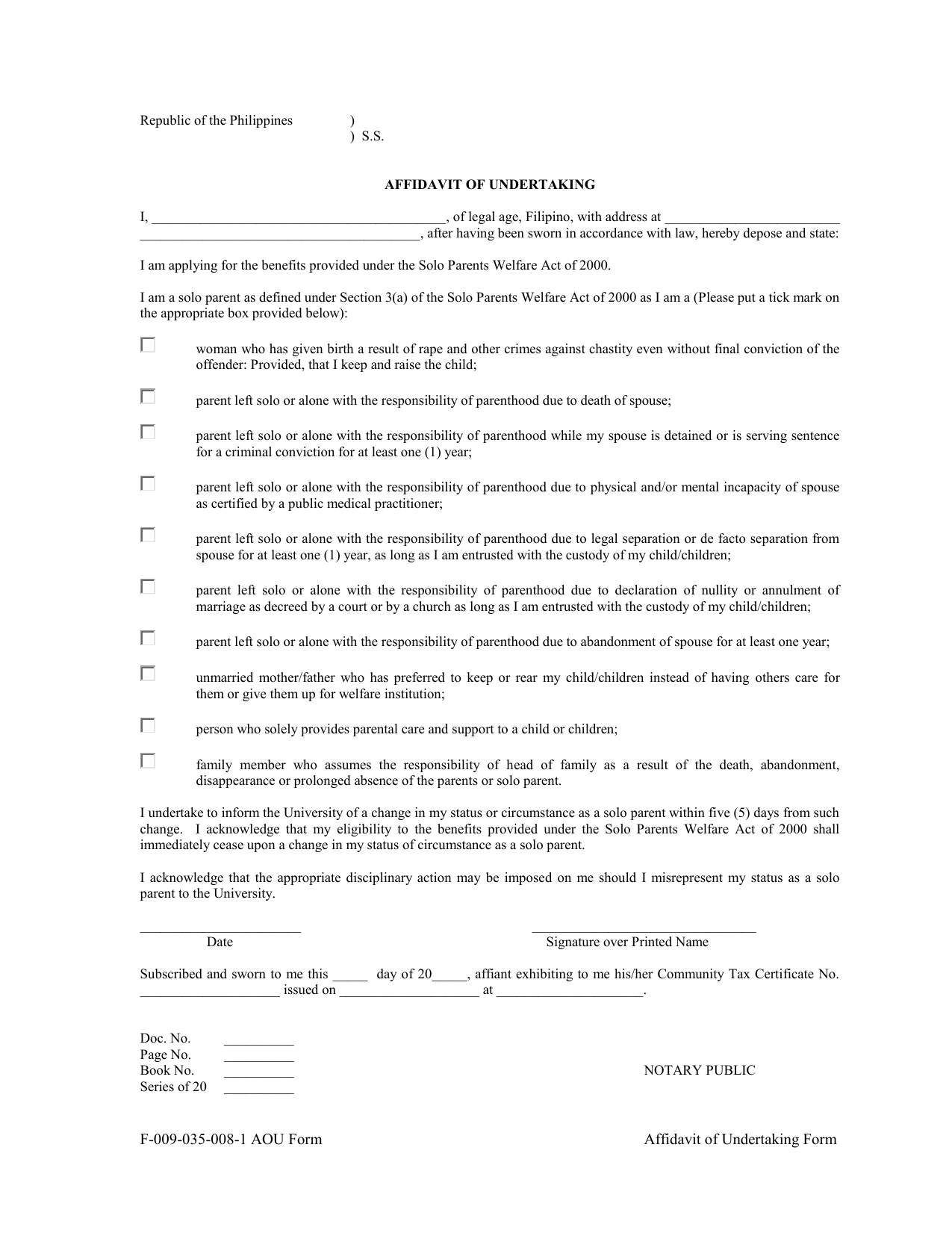

Legal Undertaking Template

https://s3.studylib.net/store/data/025220611_1-e92533fe7712549779b5d23939ec0789.png

Nearly 800 000 Parents California Tax Rebate Fair Game For Garnishing

https://bloximages.newyork1.vip.townnews.com/thecentersquare.com/content/tncms/assets/v3/editorial/c/59/c59d0fae-3eac-11ed-8eee-a3590b0ff792/63336d8936bf1.image.jpg?resize=990%2C660

https://www.aufeminin.com/enfant/maman-solo-s4023832.html

Web 9 avr 2021 nbsp 0183 32 Parent solo 224 quelles aides ai je droit En France selon les derniers chiffres de l Insee datant de 2018 4 millions d enfants mineurs vivent avec un seul de leurs

:max_bytes(150000):strip_icc()/ScheduleC1-7818321402c0410ba4c212ca697c6227.jpg?w=186)

https://www.ato.gov.au/.../?anchor=Zone_Tax_Offsets

Web You can only claim this base amount if you were a sole parent at any time during the income year and your usual place of residence is in a remote area of Australia or serve

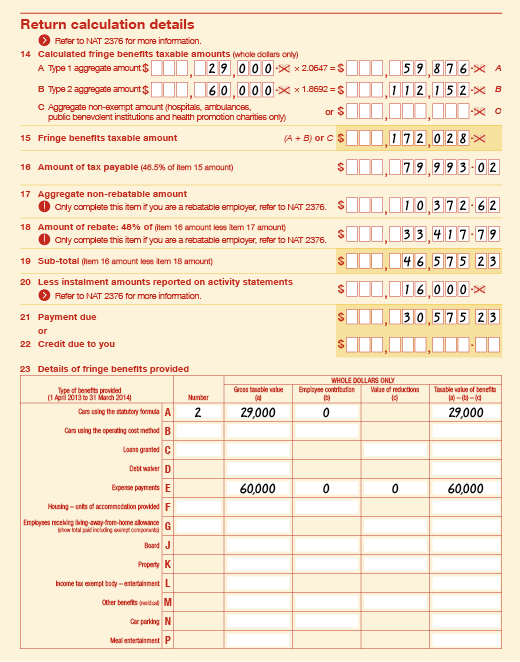

Are Fringe Benefits Taxable Income

Legal Undertaking Template

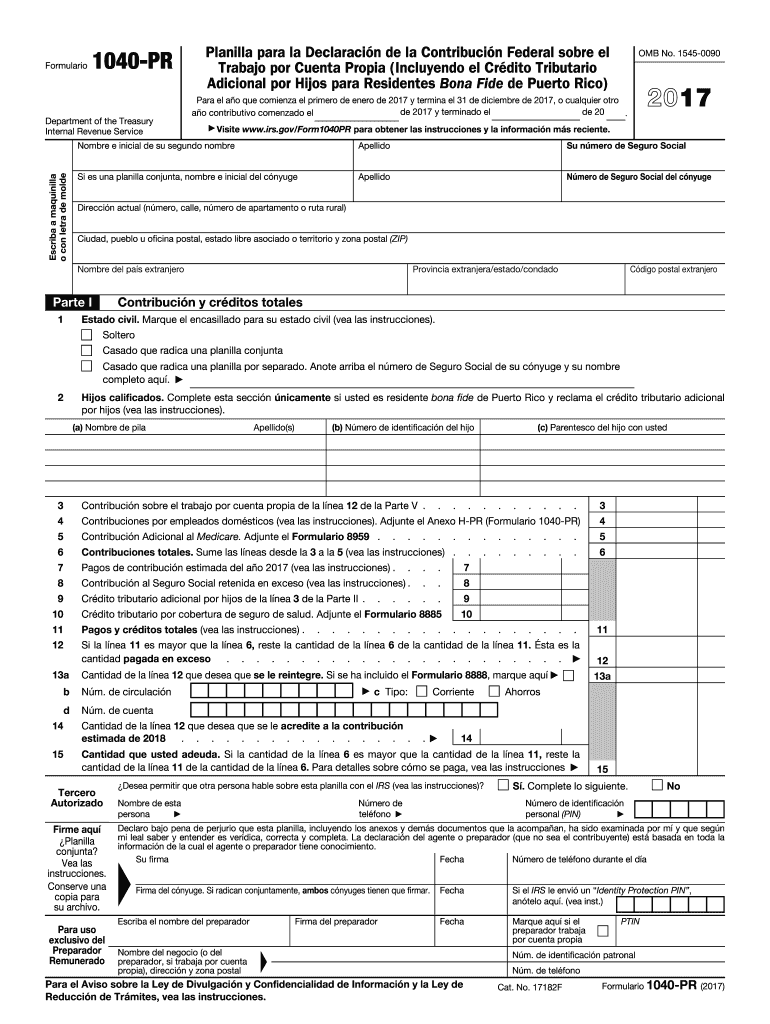

1040pr 2017 Form Fill Out Sign Online DocHub

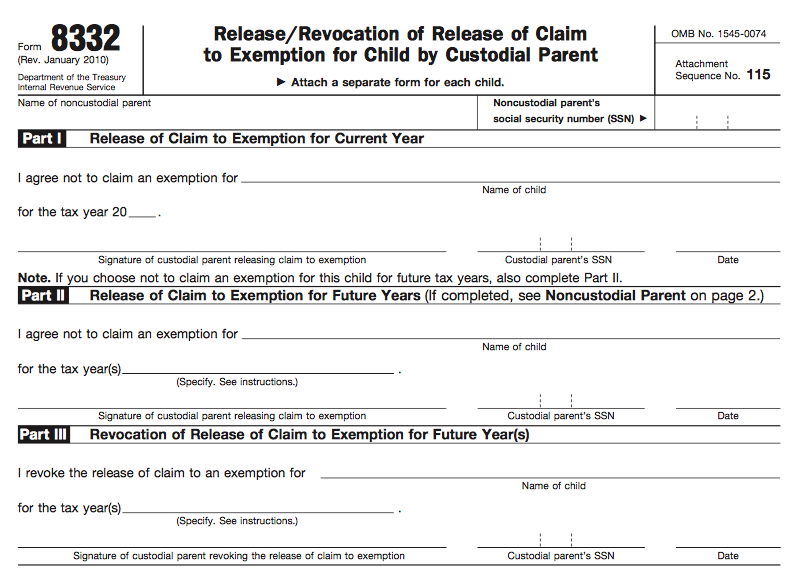

Printable 8332 Form Printable Forms Free Online

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

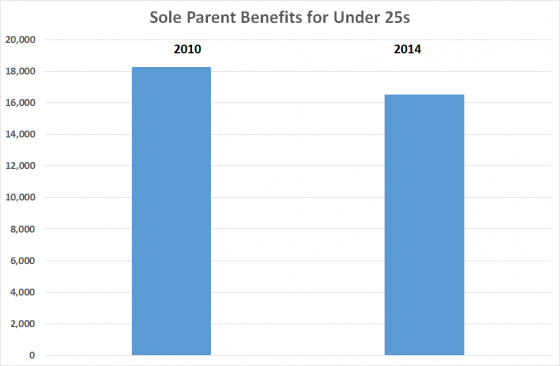

Issues That Matter Welfare Kiwiblog

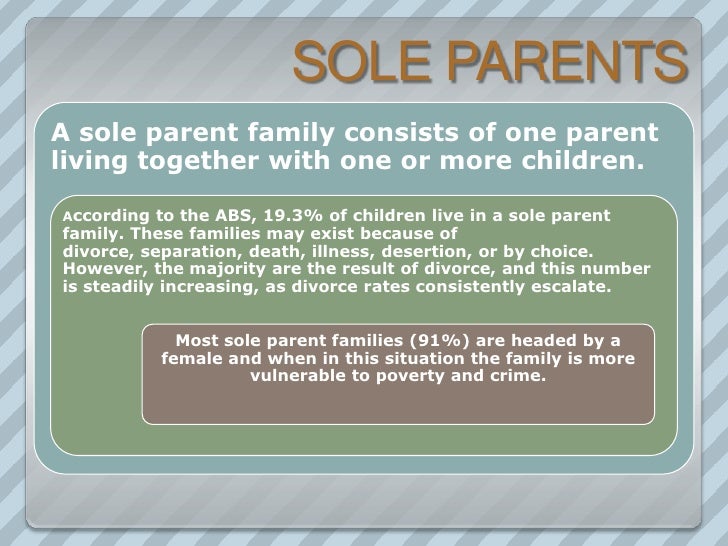

Powerpoint Sole Parents

More Than A Quarter Of US Children Live With A Sole Parent Chart

Sole Parent Tax Rebate - Web How to claim Complete the following steps to claim Family Tax Benefit Before you start check if you can get it