Stamp Duty Rebate In Income Tax Web 3 nov 2020 nbsp 0183 32 Stamp duty can go as high as 8 on your property value Hence a stamp duty rebate in income tax can be a huge sigh of relief The exemption from stamp duty

Web 10 mai 2023 nbsp 0183 32 Stamp duty can go as high as 8 on your property value Hence a stamp duty rebate in income tax can be a huge sigh of relief Web 7 mars 2023 nbsp 0183 32 In what circumstances can I reclaim stamp duty You may be able to reclaim the 3 stamp duty surcharge in the following circumstances You are selling or giving

Stamp Duty Rebate In Income Tax

Stamp Duty Rebate In Income Tax

https://getmytax.co.uk/wp-content/uploads/2023/01/Stamp-Duty-Land-Tax-Rebates.png

Stamp Duty Rebates 5 Star Featured Members

https://diib.com/featuredmembers/wp-content/uploads/2023/02/Cover-Stamp-Duty-Rebates-1024x658.jpg

Can You Split The Cost Of Stamp Duty Tax Stamp Duty Rebate

https://stampdutyrebate.co.uk/wp-content/uploads/2023/04/istockphoto-1452495470-612x612-2.jpg

Web 15 f 233 vr 2023 nbsp 0183 32 The maximum stamp duty deduction that a person can claim in a single fiscal year is Rs 1 50 lakh Stamp Duty Exemption Under Income Tax Act This rebate policy is valid only on housing Web 28 mai 2020 nbsp 0183 32 Yes both the owners can claim deductions of Rs 1 50 lakh each under Section 80C for one time in which they paid the stamp duty and registration charges What does Section 80C mean by other services

Web 14 ao 251 t 2023 nbsp 0183 32 Here you ll find everything you need to know about Stamp Duty what it is who pays it exemptions and relief the rates at which you pay it and more Stamp Duty is a big part of buying a home In this Web You may be eligible for Stamp Duty Land Tax SDLT reliefs if you re buying your first home and in certain other situations These reliefs can reduce the amount of tax you

Download Stamp Duty Rebate In Income Tax

More picture related to Stamp Duty Rebate In Income Tax

Direct Tax In Malaysia International Tax Agreements And Tax

https://www.policybazaar.com/cdn/images/bu/ppt/income_group2.jpg

Stamp Duty Rebates should Be Offered In Return For Home Energy

https://s.yimg.com/ny/api/res/1.2/bOF0_MxethrjXQiB932gLA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/en/pa_viral_news_uk_120/3691a876da0e808ba9d88cf56e1f1161

Stamp Duty For Uninhabitable Properties Stamp Duty Rebate

https://stampdutyrebate.co.uk/wp-content/uploads/2023/01/how-does-stamp-duty-refund-work-for-uninhabitable-property--980x650.jpeg

Web 8 janv 2022 nbsp 0183 32 Last Updated January 8th 2022 When buying a property we have to pay certain charges such as stamp duty and registration fees While the registration fee Web 9 juin 2023 nbsp 0183 32 A maximum deduction of Rs 1 5 lakh on payments towards stamp duty registration fee etc is allowed under Section 80C of the Income Tax

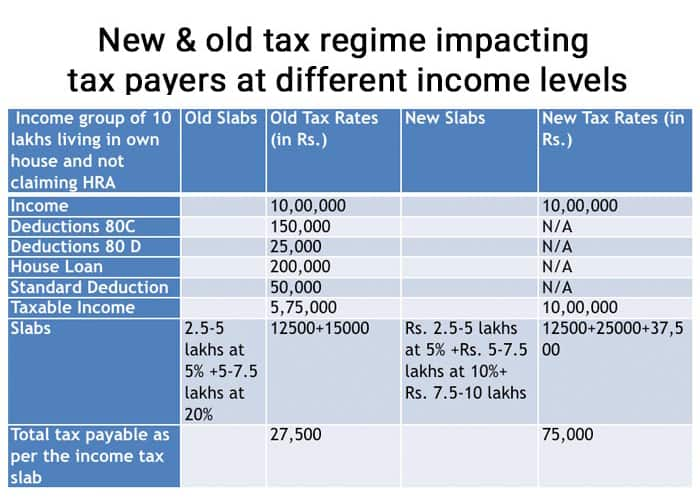

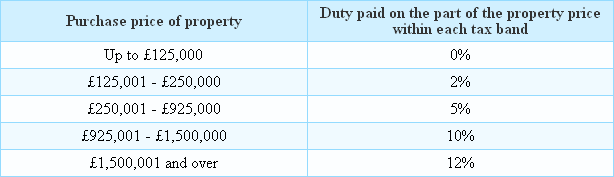

Web Hence a stamp duty rebate in income tax can be a huge sigh of relief The exemption from stamp duty can be availed if it is paid in the same financial year Video Stamp Web 23 sept 2022 nbsp 0183 32 5 163 250 000 163 925 000 10 163 925 000 163 1 500 000 12 163 1 500 000 The chancellor added that discounted stamp duty for first time buyers will now apply to

Apartment Stamp Duty Rebates A Go QuayCo Capital Investments

http://static1.squarespace.com/static/5b9b0ee2372b9691eba61857/t/5dc0b4ecdae1b62cf8a5c49d/1572910323185/Stampduty1.jpeg?format=1500w

Infographic Stamp Duty Changes Good News For Most

https://www.taxfile.co.uk/wp-content/uploads/2014/12/Stamp-duty-tax-bands.png

https://www.tatacapital.com/blog/loan-for-home/how-to-claim-stamp-duty...

Web 3 nov 2020 nbsp 0183 32 Stamp duty can go as high as 8 on your property value Hence a stamp duty rebate in income tax can be a huge sigh of relief The exemption from stamp duty

https://investguiding.com/article/how-to-claim-…

Web 10 mai 2023 nbsp 0183 32 Stamp duty can go as high as 8 on your property value Hence a stamp duty rebate in income tax can be a huge sigh of relief

Individual Income Tax Rebate

Apartment Stamp Duty Rebates A Go QuayCo Capital Investments

Increase In Tolerance Band 5 To 10 In Stamp Duty Valuation For The

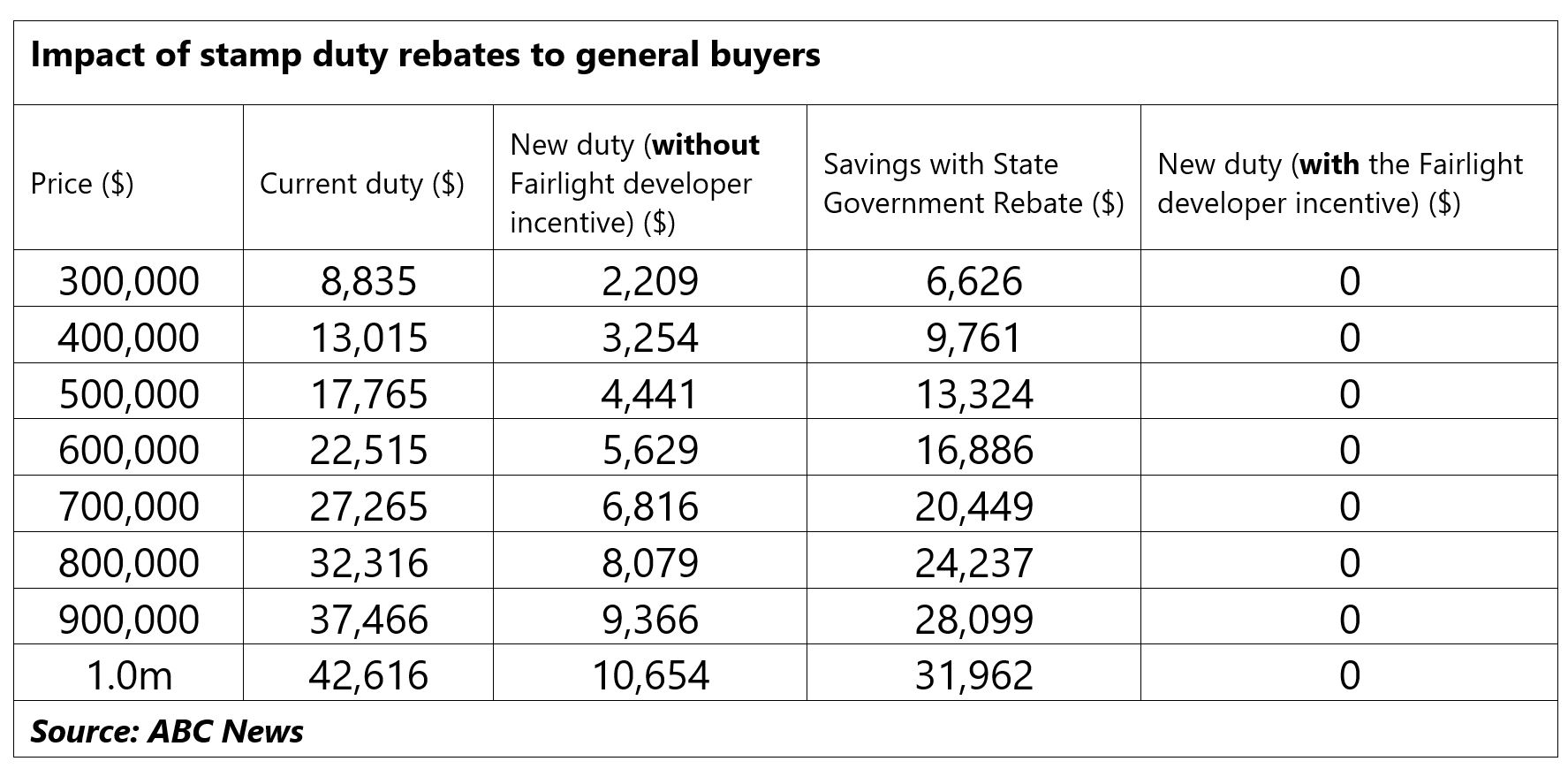

Understanding WA s Off The Plan Stamp Duty Rebates Fairlight

When Do I Have To Pay Stamp Duty Stamp Duty Rebate

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

.png)

Over Two thirds Of Landlords Unlikely To Purchase A Non EPC Compliant

Stamp Duty Rebates For Landlords

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Stamp Duty Rebate In Income Tax - Web 11 janv 2023 nbsp 0183 32 These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA