Ssi Disability Tax Rebate Web 30 mars 2021 nbsp 0183 32 The update today applies to Social Security retirement survivor or disability SSDI Supplemental Security Income SSI and Railroad Retirement Board

Web 21 mars 2023 nbsp 0183 32 On up to 50 of the Social Security Disability Insurance benefits you receive when your combined income falls between 32 000 and 44 000 On up to Web SSDI and SSI recipients who have not received a stimulus check need to request a Recovery Rebate Credit by filing a tax return By Bethany K Laurence Attorney

Ssi Disability Tax Rebate

Ssi Disability Tax Rebate

https://images.sampleforms.com/wp-content/uploads/2016/10/Social-Security-Disability-Tax-Form.jpg

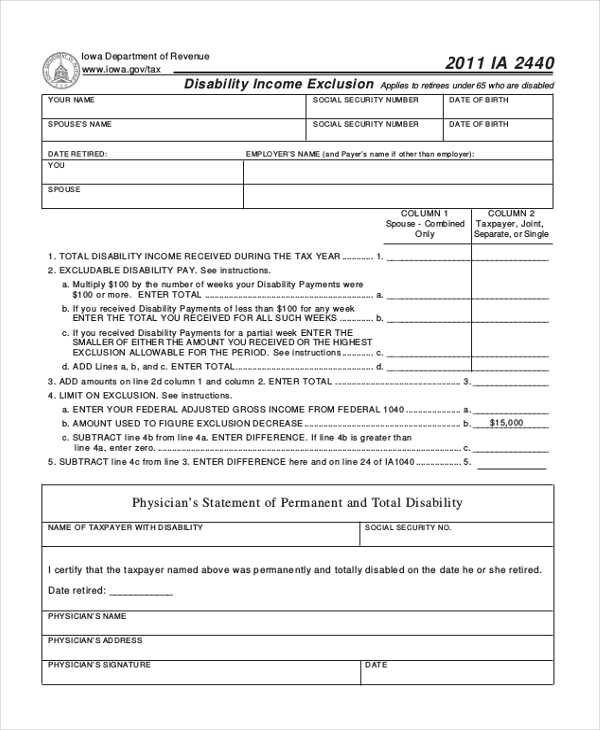

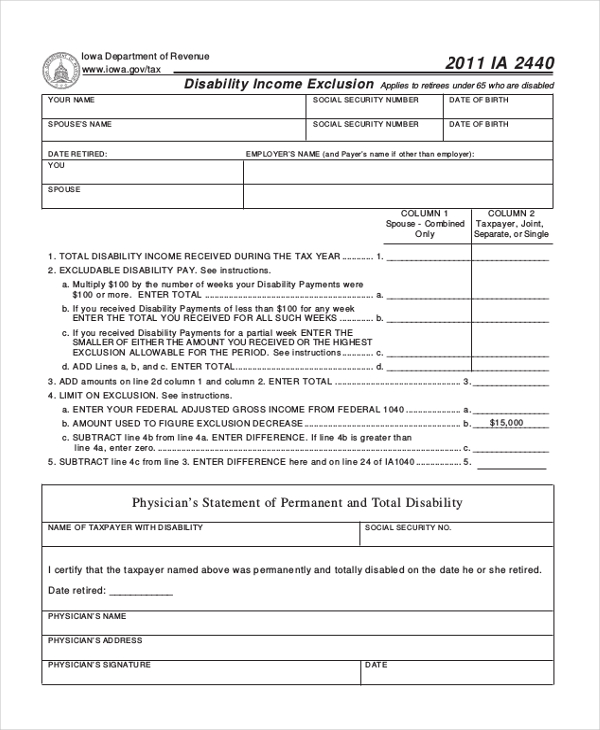

Is Social Security Disability Income Taxable By The Irs

https://www.disabilityproadvice.com/wp-content/uploads/is-social-security-taxable-income-2021-when-is-social-security-income.jpeg

Is Social Security Disability Tax Free DisabilityTalk

https://www.disabilitytalk.net/wp-content/uploads/free-9-sample-social-security-disability-forms-in-pdf-word.jpeg

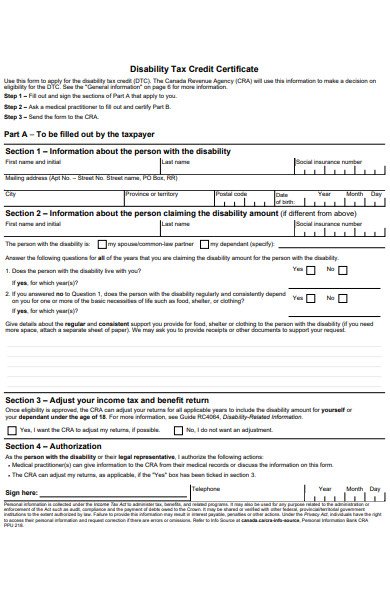

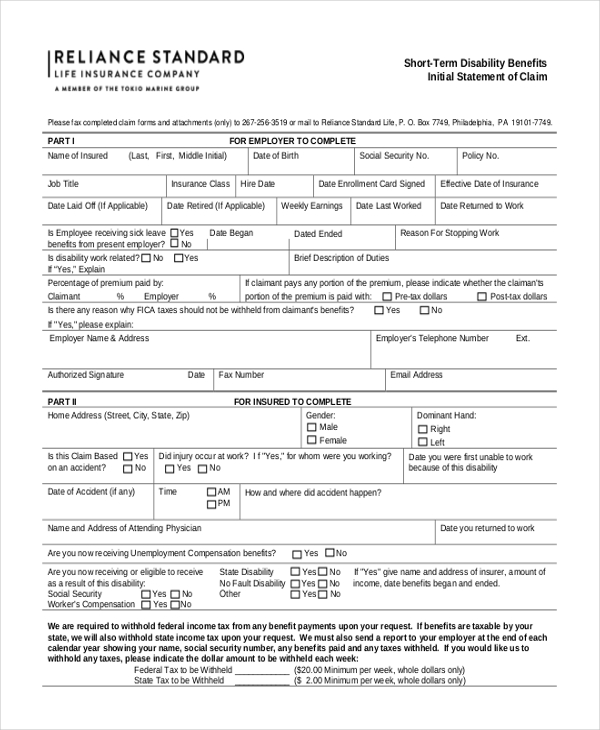

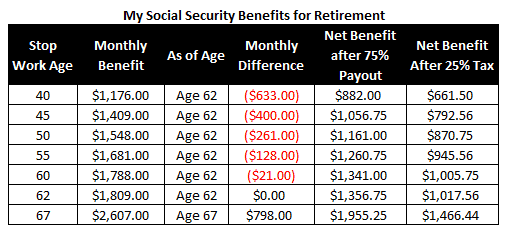

Web You are single and you receive disability benefits of 417 or more per month 5 000 or more per year You won t qualify for the credit You receive only 300 in SSDI per Web 17 oct 2021 nbsp 0183 32 Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold However the majority of people who receive Social Security benefits do not

Web 17 f 233 vr 2023 nbsp 0183 32 Regular amp Disability Benefits Question I retired last year and started receiving social security payments Do I have to pay taxes on my social security Web Recipients of Social Security Disability benefits and retirement benefits who have an adjusted gross income of 75 000 for an individual 112 500 for head of household and

Download Ssi Disability Tax Rebate

More picture related to Ssi Disability Tax Rebate

Tax Form For Disability Benefits BenefitsTalk

https://www.benefitstalk.net/wp-content/uploads/ca-ssi-disability-forms-universal-network.jpeg

How To Apply For Ssi Disability Benefits In California

https://alexisfraser.com/pictures/social-security-permanent-disability-application-form-4.png

FREE 51 Disability Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2020/03/Disability-Tax-Form.jpg

Web 7 avr 2020 nbsp 0183 32 Recipients of Social Security Disability benefits and retirement benefits who have an adjusted gross income of 75 000 for an individual 112 500 for head of Web 21 f 233 vr 2023 nbsp 0183 32 Supplemental Security Income SSI recipients who don t file tax returns will start receiving their automatic Economic Impact Payments directly from the Treasury

Web 11 ao 251 t 2014 nbsp 0183 32 The child tax credit CTC is a special Federal refundable tax credit that is available to certain low income taxpayers with earned income and at least one child in Web 3 mai 2023 nbsp 0183 32 Pre qualify in 60 seconds for up to 3 627 per month and 12 months back pay Please answer a few questions to help us determine your eligibility How old are

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paiement Des Cotisations De S curit Sociale Sur Les Revenus Apr s L

https://www.investopedia.com/thmb/RBr58FzwHr4Erp9b4DeWCfKHb0s=/6256x3918/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg

Nj Disability Forms Printable 74 FREE PRINTABLE DISABILITY FORMS

https://images.sampleforms.com/wp-content/uploads/2016/10/social-security-short-term-disability-form.jpg

https://www.irs.gov/newsroom/irs-projects-stimulus-payments-to-non...

Web 30 mars 2021 nbsp 0183 32 The update today applies to Social Security retirement survivor or disability SSDI Supplemental Security Income SSI and Railroad Retirement Board

https://turbotax.intuit.com/tax-tips/disability/is-social-security...

Web 21 mars 2023 nbsp 0183 32 On up to 50 of the Social Security Disability Insurance benefits you receive when your combined income falls between 32 000 and 44 000 On up to

Unlocking Financial Relief Disability Rent Rebate For Deserving

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paiement Des Cotisations De S curit Sociale Sur Les Revenus Apr s L

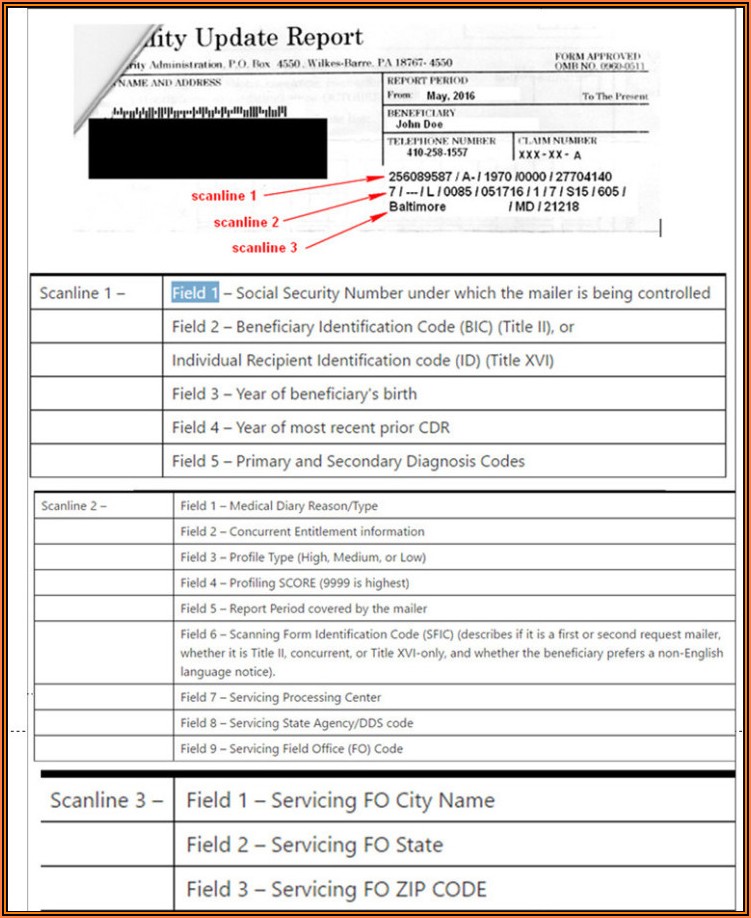

Requirements To Get SSI Disability Workers Compensation LLC

State Disability Form De 2501 Form Resume Examples emVKpzM2rX

How Ssi Disability Benefits Are Calculated

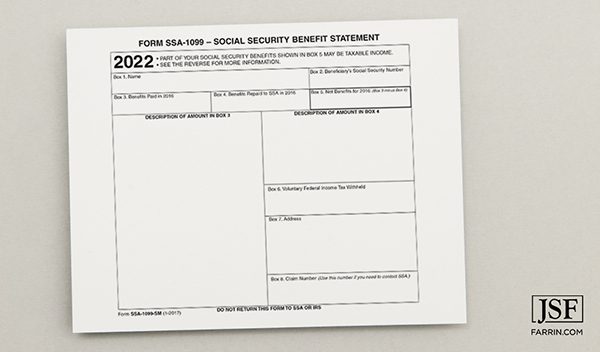

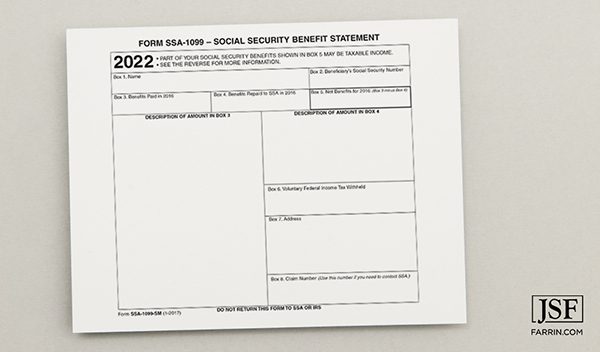

A Guide On Taxes Your SSDI Benefits James Scott Farrin

A Guide On Taxes Your SSDI Benefits James Scott Farrin

Edd Extension Forms For Disability Universal Network

If Your SSI Was Denied Will Your SSDI Be Denied Too

Ssa 1099 Form 2022 Pdf Fill Online Printable Fillable Blank

Ssi Disability Tax Rebate - Web Recipients of Social Security Disability benefits and retirement benefits who have an adjusted gross income of 75 000 for an individual 112 500 for head of household and