Standard Tax Deduction 2024 Over 65 The AMT exemption rate is also subject to inflation The AMT exemption amount for tax year 2024 for single filers is 85 700 and begins to phase out at 609 350 in 2023 the exemption amount for

The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025 The tax items for tax year 2024 of greatest interest to most taxpayers include the following dollar amounts The standard deduction for married couples filing jointly for tax year 2024 rises to 29 200 an increase of 1 500 from tax For the tax year 2024 the standard deduction for married couples filing jointly will increase to 29 200 an increase of 1 500 over the tax year 2023 The top tax rate will remain at 37 for married couples filing jointly however the income bracket has increased from 693 750 in 2023 to 731 200 in 2024 Now remember with the

Standard Tax Deduction 2024 Over 65

Standard Tax Deduction 2024 Over 65

http://mphp.in/wp-content/uploads/2023/02/IRS-Standard-Deduction.png

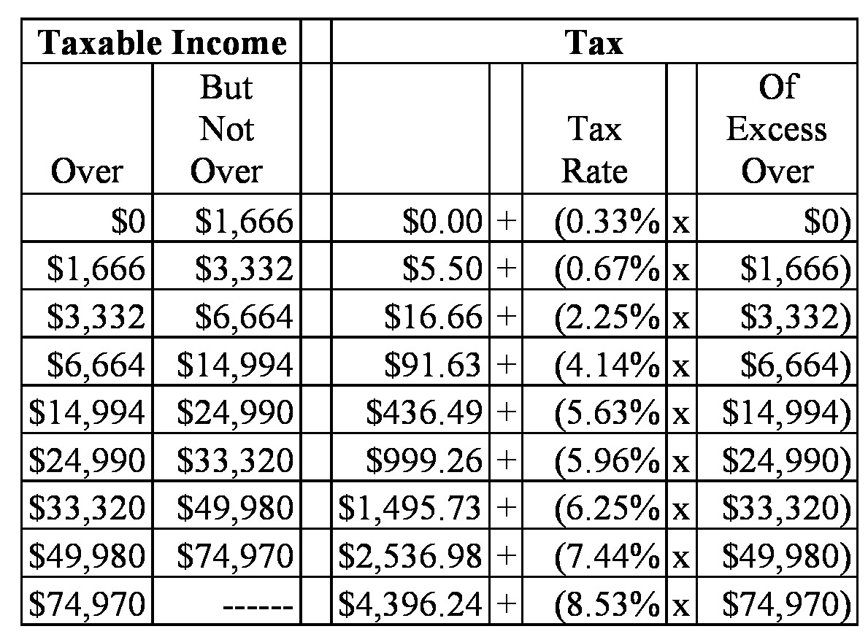

Standard Deduction Chart For People Age 65 Or Older Or Blind Line 38

https://www.unclefed.com/TaxHelpArchives/2002/1040Instrs/chart_65olderblind.gif

2021 Standard Deduction Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/form-1040-sr-seniors-get-a-new-simplified-tax-form-for-2019-2-1024x1024.png

The IRS adjusts the standard deduction for inflation for each tax year Standard Deduction 2024 Returns Due April 2025 of 1 850 for being a single filer over age 65 Her total standard The IRS considers an individual to be 65 on the day before their 65th birthday The standard deduction for those over age 65 in tax year 2023 filing in 2024 is 15 700 for singles 29 200 for

Your standard deduction is limited when someone else claims you as a dependent on their tax return For 2024 the limit is 1 300 or your earned income plus 450 whichever is greater For the For tax year 2023 the additional standard deduction amounts for taxpayers who are 65 and older or blind are 1 850 for single or head of household 1 500 for married taxpayers per qualifying

Download Standard Tax Deduction 2024 Over 65

More picture related to Standard Tax Deduction 2024 Over 65

Standard Deduction Chart For Seniors 2024 Zora Stevana

https://www.taxdefensenetwork.com/wp-content/uploads/2021/02/itemized-deductions-65-or-blind-2500x1250.jpg

2024 Standard Deduction Over 65 Tax Brackets Lilas Carmelle

https://federal-withholding-tables.net/wp-content/uploads/2021/07/irs-tax-brackets-2020-2021-news-and-freedom-1.png

Mortgage Interest Deduction Limit Worksheet

https://i2.wp.com/standard-deduction.com/wp-content/uploads/2020/10/how-to-reduce-your-tax-bill-with-itemized-deductions-bench-2-1024x883.png

The standard deduction isn t available to certain taxpayers You can t take the standard deduction if you itemize your deductions Refer to Topic no 501 Should I itemize for more information Additional standard deduction You re allowed an additional deduction if you re age 65 or older at the end of the tax year You re considered to be Form 1040 SR U S Tax Return for Seniors was introduced in 2019 You can use this form if you are age 65 or older at the end of 2023 The form generally mirrors Form 1040 However the Form 1040 SR has larger text and some helpful tips for older taxpayers See the Instructions for Form 1040 for more information

Standard deduction 2024 The standard deduction amounts for 2024 have increased to 14 600 for single filers 29 200 for joint filers and 21 900 for heads of household People 65 or older may be You will pay 10 percent on taxable income up to 11 600 12 percent on the amount over 11 600 to 47 150 and 22 percent above that up to 100 525 In addition the standard deduction is 14 600 for single filers for the 202 4 tax year up from 13 850 for 2023 The standard deduction for couples filing jointly is 29 200

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

2022 Tax Rates Standard Deduction Amounts To Be Prepared In 2023 Gambaran

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

https://www.forbes.com/sites/kellyphillipserb/2023/...

The AMT exemption rate is also subject to inflation The AMT exemption amount for tax year 2024 for single filers is 85 700 and begins to phase out at 609 350 in 2023 the exemption amount for

https://www.irs.gov/newsroom/irs-provides-tax...

The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025 The tax items for tax year 2024 of greatest interest to most taxpayers include the following dollar amounts The standard deduction for married couples filing jointly for tax year 2024 rises to 29 200 an increase of 1 500 from tax

What Are The New Irs Tax Brackets For 2023 Review Guruu Images And

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Federal Tax Brackets 2021 Newyorksilope Free Nude Porn Photos

Tax Year 2024 Standard Deduction Over 65 Dina Myrtia

IRS Announces 2022 Tax Rates Standard Deduction

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

2024 Montana Tax Brackets Ame Teddie

IDR 2020 Interest Rates Standard Deductions And Income Tax Brackets

Irs Tax Brackets 2023 Chart Printable Forms Free Online

Standard Tax Deduction 2024 Over 65 - Retirees 65 and Older Eligible for Extra Standard Deduction at Tax Time When It s Right for Your Budget David Nadelle Fri Jan 5 2024 1 standard deduction plus 1 500 for one 65