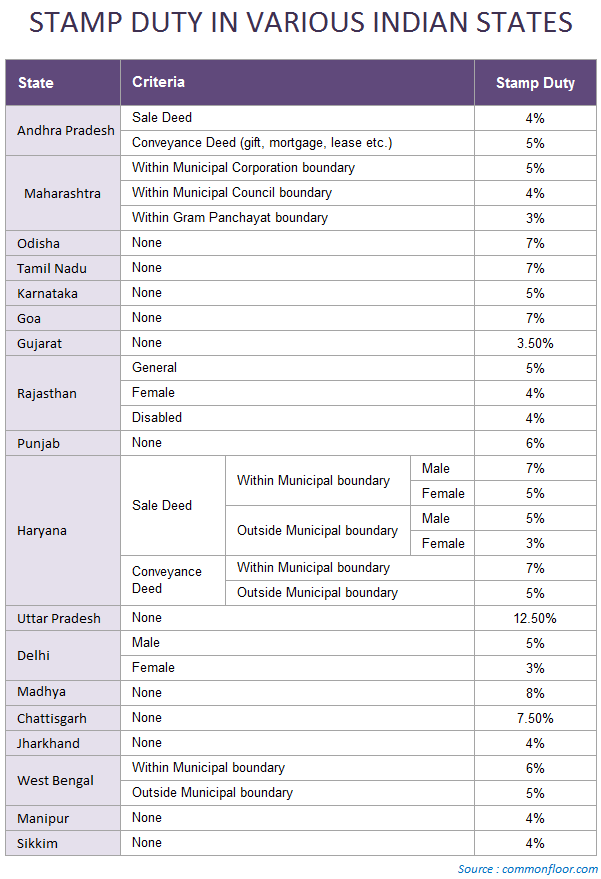

Stamp Duty Income Tax Rebate Web 3 nov 2020 nbsp 0183 32 Did you know that stamp duty is tax deductible under Section 80C of the Income Tax Act 1961 Stamp duty can go as high as 8 on your property value

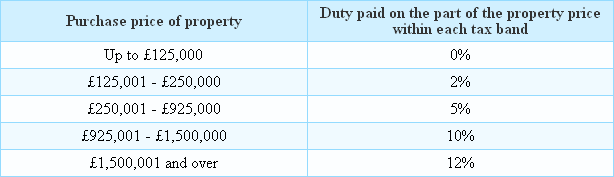

Web 7 mars 2023 nbsp 0183 32 163 925 001 163 1 5 million 10 Over 163 1 5 million 12 Can I get a refund on stamp duty There are some situations where you can get some of your stamp duty Web 25 janv 2023 nbsp 0183 32 What is the stamp duty refund Buyers are able to claim a stamp duty refund if they sell their main residence within three years of

Stamp Duty Income Tax Rebate

Stamp Duty Income Tax Rebate

https://s.yimg.com/ny/api/res/1.2/bOF0_MxethrjXQiB932gLA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/en/pa_viral_news_uk_120/3691a876da0e808ba9d88cf56e1f1161

When Do I Have To Pay Stamp Duty Stamp Duty Rebate

https://stampdutyrebate.co.uk/wp-content/uploads/2022/08/pexels-photo-6863183-1.jpeg

Stamp Duty Claims Claim Your Stamp Duty Rebate TODAY

https://getmytax.co.uk/wp-content/uploads/2023/01/Stamp-Duty-Land-Tax-Rebates.png

Web Reliefs and exemptions You may be eligible for Stamp Duty Land Tax SDLT reliefs if you re buying your first home and in certain other situations These reliefs can reduce the Web 28 mai 2020 nbsp 0183 32 Deduction on stamp duty and registration charge on property purchase could be claimed under Section 80C of the Income Tax Act 1961 Do note here that the overall deduction limit under Section

Web 15 f 233 vr 2023 nbsp 0183 32 Stamp Duty tax exemption is an Income Tax rebate for people who have paid stamp duty on the purchase of property in the same financial year Web 6 oct 2022 nbsp 0183 32 We paid 163 18 500 in stamp duty Had we waited a week our bill would have been less than a third of this Do we have any recourse Is there any possibility of a rebate I know the chances are slim

Download Stamp Duty Income Tax Rebate

More picture related to Stamp Duty Income Tax Rebate

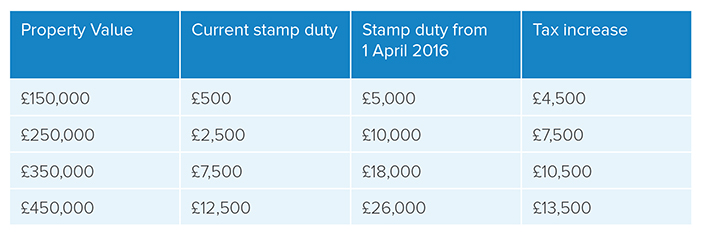

Infographic Stamp Duty Changes Good News For Most

https://www.taxfile.co.uk/wp-content/uploads/2014/12/Stamp-duty-tax-bands.png

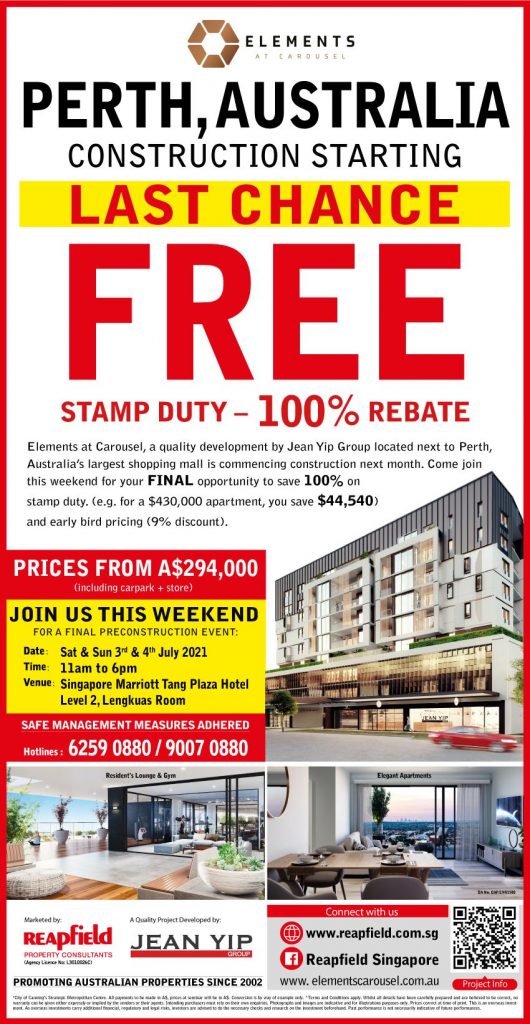

Last Chance Free Stamp Duty 100 Rebate Reapfield Property

https://reapfield.com.sg/wp-content/uploads/2021/07/EDM-3-4-Jul-2021-530x1024.jpg

Calculating Stamp Duty For Your House Purchase And Move

http://www.colinbattremovals.co.uk/wp-content/uploads/2015/01/Stamp-Duty-Tax-Rates-Table-Colin-Batt-Removals.png

Web 14 ao 251 t 2023 nbsp 0183 32 Stamp Duty Tax 2023 Is it Refundable John Charcol Here you ll find everything you need to know about Stamp Duty what it is who pays it exemptions and relief the rates at which you pay it and Web 8 janv 2022 nbsp 0183 32 In case you wish to be qualified for a stamp duty rebate then you have to be a member of HUF Hindu Undivided Family or an individual owner or a co owner with a

Web 11 janv 2023 nbsp 0183 32 Deductions can be claimed under Section 80C of the Income Tax Act on stamp duty and registration charge paid on home purchase under the overall limit of Rs 1 50 lakhs per annum This claim Web 18 d 233 c 2013 nbsp 0183 32 If you ve paid too much SDRT on a share transaction made through the CREST electronic system you can get a refund To get a refund you ll need to write to

Keep Getting Letters From Berkshire Wealth About A Stamp Duty Rebate

https://i.imgur.com/64q11yx.jpg

Tax Rebate For Individual It Is The Refund Which An Individual Can

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

https://www.tatacapital.com/blog/loan-for-home/how-to-claim-stamp-duty...

Web 3 nov 2020 nbsp 0183 32 Did you know that stamp duty is tax deductible under Section 80C of the Income Tax Act 1961 Stamp duty can go as high as 8 on your property value

https://www.homeviews.com/buying/stamp-duty-refund-how-it-works-a…

Web 7 mars 2023 nbsp 0183 32 163 925 001 163 1 5 million 10 Over 163 1 5 million 12 Can I get a refund on stamp duty There are some situations where you can get some of your stamp duty

Private Landlords Can Expand Their Portfolio Without Incurring Punitive

Keep Getting Letters From Berkshire Wealth About A Stamp Duty Rebate

10 Taxes We Pay In India The Common Man s Guide

Home Loan EMI And Tax Deduction On It EMI Calculator

Can I Claim Back Stamp Duty On An Investment Property Stamp Duty Rebate

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

P55 Tax Rebate Form Business Printable Rebate Form

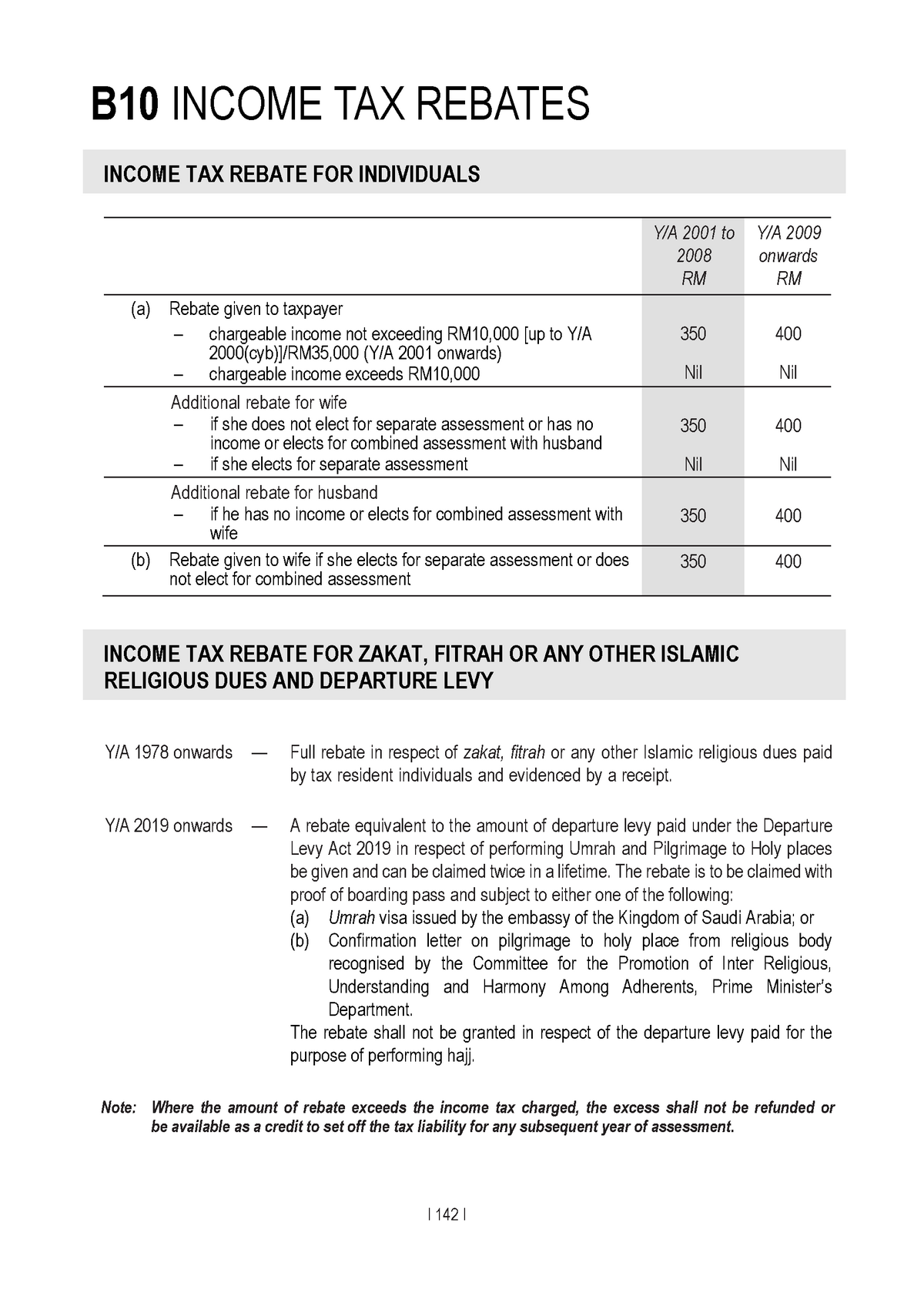

Additional Reading Income Tax Rebates Taxation Studocu

2007 Tax Rebate Tax Deduction Rebates

Stamp Duty Income Tax Rebate - Web 1 avr 2016 nbsp 0183 32 the amount of tax you re asking for a repayment of the bank account and sort code details of the person to receive the payment where possible we will pay any