Standard Deduction Eligible In New Tax Regime 5 Am I eligible for Rs 50 000 standard deduction in the new tax regime Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both

Budget 2024 has increased the standard deduction limit under the new tax regime from 50 000 to 75 000 for the AY 2025 26 FY 2024 25 However taxpayer Yes Standard deduction of Rs 50 000 is available in new tax regime from FY 2023 24 starting from April 1 2023 How to claim standard deduction of Rs 50 000

Standard Deduction Eligible In New Tax Regime

Standard Deduction Eligible In New Tax Regime

https://im.indiatimes.in/content/2023/Feb/Old-Vs-New-Tax-Regime-Which-One-To-Pick-After-Budget-2023_63db747264d86.jpg

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

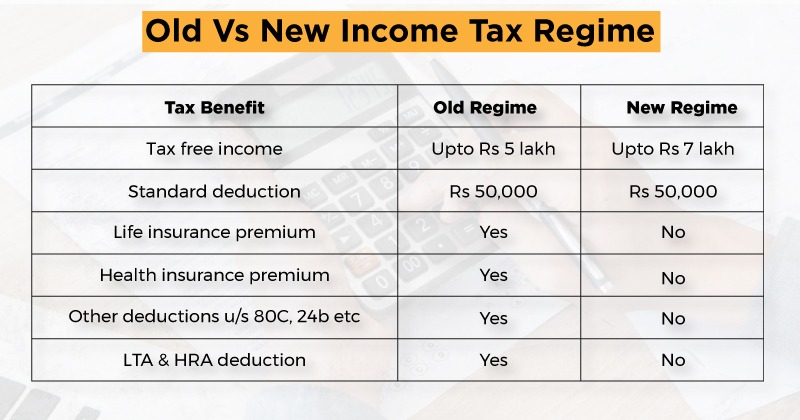

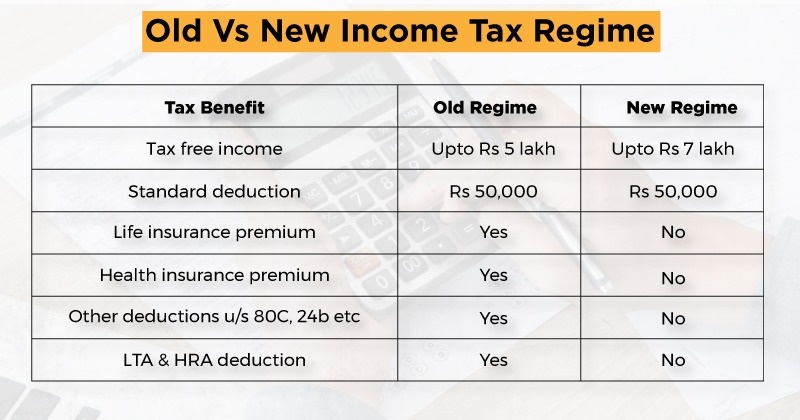

Old Vs New Income Tax Regime Key Things To Know Before Choosing One

https://images.cnbctv18.com/wp-content/uploads/2023/02/tax2.jpg

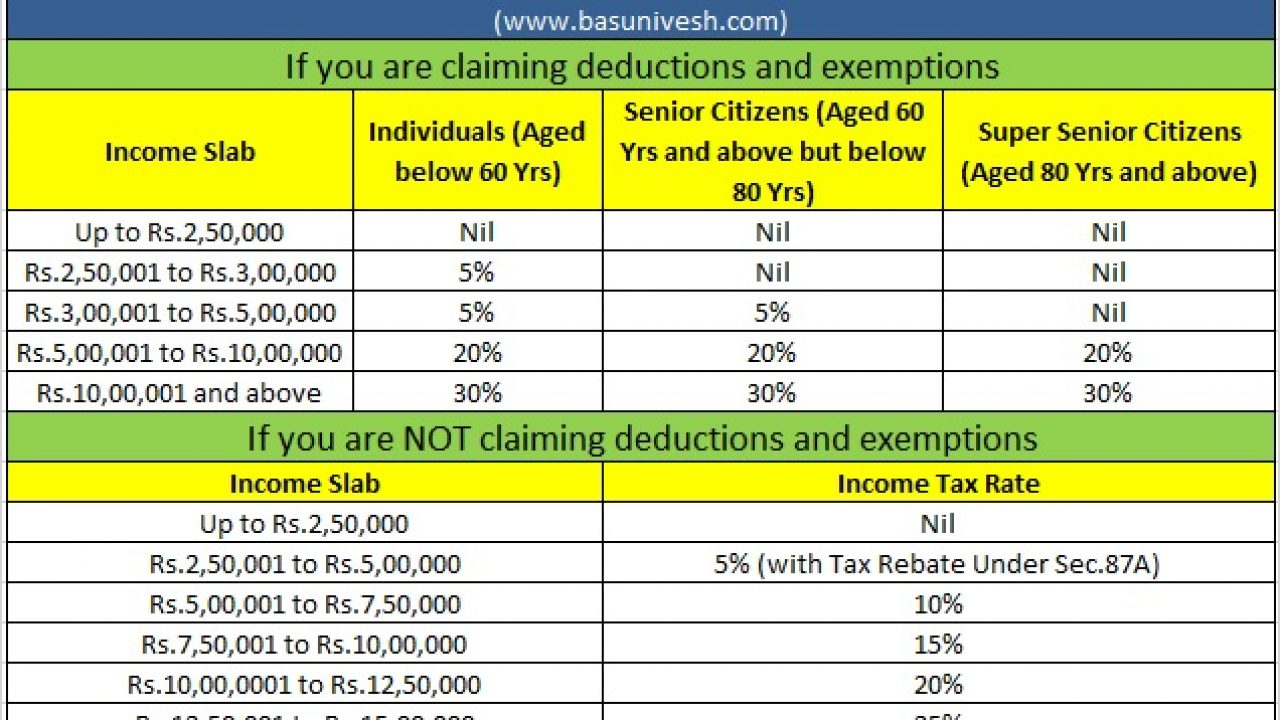

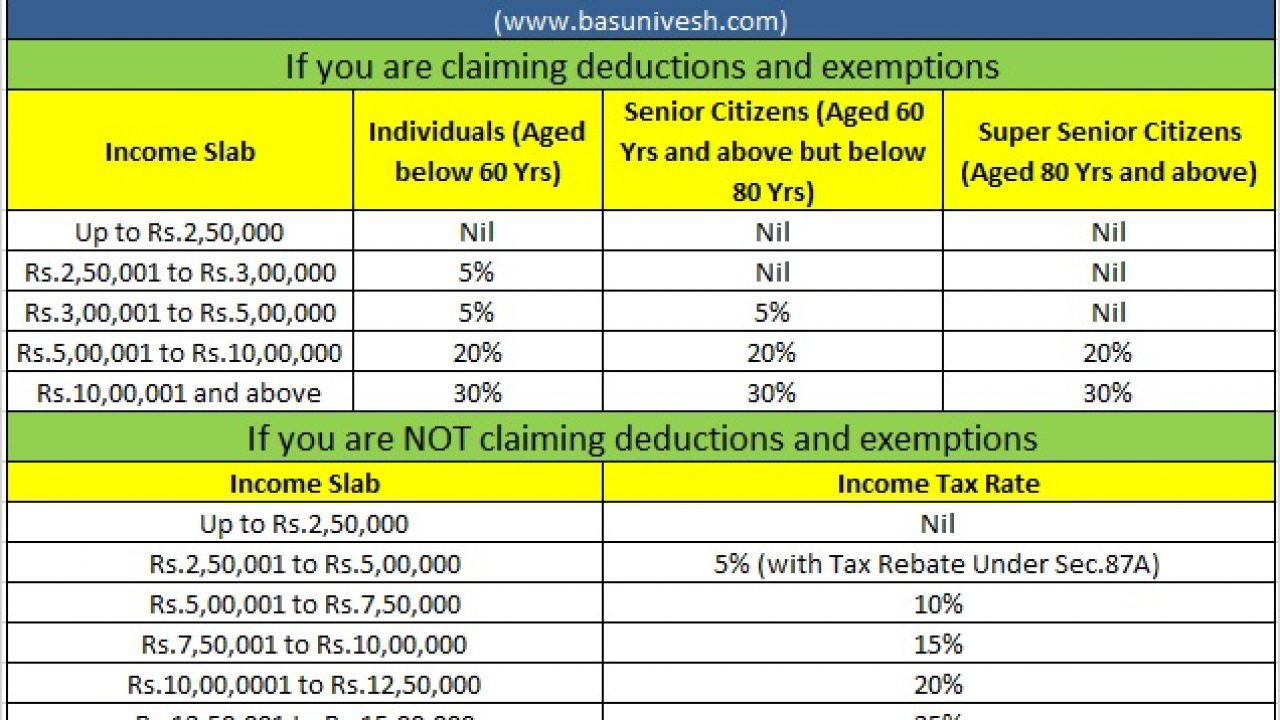

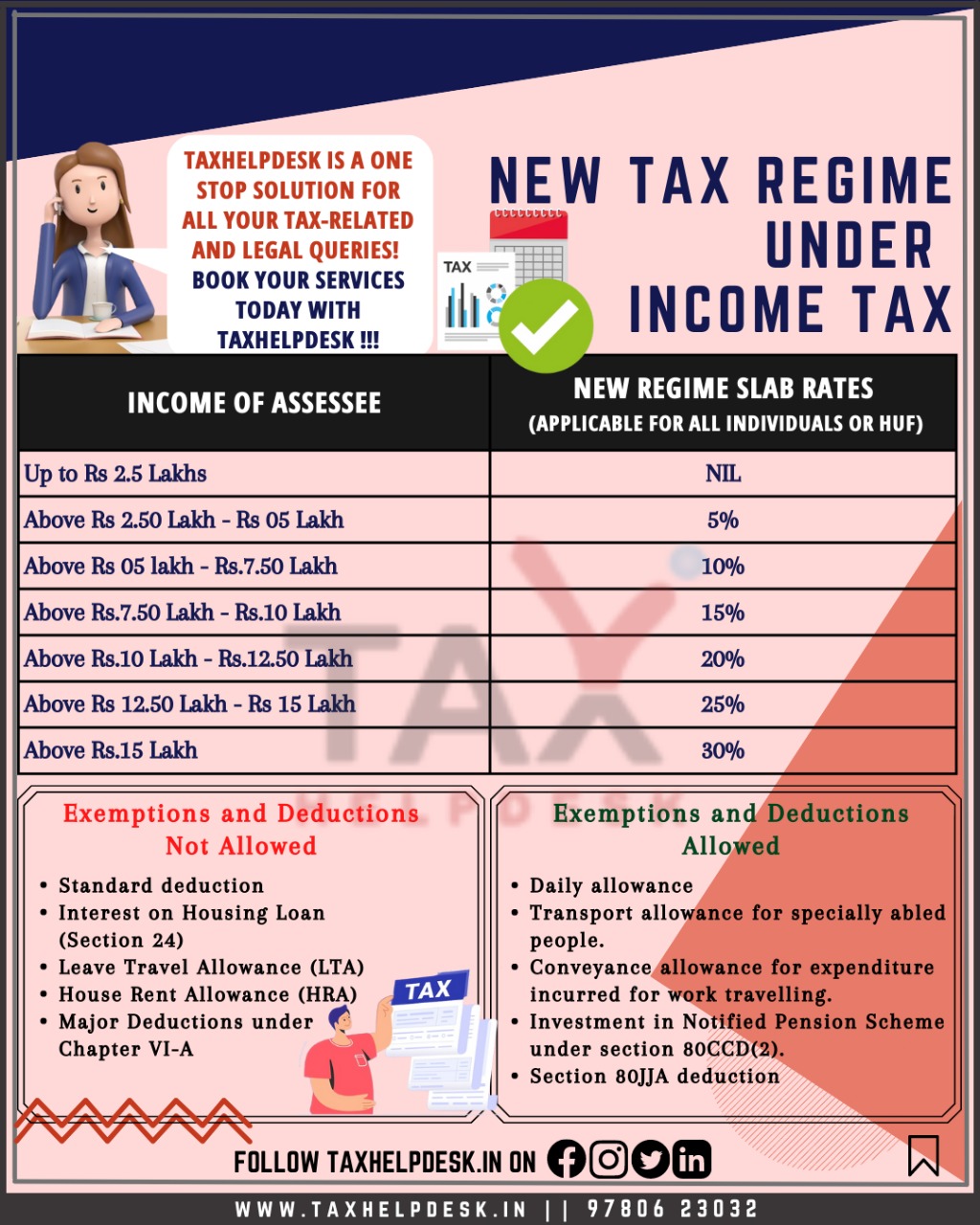

The recent adjustment in the Budget 2024 25 raised the standard deduction to 75 000 under the new tax regime benefiting salaried individuals and pensioners by reducing Under the new tax structure a standard deduction of Rs 50 000 has been implemented for salaried and pensioners only The Section 87A rebate has been

Standard Deduction of Rs 50 000 is now available for EVERY Salaried Pensioners under the New Tax Regime in India 2023 This new change has been Standard deduction The new tax regime provides a standard deduction of Rs 50 000 for salaried individuals As per the new tax regime a taxpayer can enjoy tax

Download Standard Deduction Eligible In New Tax Regime

More picture related to Standard Deduction Eligible In New Tax Regime

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202302/ezgif.com-gif-maker_78-sixteen_nine.jpg?VersionId=xUwpmYRrPS0rtimFBRBauVHLpBCu3Uq9&size=690:388

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

https://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-3-1024x576.jpeg

Standard Deduction benefit Salaried taxpayers can now avail of a standard deduction under the new tax regime of Rs 75 000 Also family pensioners can now get What does deduction mean in the new tax regime A standard deduction implies a flat rebate from taxpayers gross salary Taxpayers do not need to apply

Know all about the deductions allowed under the new tax regime income tax slab rates for FY 2023 24 and which regime is better old or new tax regime In a relief to taxpayers finance minister Nirmala Sitharaman announced a hike in the standard deduction limit under the new tax regime to Rs 75 000 in the Union

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/02/standard-deduction-and-tax-rebate-in-new-tax-regime-video-1024x576.webp

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

https://assets1.cleartax-cdn.com/finfo/wg-utils/retool/5b974531-0e4b-4442-ab2f-b5505d877432.png

https://www.incometax.gov.in/iec/foportal/sites...

5 Am I eligible for Rs 50 000 standard deduction in the new tax regime Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

Budget 2024 has increased the standard deduction limit under the new tax regime from 50 000 to 75 000 for the AY 2025 26 FY 2024 25 However taxpayer

Share

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

INTRODUCTION OF SECTION 115BAC TO INCOME TAX ACT 1961 Onfiling Blog

Tax Rates Absolute Accounting Services

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Old Income Tax Regime Vs New How Are Both Different Zee Business

Old Income Tax Regime Vs New How Are Both Different Zee Business

E calculator Launched By The Income Tax Department For Individuals To

Rebate Limit New Income Slabs Standard Deduction Understanding What

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

Standard Deduction Eligible In New Tax Regime - The following deductions under New Tax Regime are still available for tax payers The Standard Deduction of Rs 50 000 for salaried individuals and pensioners