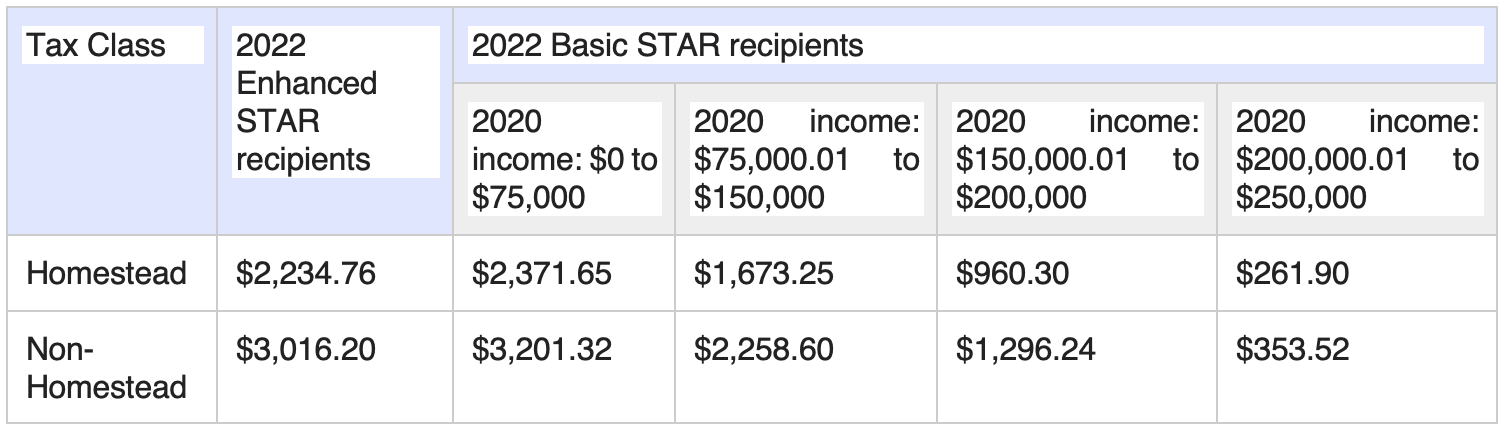

Star Credit Vs Homeowner Tax Rebate Web If you received the Enhanced STAR exemption or credit in 2022 your homeowner tax rebate credit was 66 of the Enhanced STAR exemption savings regardless of your

Web 6 sept 2023 nbsp 0183 32 The amount of the STAR credit can differ from the STAR exemption savings because by law the STAR credit can increase by as much as 2 each year but the Web 9 juin 2022 nbsp 0183 32 School Tax Relief STAR credit homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by

Star Credit Vs Homeowner Tax Rebate

Star Credit Vs Homeowner Tax Rebate

https://pelhamexaminer.com/wp-content/uploads/2022/08/Screen-Shot-2022-08-23-at-4.37.55-PM.png

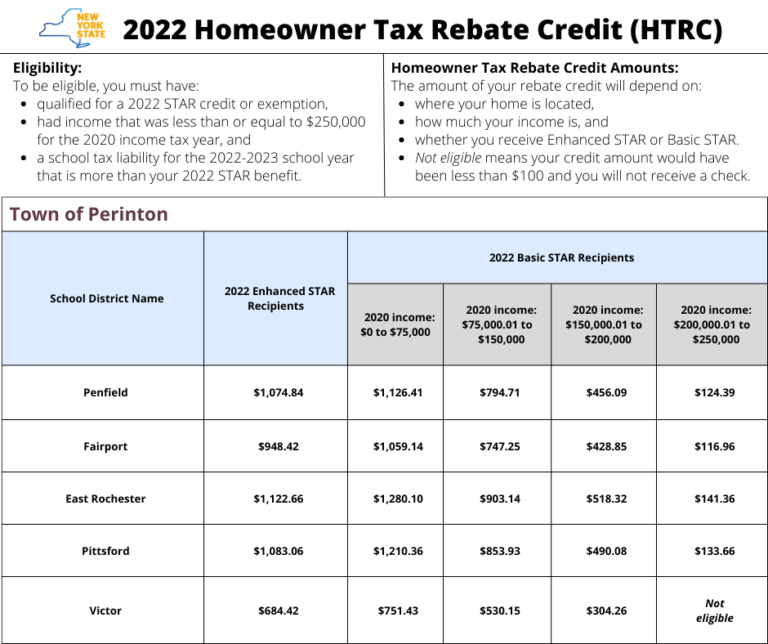

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://www.powerrebate.net/wp-content/uploads/2023/05/nys-homeowner-tax-rebate-credit-htrc-info-town-of-perinton.png

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI

https://i0.wp.com/www.informnny.com/wp-content/uploads/sites/58/2022/08/IMG_5265.jpg?w=2000&ssl=1

Web School Tax Relief STAR Senior Citizen Homeowners Exemption SCHE Veterans Exemption Property Tax Guide Was this information helpful Yes No Download the Web 8 sept 2023 nbsp 0183 32 Homeowners can switch from an exemption to a check and those who opt to do so could see the value of their STAR savings increase annually because by law the

Web 29 ao 251 t 2023 nbsp 0183 32 General questions Registering for the STAR credit I ve registered and have questions New homeowners STAR exemption Changes in ownership residency or Web 13 juin 2022 nbsp 0183 32 The Tax Department will calculate income for eligibility purposes and issue the credit based on that determination The amount of the rebate depends on a few

Download Star Credit Vs Homeowner Tax Rebate

More picture related to Star Credit Vs Homeowner Tax Rebate

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

https://i.ytimg.com/vi/Dk6m3vyq3cY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYOSBUKHIwDw==&rs=AOn4CLAiLu8JQ1ipHT9vjuy4jqjIumoU2g

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

Homeowner Tax Rebate Credit 2023 DoyanTekno English

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhA9Ap4lq_NtwmWdmz9OAjCDFAX_HoAwRnI27Z-BcqcE8qNfaVkOi8U3LaCXBeR-oMly1wGLHRZelm3VlnvJTdkk62TCvTzGRs_ywfROFuF9w7sjIjjIMbuEiqq7wgKwsXXOX_YeZN6WzpBkteh3xI3UteLtOqgLLgsPTA3FbJpM1DPsVHZY8g4zKw4/w1200-h630-p-k-no-nu/Homeowner Tax Rebate Credit 2023.jpg

Web 29 ao 251 t 2022 nbsp 0183 32 Key Takeaways President Biden signed the Inflation Reduction Act into law on Aug 16 2022 Consumers might qualify for 10 000 or more in tax breaks and rebates The tax incentives help make Web 27 mai 2022 nbsp 0183 32 2022 Homeowner Tax Rebate Credit Amounts Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality If the

Web 5 sept 2023 nbsp 0183 32 You can use your STAR benefit to pay your school taxes You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the Web 2 avr 2019 nbsp 0183 32 At 3 billion a year STAR gives 2 6 million income eligible homeowners a hefty rebate on their school taxes which can represent about 60 percent of a New York s

Homeowner Tax Rebate 2023 Who s Eligible And How To Claim It Tax

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/2023-Homeowner-Tax-Rebate.jpg

South Dakota Homeowner Tax Credits Rebates And Savings Pierre SD

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100067056669661

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Web If you received the Enhanced STAR exemption or credit in 2022 your homeowner tax rebate credit was 66 of the Enhanced STAR exemption savings regardless of your

https://www.tax.ny.gov/pit/property/star/comparison

Web 6 sept 2023 nbsp 0183 32 The amount of the STAR credit can differ from the STAR exemption savings because by law the STAR credit can increase by as much as 2 each year but the

Maryland Homeowner Tax Credits Savings And Rebates

Homeowner Tax Rebate 2023 Who s Eligible And How To Claim It Tax

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI

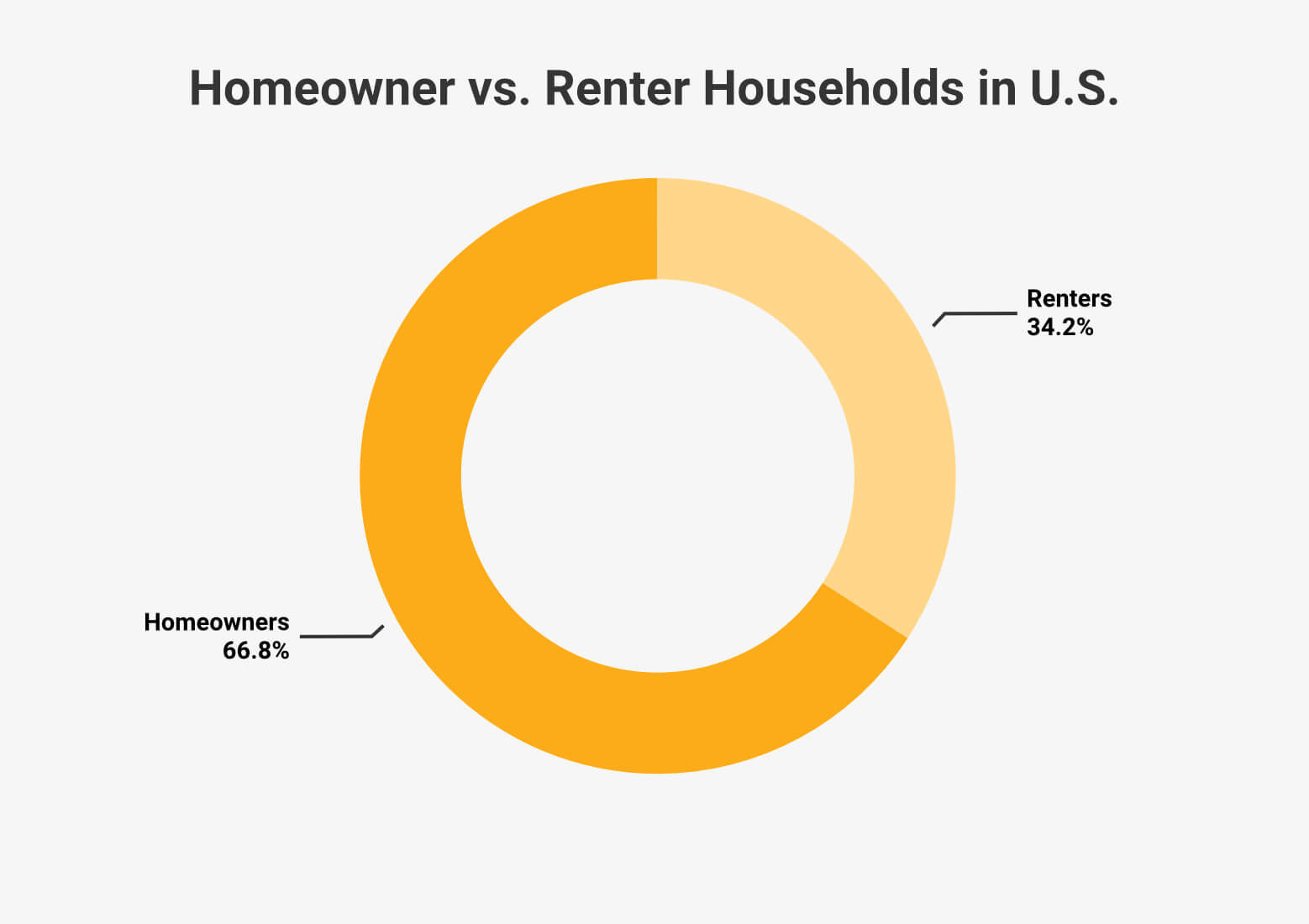

Homeowners Vs Renters Statistics 2023

City Of Watertown New York NYS Homeowner Tax Rebate Credit

Ev Tax Credit 2022 Retroactive Shemika Wheatley

Ev Tax Credit 2022 Retroactive Shemika Wheatley

New York Homeowner Tax Credits Rebates Savings Home

New Tax Regime 2023 24 New Tax Regime 2023 Vs Old Tax Regime How To

Residential Homeowner s Guide To Federal Tax Rebates For Solar Power In

Star Credit Vs Homeowner Tax Rebate - Web 29 ao 251 t 2023 nbsp 0183 32 General questions Registering for the STAR credit I ve registered and have questions New homeowners STAR exemption Changes in ownership residency or