State Of Illinois Earned Income Tax Credit You qualify for the Illinois EITC if during tax year 2023 you Have worked and earned income under 63 398 Have investment income below 11 000 Have a valid Social Security number

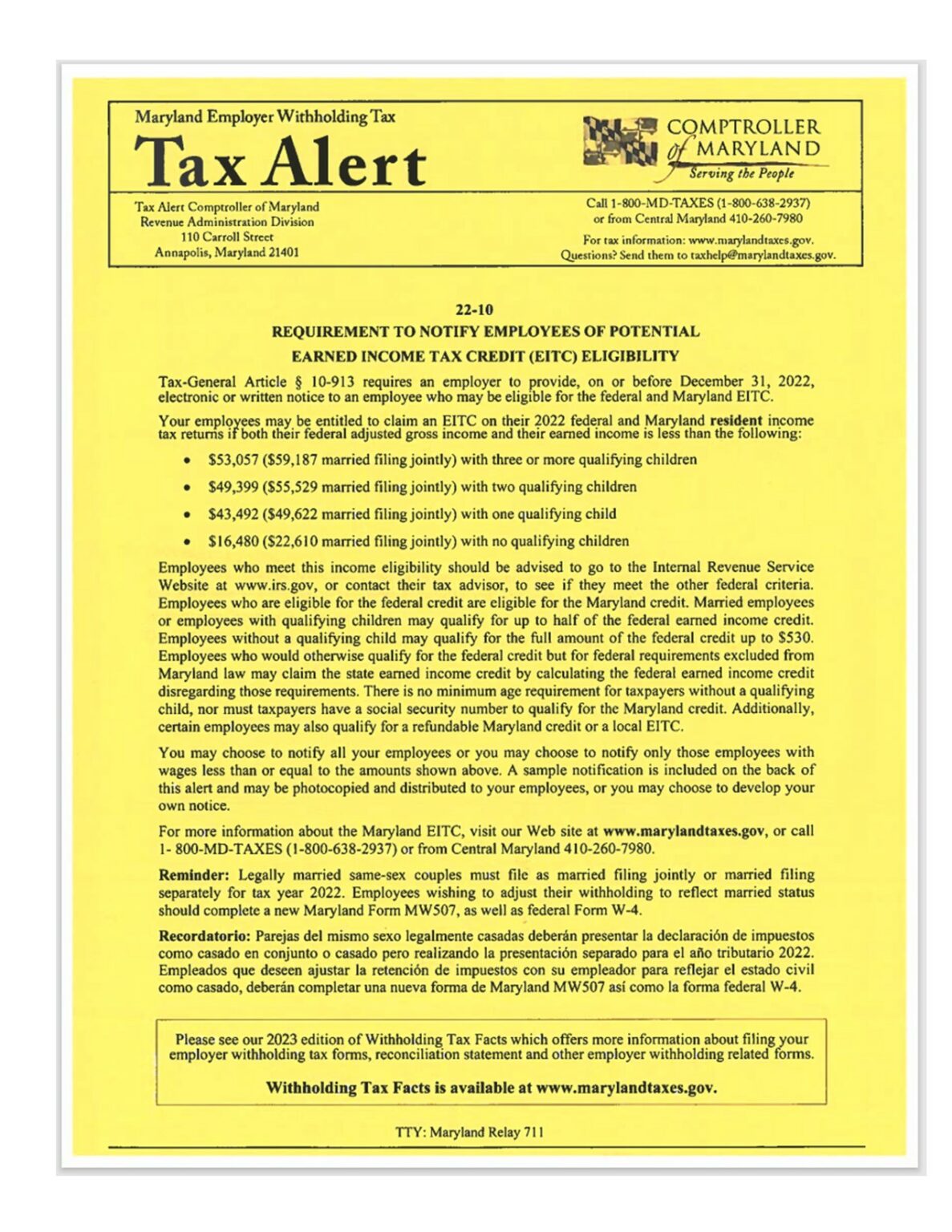

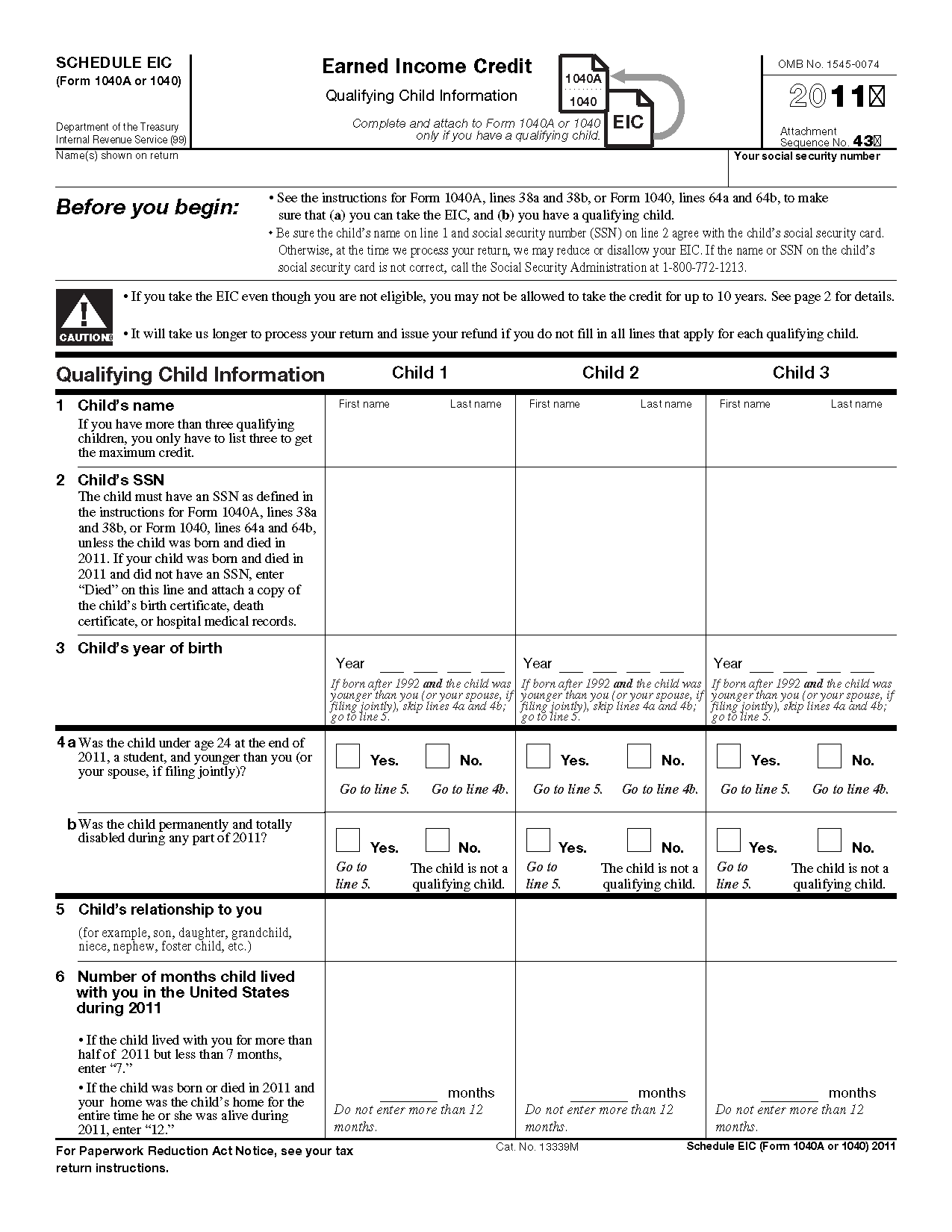

The IDHS 4039 Free Tax Help notice explains the Earned Income Tax Credit EITC and provides information regarding free tax filing assistance The IDHS 4406 EITC flyer An Earned Income Tax Credit or EITC is a tax benefit for people who work and have limited income Even if you owe no income tax you could still be eligible to receive a payment as

State Of Illinois Earned Income Tax Credit

State Of Illinois Earned Income Tax Credit

https://cdn.aarp.net/content/dam/aarp/money/taxes/2022/02/1140-earned-income-tax-credit-calculations.jpg

Illinois Earned Income Tax Credit YouTube

https://i.ytimg.com/vi/7QwSMacTDew/maxresdefault.jpg

This Is Earned Income Tax Credit Awareness Day

https://dfcby4322olzt.cloudfront.net/wp-content/uploads/2018/01/eitc.jpg

The earned income credit EIC is Illinois only refundable tax credit It s equal to 18 of the EIC amount received on your federal tax return Income limits and other rules apply but you ll qualify if you re eligible for the The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe

According to a press release from the Illinois Department of Revenue and Gov J B Pritzker the EITC will give increased tax relief this year rising from an 18 match of the federal credit to To claim the Illinois EITC on your 2023 IL 1040 Illinois Individual Income Tax Return you must complete Schedule IL E EIC and enter the total from Line 9 on your IL 1040 Line 29 On the

Download State Of Illinois Earned Income Tax Credit

More picture related to State Of Illinois Earned Income Tax Credit

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Earned Income Tax Credit Horizon Goodwill Industries

https://horizongoodwill.org/wp-content/uploads/2022/12/tax-1-1-1187x1536.jpg

Earned Income Tax Credit All You Need To Know About Claiming It

http://www.sarkariexam.com/wp-content/uploads/2023/08/Earned-Income-Tax-Credit-All-you-need-to-know-about-claiming-it.jpg

In 2020 California and Colorado became the first states to allow ITIN filers to claim their state s EITC The District of Columbia Illinois Maine Maryland New Mexico Oregon and Washington have also made ITIN filers eligible for their Earned income tax credit eitc Rate Fully Refundable 20 of the federal credit Eligibility Requirements All Illinois taxpayers who qualify for the federal credit are automatically eligible

In Illinois those who qualify for the federal EITC will generally qualify for Illinois Earned Income Tax Credit EIC and receive 18 percent of their federal credit 4 Starting Tax year 2023 will see those who qualify for Illinois EITC receive tax relief matching 20 of their federal Earned Income Tax Credit amount up from 18 previously

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Minnesota Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

https://tax.illinois.gov › programs › eitc › qualifications.html

You qualify for the Illinois EITC if during tax year 2023 you Have worked and earned income under 63 398 Have investment income below 11 000 Have a valid Social Security number

https://www.dhs.state.il.us › page.aspx

The IDHS 4039 Free Tax Help notice explains the Earned Income Tax Credit EITC and provides information regarding free tax filing assistance The IDHS 4406 EITC flyer

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

See The EIC Earned Income Credit Table Income Tax Return Income

A State Earned Income Tax Credit Would Aid Pa Working Families

California Earned Income Tax Credit Worksheet

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

What Is The Earned Income Tax Credit The Motley Fool

What Is The Earned Income Tax Credit The Motley Fool

PPT The Illinois Earned Income Tax Credit PowerPoint Presentation

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

Earned Income Credit Worksheet 2023

State Of Illinois Earned Income Tax Credit - Other types of earned income not reported on Form W 2 in box 1 include household employee wages tip income not reported to your employer certain Medicaid waiver payments if you