Standard Deduction Taxable Income The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for individuals 27 700

The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to

Standard Deduction Taxable Income

Standard Deduction Taxable Income

https://media.cheggcdn.com/media/3b0/3b047866-ef26-49d1-ad9e-1b18e0d828ff/phpQD3kD8

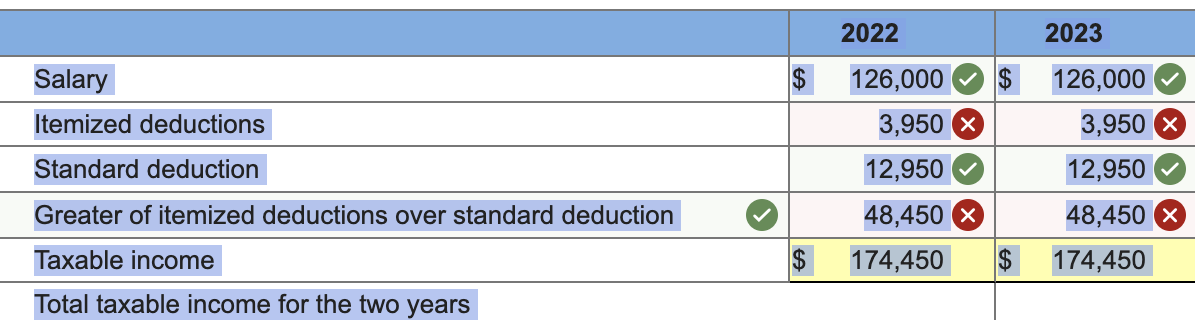

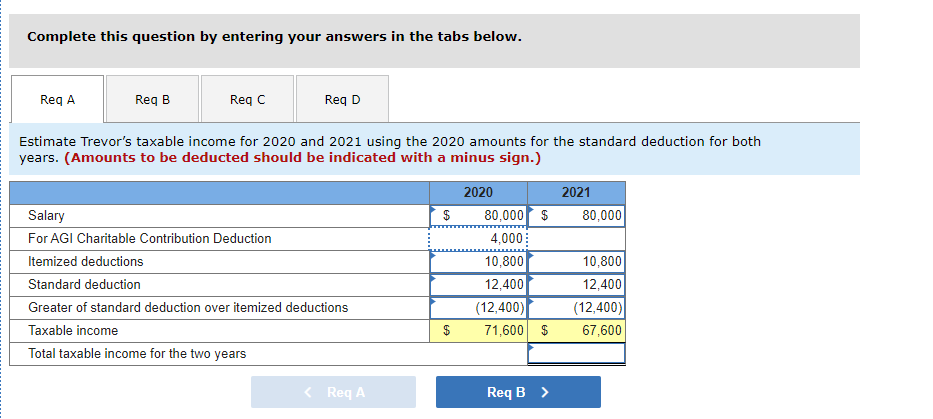

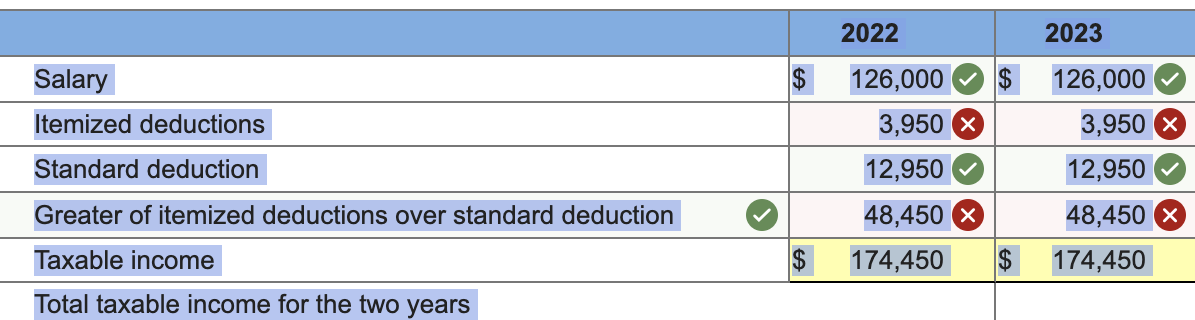

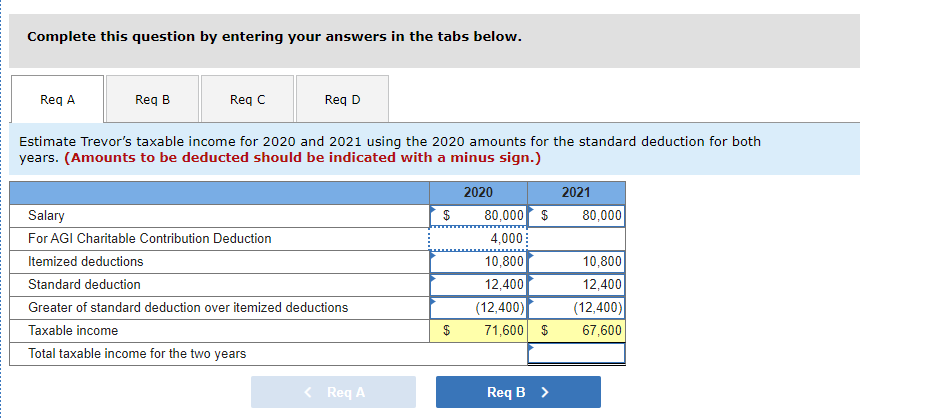

Trevor Is A Single Individual Who Is A Cash method Chegg

https://media.cheggcdn.com/media/69e/69eb568b-e81f-41fb-bd70-36691353c9e3/phptBJzXV.png

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

It ensures that only households with income above certain thresholds will owe any income tax Taxpayers can claim a standard deduction when filing their tax returns thereby reducing their The standard deduction is a specific dollar amount that reduces the amount of taxable income The standard deduction consists of the sum of the basic standard deduction

Your standard deduction depends on your filing status age and whether a taxpayer is blind Learn how it affects your taxable income and any limits on claiming it The standard deduction for 2024 taxes due this year is 14 600 for single filers and 29 200 for those married filing jointly

Download Standard Deduction Taxable Income

More picture related to Standard Deduction Taxable Income

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Calculating Net Taxable Income Through Allowable Deductions A

https://imgv2-1-f.scribdassets.com/img/document/599876090/original/a7c3895fbe/1708316564?v=1

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

https://boxelderconsulting.com/wp-content/uploads/2022/11/Screen-Shot-2022-11-17-at-12.20.59-PM-1024x469.png

The Standard Deduction lets you reduce your taxable income by a fixed amount making tax filing simpler since you don t need to itemize deductions Each year the Standard Deduction amount typically goes up to A tax deduction reduces your taxable income and how much tax you owe You can itemize your deductions or take a fixed amount with the standard deduction

Understand how the standard deduction impacts your taxable income and tax bracket considering filing status and additional adjustments The standard deduction is a fixed dollar amount that reduces your taxable income Itemized deductions can also reduce your taxable income but the amount varies and is not

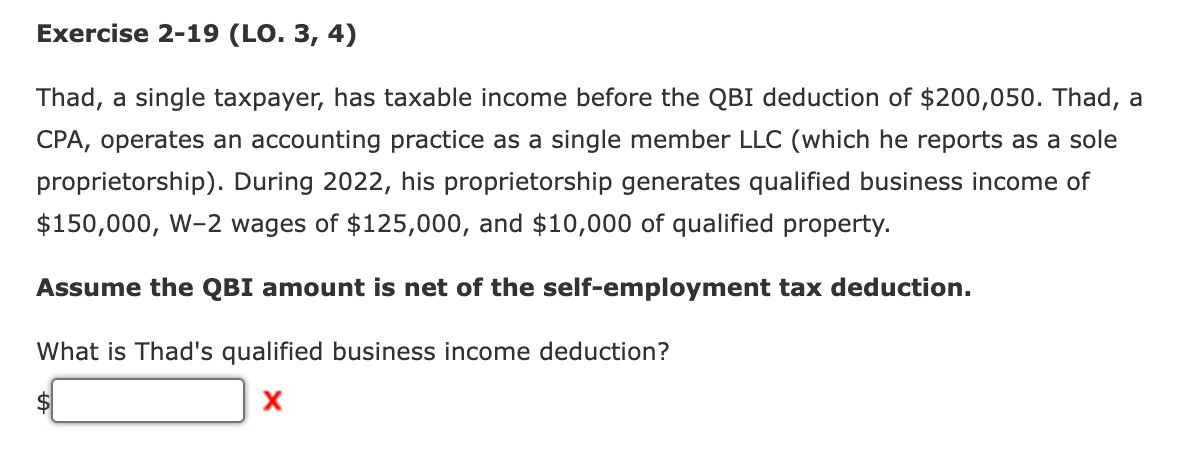

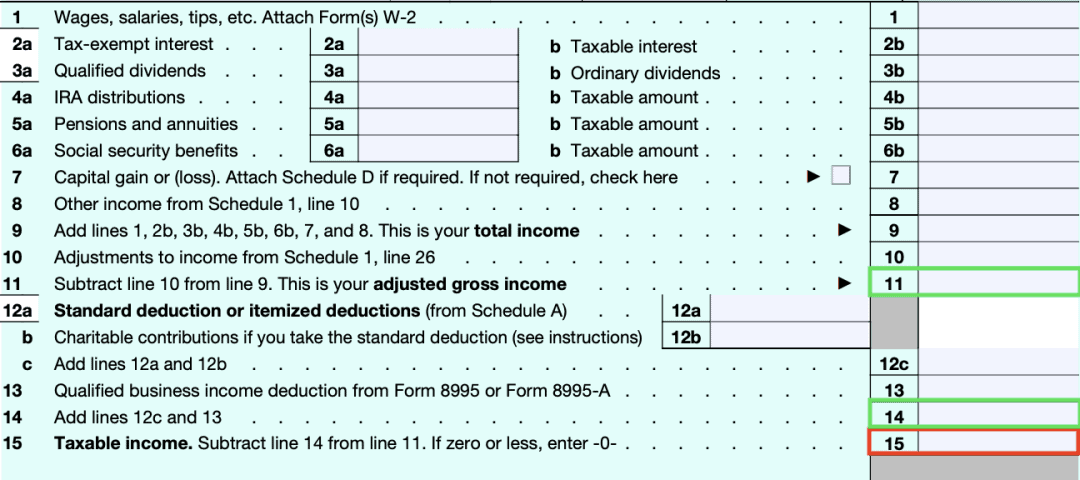

Solved Thad A Single Taxpayer Has Taxable Income Before Chegg

https://media.cheggcdn.com/media/779/7792e481-9ef4-48eb-88d6-640f0023a734/phptpRSBe

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

https://www.investopedia.com › terms › standarddeduction.asp

The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for individuals 27 700

https://www.irs.gov › taxtopics

The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Solved Thad A Single Taxpayer Has Taxable Income Before Chegg

New 2023 IRS Income Tax Brackets And Phaseouts

W4 Withholding Calculator EivinDoutzen

60k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Solved Taylor A Single Taxpayer Has 16 000 AGI Assume Chegg

Solved Taylor A Single Taxpayer Has 16 000 AGI Assume Chegg

IRS Form 6251 Instructions A Guide To Alternative Minimum Tax

Solved Please Note That This Is Based On Philippine Tax System Please

IRS Announces 2022 Tax Rates Standard Deduction

Standard Deduction Taxable Income - Around 90 of all taxpayers claim the standard deduction on their federal tax return See how much it can reduce your taxable income