State Of Illinois Tax Exempt Status Exempt organizations may be formed as eit her a corporation or a trust Therefore exempt organizations pay both income tax and replacement tax but the rates differ Use the

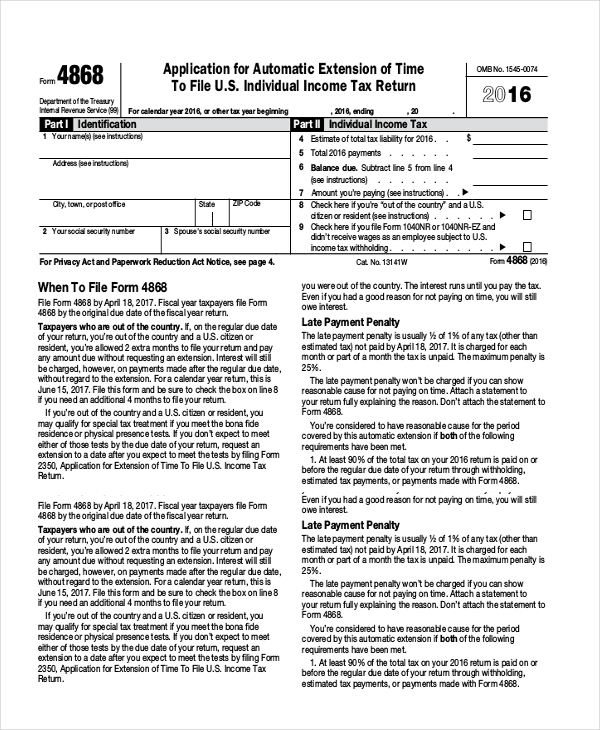

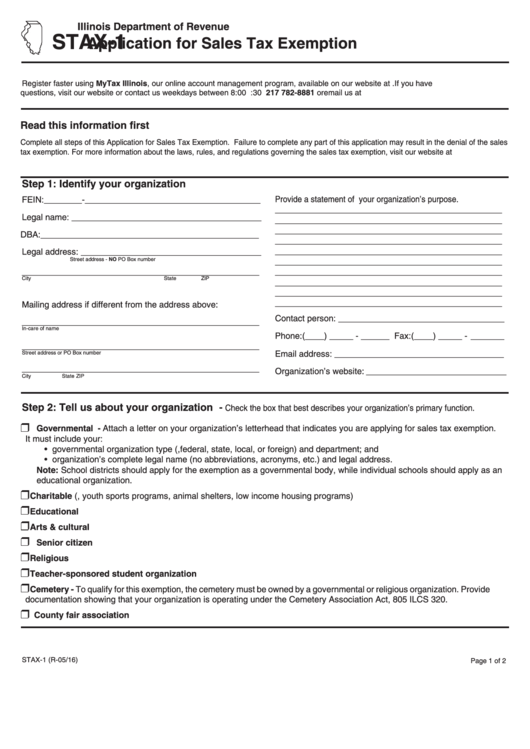

The criteria is governed by the state statues that apply Retailers Occupation Tax Act 35 ILCS 120 for sales tax exemptions Pro perty Tax Code 35 ILCS 200 for property A nonprofit is not automatically exempt from Illinois sales tax You must apply for a sales tax exemption E number by sending in Form STAX 1 Application for Sales Tax

State Of Illinois Tax Exempt Status

State Of Illinois Tax Exempt Status

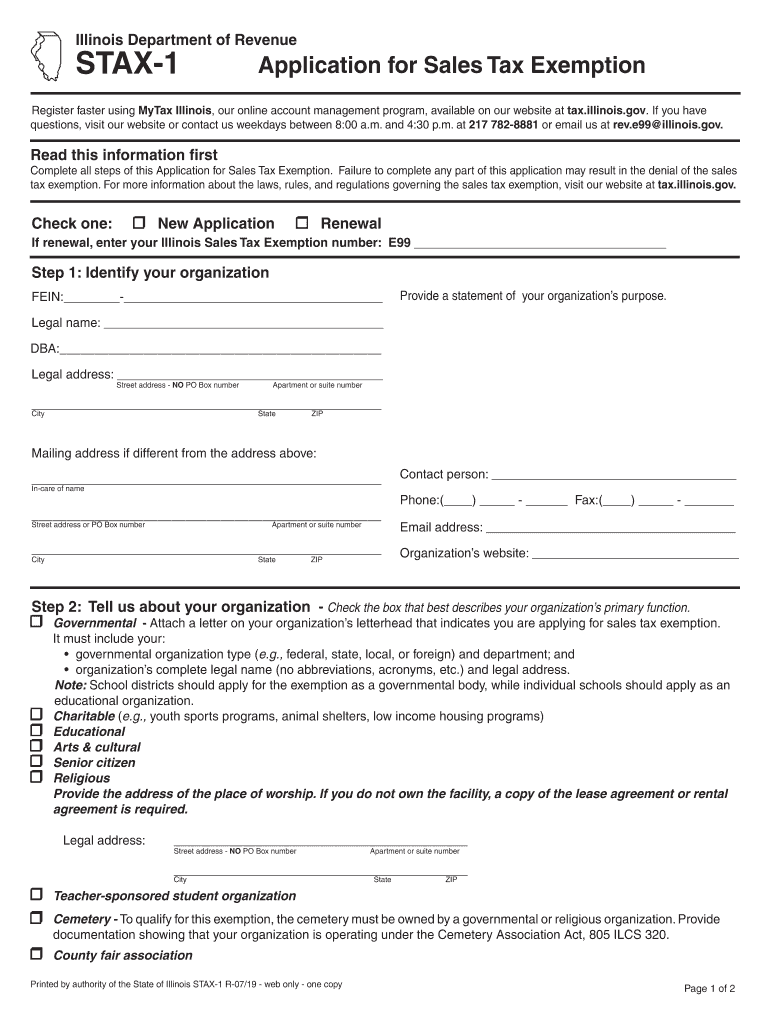

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

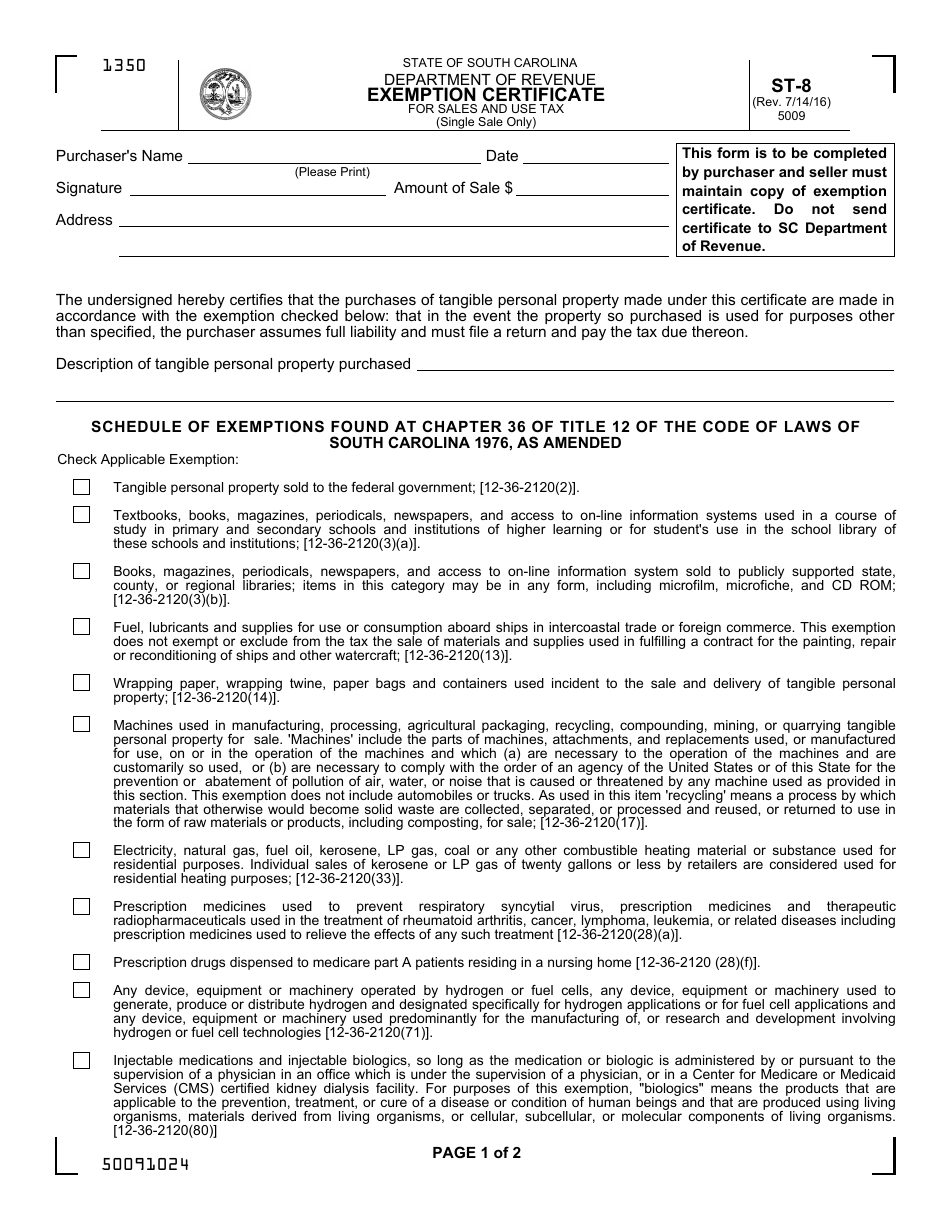

2023 Federal Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-9-sample-federal-tax-forms-in-pdf-ms-word.jpg

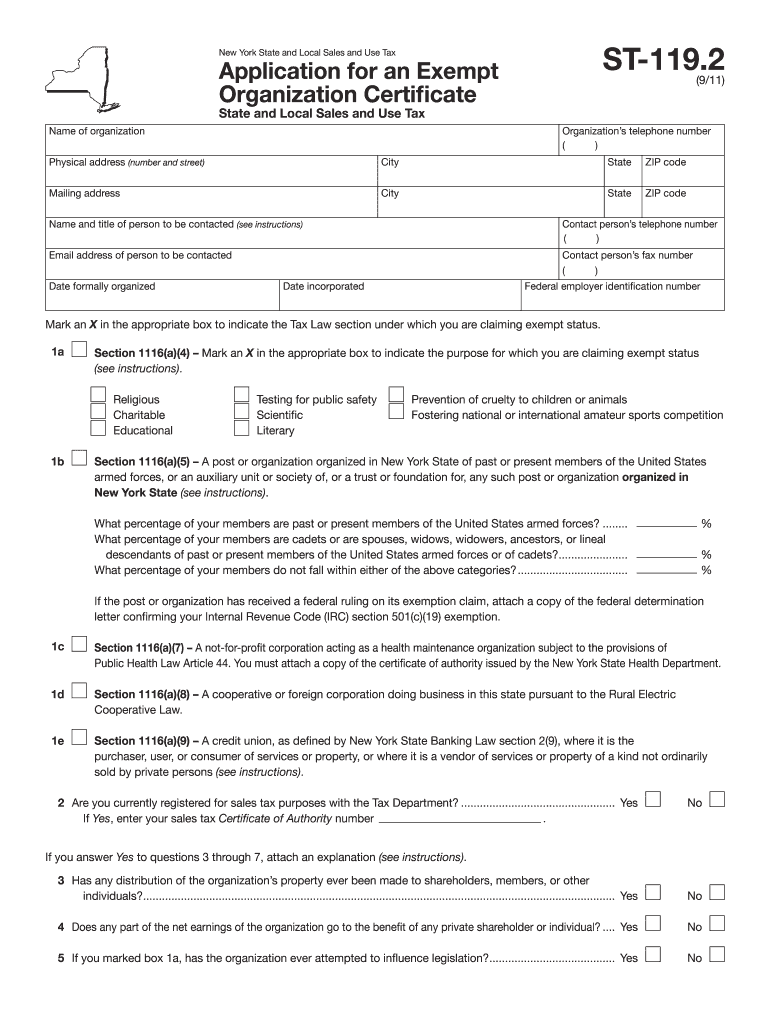

Senior Exemption Certificate Fill Out And Sign Printable Pdf Template

https://www.signnow.com/preview/489/44/489044156/large.png

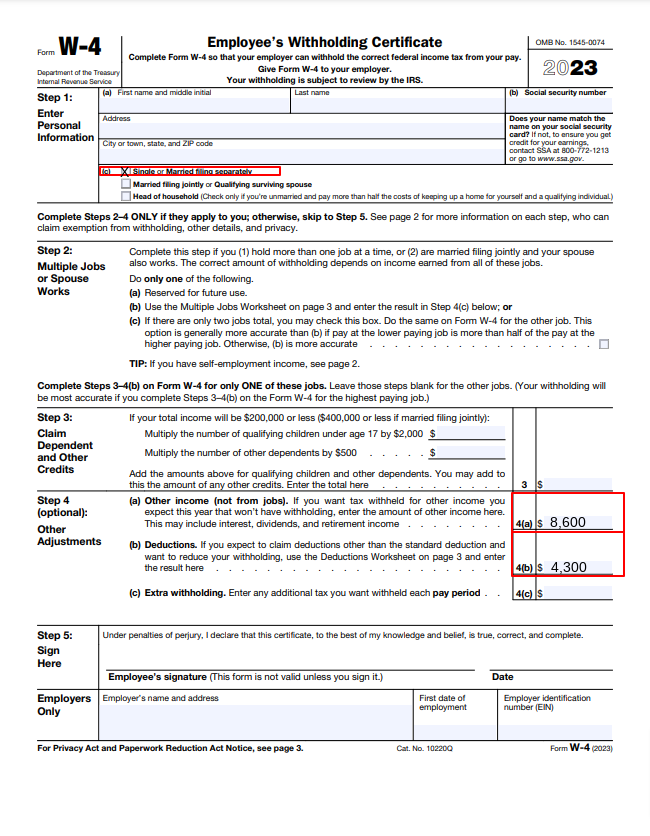

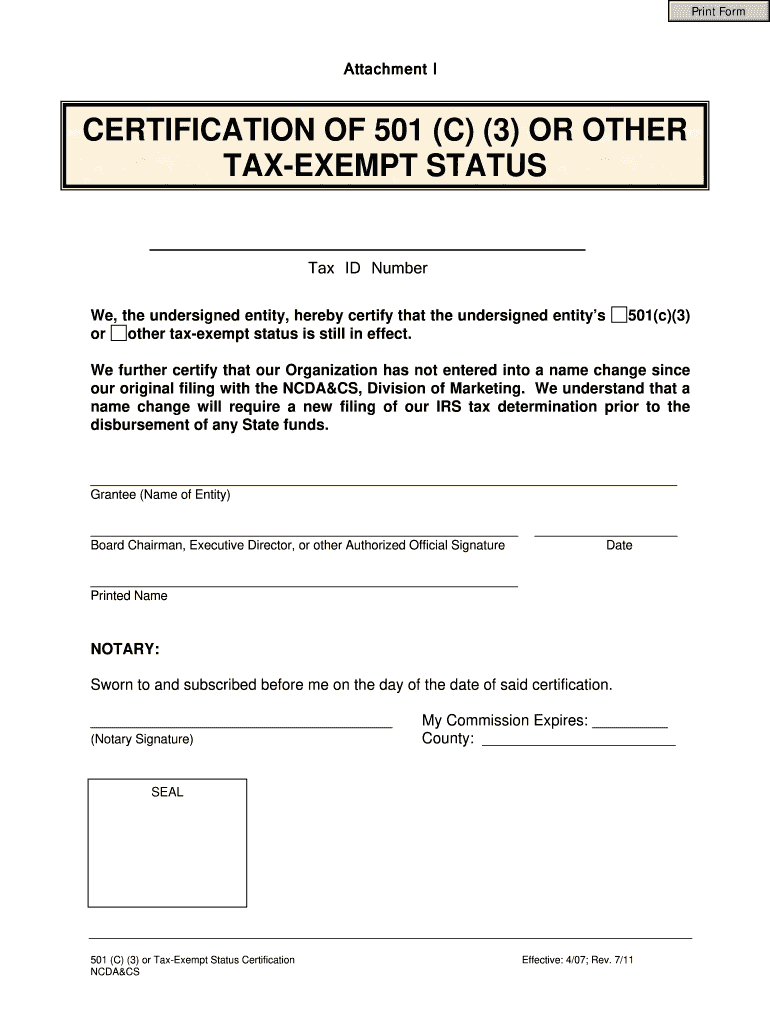

Internal Revenue Services IRS Publication 557 Tax Exempt Status for Your Organization An organization does not have to be incorporated to apply for exempt The Internal Revenue Service also recognizes the U of I System as exempt from federal income tax under Section 501 c 3 In addition the U of I System is exempt from the

The Tax Exempt Organization Search Tool You can check an organization s Eligibility to receive tax deductible charitable contributions Review information about the If your organization has not applied for IRS tax exempt status please answer no to question 18 on the registration form CO 1 Contact the Charitable Trust Bureau at 312

Download State Of Illinois Tax Exempt Status

More picture related to State Of Illinois Tax Exempt Status

Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/11/44/11044386/large.png

Sales Tax Exemption Certificate New York 2011 2024 Form Fill Out And

https://www.signnow.com/preview/5/640/5640089/large.png

Irs Tax Exempt Form 501c3 Form Resume Examples 86O78MakBR

https://www.viralcovert.com/wp-content/uploads/2018/10/irs-501c3-form-1023.jpg

In this article we discuss the difference between a not for profit organization and tax exempt status in Illinois and answer the following questions What Is A Nonprofit Illinois state filing information for tax exempt organizations

Over the years Illinois sales taxes have been amended many times to exempt various types of sales and transactions Exemptions are transactions that fall within the scope of Tax exempt status in the state Some states require periodic renewal of the state s recognition of a nonprofit s tax exempt status For example many states issue their own tax exempt certificate for sales and use tax purposes that nonprofits must apply for and periodically renew

Illinois Tax Exempt Certificate Five Mile House

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg?format=2500w

2017 PAFPI Certificate of TAX Exemption Certificate Of

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

https://tax.illinois.gov/research/taxinformation/income/exempt.html

Exempt organizations may be formed as eit her a corporation or a trust Therefore exempt organizations pay both income tax and replacement tax but the rates differ Use the

https://tax.illinois.gov/research/publications/pio-37.html

The criteria is governed by the state statues that apply Retailers Occupation Tax Act 35 ILCS 120 for sales tax exemptions Pro perty Tax Code 35 ILCS 200 for property

Sales Tax Exemptions Finance And Treasury

Illinois Tax Exempt Certificate Five Mile House

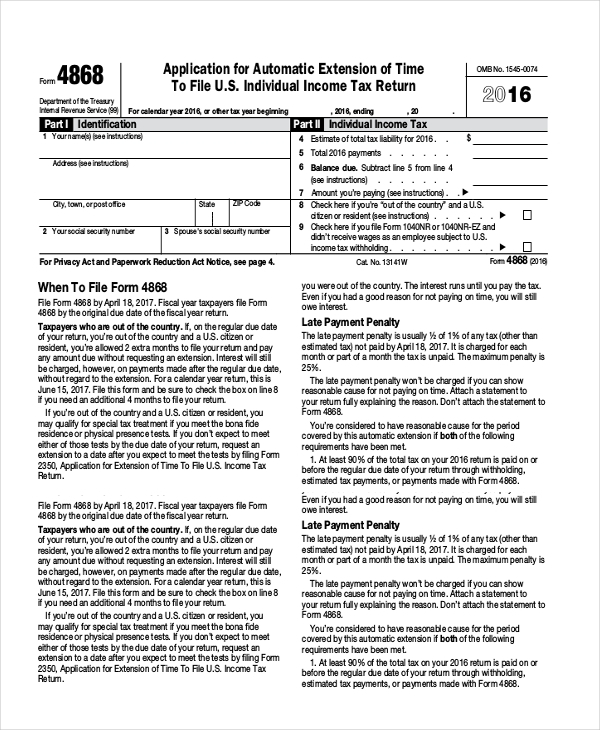

Form IL 1000 E Fill Out Sign Online And Download Fillable PDF

Tax Exempt Forms San Patricio Electric Cooperative

Gsa Missouri Tax Exempt Form Form Example Download

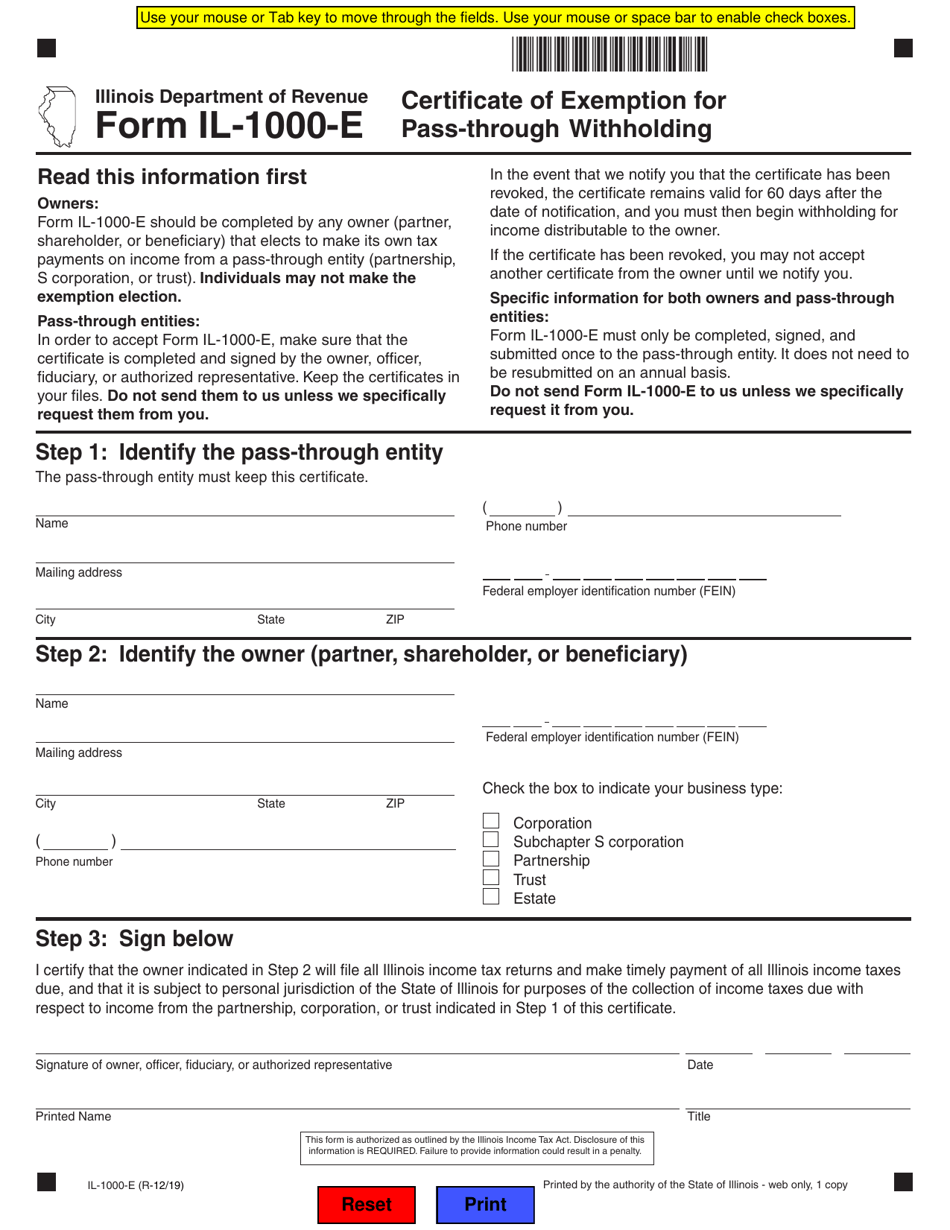

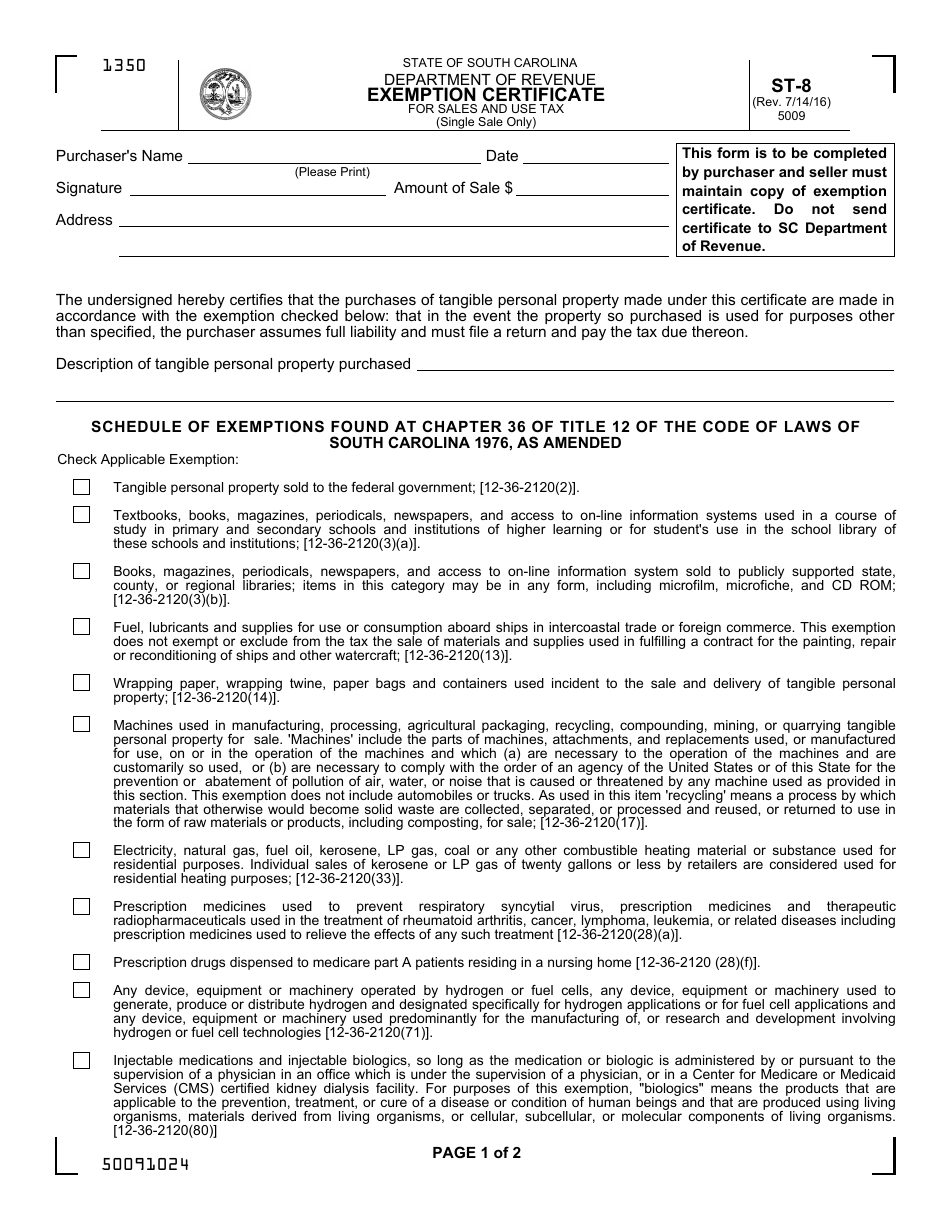

Form ST 8 Fill Out Sign Online And Download Fillable PDF South

Form ST 8 Fill Out Sign Online And Download Fillable PDF South

Tax Exemption Letter By UT Law School Fdn Issuu

Stax1 Application For Sales Tax Exemption Illinois Printable Pdf

501c3 Form PDF Complete With Ease AirSlate SignNow

State Of Illinois Tax Exempt Status - If your organization has not applied for IRS tax exempt status please answer no to question 18 on the registration form CO 1 Contact the Charitable Trust Bureau at 312