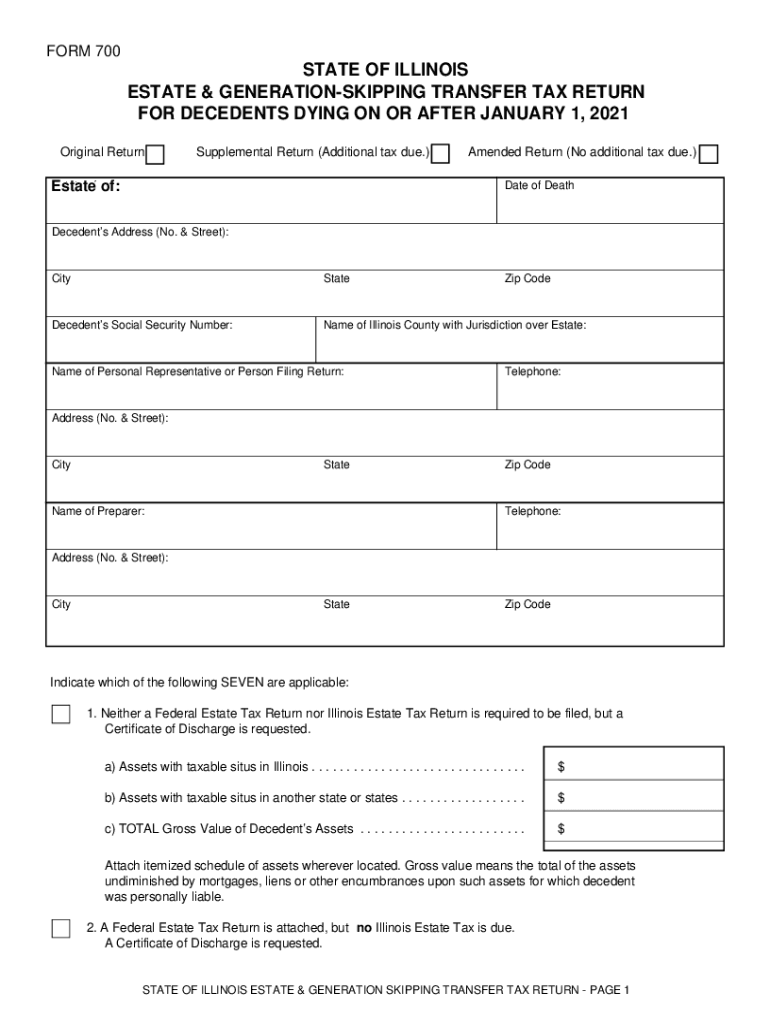

State Of Illinois Estate Tax Return The Illinois estate tax rate is graduated and goes up to 16 However it is only applied on estates worth more than 4

For persons dying in 2023 the federal exemption for Federal Estate Tax purposes is 12 920 000 The exclusion amount for Illinois Estate Tax purposes is 4 000 000 The As of July 1 2012 estates will no longer submit estate tax payments to their county treasurer Instead all Illinois Estate and Generation Skipping Transfer Tax estate

State Of Illinois Estate Tax Return

State Of Illinois Estate Tax Return

http://sharpenet.com/wp-content/uploads/2017/03/Estate-Tax-Return-119840681.jpg

The Caucus Blog Of The Illinois House Republicans Estate Tax Continues

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiiYqRQhOcDp1iJcX1Sz4doYsdSloUPlb4LezBoWCSILr3xrqvi3-r7m2Yqtx7l9PP09xsStGNtf9ZMQLmlF4mVHs_z9b048PMJCsSDGtK_sJwj44tm-6QA_Fuu844vfJ0AlzHSJqBe5HCi7vkFgxGgoYNe54SiGwX54Z-YjiOHkEwKGX1c05GETnLW/w1200-h630-p-k-no-nu/Estate Tax.jpg

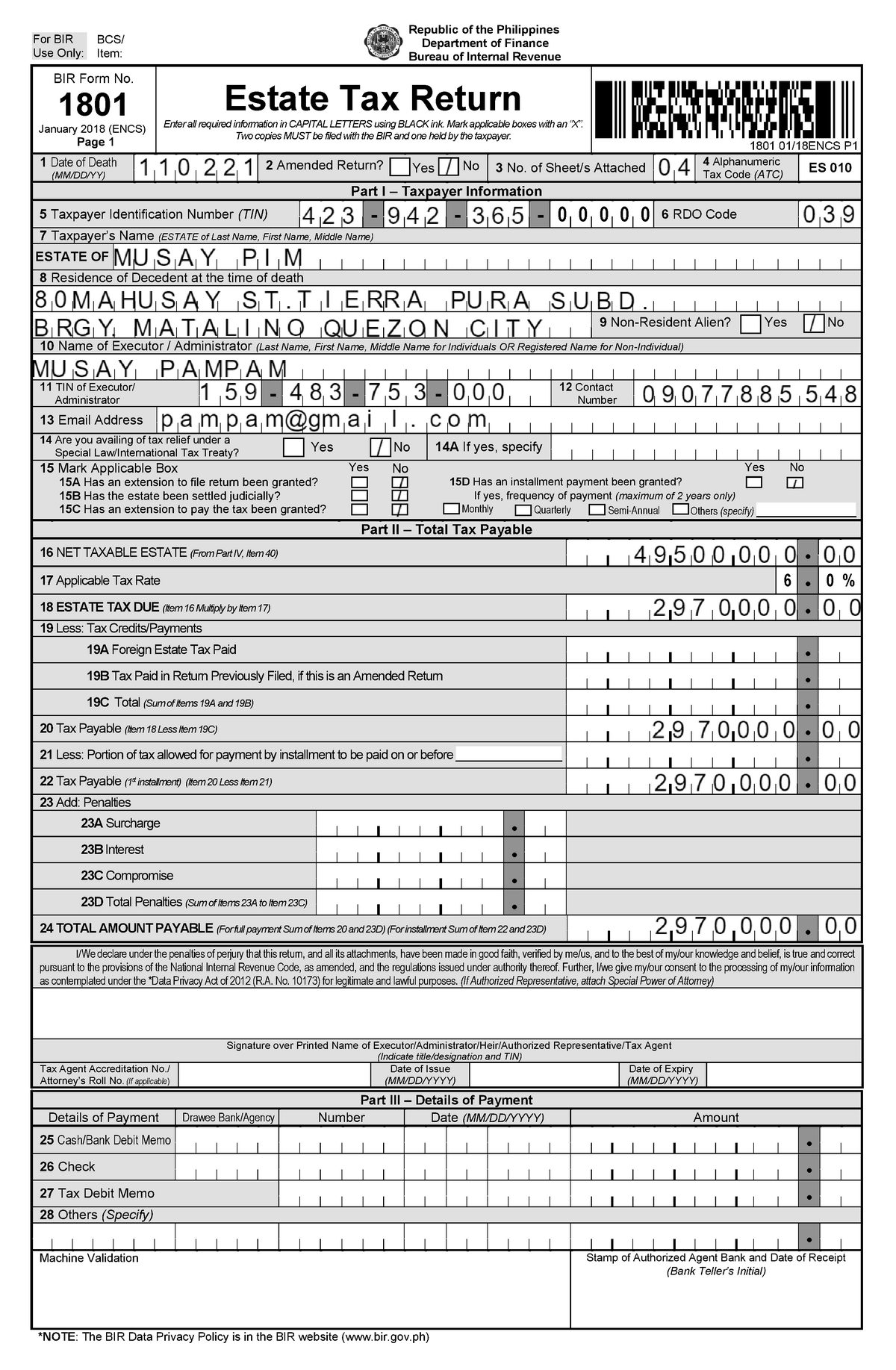

Estate TAX Return 1801 Jan 2018 ENCS 2 For BIR Use Only BCS Item

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/550a239c30facffcd19ed0b7a7175250/thumb_1200_1835.png

You must file Form IL 1041 Fiduciary Income and Replacement Tax Return if you are a fiduciary of a trust or an estate and the trust or the estate has net income or loss as If the gross estate of an Illinois resident has a value of more than 4 million the personal representative or executor of the estate must file a state estate tax return

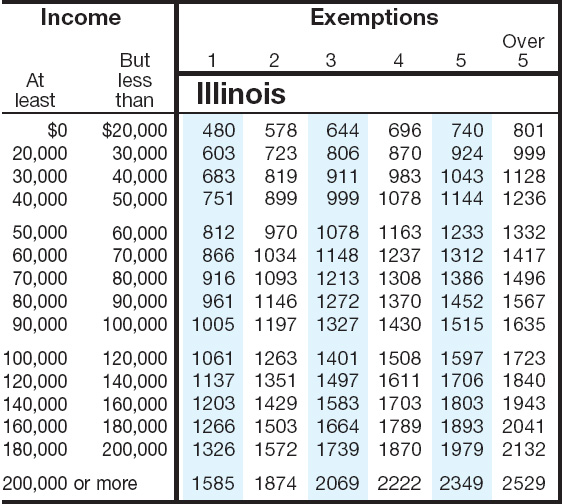

2013 2023 Decedents Estate Tax Calculator Illinois Tentative Taxable Estate Illinois Tentative Taxable Estate Plus Adjusted Taxable Gifts Illinois is not known as a tax friendly state We know that income tax rates and property tax rates can be high But how much do you know about the Illinois estate tax In this article we will discuss

Download State Of Illinois Estate Tax Return

More picture related to State Of Illinois Estate Tax Return

How Does The Illinois Estate Tax Affect You DHJJ

https://dhjj.com/wp-content/uploads/2017/07/dreamstime_s_81671045-e1500404463461.jpg

Tax S 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/577/674/577674402/large.png

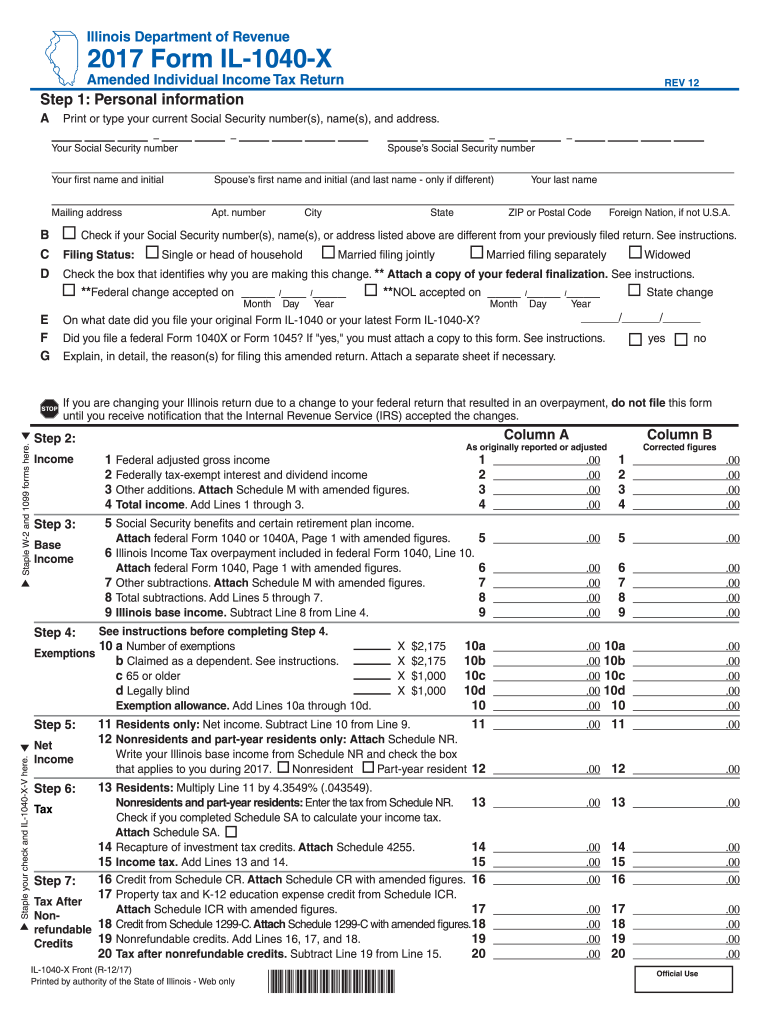

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/453/14/453014487/large.png

When you are filing a return on behalf of a single deceased taxpayer print the name of the taxpayer on the appropriate line write deceased and the date of death above the The Illinois estate tax rate is graduated and goes up to 16 on estates worth more than 4 million What is Included in An Estate The deceased individual s property and assets are considered part of the estate for

The Illinois estate tax return must be filed and any estate tax due must be paid within nine months after the decedent s date of death What is the Illinois estate tax The Illinois estate tax is a tax on the transfer of property at death The tax is imposed on the estate of every resident of Illinois who

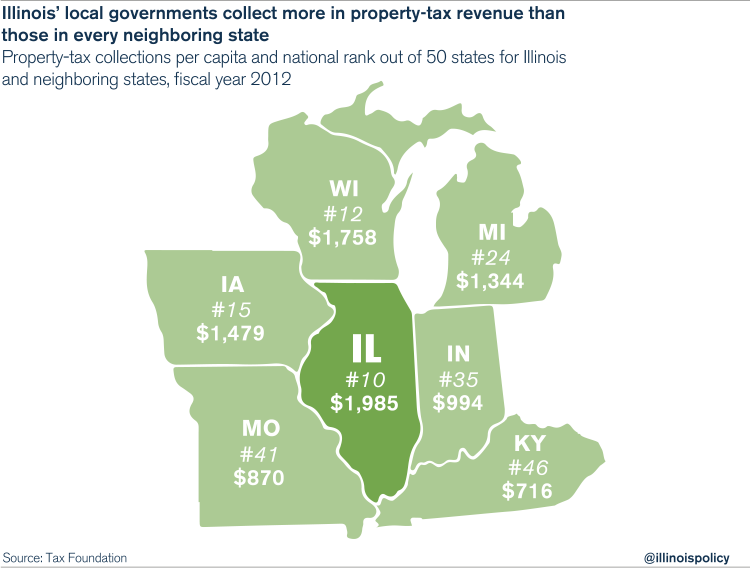

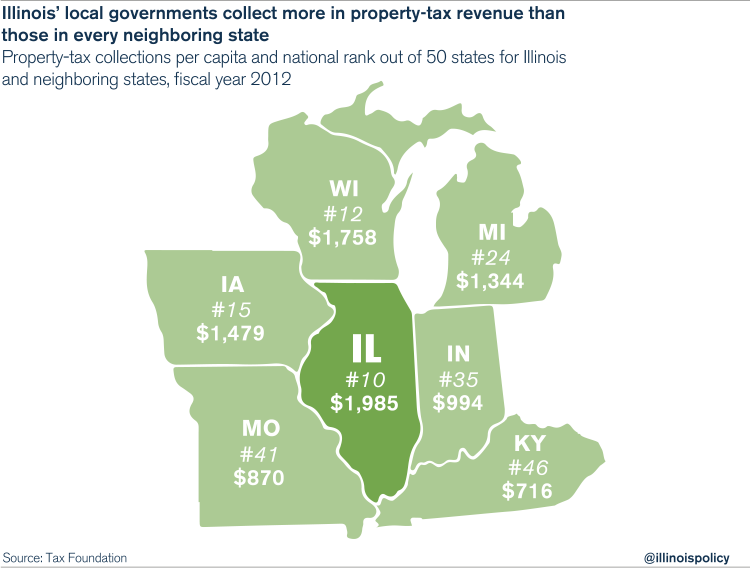

Illinois State Government Takes In More Tax Dollars Per Person Than

https://d2dv7hze646xr.cloudfront.net/wp-content/uploads/2015/10/PropertyTaxesOCT_2-e1444743834460.png

Fillable Online Tax Illinois 1997 Schedule CR Illinois Department Of

https://www.pdffiller.com/preview/10/998/10998063/large.png

https://smartasset.com/.../illinois-est…

The Illinois estate tax rate is graduated and goes up to 16 However it is only applied on estates worth more than 4

https://illinoisattorneygeneral.gov/Page...

For persons dying in 2023 the federal exemption for Federal Estate Tax purposes is 12 920 000 The exclusion amount for Illinois Estate Tax purposes is 4 000 000 The

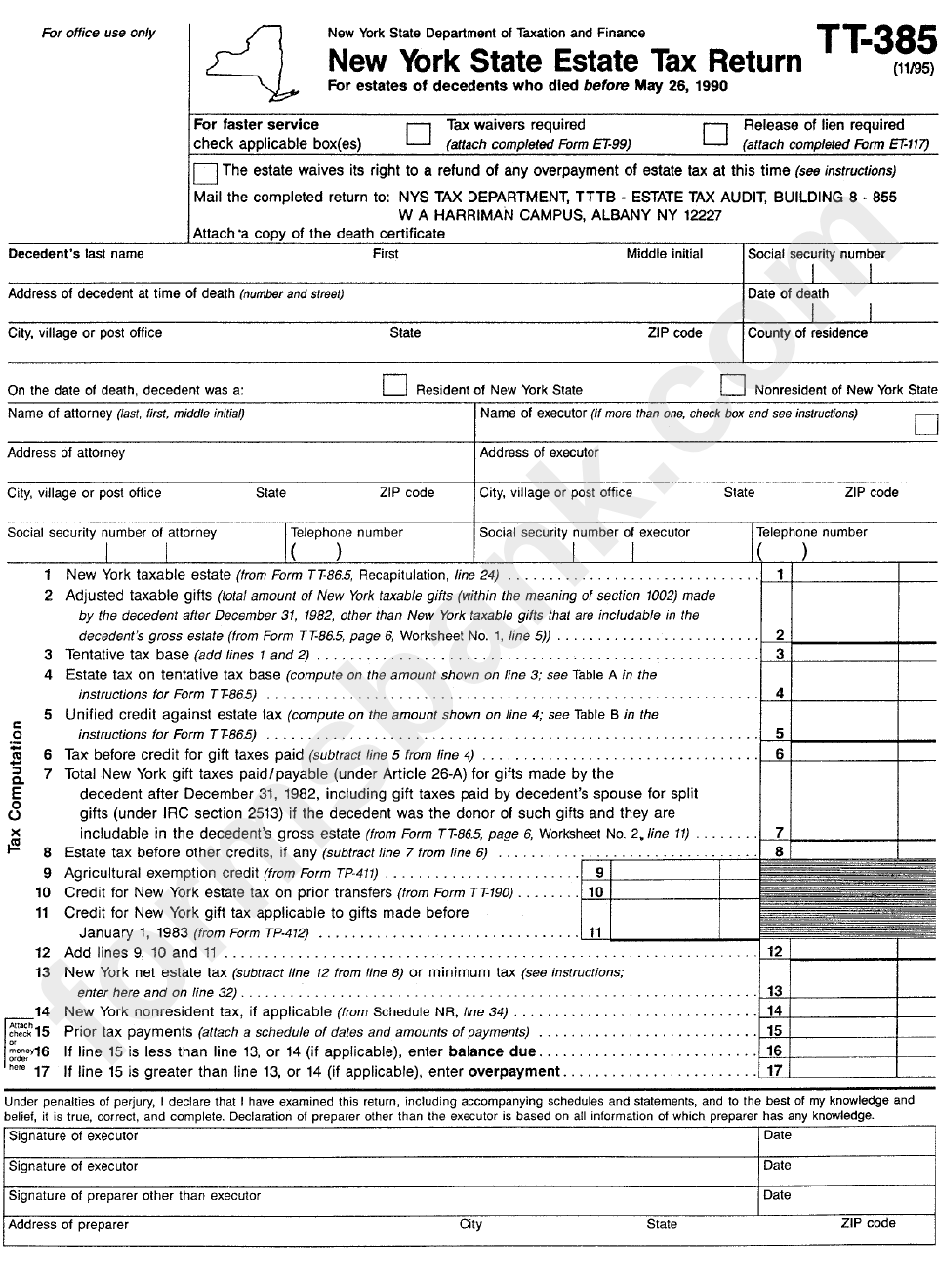

Printable New York State Tax Forms Printable Forms Free Online

Illinois State Government Takes In More Tax Dollars Per Person Than

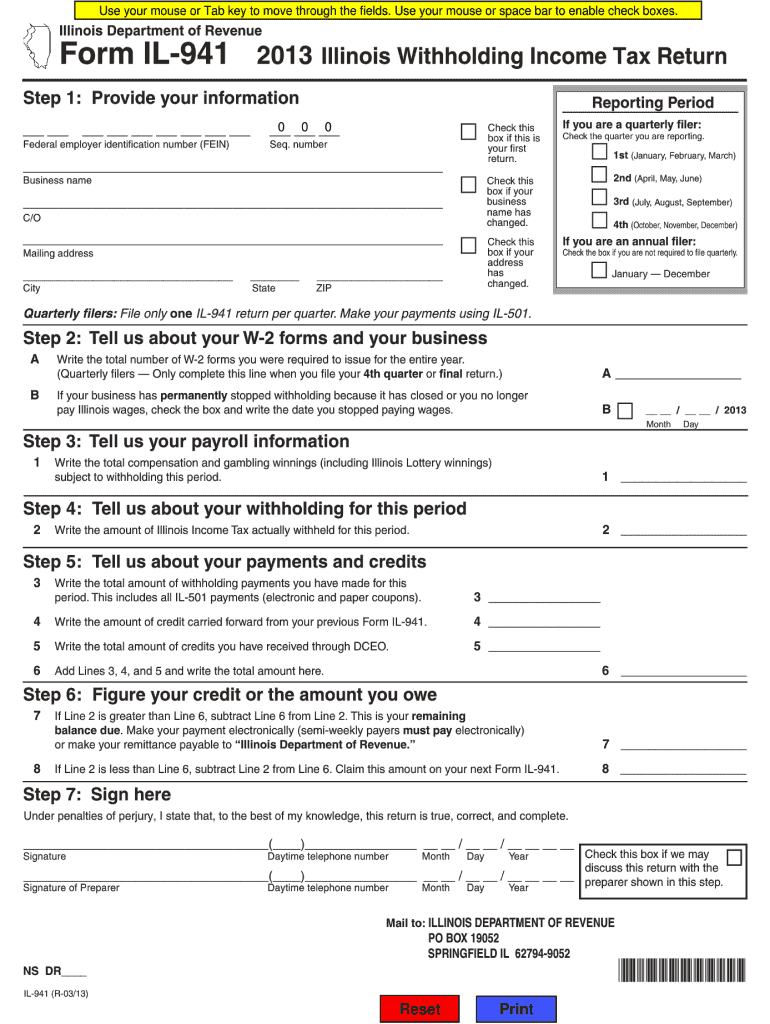

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

State Sales Tax Illinois State Sales Tax

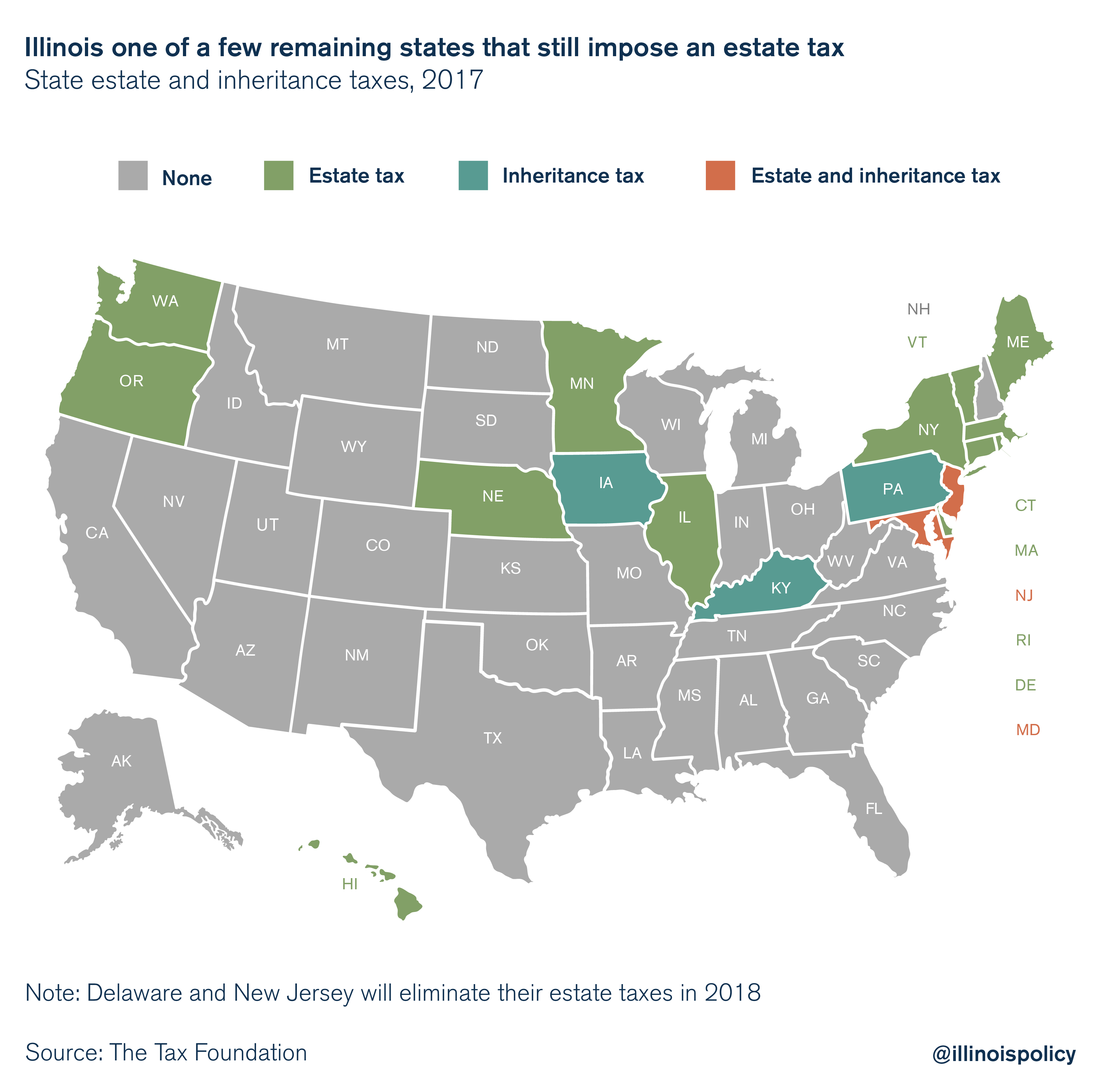

As Other States Repeal Illinois Death Tax Remains

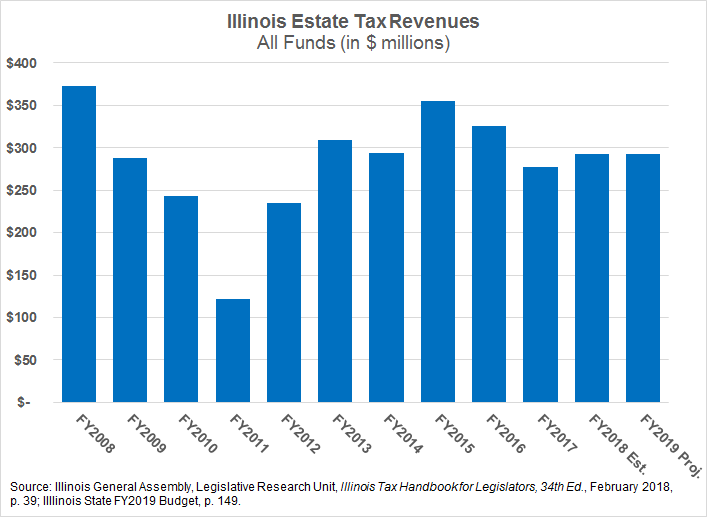

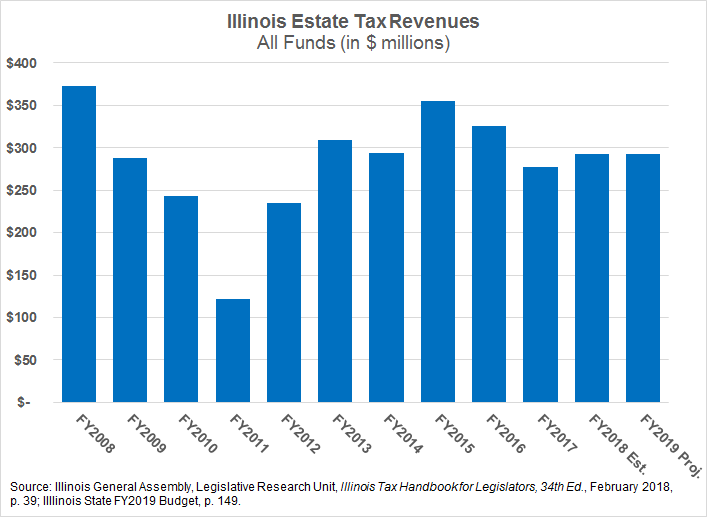

Whither The Illinois Estate Tax Civic Federation

Whither The Illinois Estate Tax Civic Federation

17 States That Charge Estate Or Inheritance Taxes Alhambra Investments

Why Billions Of Dollars In Estate Taxes Go Uncollected NBC News

What Do I Need To Know About Property Transfer Tax Silver Law

State Of Illinois Estate Tax Return - Illinois is not known as a tax friendly state We know that income tax rates and property tax rates can be high But how much do you know about the Illinois estate tax In this article we will discuss