State Of Illinois Tax Rebates Web Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your rebate amount is

Web 23 ao 251 t 2022 nbsp 0183 32 The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent Web 8 d 233 c 2022 nbsp 0183 32 To qualify for the Illinois income tax rebate you had to be an Illinois resident in 2021 and the adjusted gross income on your 2021 Illinois tax return must be under

State Of Illinois Tax Rebates

State Of Illinois Tax Rebates

https://files.illinoispolicy.org/wp-content/uploads/2016/08/IL-High-Tax-Graphics2-1024x642.png

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

https://www.eztaxreturn.com/blog/wp-content/uploads/2022/08/Screenshot-2022-08-29-at-17-11-37-2022-State-of-Illinois-Tax-Rebates.png

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/759130d/2147483647/strip/true/crop/758x413+0+0/resize/880x479!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

Web 30 sept 2022 nbsp 0183 32 Those with an income of 400 000 or less jointly or under 200 000 single will receive a 50 rebate if filing as single or 100 if filing as a couple With Web Your rebates will be issued based upon the information you included on these forms Certain income restrictions apply see tax illinois gov rebates for more information If

Web 2022 State of Illinois Tax Rebates Sign Property Tax Rebate Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is Web 12 sept 2022 nbsp 0183 32 Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer

Download State Of Illinois Tax Rebates

More picture related to State Of Illinois Tax Rebates

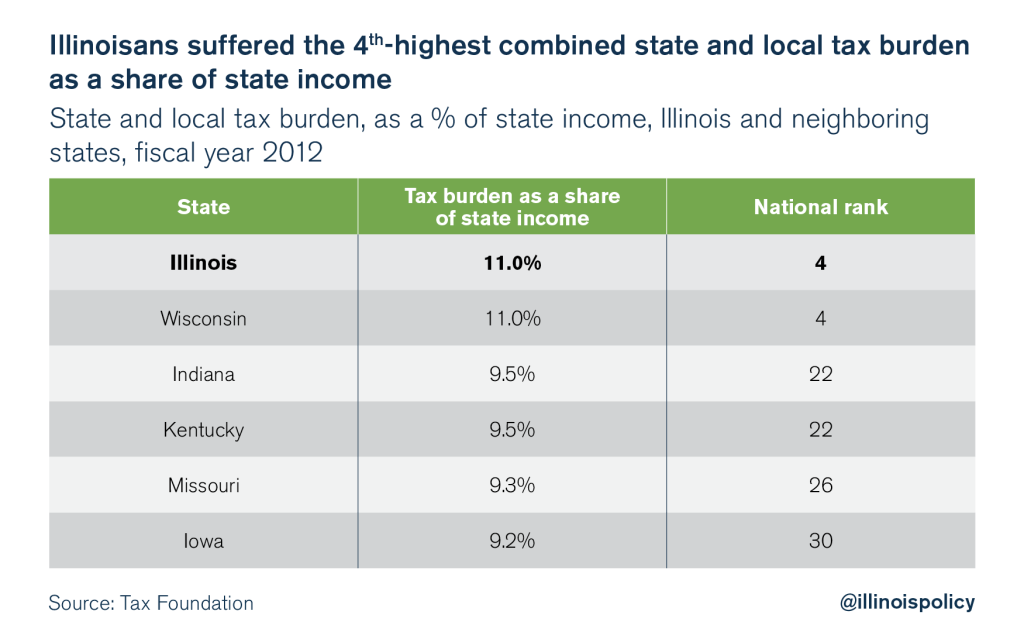

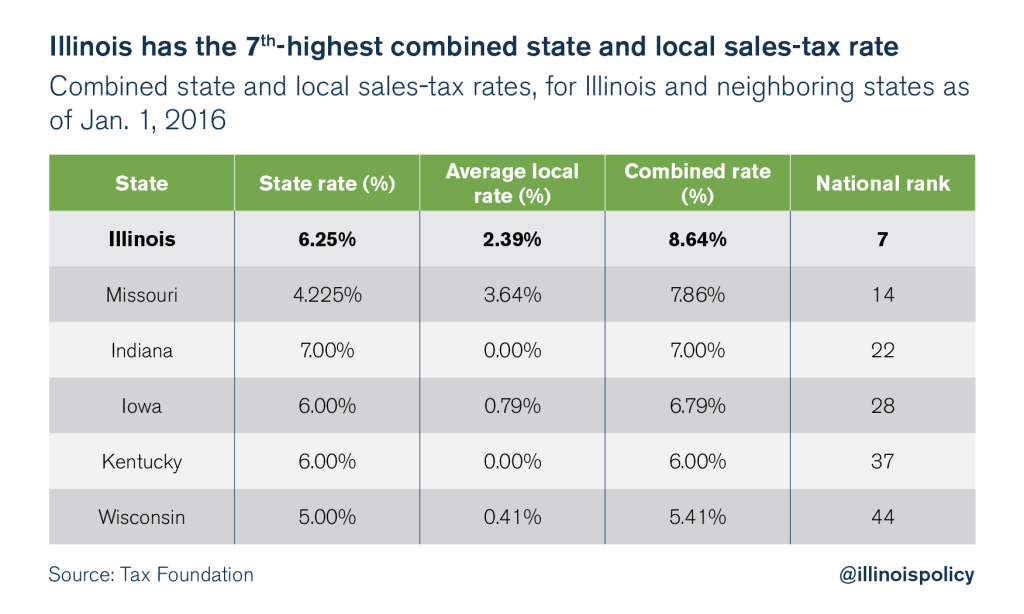

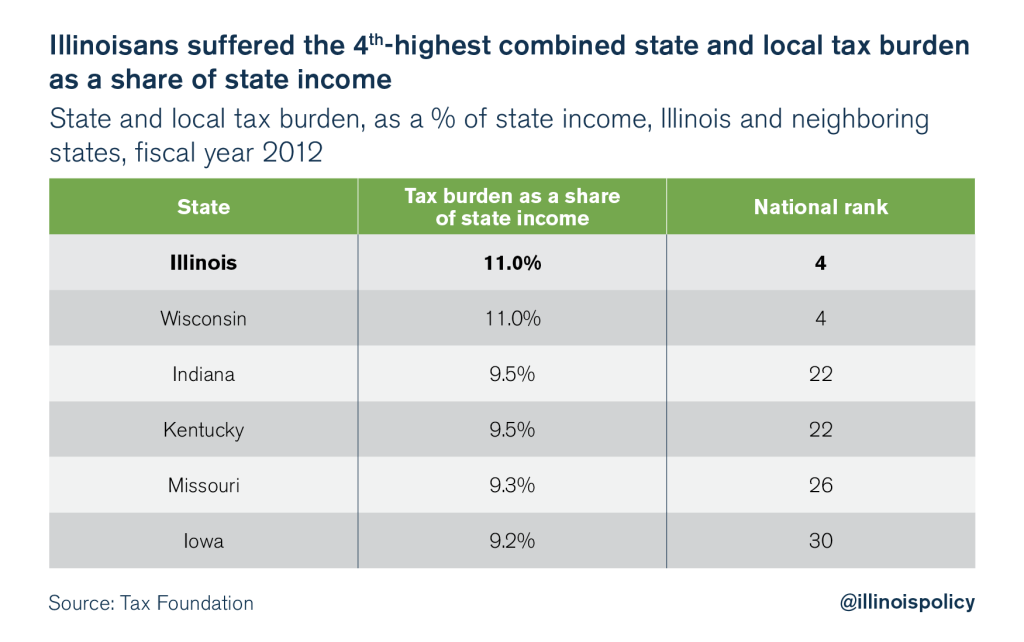

Illinois Is A High tax State Illinois Policy

https://files.illinoispolicy.org/wp-content/uploads/2016/08/IL-High-Tax-Graphics41-1024x614.png

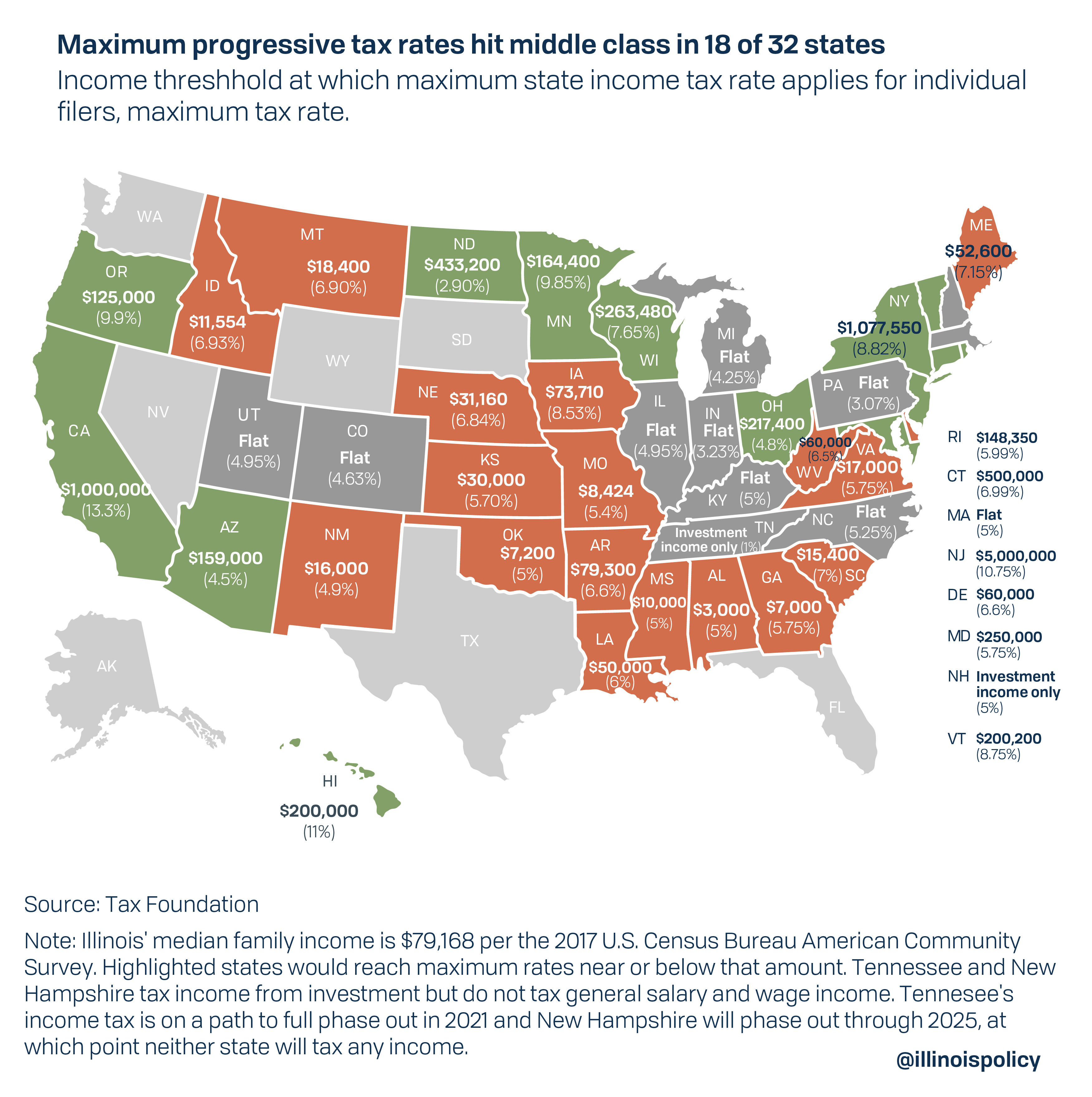

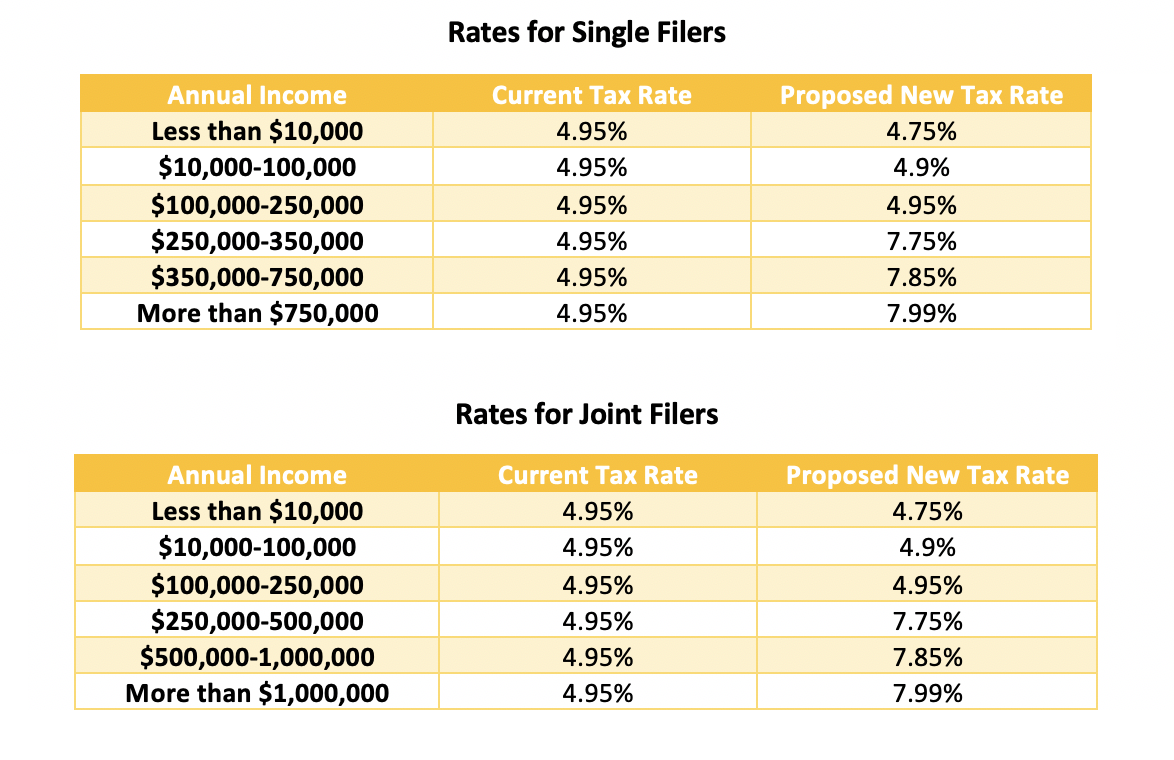

Official Illinois Progressive Tax Explainer Ranges From Misleading To

https://files.illinoispolicy.org/wp-content/uploads/2020/07/BT_2020.01.08_tax-rates_tax-rates.png

2021 Illinois Property Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

Web 19 avr 2022 nbsp 0183 32 Illinois Gov JB Pritzker on Tuesday signed the state s 46 5 billion budget for 2023 The budget includes a plan to issue tax rebates and direct payments among Web 2 ao 251 t 2022 nbsp 0183 32 Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer

Web 12 sept 2022 nbsp 0183 32 Illinois is also providing property tax rebates for eligible homeowners Those rebates will be equal to the property tax credit they qualified for on their 2021 Web 28 sept 2022 nbsp 0183 32 How Much Money Could You Get and Who Is Eligible There will be two rebates One is for income taxes and another for property taxes Income tax The

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-IL-Tax-Rebates_post.jpg

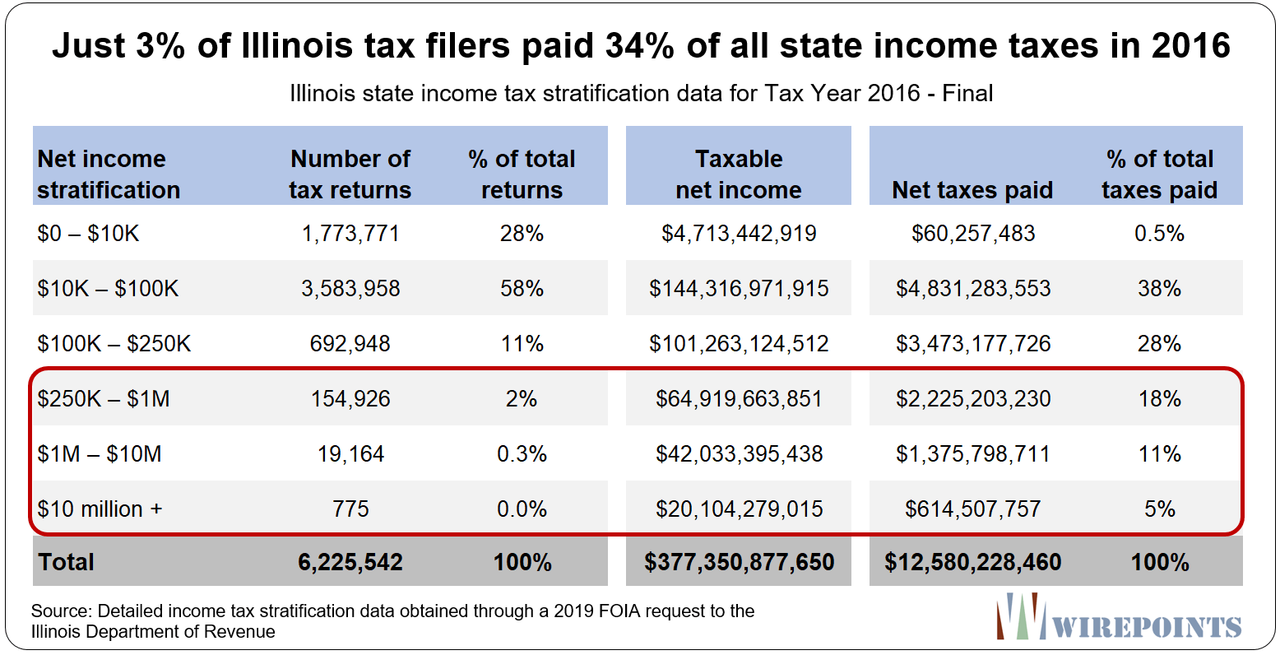

Who Will Want To Be A Millionaire In Illinois Zero Hedge

https://zh-prod-1cc738ca-7d3b-4a72-b792-20bd8d8fa069.storage.googleapis.com/s3fs-public/inline-images/Just-3-of-Illinois-tax-filers-paid-34-of-all-state-income-taxes-in-2016.png

https://tax.illinois.gov/content/dam/soi/en/web/tax/programs…

Web Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your rebate amount is

https://www.sj-r.com/story/news/politics/state/…

Web 23 ao 251 t 2022 nbsp 0183 32 The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent

Real Estate Tax Calculator Illinois QATAX

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Illinois Tax Rebate Tracker Rebate2022

Three Chicago Fed Economists Say They Know How To Tax Illinoisans

Cut Taxes Raise Revenue Can Illinois Tax Plan Work For Colorado

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

Illinois Tax Rebates Are Coming In Time For The Election

Illinois Tax Rebate Check Status Rebate2022

Banks Are Rejecting Some Illinois Tax Rebate Checks Here s Why

State Of Illinois Tax Rebates - Web 2022 State of Illinois Tax Rebates Sign Property Tax Rebate Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is