Standard Mileage Expense Rate Beginning on Jan 1 2024 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 67 cents per mile driven for business use up 1 5 cents from 2023

The standard mileage rate also known as the mileage per diem or deductible mileage is the default cost per mile set by the Internal Revenue Service IRS for taxpayers who deduct the For 2022 the business mileage rate is 58 5 cents per mile medical and moving expenses driving is 18 cents per mile and charitable driving is 14 cents per mile the same as last year

Standard Mileage Expense Rate

Standard Mileage Expense Rate

https://jma-cpas.com/wp-content/uploads/2015/12/IRS-Mileage-Rates-2016-1280x420.jpg

2020 IRS Standard Mileage Rate Announced CompanyMileage

https://companymileage.com/wp-content/uploads/2019/12/irs-rate.jpg

IRS Increases Standard Mileage Rate Abdo

https://abdosolutions.com/wp-content/uploads/2022/06/2022StandardMileage-Social-Image.jpg

The 2024 IRS standard mileage rates are 67 cents per mile for every business mile driven 14 cents per mile for charity and 21 cents per mile for moving or medical Notice 2023 3 PDF 105 KB provides that beginning January 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 65 5 cents per mile for

What is the Standard Mileage Rate A standard mileage rate is the dollar amount per mile imposed by the Internal Revenue Service IRS when calculating the deductible costs for The 2024 standard mileage rate is 67 cents per mile up from 65 5 cents per mile last year The 2024 medical or moving rate is 21 cents per mile down from 22 cents per mile last year The

Download Standard Mileage Expense Rate

More picture related to Standard Mileage Expense Rate

What Will The IRS Standard Mileage Rate Be In 2021 CompanyMileage

https://companymileage.com/wp-content/uploads/2020/11/irs-standard-mileage-rate-trends-scaled.jpeg

Standard Mileage Rate Method Archives

https://falconexpenses.com/blog/wp-content/uploads/2019/02/MileageExpenseLog_Falcon.png

IRS Issues Standard Mileage Rates For 2023 Business Use Increases 3

https://www.clevelandgroup.net/wp-content/uploads/2023/01/mileage-rate.jpg

For a car you lease you must use the standard mileage rate method for the entire lease period including renewals if you choose the standard mileage rate You ll enter your mileage in the The standard mileage rate writes off a certain amount for every mile you drive for business purposes So for the 2023 tax year you are able to write off 0 655 for every mile you drive

The standard mileage rate for 2023 is 65 5 cents per mile This amount increases to 67 cents per mile for 2024 Should you use the standard mileage or actual expenses method If you drive for a company such as Uber the With the standard mileage rate you deduct a set amount for each business mile you drive The IRS sets the amount each year For tax year 2023 the standard mileage rate is 65 5 cents

IRS Standard Mileage Rates In 2023 MileageWise

https://www.mileagewise.com/wp-content/uploads/2021/12/.irs-standard-mileage-rate-2022.jpeg

Standard Mileage Rates For 2016 Tyler Simms St Sauveur CPAs P C

https://tss-cpa.com/wp-content/uploads/2016/04/mileage.jpg

https://www.irs.gov/newsroom/irs-issues-standard...

Beginning on Jan 1 2024 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 67 cents per mile driven for business use up 1 5 cents from 2023

https://www.investopedia.com/terms/s/standardmileagerate.asp

The standard mileage rate also known as the mileage per diem or deductible mileage is the default cost per mile set by the Internal Revenue Service IRS for taxpayers who deduct the

Increased Standard Mileage Rate For 2023 Wegner CPAs

IRS Standard Mileage Rates In 2023 MileageWise

New Standard Mileage Rates Announced For 2023 New Business Direction LLC

What Is The Standard Mileage Rate For 2017 MileIQ

Standard Mileage Rate 2020 Credit Karma

What Is Standard Mileage Rate Definition Limits ExcelDataPro

What Is Standard Mileage Rate Definition Limits ExcelDataPro

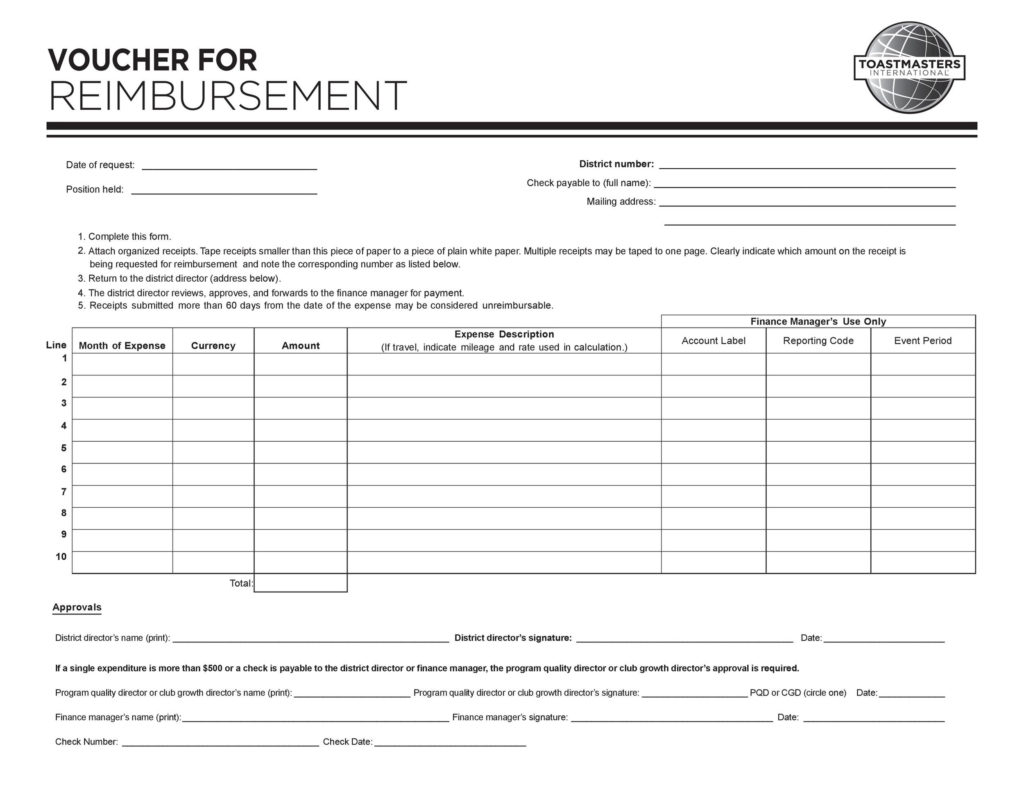

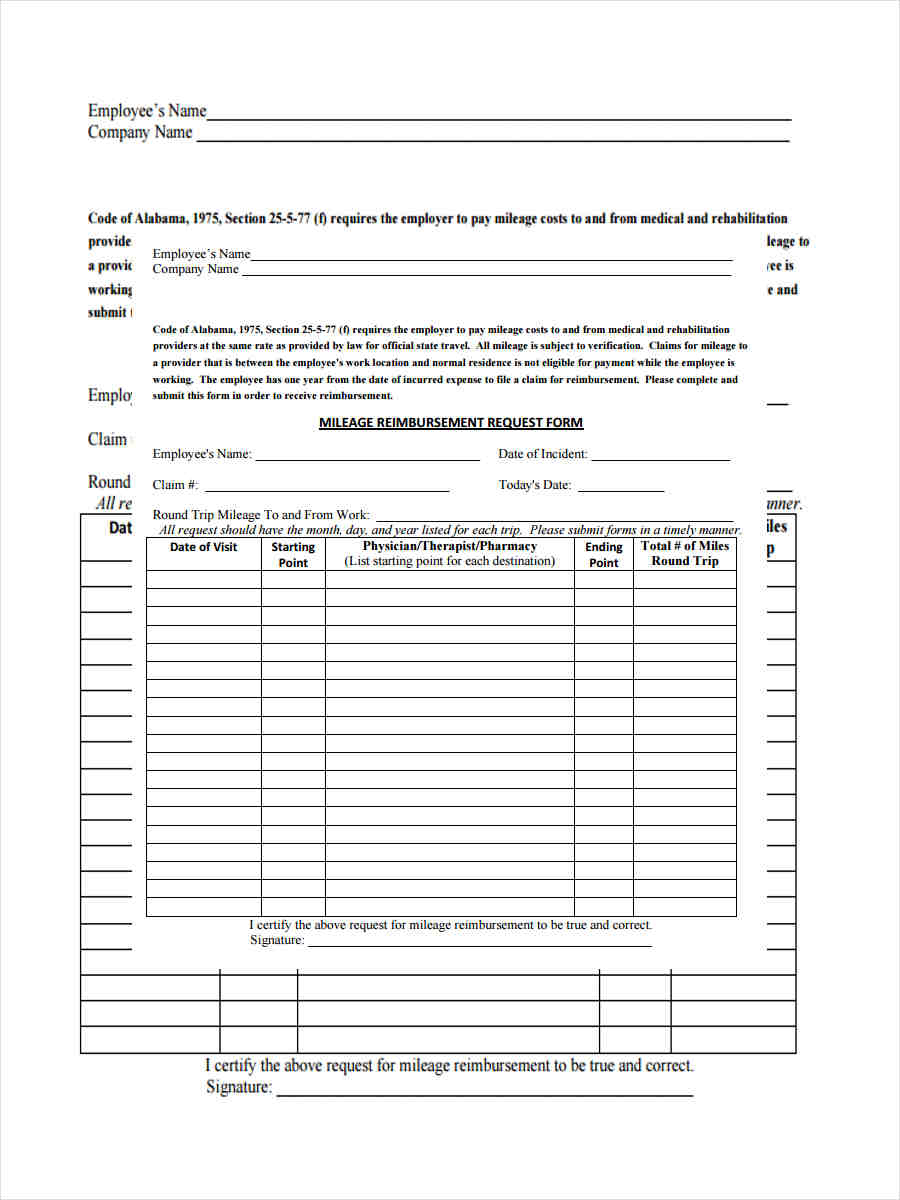

Reimbursement Form Template IRS Mileage Rate 2021

IRS Announces Mileage Rate Increase Starting July 2022 Dana Borys

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

Standard Mileage Expense Rate - Notice 2023 3 PDF 105 KB provides that beginning January 1 2023 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 65 5 cents per mile for