Standard Tax Deduction 2022 Self Employed Yes In fact it s probably the best way to file Self employed can claim the standard deduction on Form 1040 Line 40 The best part the IRS lets taxpayers

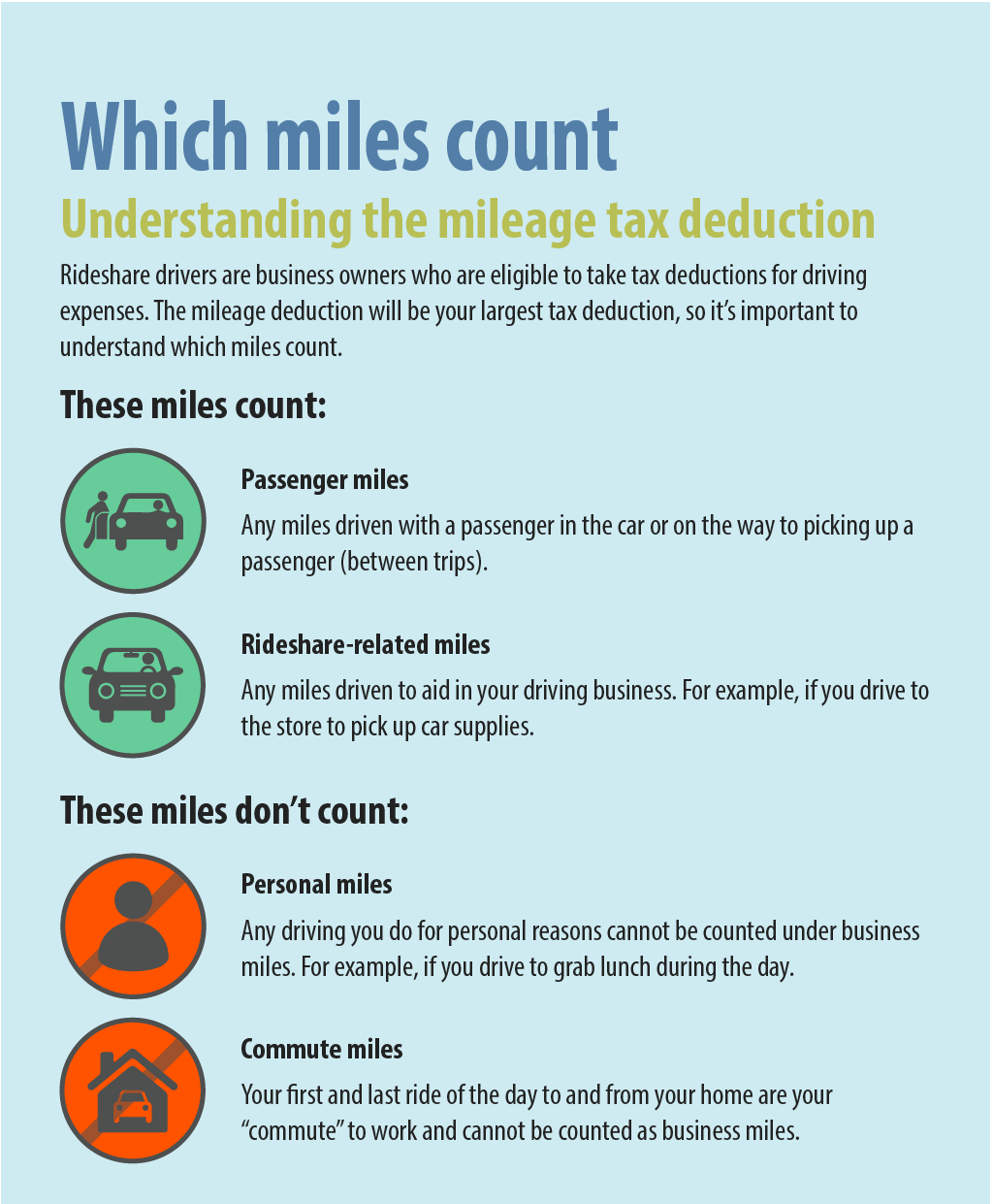

1 The home office deduction 2 Health insurance maybe deduction 3 Continuing education deduction 4 Mileage deduction 5 Retirement savings deduction 6 Key Takeaways Retirement plans for yourself and for your employees can be a large write off In 2023 an individual can contribute 22 500 plus an additional

Standard Tax Deduction 2022 Self Employed

Standard Tax Deduction 2022 Self Employed

http://www.eitcoutreach.org/wp-content/uploads/which-miles-count.png

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

Pin Di Worksheet

https://i.pinimg.com/originals/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

Employers calculate Social Security and Medicare taxes of most wage earners However you figure self employment tax SE tax yourself using Schedule SE Self employed individuals generally must pay self employment SE tax as well as income tax SE tax is a Social Security and Medicare tax primarily for individuals who work for

Self employment tax rate The law sets the self employment tax rate as a percentage of your net earnings from self employment This rate consists of 12 4 for What Is the Tax Rate for Self Employment For 2022 the self employment tax rate is 15 3 on net earnings The tax is divided into two parts 12 4 goes toward

Download Standard Tax Deduction 2022 Self Employed

More picture related to Standard Tax Deduction 2022 Self Employed

Self Employment Tax Form 2022 Standard Deduction Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-employment-tax-form-2022-standard-deduction.png

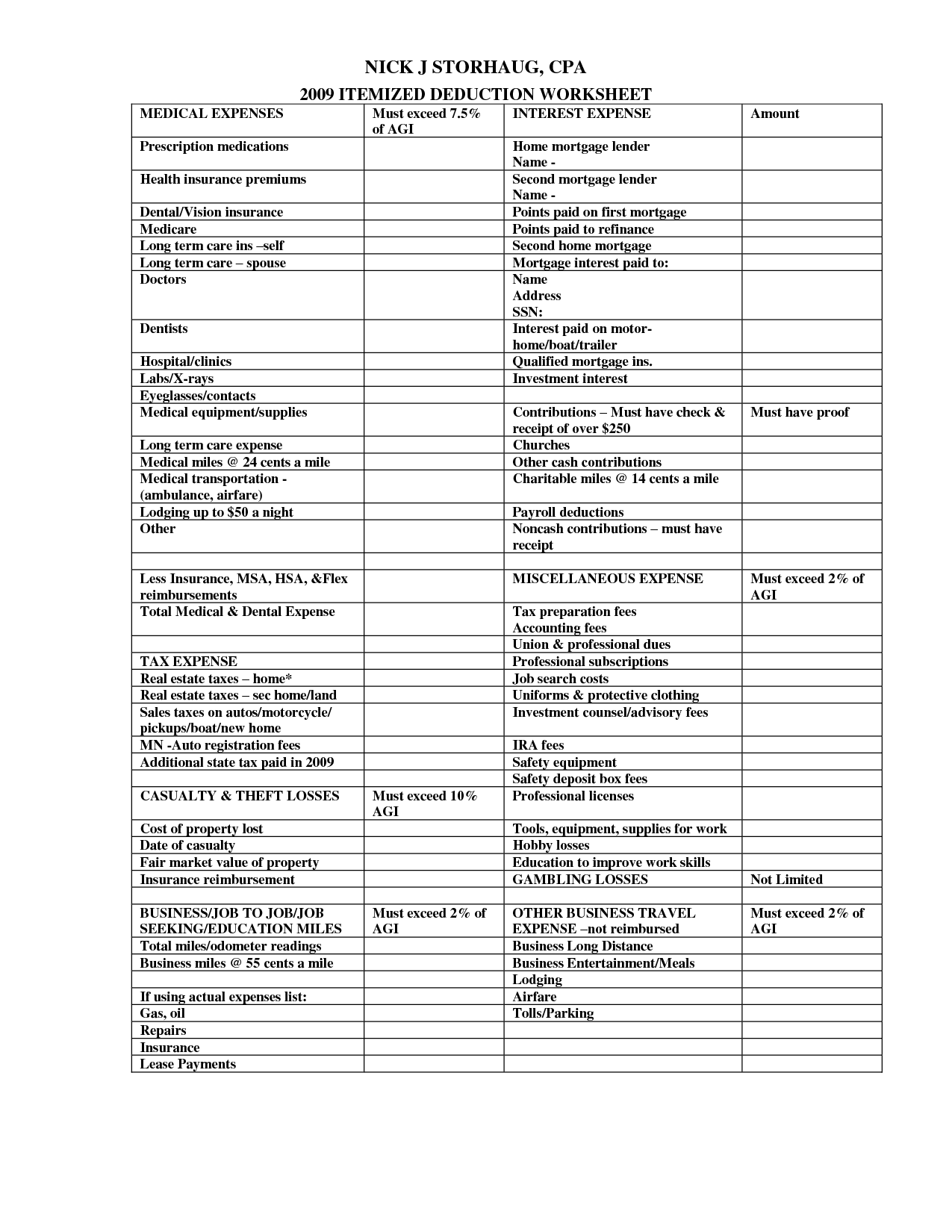

Printable Itemized Deductions Worksheet

https://www.pdffiller.com/preview/391/382/391382225/large.png

Irs Introduces New Tax Brackets Standard Deductions For 2022 Wealthmd

https://wealthmd.net/wp-content/uploads/2021/12/2022-Tax-Chart-1024x390-1.jpg

How to write off business expenses on top of the standard deduction You ll always get taxed on your self employment income even if it s less than the standard A Guide to Tax Deductions for the Self Employed The general rule is that any ordinary and reasonable expense you pay while conducting a business activity is

There s the option of a standard deduction i e a flat tax rate whether single or married filing jointly but itemized deductions could potentially save taxpayers Get started More calculators Self Employed Tax Deductions Calculator Find deductions as a 1099 contractor freelancer creator or if you have a side gig Get started Tax

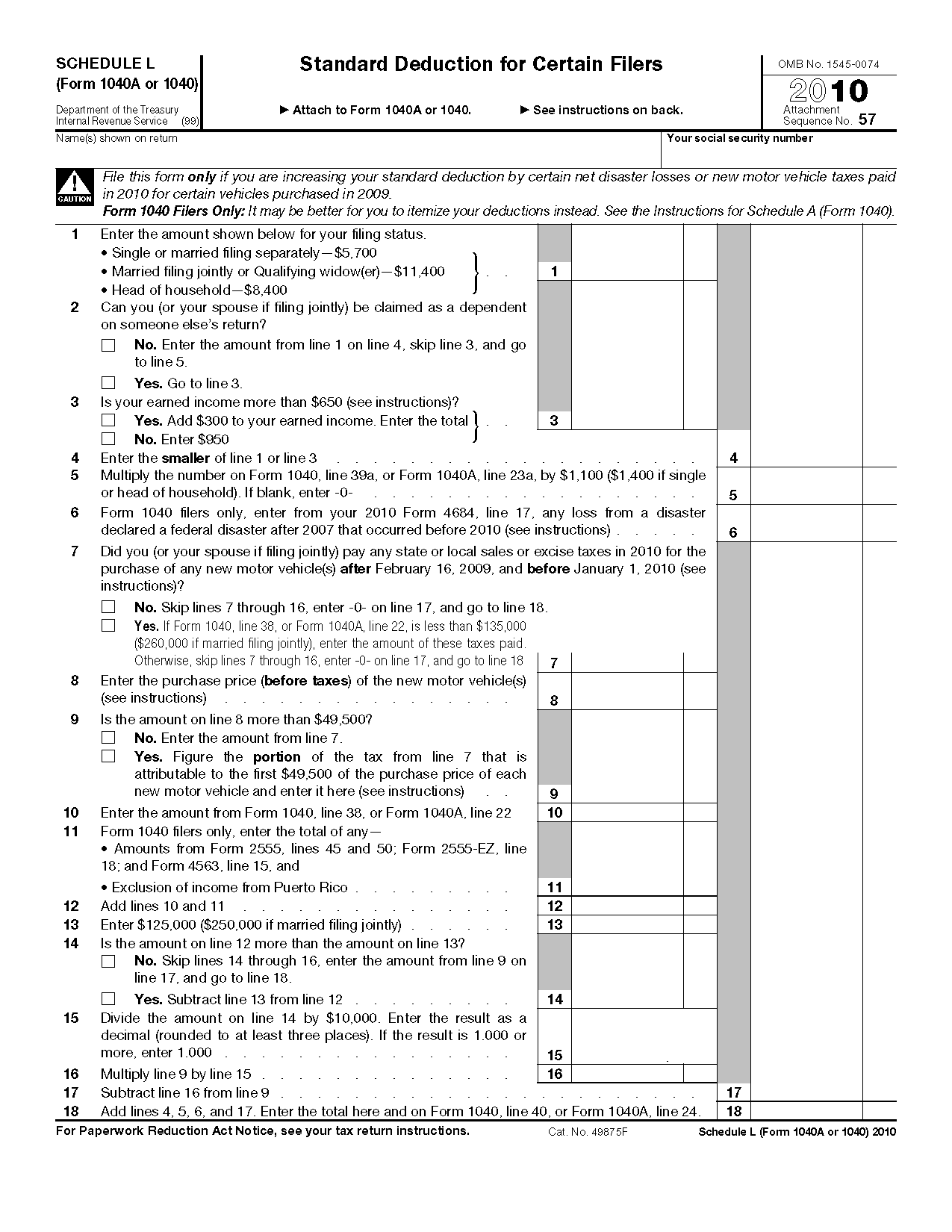

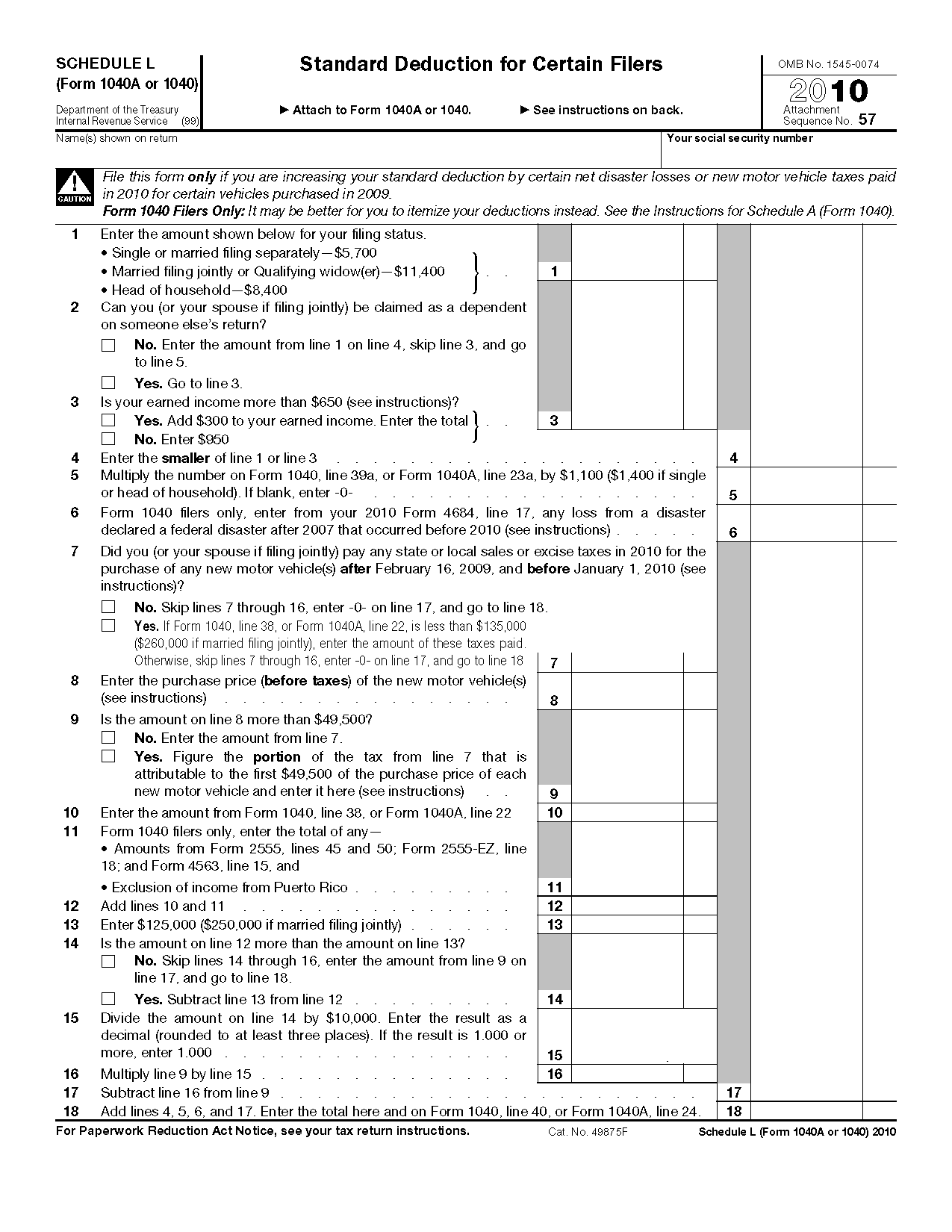

Form 1040 Schedule L Standard Deduction For Certain Filers 2021 Tax

https://1044form.com/wp-content/uploads/2020/08/form-1040-schedule-l-standard-deduction-for-certain-filers.png

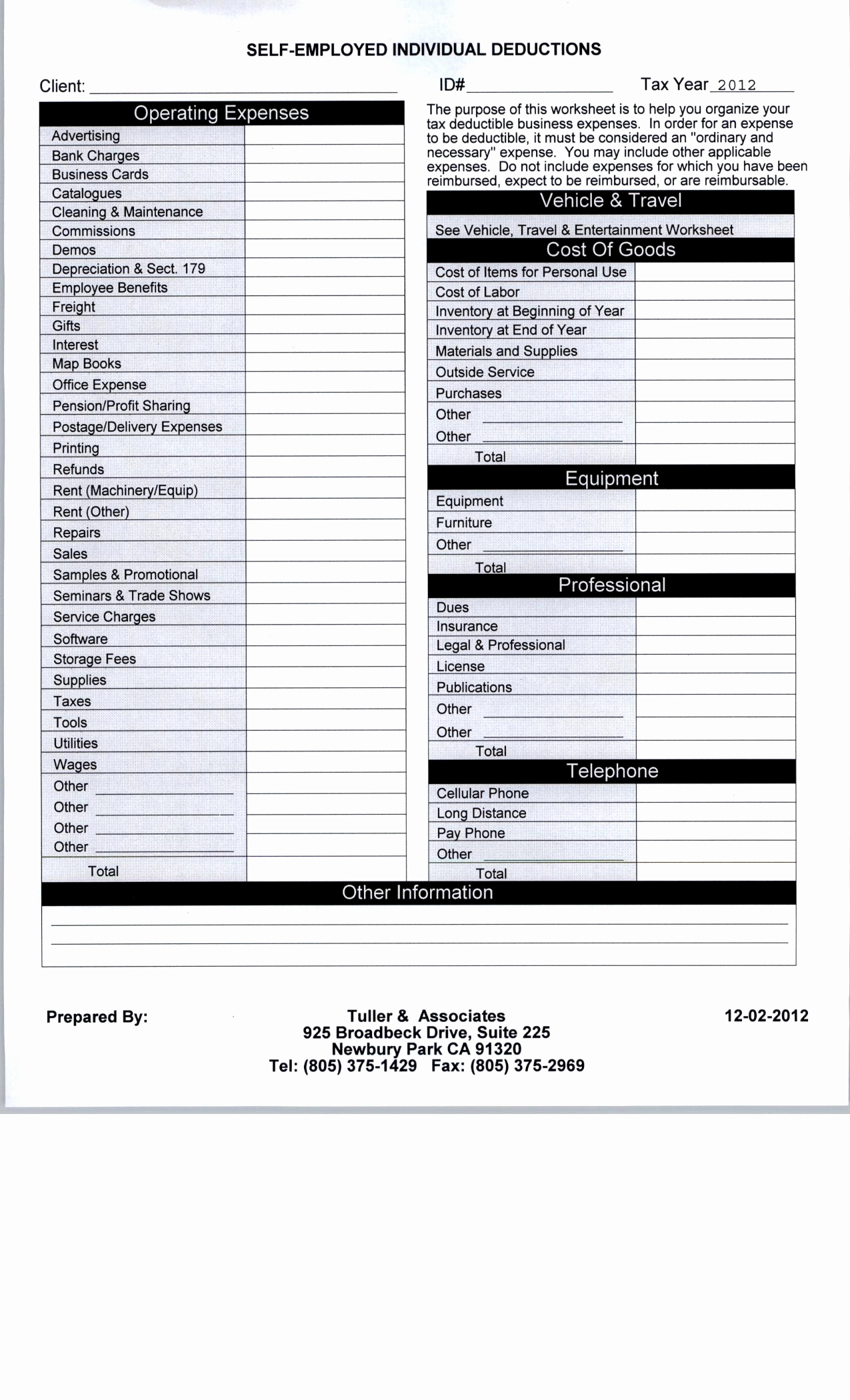

Business Expense Spreadsheet For Taxes New Self Employed Tax And

https://db-excel.com/wp-content/uploads/2018/11/business-expense-spreadsheet-for-taxes-new-self-employed-tax-and-business-expense-deductions-spreadsheet.jpg

https://mileiq.com/blog/can-self-employed-take-the-standard-deduction

Yes In fact it s probably the best way to file Self employed can claim the standard deduction on Form 1040 Line 40 The best part the IRS lets taxpayers

https://www.nerdwallet.com/article/taxes/self...

1 The home office deduction 2 Health insurance maybe deduction 3 Continuing education deduction 4 Mileage deduction 5 Retirement savings deduction 6

10 Business Tax Deductions Worksheet Worksheeto

Form 1040 Schedule L Standard Deduction For Certain Filers 2021 Tax

Self Employed Tax Deductions Worksheet Worksheet Resume Examples

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Standard Tax Deduction 2022 Self Employed - What Is the Tax Rate for Self Employment For 2022 the self employment tax rate is 15 3 on net earnings The tax is divided into two parts 12 4 goes toward