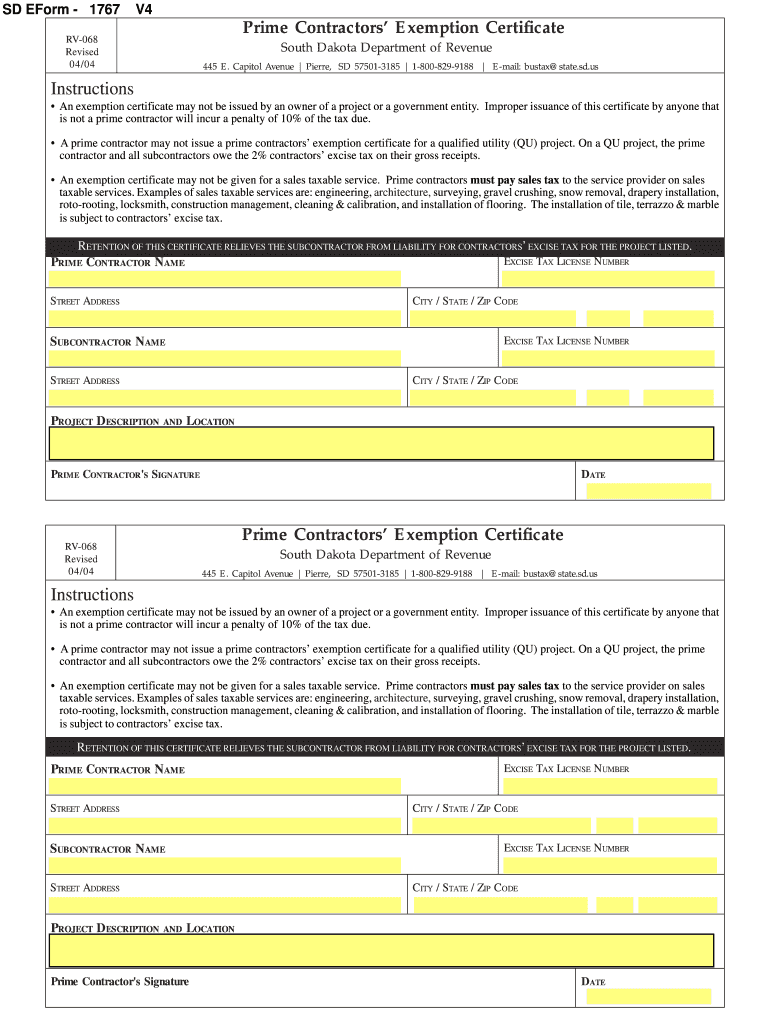

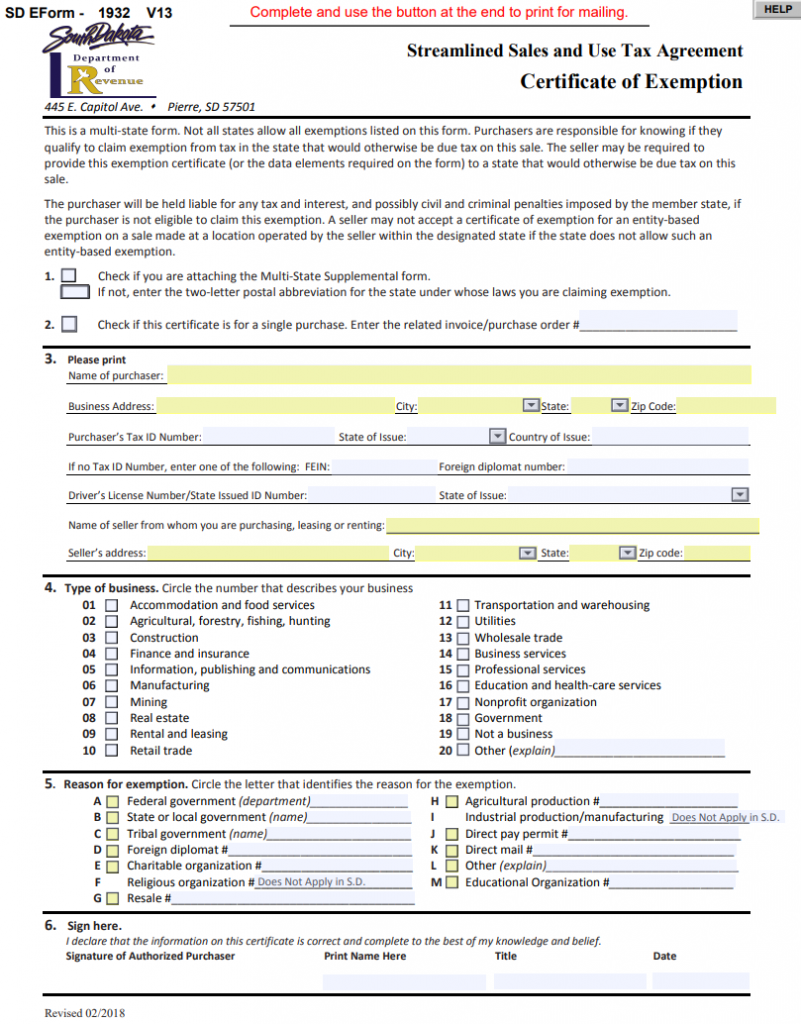

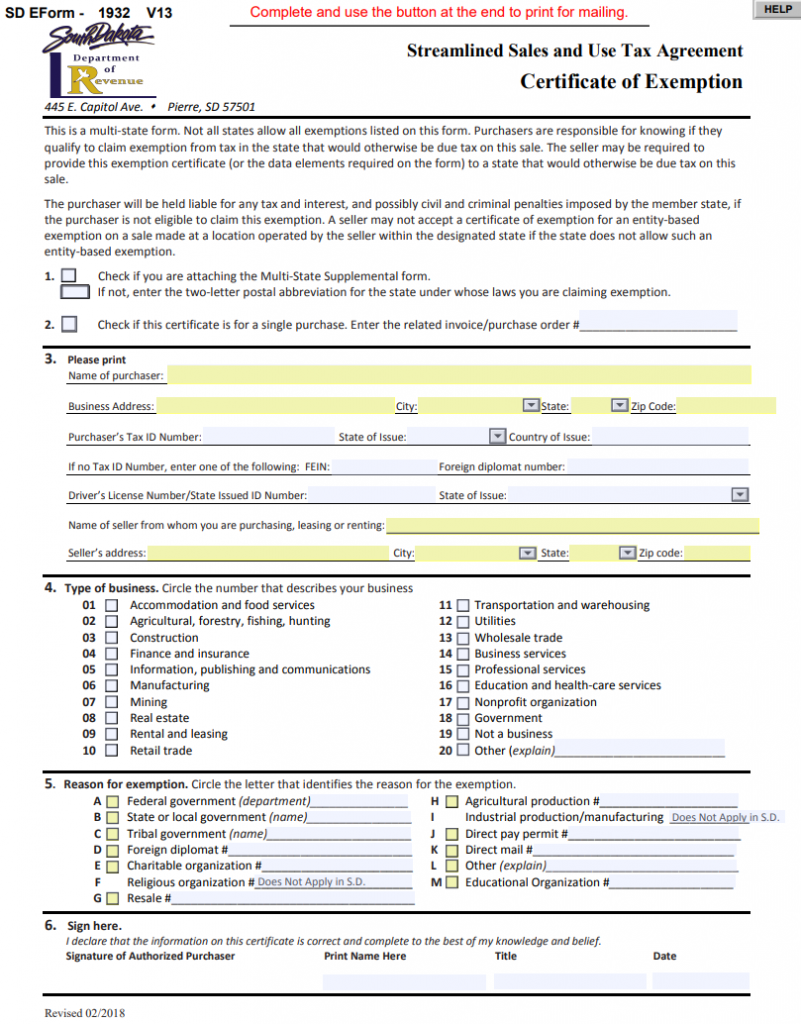

South Dakota Streamlined Sales Tax Exemption Certificate Other Must include a clear and concise explanation of the reason for the exemption claimed For additional information please review the Exemption Certificate Tax Facts available at www state sd us drr or by calling 1 800 829 9188 South Dakota Streamlined Sales Tax Agreement Certificate of Exemption

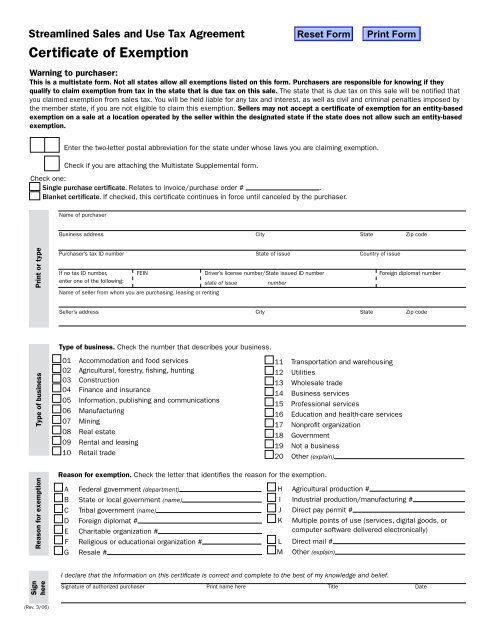

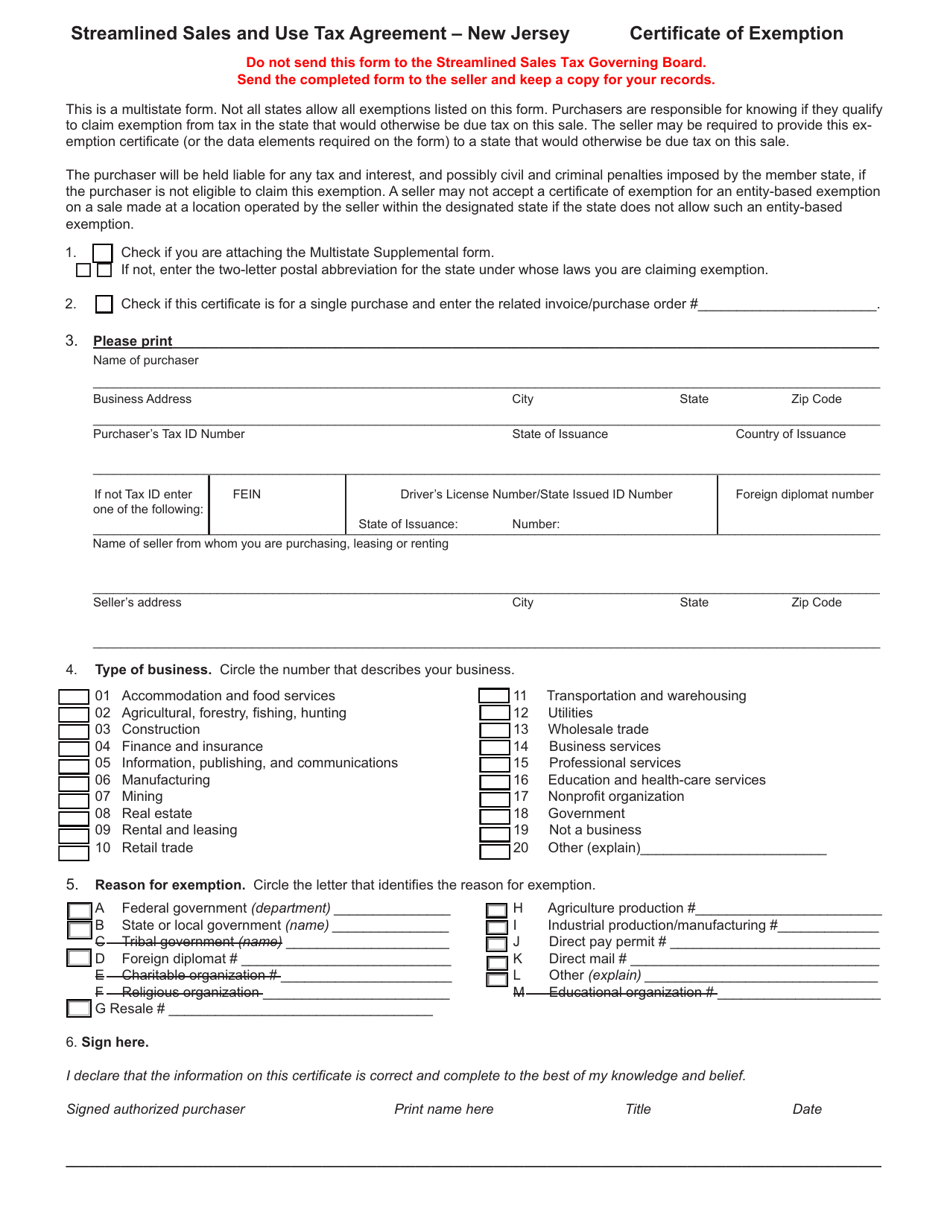

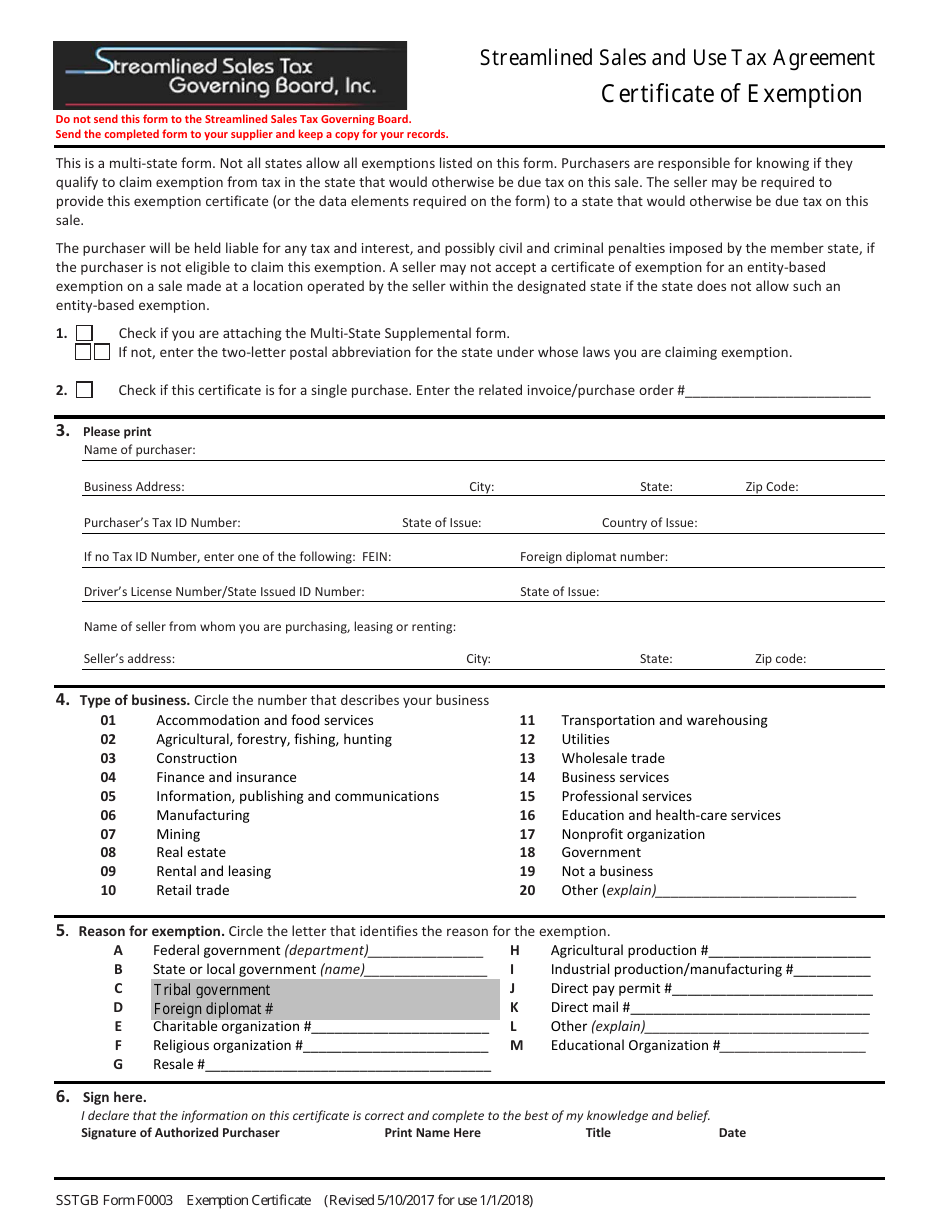

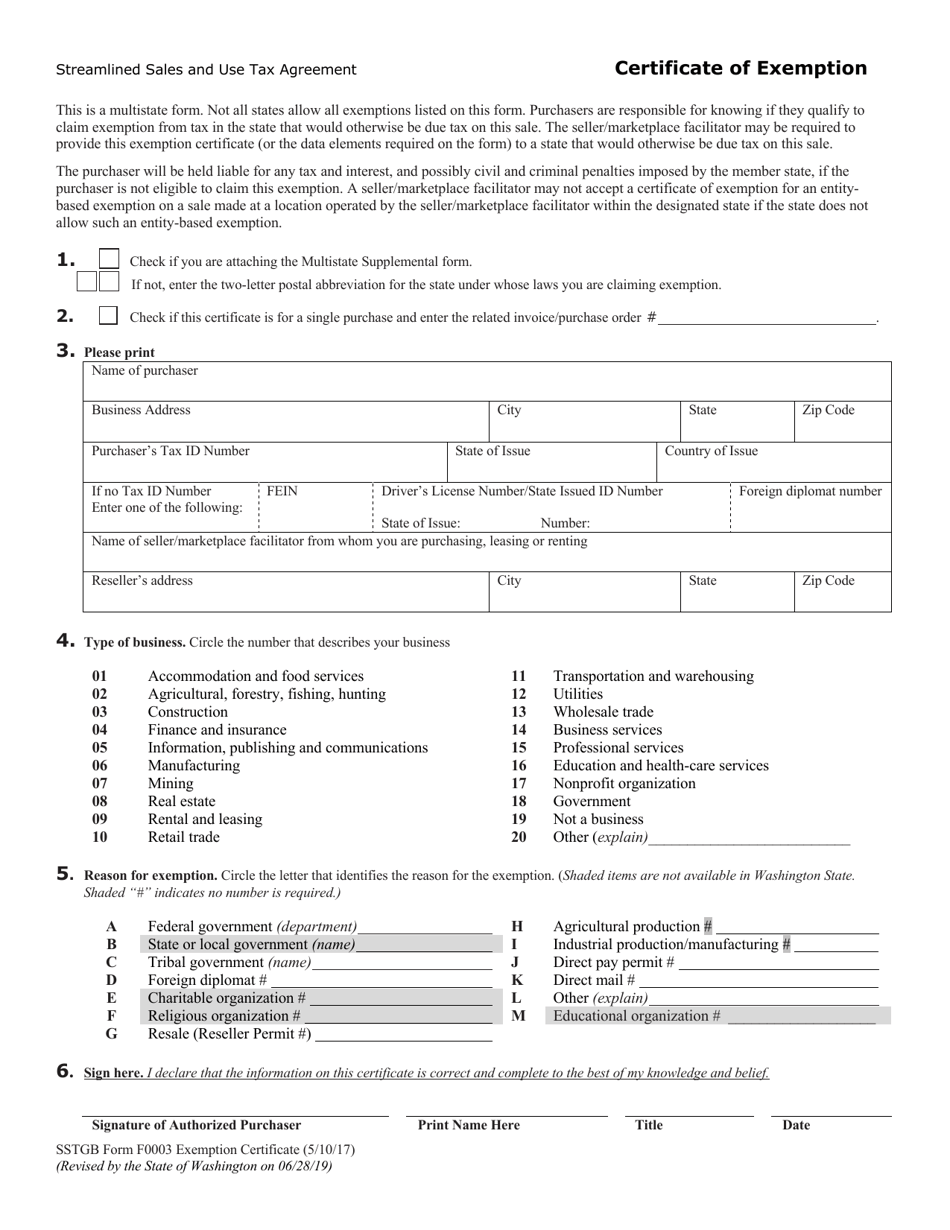

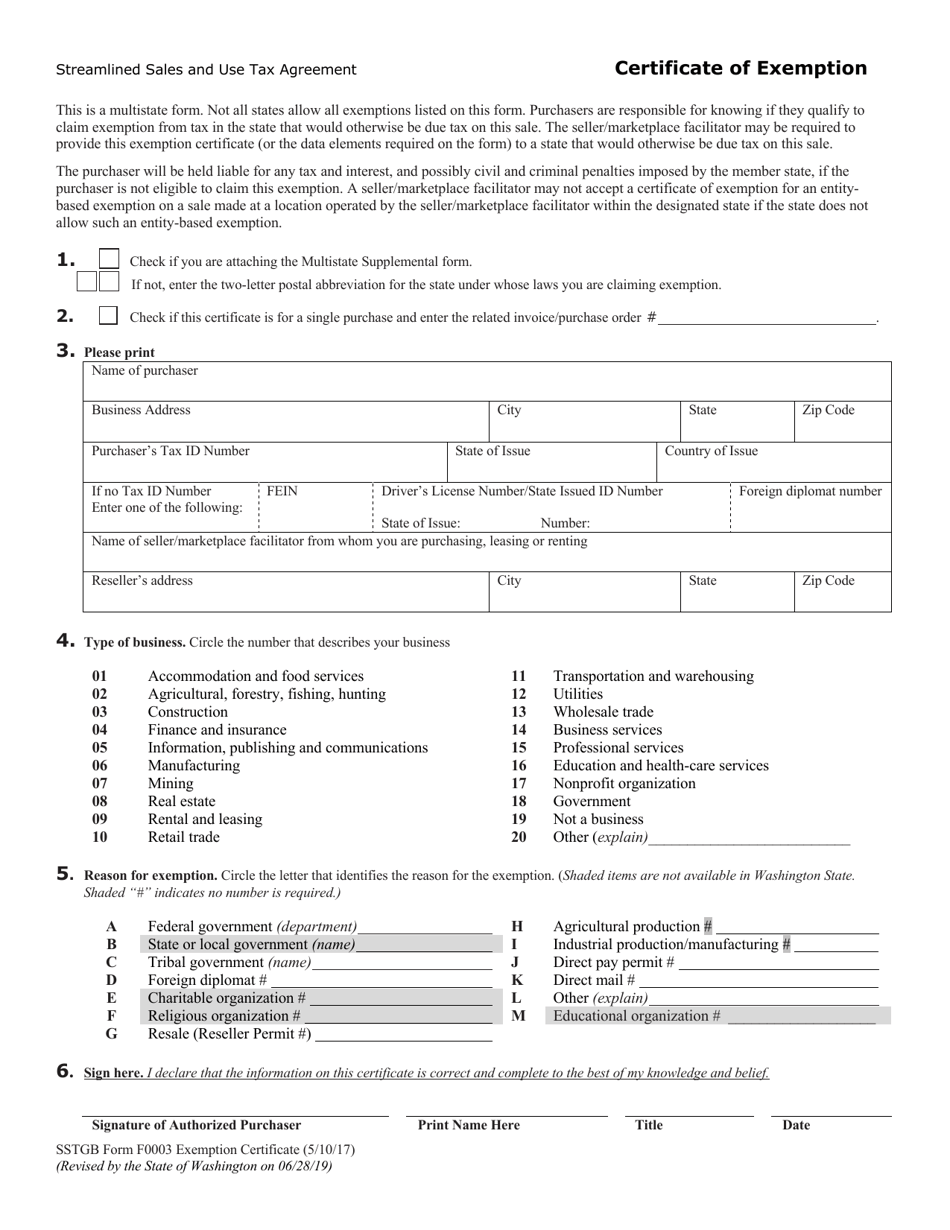

Laws regulations and information for individuals regarding taxation on sales and use tax in South Dakota Go to Individuals Section Find sales and us tax laws tax facts educational seminars streamlined sales tax project information and instructions on how to enter the voluntary disclosure program Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board Send the completed form to the seller and keep a copy for your records This is a multi state form for use in the states listed Not all states allow all exemptions listed on this form

South Dakota Streamlined Sales Tax Exemption Certificate

South Dakota Streamlined Sales Tax Exemption Certificate

https://www.signnow.com/preview/16/737/16737755/large.png

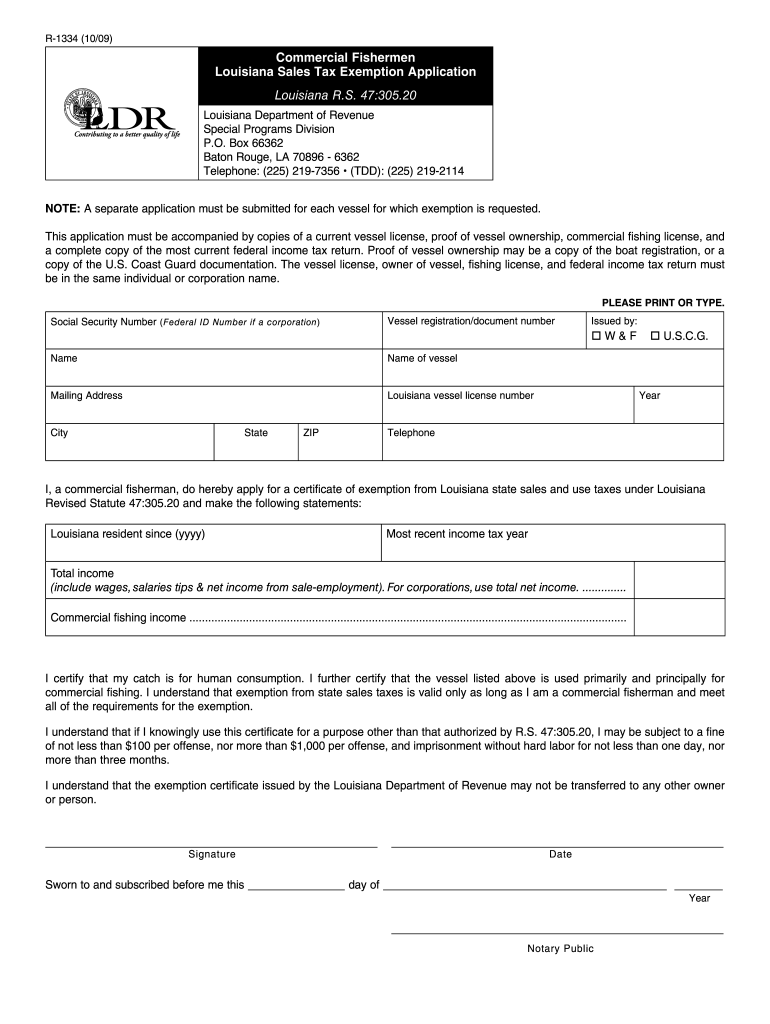

Louisiana Resale Certificate PDF Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/11/44/11044386/large.png

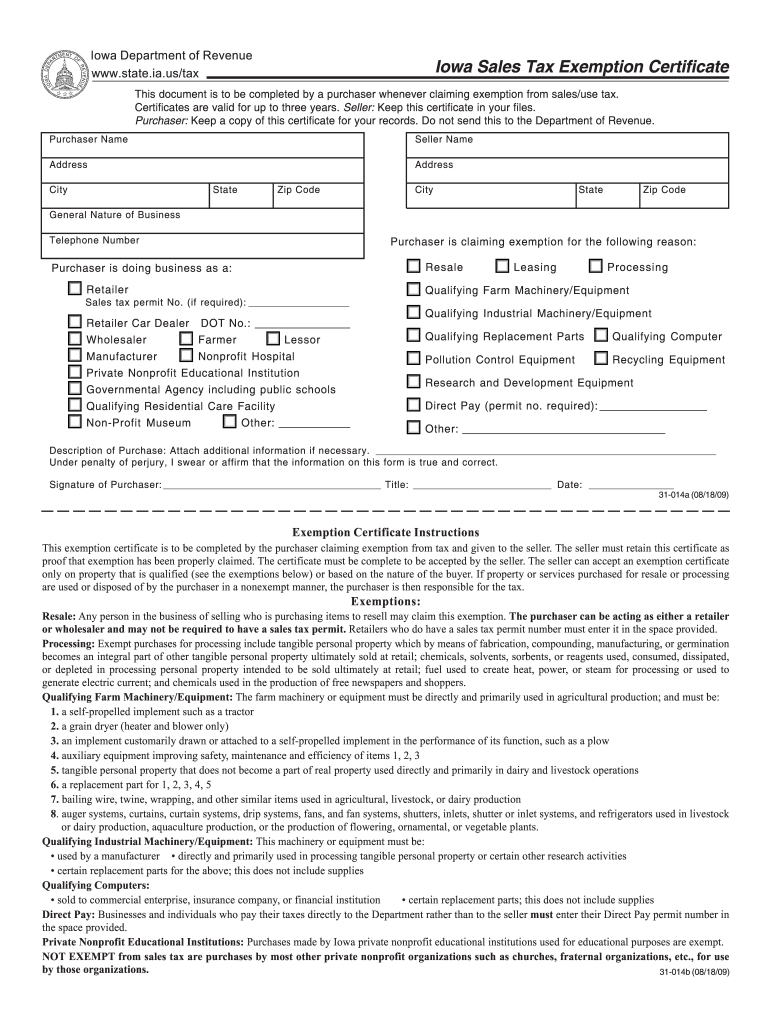

Streamlined Sales Tax Certificate Of Exemption State Of Iowa

https://img.yumpu.com/43329306/1/500x640/streamlined-sales-tax-certificate-of-exemption-state-of-iowa.jpg

Exemption certificate even if it is ultimately determined that the purchaser improperly claimed an exemption provided all of the following conditions are met 1 All fields on the exemption certificate are completed by the purchaser 2 The fully completed exemption certificate is provided to you at the time of sale 3 Exemption Certificate Form The Streamlined Sales Tax Certificate of Exemption Exemption Certificate has been updated Instructions for purchasers and sellers are on the back side of this form This form contains the same information as the prior form You do not need to update the forms you have on file but should use this form going forward

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the South Dakota sales tax You can download a PDF of the South Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page For other South Dakota sales tax exemption You may choose to contact a Certified Service Provider CSP to calculate the sales tax due on your transactions file your sales tax returns and remit payment of this tax on your behalf to the SST states Model 1 If you anticipate using a CSP please contact them prior to registering the CSP can register for you

Download South Dakota Streamlined Sales Tax Exemption Certificate

More picture related to South Dakota Streamlined Sales Tax Exemption Certificate

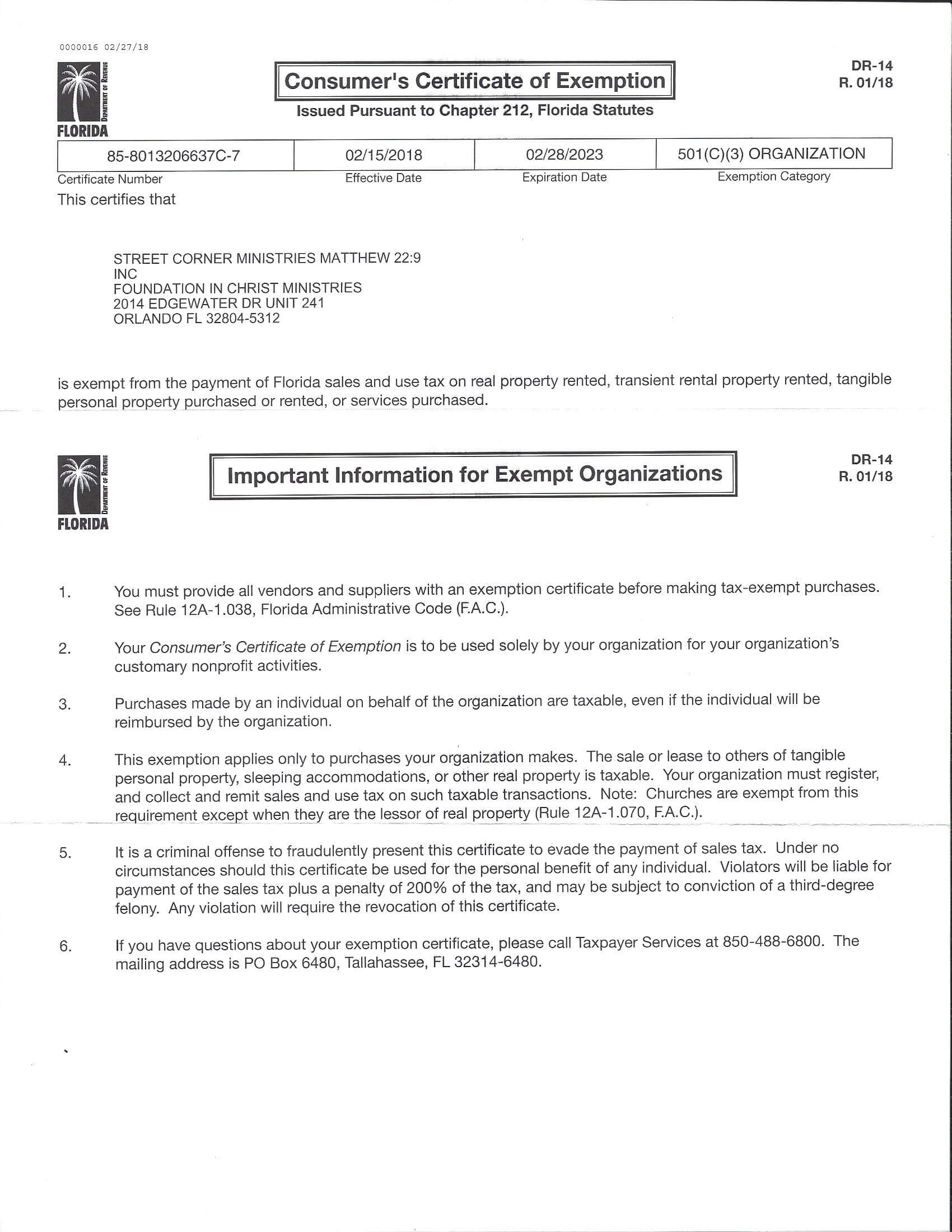

Printable Florida Sales Tax Exemption Certificates

http://www.salestaxhandbook.com/img/MTC_Thumbnail.jpg

New Jersey Streamline Sales Use Tax Agreement Certificate Of

https://data.templateroller.com/pdf_docs_html/2060/20606/2060608/streamline-sales-use-tax-agreement-certificate-of-exemption-new-jersey_print_big.png

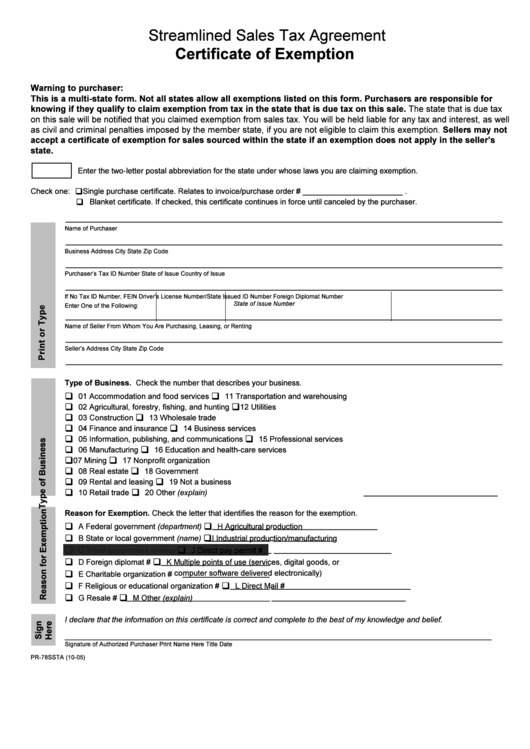

Fillable Form Pr 78ssta Streamlined Sales Tax Agreement Certificate

https://data.formsbank.com/pdf_docs_html/216/2162/216237/page_1_thumb_big.png

For advertising and promotional Direct Mail does the state require the seller to collect tax pursuant to Section 310 A 5 if the purchaser does not provide a direct pay permit Exemption Certificate claiming direct mail or jurisdictional information South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser This is a multi state form Not all states allow all exemptions listed on this form Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that is due tax on this sale The state that is due tax on this sale may

The South Dakota Department of Revenue DOR Aug 1 released a Streamlined Sales and Use Tax Certificate of Exemption Form 2040 The DOR included instructions that 1 purchasers must know if they qualify to claim an exemption from tax in the state and the seller may be required to provide the certificate to a state that would Claim exemption from tax in the state that would otherwise be due tax on this sale The seller may be required to provide this exemption certificate or the data elements required on the form to a state that would otherwise be due tax on this sale

South Dakota State Tax Exempt Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/how-to-get-a-certificate-of-exemption-in-south-dakota-1.png

South Dakota Streamlined Sales Tax Agreement Certificate Of Exemption

https://www.pdffiller.com/preview/614/894/614894034/large.png

https://www.dhs.sd.gov/content/dam/digital/united...

Other Must include a clear and concise explanation of the reason for the exemption claimed For additional information please review the Exemption Certificate Tax Facts available at www state sd us drr or by calling 1 800 829 9188 South Dakota Streamlined Sales Tax Agreement Certificate of Exemption

https://dor.sd.gov/businesses/taxes/sales-use-tax

Laws regulations and information for individuals regarding taxation on sales and use tax in South Dakota Go to Individuals Section Find sales and us tax laws tax facts educational seminars streamlined sales tax project information and instructions on how to enter the voluntary disclosure program

Iowa Sales Tax Exemption Certificate Fillable Form Fill Out And Sign

South Dakota State Tax Exempt Form ExemptForm

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

Form F003 2018 Fill Out Sign Online And Download Printable PDF

How To Get A Vermont Certificate Of Exemption 2023 Guide

SSTGB Form F0003 Fill Out Sign Online And Download Fillable PDF

SSTGB Form F0003 Fill Out Sign Online And Download Fillable PDF

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

What Is South Dakota Sales Tax DakotaPost

Sstgb Form F0003 Exemption Certificate 2019 State Of Tennessee Fill

South Dakota Streamlined Sales Tax Exemption Certificate - You may choose to contact a Certified Service Provider CSP to calculate the sales tax due on your transactions file your sales tax returns and remit payment of this tax on your behalf to the SST states Model 1 If you anticipate using a CSP please contact them prior to registering the CSP can register for you