South Carolina Motor Fuel Income Tax Credit Use I 385 to claim a refundable Income Tax credit for the amount you paid during the tax year for the increase in motor fuel user fee or preventative maintenance costs

You will need a MyDORWAY account to apply for Motor Fuel refunds Who may file Individuals who have purchased motor fuel that is exempt from the motor fuel user fee Learn how to use the SC Gas Tax Credit App to track your gas receipts and auto maintenance costs for the state s Motor Fuel Income Tax Credit Find out what t

South Carolina Motor Fuel Income Tax Credit

South Carolina Motor Fuel Income Tax Credit

https://millikenperkins.com/wp-content/uploads/2014/05/658198_44079665.jpg

/cloudfront-us-east-1.images.arcpublishing.com/gray/3RGACTEFYNF63GMXQHWFDSXSDQ.jpg)

How S C Drivers Can Claim A Gas Tax Credit In 2020

https://gray-wistv-prod.cdn.arcpublishing.com/resizer/BXfT7Zp_7BG8g2q9Biebvuj5TIM=/1200x675/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/3RGACTEFYNF63GMXQHWFDSXSDQ.jpg

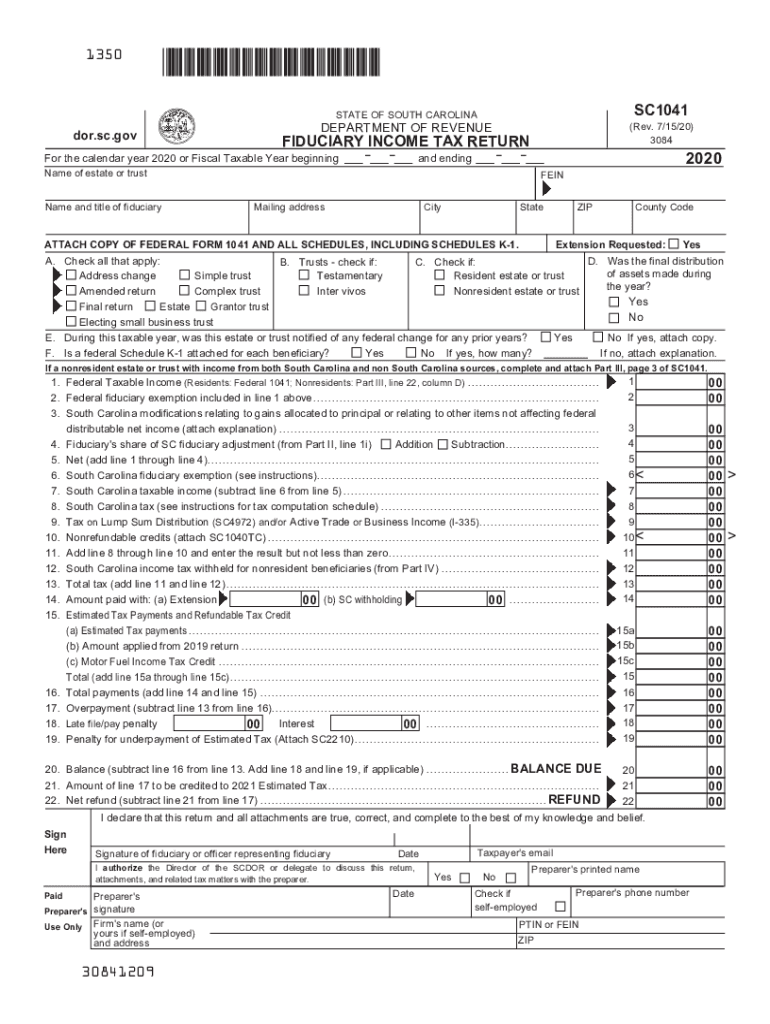

SC DoR SC1041 2020 2022 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/552/450/552450635/large.png

The South Carolina Department of Revenue Oct 19 2022 released Form I 385 2022 Motor Fuel Income Tax Credit The individual income corporate income and You can submit the receipts and fill out the Motor Fuel Income Tax Credit I 385 form available at dor sc gov forms before filing taxes next year The gas tax is

When filing income tax returns claim the credit on the Motor Fuel Income Tax Credit I 385 form available at dor sc gov forms and included in many online filing With SC Gas Tax Credit App you can Automatically produce the information to file the Motor Fuel Income Credit Form I385 Easily document and track fuel purchases and preventative maintenance for up

Download South Carolina Motor Fuel Income Tax Credit

More picture related to South Carolina Motor Fuel Income Tax Credit

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Earned Income Tax Credit EITC Get Your Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

A State Earned Income Tax Credit Would Aid Pa Working Families

https://www.gannett-cdn.com/presto/2022/02/07/NETN/fea7d07e-330c-4d39-a52b-f73203782a0f-MarybelleMartin.jpg?crop=5503,3095,x0,y1651&width=3200&height=1800&format=pjpg&auto=webp

The revenue and fiscal affairs office provides projections on motor fuel revenue data on historical revenue distributions and information on Motor fuel user fees The credit is calculated on South Carolina Form I 385 Motor Fuel Income Tax Credit This form must be included with the resident taxpayer s income tax return

More from the motor fuel user fee credit The refundable credit has been increased from 0 09 a gallon to 0 11 a gallon for tax year 2022 What is the Motor Fuel Income Tax Credit South Carolina taxpayers can claim this Income Tax credit on the lesser of the increase in the Motor Fuel User Fee

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Mace Advantage VP Coming To SC Deputy Charged Staley On Fresh

https://www.nowchs.com/wp-content/uploads/2022/06/283876840_569481614546532_6689290307946676313_n-768x511.jpg

https://dor.sc.gov/forms-site/Forms/I385_2021.pdf

Use I 385 to claim a refundable Income Tax credit for the amount you paid during the tax year for the increase in motor fuel user fee or preventative maintenance costs

/cloudfront-us-east-1.images.arcpublishing.com/gray/3RGACTEFYNF63GMXQHWFDSXSDQ.jpg?w=186)

https://dor.sc.gov/tax/motor-fuel/refunds-exemptions

You will need a MyDORWAY account to apply for Motor Fuel refunds Who may file Individuals who have purchased motor fuel that is exempt from the motor fuel user fee

Where s My Refund Up As Well As All IRS Systems Refund Schedule 2022

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

South Carolina Passes EITC But We Can Do Better The Progressive Pulse

SC Gas Tax Credit App Apps On Google Play

Michigan Gas tax Suspension Bill Could Be Headed For Veto Whitmer

South Carolina Department Of Revenue Motor Fuel User Fee Bond EZ

South Carolina Department Of Revenue Motor Fuel User Fee Bond EZ

SC Gas Tax Credit App En App Store

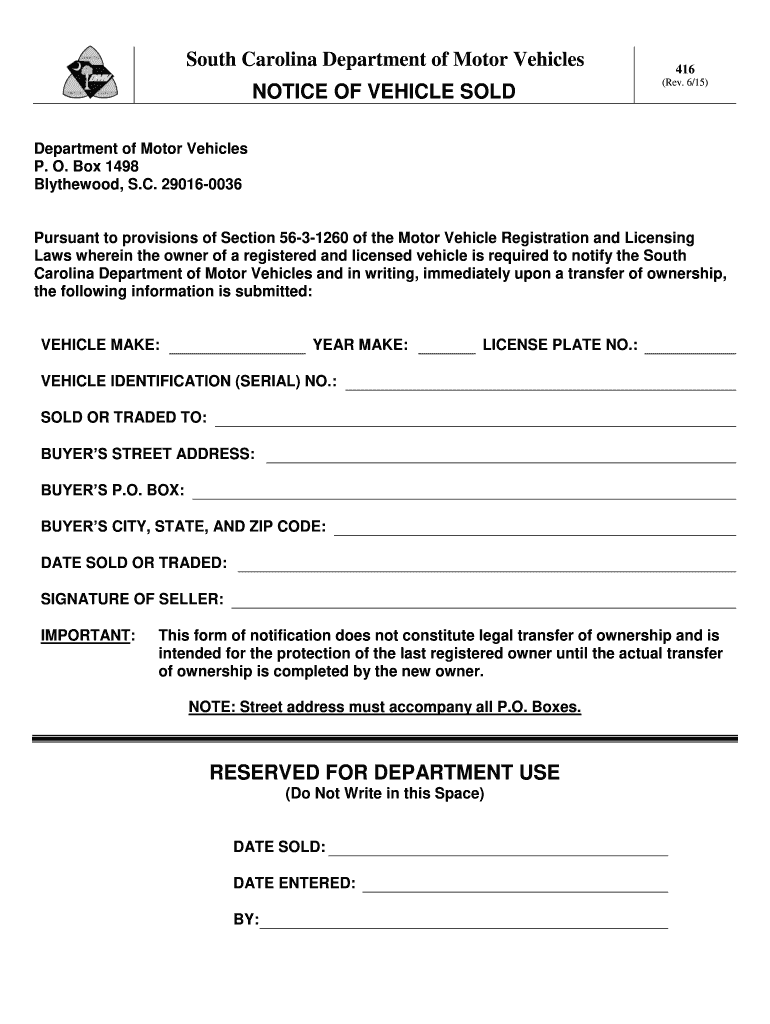

Free South Carolina Motor Vehicle Bill Of Sale Form Legal Templates

South Carolina Motor Vehicle Bill Of Sale Download Printable Pdf

South Carolina Motor Fuel Income Tax Credit - The South Carolina Department of Revenue Oct 19 2022 released Form I 385 2022 Motor Fuel Income Tax Credit The individual income corporate income and