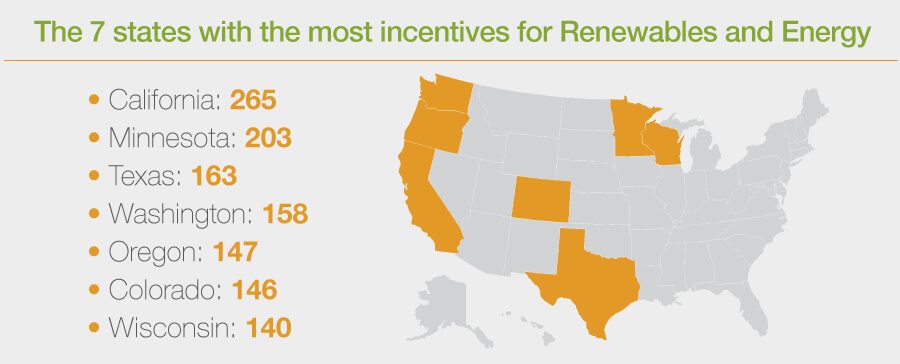

State And Federal Rebates For Solar Energy Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Web Unlike utility rebates rebates from state governments generally do not reduce your federal tax credit For example if your solar PV system was installed in 2022 Web January 18 2023 DOE today announced guidance so that state local and Tribal governments can begin applying for funding through the Energy Efficiency and

State And Federal Rebates For Solar Energy

State And Federal Rebates For Solar Energy

https://i.pinimg.com/originals/28/9a/86/289a86f8e3a3f535e2fa5b854752b4fb.png

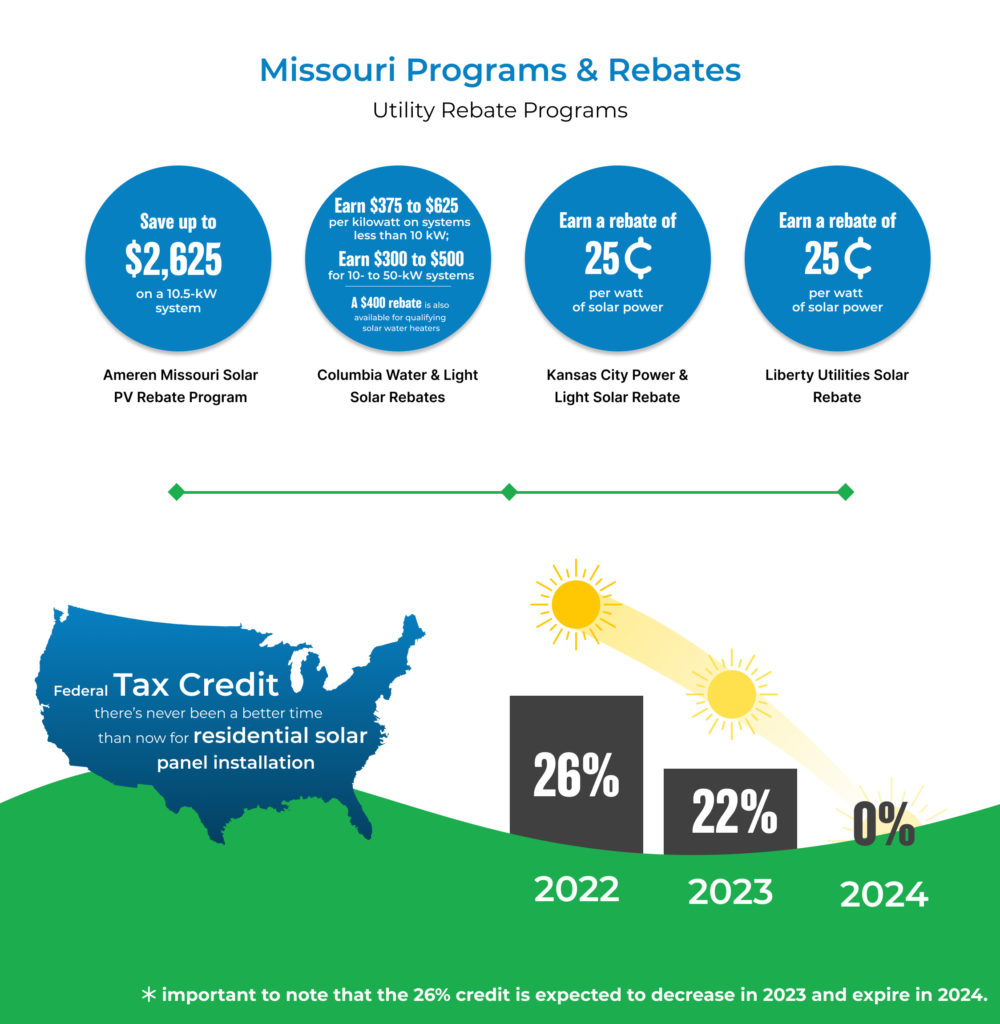

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

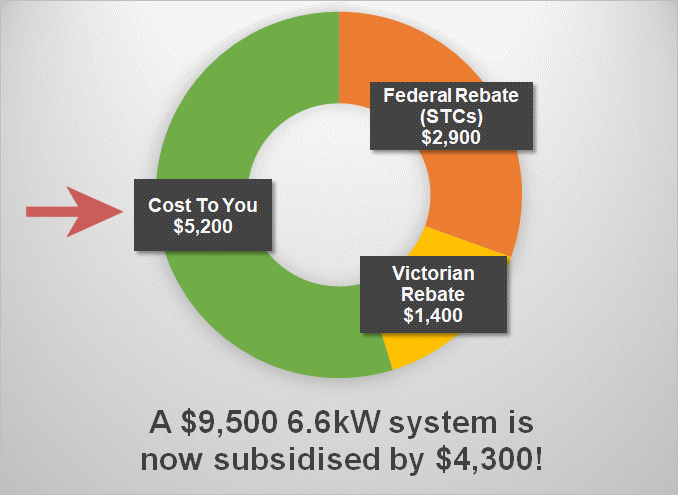

Victorian Solar Rebate Explained SolarQuotes

https://www.solarquotes.com.au/wp-content/uploads/2021/07/victoria-rebate-chart.png

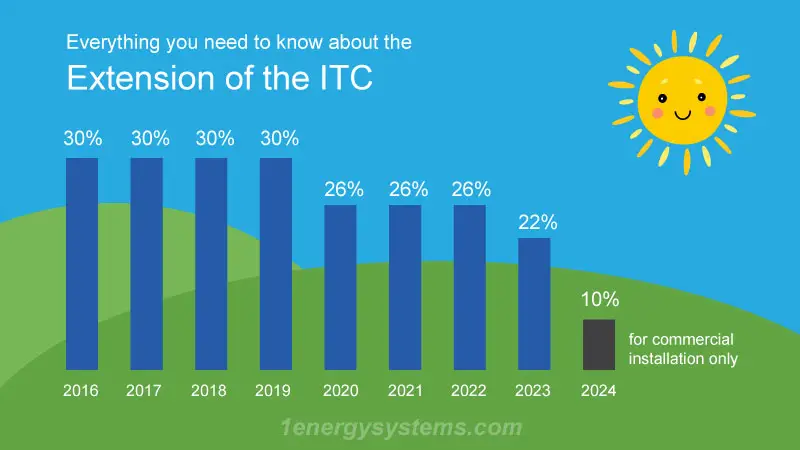

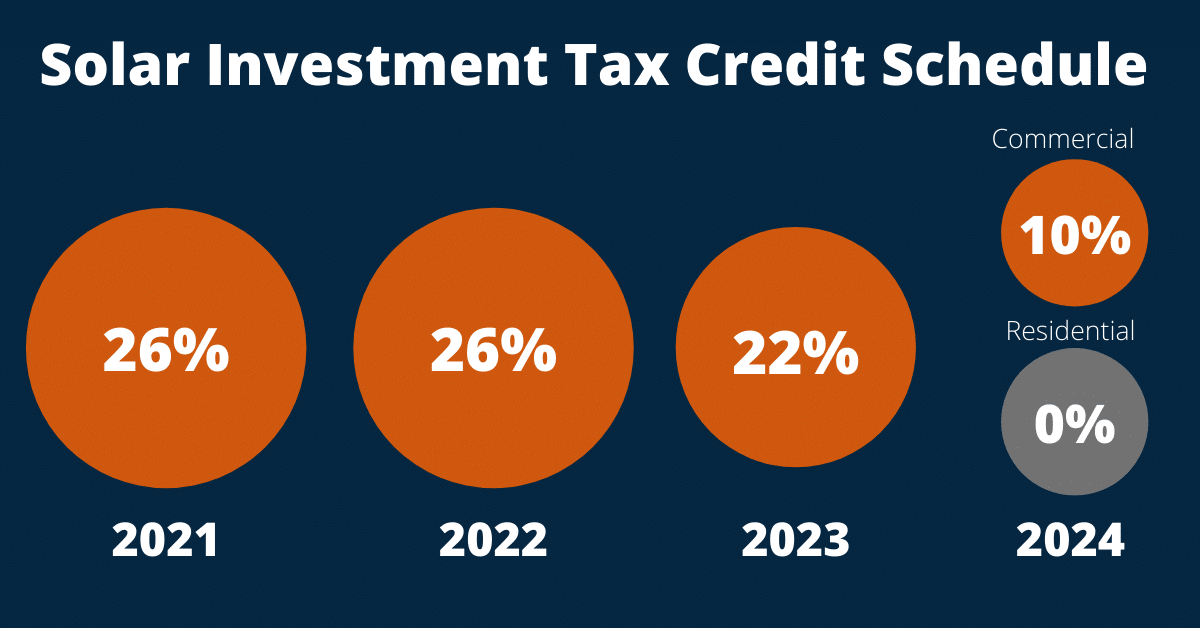

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of Web Combined with 30 federal solar tax credit and some of the highest electricity prices in the nation Massachusetts offers some of the best solar savings potential in the US Utility incentives Massachusetts also

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032

Download State And Federal Rebates For Solar Energy

More picture related to State And Federal Rebates For Solar Energy

Solar Panel Cost In 2020 And Where The Money Goes

https://www.solarpowerrocks.com/wp-content/uploads/2020/01/2020-United-States-solar-rebates-ranked.png

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

https://www.solarpowerrocks.com/wp-content/uploads/2020/01/2020-OR-solar-rebates--ranked.png

Free Definitive Solar Tips 2022 Solar Panels Price Guide

https://www.datocms-assets.com/15768/1573550821-solar-rebates-state-level.png?fit=max&w=640

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat Web 30 janv 2023 nbsp 0183 32 The Investment Tax Credit ITC is a federal tax credit that allows homeowners and businesses to deduct a portion of the cost of their solar energy system from their federal taxes The credit is currently set

Web Breaker box 4 000 limit Electric wiring 2 500 limit Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you Web 14 nov 2022 nbsp 0183 32 A tax credit is a dollar for dollar reduction to the income tax you owe For example claiming a 5 000 federal tax credit will reduce your total federal income taxes

Solar Rebate Programs For Solar By State

https://4.bp.blogspot.com/-f4ExFGx6hiA/U5d022BzDgI/AAAAAAAARs0/gyegmJh5N9Y/s1600/solar+rebate+programs+by+state.PNG

The Future Of Solar Energy Rebates Solaris

https://cdn10.bigcommerce.com/s-3yc5xwvk/product_images/uploaded_images/federal-rebate-for-solar.png?t=1460888427

https://www.energy.gov/sites/default/files/2021/02/f82/Guid…

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web Unlike utility rebates rebates from state governments generally do not reduce your federal tax credit For example if your solar PV system was installed in 2022

Solar Panel Rebates And Incentives A Comprehensive Guide

Solar Rebate Programs For Solar By State

Every Year We Rank The Best States For Solar Power And The Worst

Solar Installation Services

2019 Texas Solar Panel Rebates Tax Credits And Cost

Be Sure To Ask The Representative About Federal And State Incentives

Be Sure To Ask The Representative About Federal And State Incentives

Do Solar Batteries Qualify For Tax Credit At Alexander Roberts Blog

Solar Rebates By State In 2021 Solar

Ohio Solar Power For Your House Rebates Tax Credits Savings

State And Federal Rebates For Solar Energy - Web 18 mai 2023 nbsp 0183 32 The 30 percent credit for a total system cost of 31 558 equals approximately 9 467 There is no ceiling on the amount you can receive through the federal tax credit