South Dakota Sales Tax Exemption Nonprofit There are four reasons that products and services would be exempt from South Dakota sales tax The purchaser is a tax exempt entity The product or service is specifically

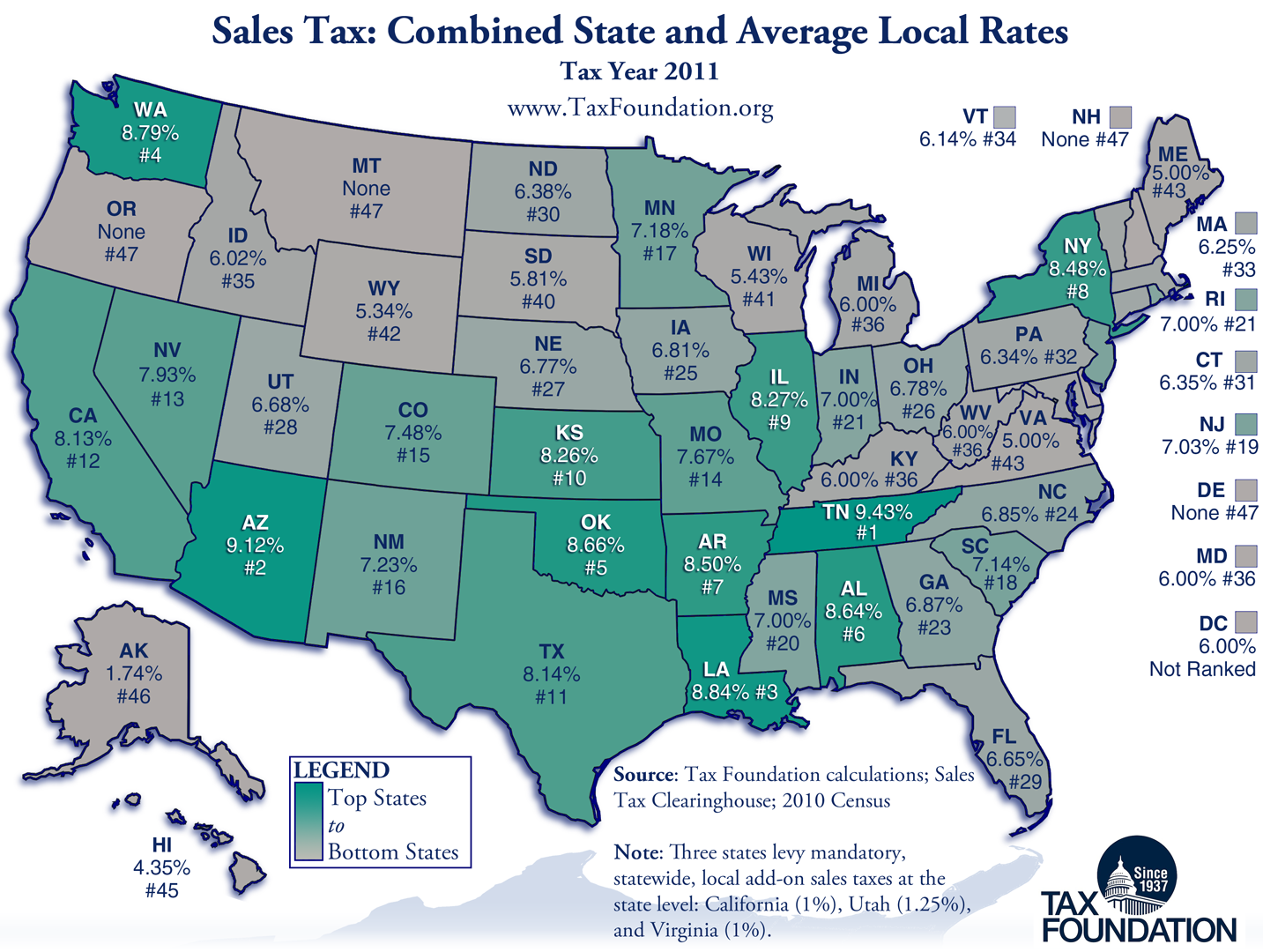

Sales to the State of South Dakota and South Dakota public or municipal corporations are exempt from sales tax The governments from other states or the District of Columbia Nonprofit Corporations If you intend to apply for an IRS federal tax exemption as a charitable organization your articles of incorporation must contain a required purpose

South Dakota Sales Tax Exemption Nonprofit

South Dakota Sales Tax Exemption Nonprofit

https://www.pdffiller.com/preview/5/506/5506066/large.png

South Dakota Non Profit Filing Requirements SD Nonprofits Annual

https://www.expresstaxexempt.com/Content/Images/newImages/usStateMap/southDakotaMap.png

Iowa Sales Tax Exemption Certificate Fillable Form Fill Out And Sign

https://www.signnow.com/preview/0/211/211451/large.png

South Dakota law requires nonprofit organizations to file a Sales Tax Exempt Status Application online with the South Dakota Department of Revenue in order to obtain an SDCL 10 45 10 exempts from sales tax the sale of products and services to the following governmental entities Indian Tribes United States government agencies State of South

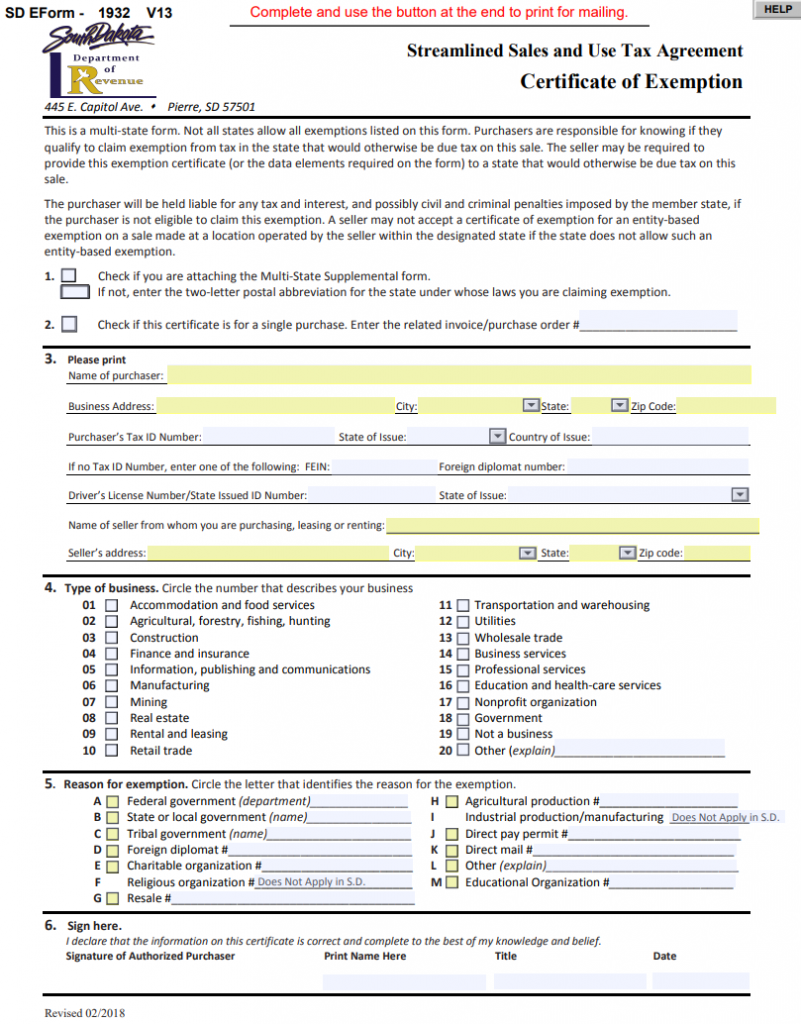

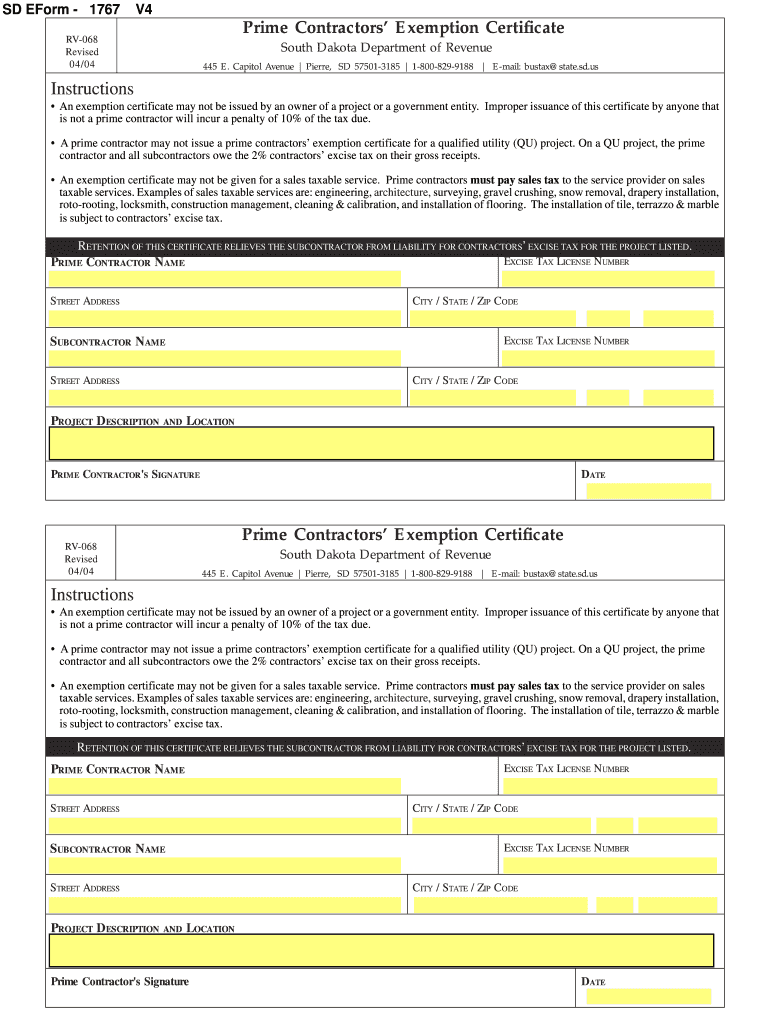

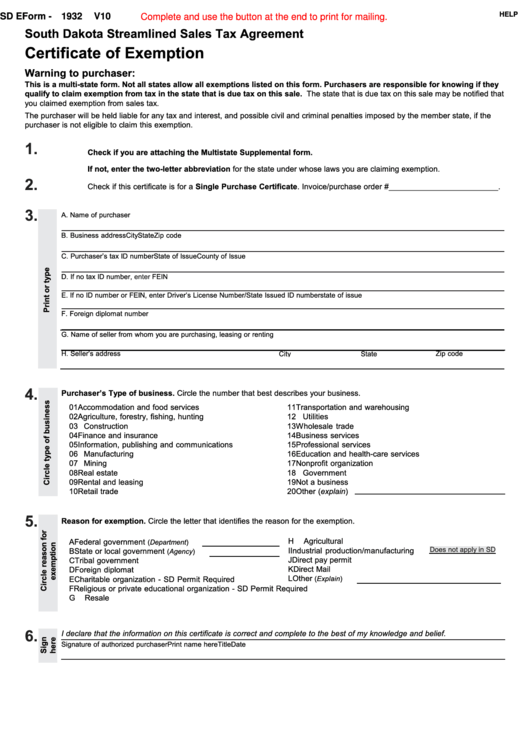

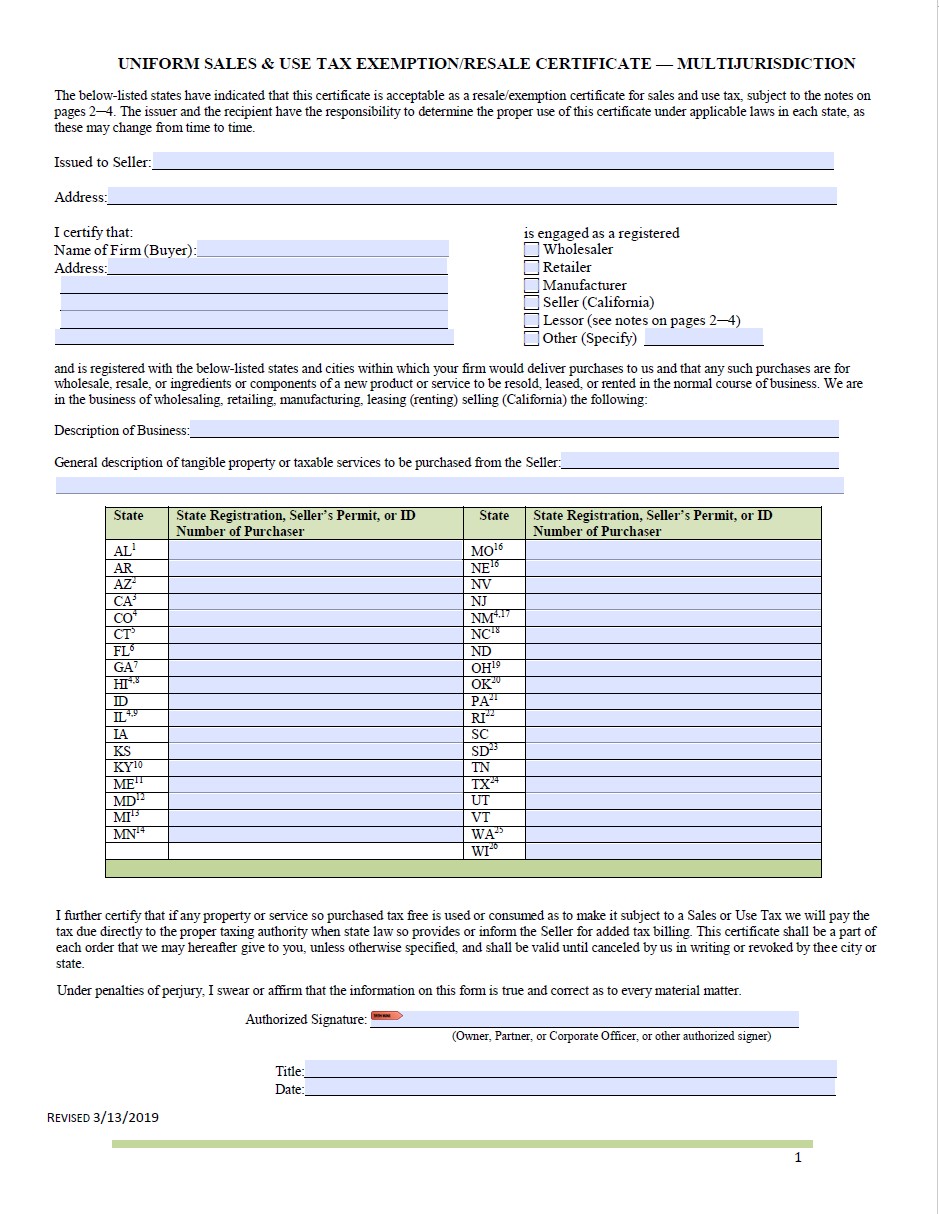

So there s no need to file to obtain an exemption from South Dakota income tax However you will still need to file to obtain a sales tax exemption In order to do this complete the Only certain types of nonprofit organizations are exempt from sales taxes in South Dakota For a complete listing of exemptions and a copy of the Certificate of Exemption

Download South Dakota Sales Tax Exemption Nonprofit

More picture related to South Dakota Sales Tax Exemption Nonprofit

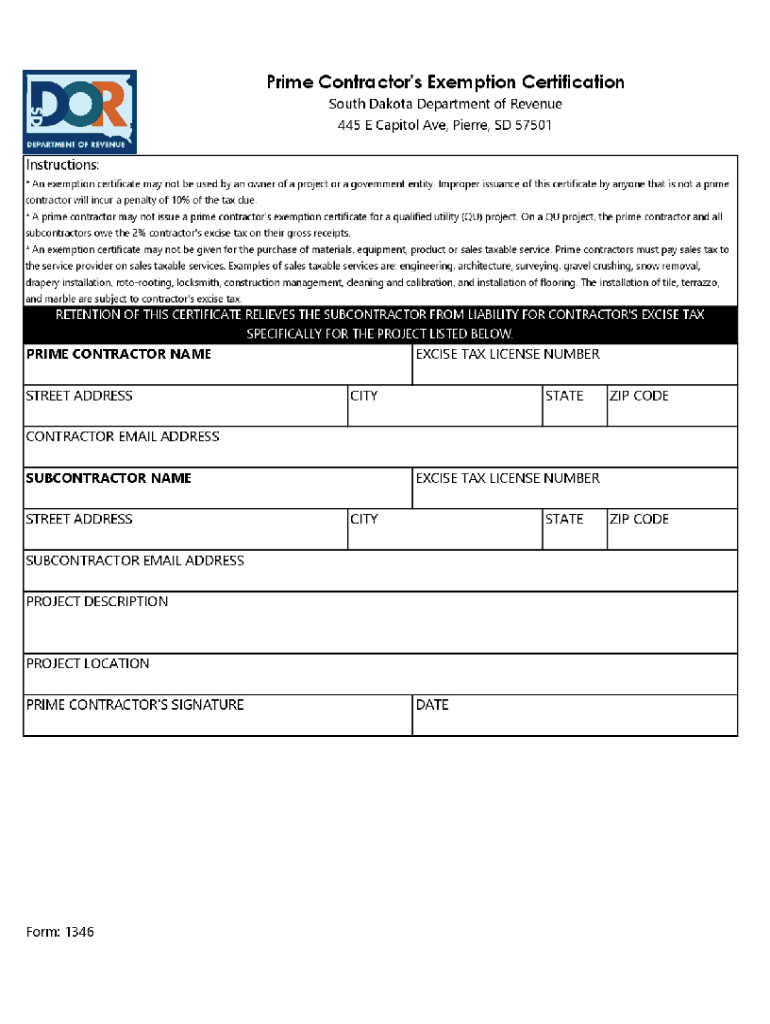

South Dakota Tax Exempt Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/549/396/549396447/large.png

What Is A Sales Tax Exemption Certificate In Florida Printable Form

https://www.salestaxhandbook.com/img/MTC_Thumbnail.jpg

South Dakota State Tax Exempt Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/how-to-get-a-certificate-of-exemption-in-south-dakota-1.png

V Sales Tax Exemption Many nonprofits can benefit from being exempt from sales tax on purchases of services goods and materials Some of the states that allow for sales tax STATE SALES TAX EXEMPTION States usually offer sales tax exemption for nonprofits or they do not Your state has a variation and has very limited or specific protocols to

I Sales Tax Exemption Many nonprofits can benefit from being exempt from sales tax on purchases of services goods and materials Some of the states that allow for sales tax South Dakota Sales Tax Exemption for a Nonprofit In some states your organization is not automatically exempt from state sales tax even after obtaining 501 c 3 recognition

What Is South Dakota Sales Tax DakotaPost

https://global-uploads.webflow.com/6000de2b18ee374b5befe5f6/61cdef83fed594e6e943396a_south-dakota-sales-tax.jpg

South Dakota Exemption Certificate Form Fill Out And Sign Printable

https://www.signnow.com/preview/16/737/16737755/large.png

https://dor.sd.gov/businesses/taxes/sales-use-tax

There are four reasons that products and services would be exempt from South Dakota sales tax The purchaser is a tax exempt entity The product or service is specifically

https://dor.sd.gov/media/q0xpvden/exemption...

Sales to the State of South Dakota and South Dakota public or municipal corporations are exempt from sales tax The governments from other states or the District of Columbia

State Sales Tax State Sales Tax Exemption Florida

What Is South Dakota Sales Tax DakotaPost

South Dakota Sales Tax Rate To Drop Temporarily

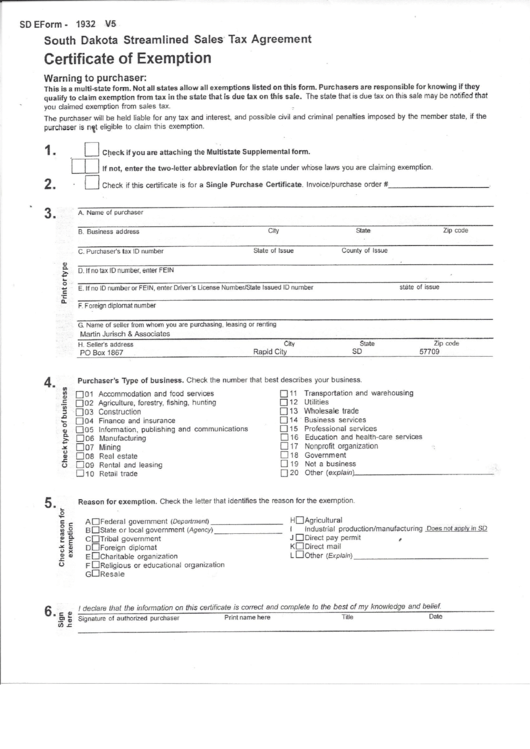

Sd Eform 1932 V10 South Dakota Streamlined Sales Tax Agreement

North Dakota Sales Tax Registration Phat Diary Slideshow

How Much Does Your State Collect In Sales Taxes Per Capita Income

How Much Does Your State Collect In Sales Taxes Per Capita Income

Vermont State Tax Exempt Form Trudie Cote

State And Local Public Finance Taxing Professional Services Beating

Certificate Of Exemption South Dakota Streamlined Sales Tax Agreement

South Dakota Sales Tax Exemption Nonprofit - Businesses who file and pay their sales or use tax returns electronically are eligible to receive a collection allowance of 1 5 of the tax due not to exceed 70 each reporting