State Income Taxes In Montana Individual Income Tax If you live or work in Montana you may need to file and pay individual income tax These resources can help you determine your filing requirements

Use our income tax calculator to find out what your take home pay will be in Montana for the tax year Enter your details to estimate your salary after tax Montana state tax rates and rules for income sales property fuel cigarette and other taxes that impact residents

State Income Taxes In Montana

State Income Taxes In Montana

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Montana State Taxes Tax Types In Montana Income Property Corporate

https://files.taxfoundation.org/20190403125958/FINAL-01.png

Visualizing Taxes By State

https://cdn.howmuch.net/articles/133_Gas-Tax-per-Gallon-b125.jpg

Montana has a graduated state individual income tax with rates ranging from 4 70 percent to 5 90 percent Montana has a 6 75 percent corporate income tax rate Montana does The Income tax rates and personal allowances in Montana are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below

Montana State Income Tax Tables in 2021 The Income tax rates and personal allowances in Montana are updated annually with new tax tables published for Resident Montana s state income tax system is progressive meaning high earners are taxed more than low earners The tax brackets in Montana are the same for all filers regardless of

Download State Income Taxes In Montana

More picture related to State Income Taxes In Montana

Income Tax Rates By State INVOMERT

https://i2.wp.com/www.richardcyoung.com/wp-content/uploads/2016/02/income-tax-rate-map.png

Tax Payment Which States Have No Income Tax Marca

https://phantom-marca.unidadeditorial.es/7f630bcfa3cc4f2b33db1ffa28dd66ab/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/05/16756118713316.jpg

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state Learn more about Montana Residency or see the The Montana income tax has seven tax brackets with a maximum marginal income tax of 6 750 as of 2024 Detailed Montana state income tax rates and brackets are available

Montana levies a state income tax with rates ranging from 1 to 6 9 This tax is withheld from your paycheck in addition to federal income taxes Montana has a state standard Montana State Income Tax Tables in 2023 The Income tax rates and personal allowances in Montana are updated annually with new tax tables published for Resident and Non

How To Reduce Virginia Income Tax

https://static.wixstatic.com/media/753bc4_54233880b95140b6b722381f7064e880~mv2.jpg/v1/fill/w_1000,h_843,al_c,q_90,usm_0.66_1.00_0.01/753bc4_54233880b95140b6b722381f7064e880~mv2.jpg

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

https://mtrevenue.gov/taxes/individual-income-tax

Individual Income Tax If you live or work in Montana you may need to file and pay individual income tax These resources can help you determine your filing requirements

https://www.forbes.com/advisor/income-tax-calculator/montana

Use our income tax calculator to find out what your take home pay will be in Montana for the tax year Enter your details to estimate your salary after tax

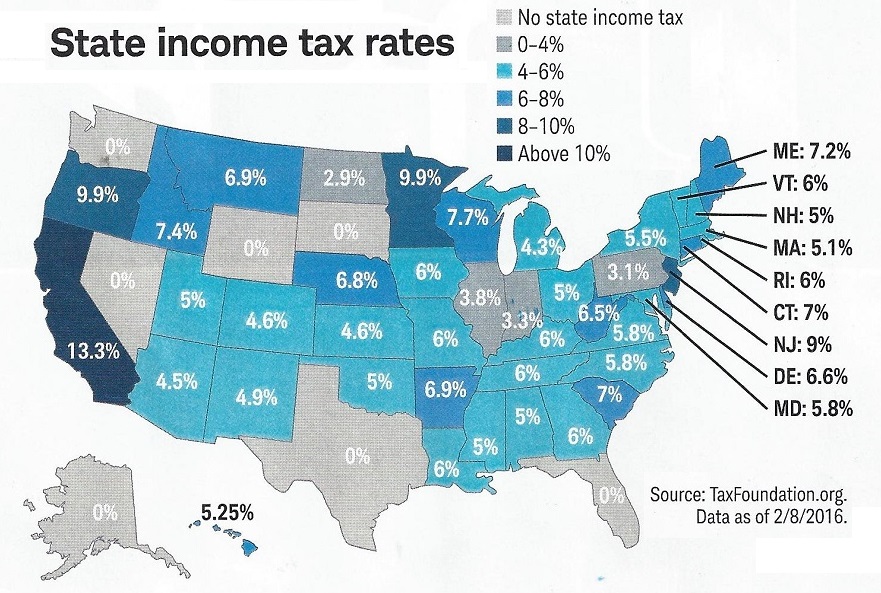

Kirk s Market Thoughts State Income Tax Rates Map For 2016

How To Reduce Virginia Income Tax

We re 1 New Yorkers Pay Highest State And Local Income Taxes

Montana Income Tax MT State Tax Calculator Community Tax

Company Income Tax Malaysia Jacob Berry

Lower Income Taxes In Utah Means Reduced Education Funding Affecting

Lower Income Taxes In Utah Means Reduced Education Funding Affecting

Taxes Fees Montana Department Of Revenue

Which States Have The Highest And Lowest Income Tax USAFacts

How State Taxes Are Paid Matters Stevens And Sweet Financial

State Income Taxes In Montana - The Income tax rates and personal allowances in Montana are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below