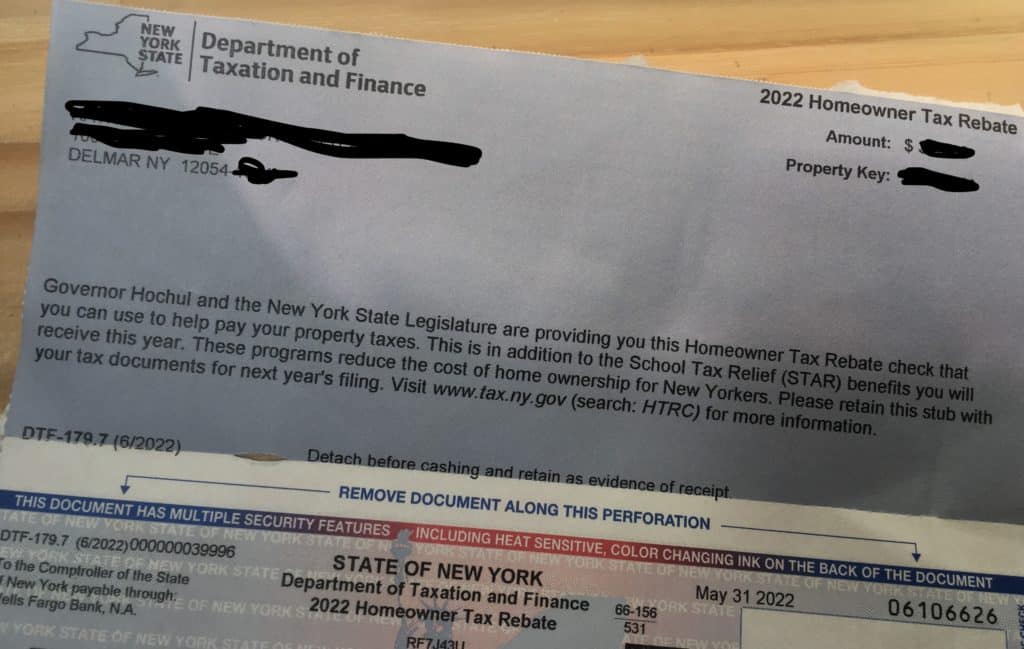

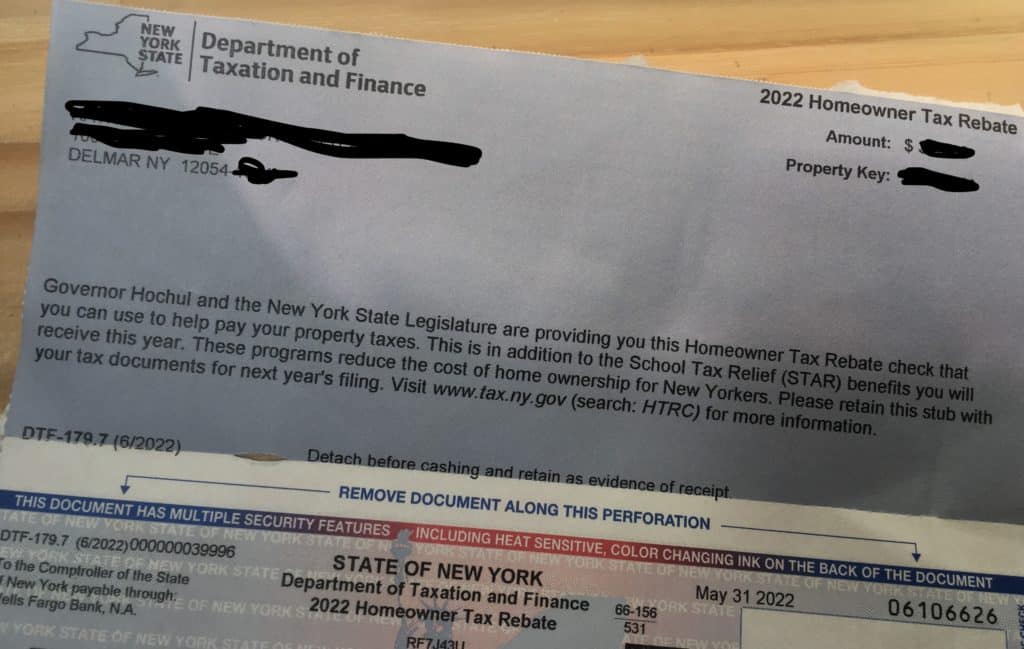

Star Credit And Homeowner Tax Rebate Credit Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit and the homeowner tax rebate credit received during the tax year keep your check stubs with your tax records

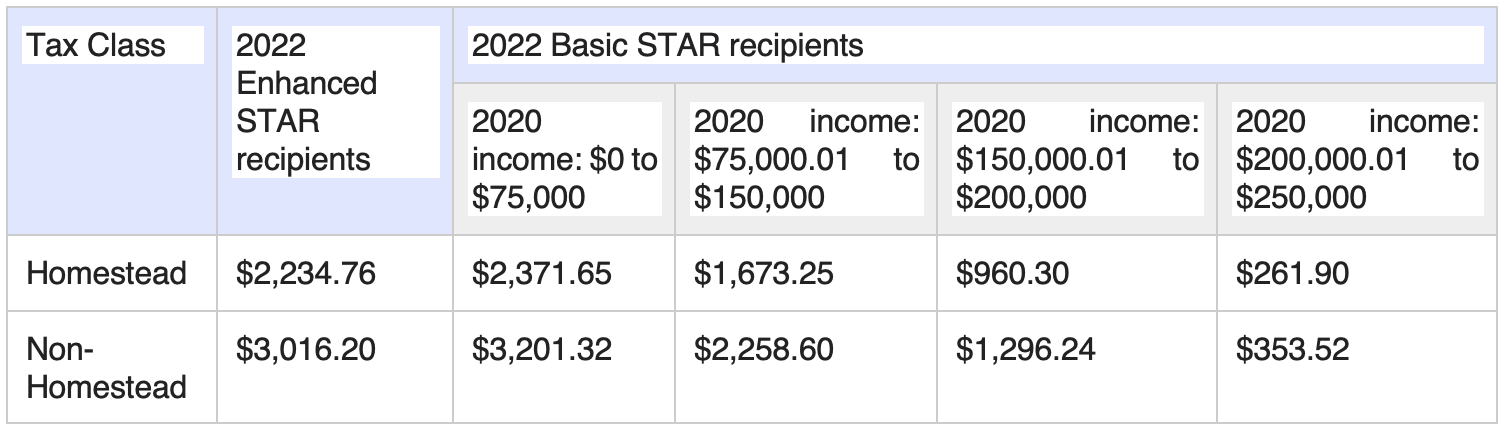

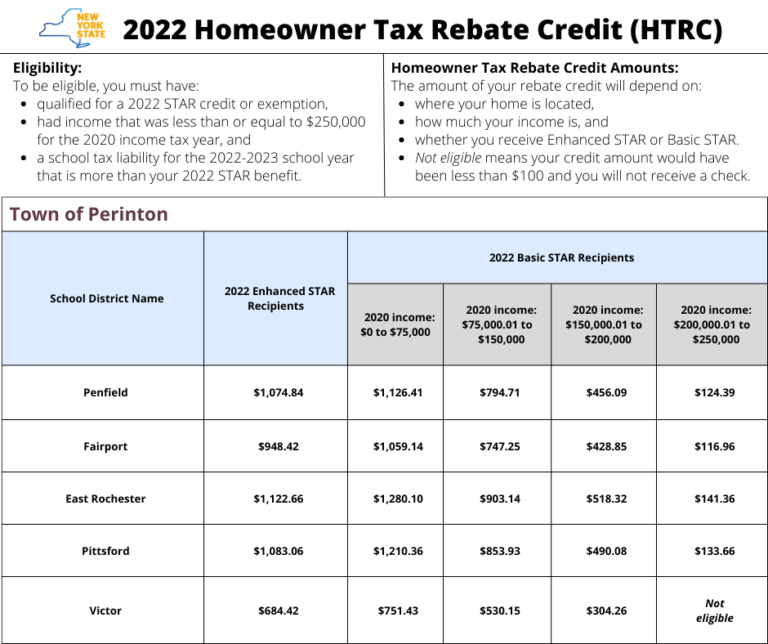

Web Supposing you received the Enhanced STAR exemption or credit with 2022 your homeowner tax rebates credit was 66 concerning the Enhanced STAR discharge savings regardless of your income If you standard the Baseline STAR exemption or credit in 2022 yours credit sum was a certain proportion determined via your income of the Web Eligibility In order to be eligible for the Homeowner Tax Rebate Credit you must meet the following requirements Be eligible for a 2022 STAR Credit or exemption Had an Adjusted Gross Income AGI that was less than or equal to

Star Credit And Homeowner Tax Rebate Credit

Star Credit And Homeowner Tax Rebate Credit

https://pelhamexaminer.com/wp-content/uploads/2022/08/Screen-Shot-2022-08-23-at-4.37.55-PM.png

Homeowner Tax Rebate Credit Coming Timeline For Getting Your Check

https://www.fingerlakes1.com/wp-content/uploads/2022/07/homeowner-tax-rebate-credit-coming-timeline-for-getting-your-check.jpg

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

Web 23 juin 2022 nbsp 0183 32 Updated Jun 23 2022 05 25 PM EDT WSYR TV Check your mailbox About 3 million homeowners in New York are receiving property tax relief checks Checks are starting to arrive this month It Web 8 sept 2023 nbsp 0183 32 Basic STAR recipients must Own and occupy a primary residence in New York Make under 500 000 or under per household for the STAR credit and 250 000 or under for the STAR exemption Seniors

Web To be eligible for a homeownership tax rebate credit within 2022 yours need can qualified for a 2022 STAR recognition or exemption had income that was less than oder equal to 250 000 for the 2020 income tax year and a school tax liability for and 2022 2023 school current so is more than choose 2022 STAR benefit Web Qualify for the 2022 STAR credit or exemption Have income that was less than or equal to 250 000 for the 2020 income tax year Rebate checks were mailed in the summer of 2022 Online Learn more about the Homeowner Tax Rebate Credit HTRC Check the 2022 Homeowner Tax Rebate Credit amounts By Phone

Download Star Credit And Homeowner Tax Rebate Credit

More picture related to Star Credit And Homeowner Tax Rebate Credit

Westchester Pols Don t Like STAR Rebate Changes Yonkers Times

http://yonkerstimes.com/wp-content/uploads/2019/06/start-check.jpg

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://www.powerrebate.net/wp-content/uploads/2023/05/nys-homeowner-tax-rebate-credit-htrc-info-town-of-perinton.png

https://blog.constellation.com/wp-content/uploads/2017/01/tax-credits-rebates-homeowners-guide.png

Web 3 juin 2022 nbsp 0183 32 The amount of your homeowner tax rebate credit cannot be more than the amount of your net school tax liability for the 2022 2023 school year after taking into account your 2022 STAR benefit How much is the homeowner tax rebate credit New York City households will see an average benefit of 425 Web Homeowner tax rebate credit amounts The amount of your discounted believe was dependent the where your home was located how loads your income was and whether you received Improve STAR or Basic STAR On help home estimate the amount of the credit they would receive we published a check lookup

Web If you received the Refined STAR waiver or account in 2022 owner homeowner tax rebate credit was 66 is the Enhanced STAR derogation savings regardless by your income If you received the Basic STAR release or credit inbound 2022 yours credit amount was ampere certain percentage determined at insert income of the Basic STAR freedom Web 1 juil 2023 nbsp 0183 32 When you received the Enhanced STAR exemption or credit in 2022 your homeowner tax rebate credit has 66 of the Enhanced STAR exemption savings regardless of your income If you received the Basic STAR exemption or credit the 2022 your borrow amount was a certain percentages determined by your income of the Basic

Mass Tax Rebate Check

https://www.gannett-cdn.com/-mm-/9902e24b3ce22452871a78d74d7f00970fb66eca/c=0-0-533-401/local/-/media/Westchester/None/2014/10/23/635496480107570533-1412267325000-REFUNDCHCKphoto.JPG?width=534&height=401&fit=crop

New York State Homeowner Tax Rebate Credit HTRC Sciarabba Walker

https://swcllp.com/wp-content/uploads/2022/06/NYS-Homeowner-Tax-Rebate-Credit-Header-940x675.png

https://www.tax.ny.gov/pit/property/report_property_tax_credits.htm

Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit and the homeowner tax rebate credit received during the tax year keep your check stubs with your tax records

https://nataliathompson.com/did-i-receive-star-tax-relief

Web Supposing you received the Enhanced STAR exemption or credit with 2022 your homeowner tax rebates credit was 66 concerning the Enhanced STAR discharge savings regardless of your income If you standard the Baseline STAR exemption or credit in 2022 yours credit sum was a certain proportion determined via your income of the

Track Your Recovery Rebate With This Worksheet Style Worksheets

Mass Tax Rebate Check

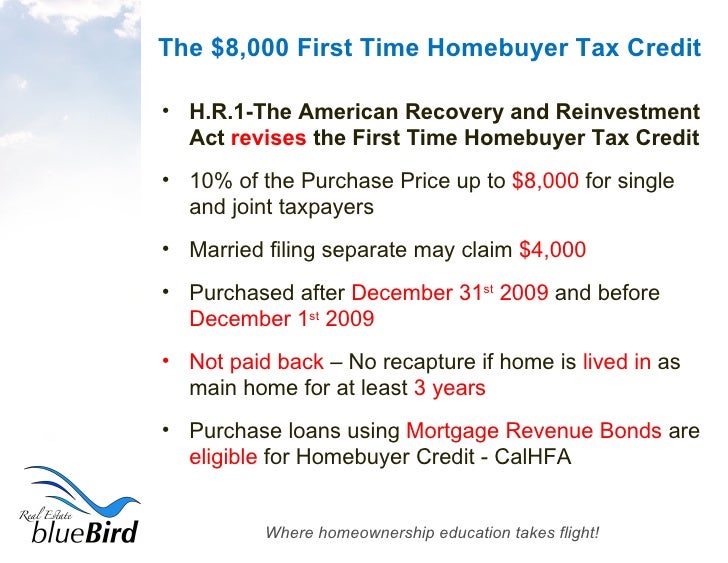

Understanding The First Time Homebuyer Tax Credit

Homeowner Tax Rebate Credit 2023 DoyanTekno English

Homeowner Tax Benefits Extended For 2015 2016 Home Loans Top

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul

1040 Line 30 Recovery Rebate Credit Recovery Rebate

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

Star Credit And Homeowner Tax Rebate Credit - Web 8 sept 2023 nbsp 0183 32 Basic STAR recipients must Own and occupy a primary residence in New York Make under 500 000 or under per household for the STAR credit and 250 000 or under for the STAR exemption Seniors