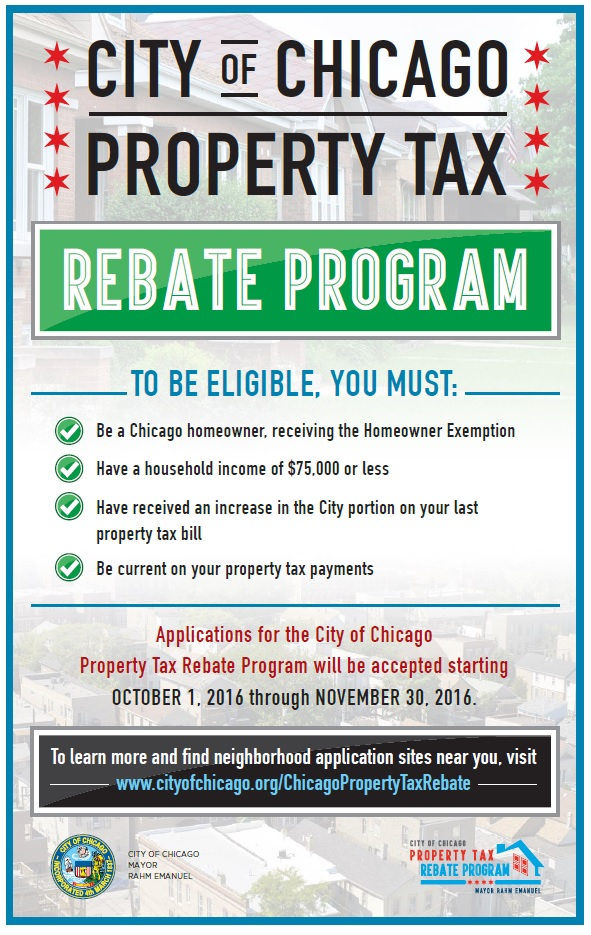

State Of Illinois Property Tax Rebate 2023 Web 3 f 233 vr 2022 nbsp 0183 32 This plan offers 475 million in property tax rebates It is estimated that this relief will be a rebate up to 300 for residential owners who qualify for the Illinois

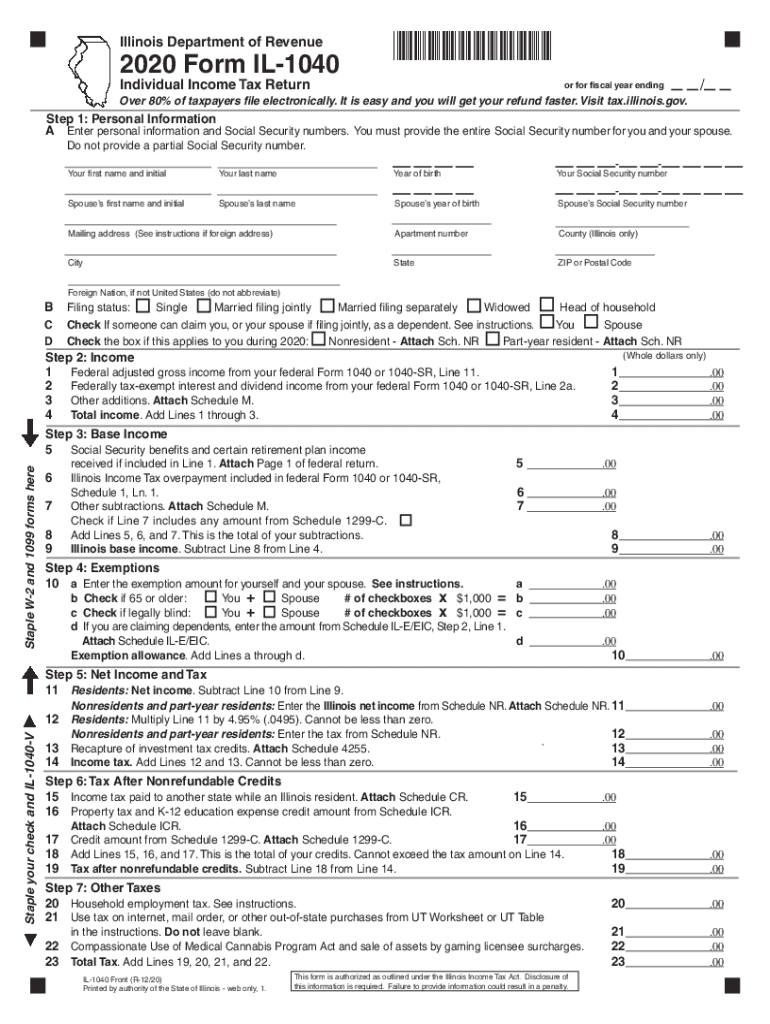

Web Only the property tax rebate You must complete and submit Form IL 1040 PTR Property Tax Rebate Form on or before October 17 2022 Only the individual income Web 1 What is the Illinois Property Tax Credit 2 Am I eligible for a property tax credit 3 What may not be included when I figure a property tax credit 4 How do I claim the

State Of Illinois Property Tax Rebate 2023

State Of Illinois Property Tax Rebate 2023

https://www.latestrebate.com/wp-content/uploads/2023/02/retirees-need-to-take-action-for-latest-property-tax-rebate-npr-illinois-1-1536x836.png

Illinois Tax Forms Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/552/409/552409798/large.png

Nj Property Tax Rebates 2023 PropertyRebate

https://www.propertyrebate.net/wp-content/uploads/2023/05/illinois-to-begin-sending-out-property-tax-and-income-tax-rebates-youtube-3.jpg

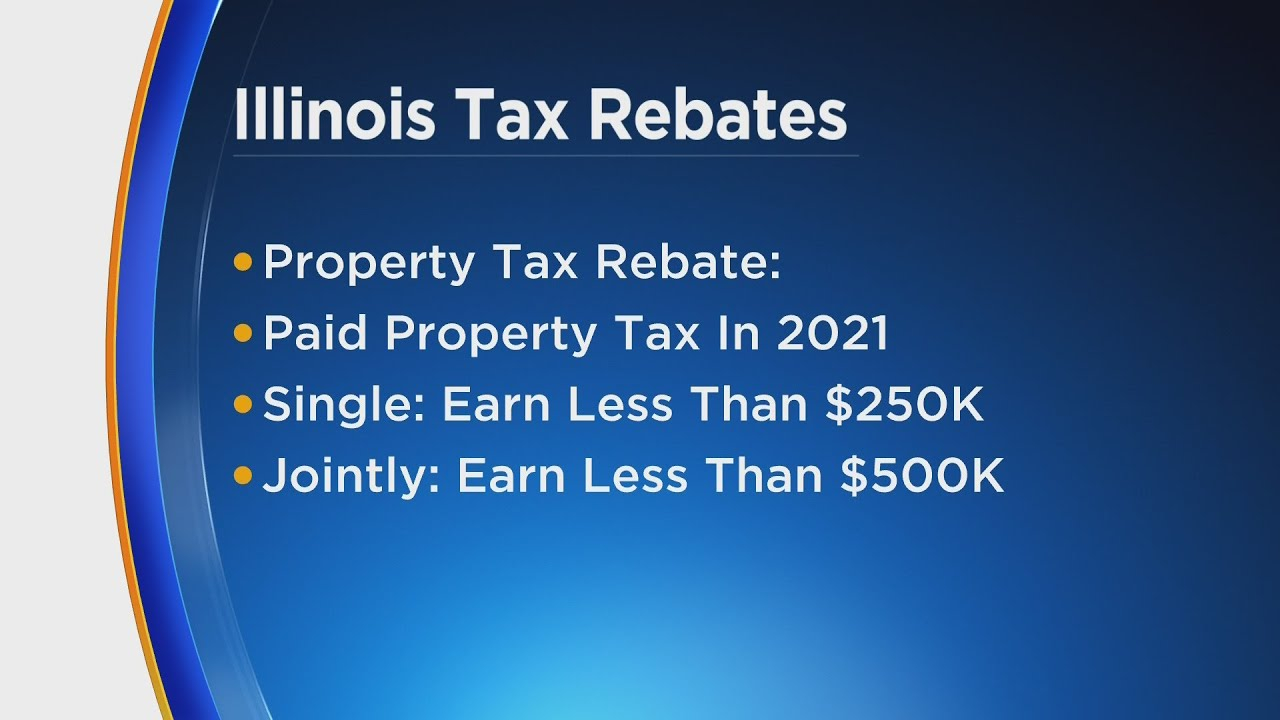

Web 19 avr 2022 nbsp 0183 32 Illinois Gov JB Pritzker on Tuesday signed the state s 46 5 billion budget for 2023 The budget includes a plan to issue tax rebates and direct payments among Web 8 mai 2023 nbsp 0183 32 The 2023 State of Illinois Tax Rebate program not only provides immediate financial relief but also offers an opportunity for long term financial planning and

Web 23 sept 2022 nbsp 0183 32 The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their Web 18 janv 2023 nbsp 0183 32 Overpaid property taxes will be refunded to more than 53 000 county homeowners starting this week and continuing for the next three months the Cook

Download State Of Illinois Property Tax Rebate 2023

More picture related to State Of Illinois Property Tax Rebate 2023

Illinois Tax Forms Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/611/453611818/large.png

Which States Have Property Tax Rebates PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/north-central-illinois-economic-development-corporation-property-taxes-1.png

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Web 12 f 233 vr 2023 nbsp 0183 32 Those rebates passed as part of the state s fiscal year 2023 budget were given to individuals who made less than 200 000 or couples who made less than Web 11 ao 251 t 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be

Web 6 avr 2023 nbsp 0183 32 It is important to note the following deadlines for the Illinois Property Tax Rebate 2023 The application period will begin on June 1 2023 and end on October 1 Web 30 juin 2023 nbsp 0183 32 In accordance with Illinois statute 50 ILCS 420 4 1 the Illinois Department of Revenue is required to provide an estimated entitlement of the amount of Personal

Il 1040X Instructions 2017 Fill Out And Sign Printable PDF Template

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/il-1040x-instructions-2017-fill-out-and-sign-printable-pdf-template-signnow.png?resize=768%2C1021&ssl=1

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-2023-Illinois.jpg?resize=978%2C781&ssl=1

https://chicagorealtor.com/governor-pritzker-presents-2023-budget...

Web 3 f 233 vr 2022 nbsp 0183 32 This plan offers 475 million in property tax rebates It is estimated that this relief will be a rebate up to 300 for residential owners who qualify for the Illinois

https://tax.illinois.gov/programs/rebates.html

Web Only the property tax rebate You must complete and submit Form IL 1040 PTR Property Tax Rebate Form on or before October 17 2022 Only the individual income

2022 State Of Illinois Tax Rebates Kakenmaster Tax Accounting

Il 1040X Instructions 2017 Fill Out And Sign Printable PDF Template

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

2023 Property Tax Rebate PropertyRebate

Illinois Income And Property Tax Rebates Will Be Issued Starting Monday

Illinois Unemployment 941x Fill Out Sign Online DocHub

Illinois Unemployment 941x Fill Out Sign Online DocHub

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Il Income And Property Tax Rebate PropertyRebate

Property Tax Rebate Form Pa 2023 PropertyRebate

State Of Illinois Property Tax Rebate 2023 - Web 29 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be