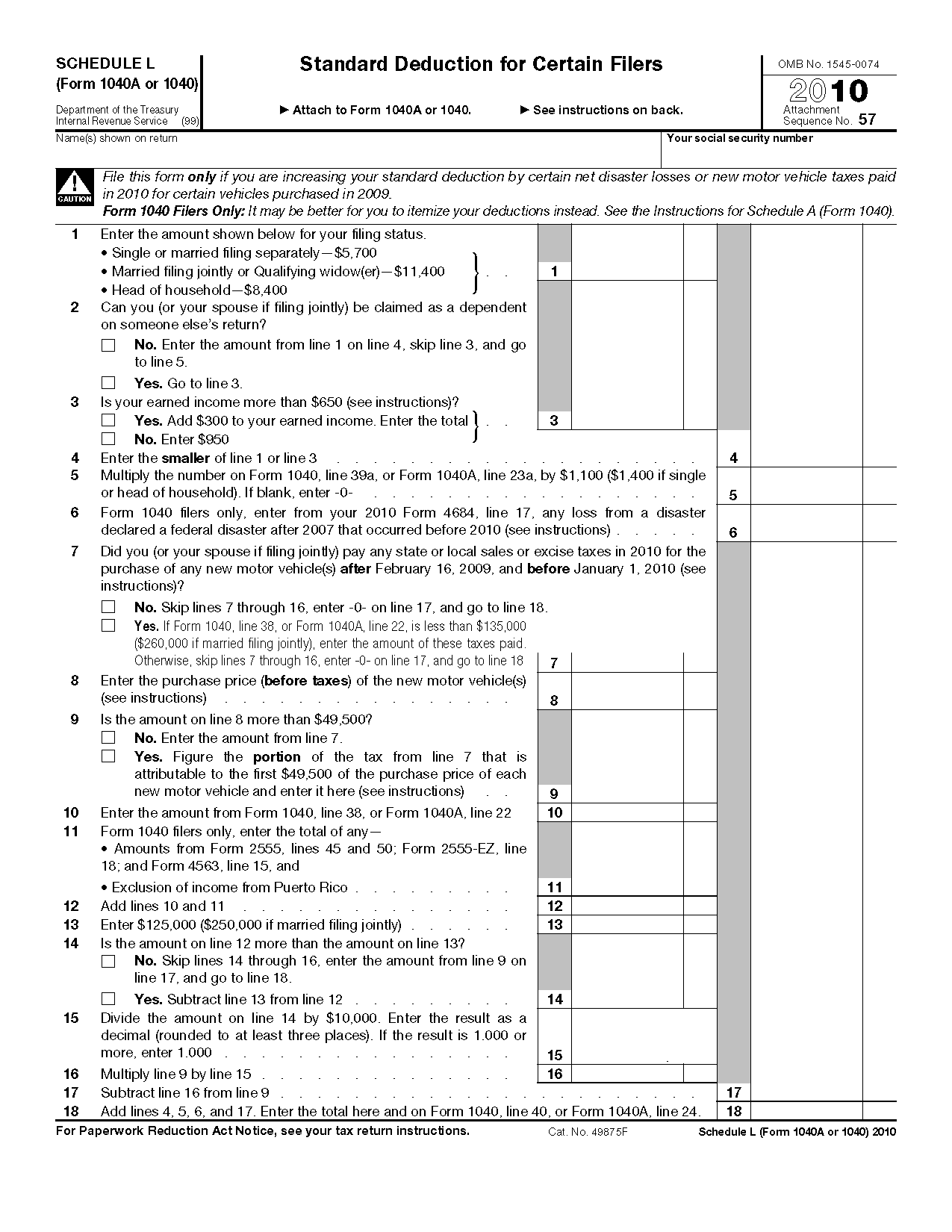

Standard Tax Deduction The standard deduction is a flat dollar amount set by the IRS based on your filing status It s the simplest way to reduce your taxable income on your tax return In fact Congress

The standard deduction is a specific dollar amount that filers can subtract from their adjusted gross income to lower how much of their income is subject The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness

Standard Tax Deduction

Standard Tax Deduction

https://i.pinimg.com/736x/2d/5a/bd/2d5abd52bdb8d039ecf499b8a449547a.jpg

Can You Claim Standard Deduction And Itemized page 2 Standard

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives-825x1024.jpg

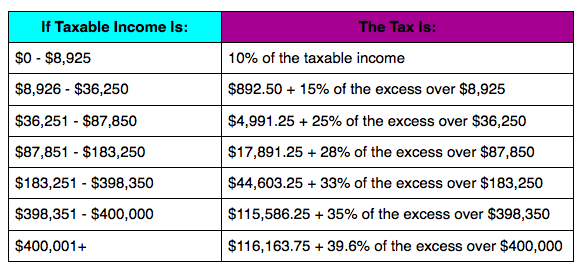

2022 Tax Brackets Pearson Co PC

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single deduction of a The standard deduction for tax year 2024 is 14 600 for singles 29 200 for joint filers and 21 900 for heads of household Learn more

Standard deduction The standard deduction is a specific dollar amount that reduces the amount of taxable income The standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness In general the IRS adjusts the standard deduction each year for inflation The standard deduction is a flat amount deducted from taxable salary income allowing taxpayers to reduce their taxable income without submitting any proof or disclosures

Download Standard Tax Deduction

More picture related to Standard Tax Deduction

Standard Deduction Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/statistics/images/standard_deduction_0.png

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

The standard deduction is a fixed dollar amount that reduces your taxable income Itemized deductions can also reduce your taxable income but the amount varies and is not The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill The amount set by the IRS could vary by tax year and filing status generally single married filing jointly married filing separately or head of household

The standard deduction reduces a taxpayer s taxable income It ensures that only households with income above certain thresholds will owe any income tax Taxpayers can claim a standard deduction when filing their tax returns thereby reducing their The Standard Deduction is a fixed dollar amount that reduces the amount of income you get taxed on Think of it as tax free income that you get to keep before taxes are applied to the rest The amount you can claim as your Standard Deduction is affected by factors such as your filing status and age

2023 IRS Standard Deduction

https://betterhomeowners.com/images/cached/deed5a26-242c-4893-95cb-399057c10352.jpg

14 Best Images Of Federal Itemized Deductions Worksheet Federal

http://www.worksheeto.com/postpic/2014/06/1040-tax-form-template_449375.png

https://www.forbes.com/advisor/taxes/standard-deduction

The standard deduction is a flat dollar amount set by the IRS based on your filing status It s the simplest way to reduce your taxable income on your tax return In fact Congress

https://www.nerdwallet.com/article/taxes/standard-deduction

The standard deduction is a specific dollar amount that filers can subtract from their adjusted gross income to lower how much of their income is subject

Federal Income Tax Rates

2023 IRS Standard Deduction

2021 Taxes For Retirees Explained Cardinal Guide

Your Guide To 2018 Tax Changes MOA Accounting

Tax Filing Chart 2023 Printable Forms Free Online

2022 Federal Tax Brackets And Standard Deduction Printable Form

2022 Federal Tax Brackets And Standard Deduction Printable Form

State Income Tax Standard Deductions Tax Policy Center

The IRS Just Announced 2023 Tax Changes

The Standard Tax Deduction How It Works And How To Use It

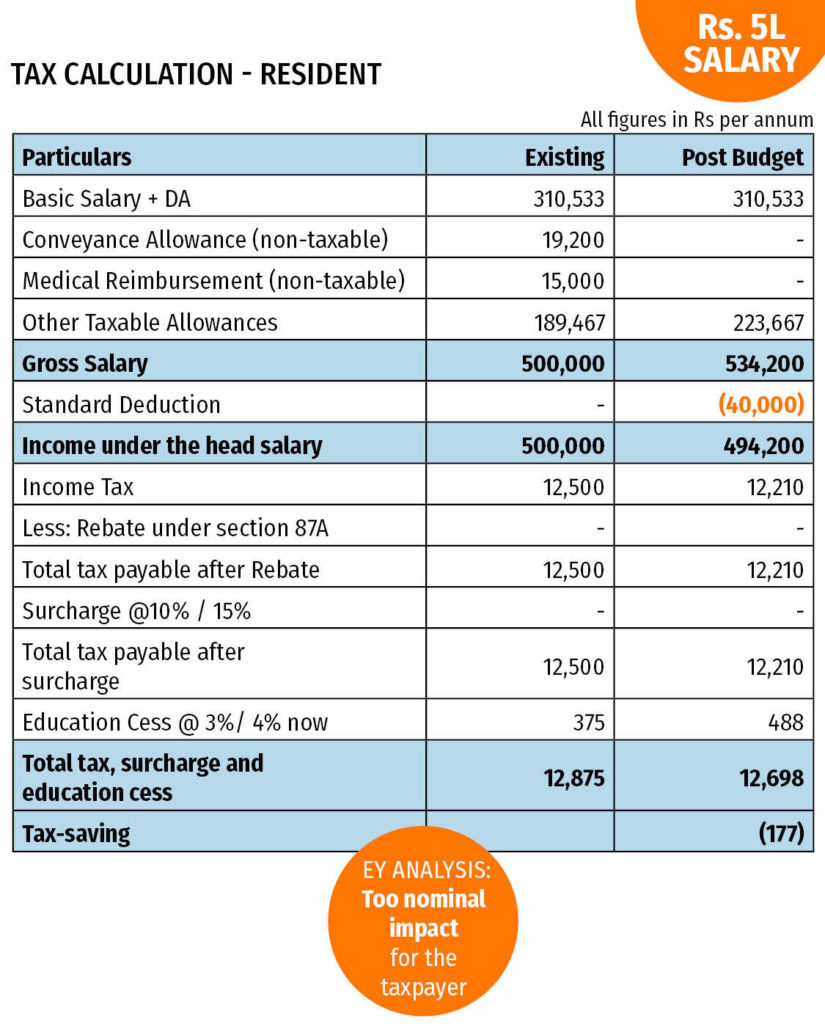

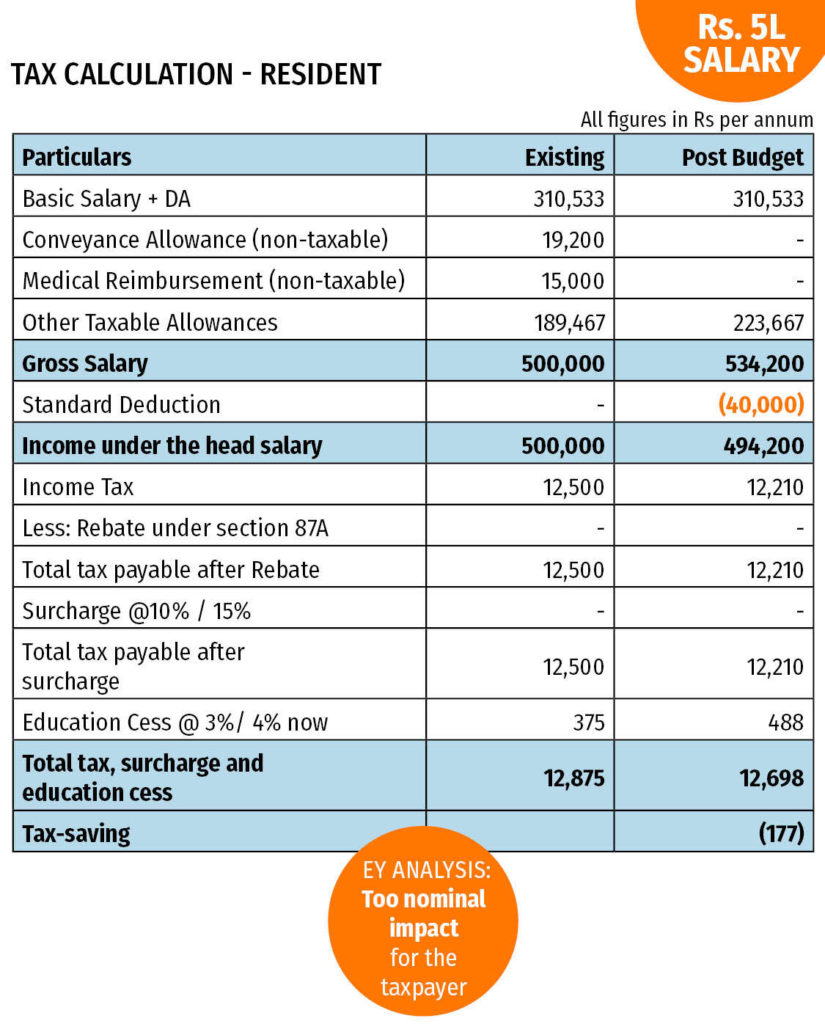

Standard Tax Deduction - Budget 2024 Update With effect from FY 2024 25 under the new tax regime the standard deduction is increased to Rs 75 000 There has been no change to the old tax regime with respect to the standard deduction Thus salaried taxpayers are eligible for the standard deduction of only Rs 50 000 under the old regime