State Of Maine Property Tax Rebate Web The State of Maine provides a measure of property tax relief through different programs to qualified individuals While some are applied at a local level others may be applied for

Web Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief Income Tax Credits Individual income tax credits provide a Web Provided Direct Property Tax Relief to Maine Families Governor Mills expanded the Property Tax Fairness Credit to 83 000 Mainers by providing a one time boost in the

State Of Maine Property Tax Rebate

State Of Maine Property Tax Rebate

https://www.propertyrebate.net/wp-content/uploads/2023/05/maine-property-records-search-owners-title-tax-and-deeds-infotracer.jpg

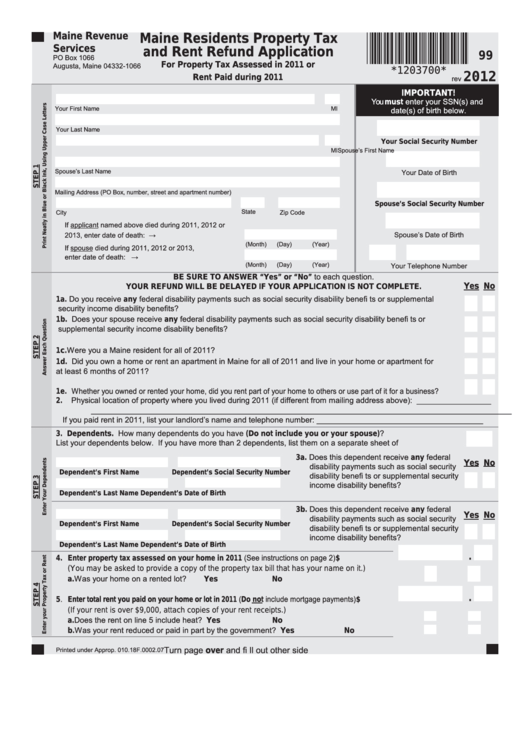

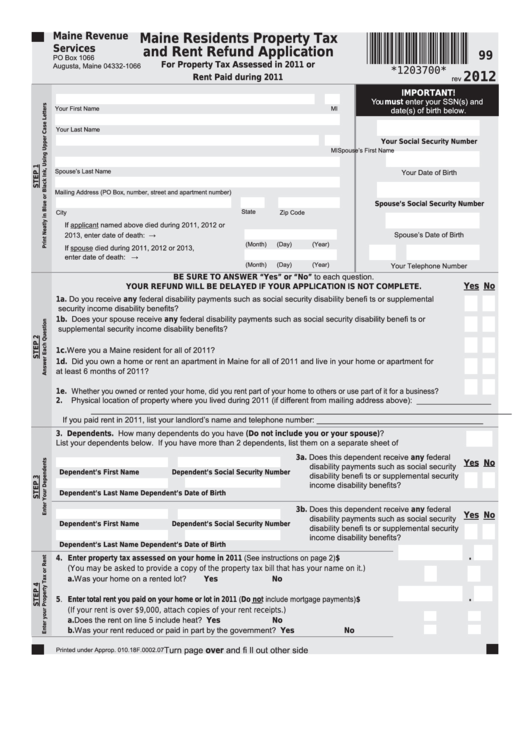

Form 99 Maine Residents Property Tax And Rent Refund Application

https://data.formsbank.com/pdf_docs_html/359/3591/359134/page_1_thumb_big.png

R I P Property Tax And Rent Rebate The Money Edge Biz The Maine Edge

https://www.themaineedge.com/media/k2/items/cache/54e18e61193ec51e66c99052eae28775_XL.jpg

Web Property Tax Stabilization for Senior Citizens also known as the Property Tax Stabilization Program the Program is a State program that allows certain senior citizen Web 20 d 233 c 2022 nbsp 0183 32 The program allows Maine homeowners age 65 and older to have their property taxes frozen at the previous year s levels as long as they meet a few

Web Beginning in tax year 2022 the property tax fairness credit is increased to 100 of the benefit base that is greater than 5 previously 5 of the individual s income up to Web 21 juil 2021 nbsp 0183 32 Legislation that Gov Janet Mills signed into law Monday will provide property tax relief to thousands of Mainers who are 65 or older and earn less than 40 000 per year The property tax

Download State Of Maine Property Tax Rebate

More picture related to State Of Maine Property Tax Rebate

State Of Maine Rew 5 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/552/474/552474294/large.png

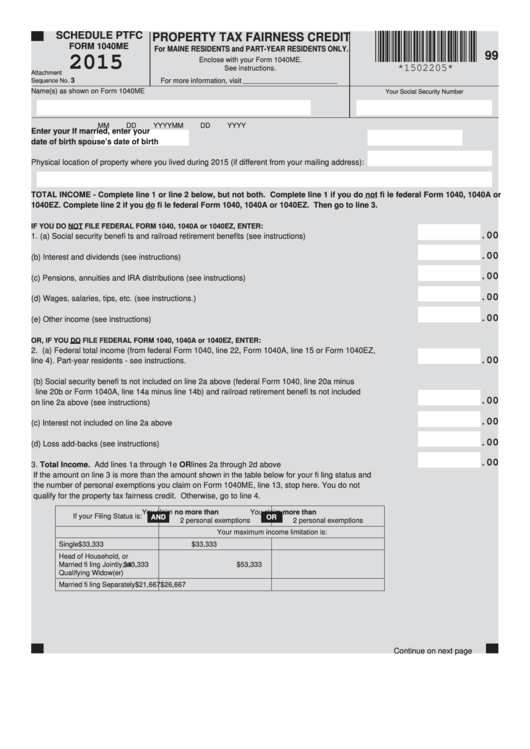

Schedule Ptfc Form 1040me Maine Property Tax Fairness Credit 2015

https://data.formsbank.com/pdf_docs_html/331/3313/331392/page_1_thumb_big.png

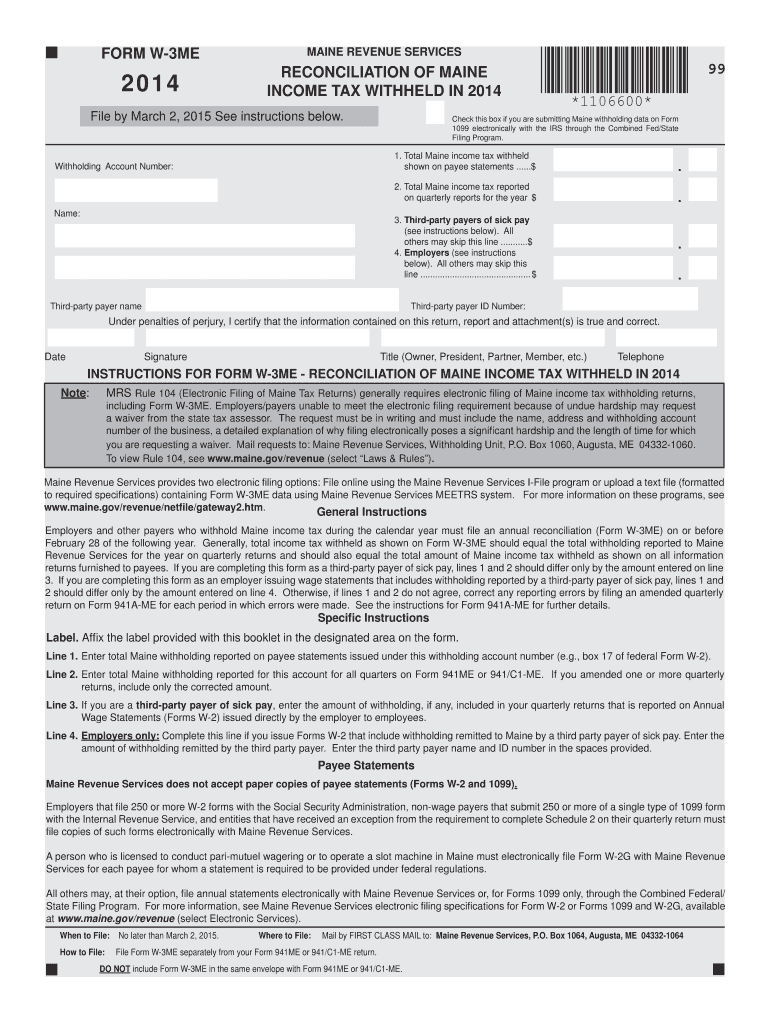

Maine Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/962/6962351/large.png

Web 32 lignes nbsp 0183 32 10 24 22 Homestead Property Tax Exemption for Cooperative Housing Corporations 10 24 22 Open Space Land Program 10 8 21 Property Tax Stabilization Web Homestead Exemption This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and

Web 4 ao 251 t 2022 nbsp 0183 32 By Stanley Rose August 4 2022 A program has been created for seniors in Maine that offers them the ability to sidestep all local property tax increases on their homes potentially permanently but only for Web 4 avr 2023 nbsp 0183 32 Esta Pratt Kielley Maine Public The State House in Augusta at dusk on November 9 2022 Maine lawmakers are winnowing a slate of bills seeking to repeal or

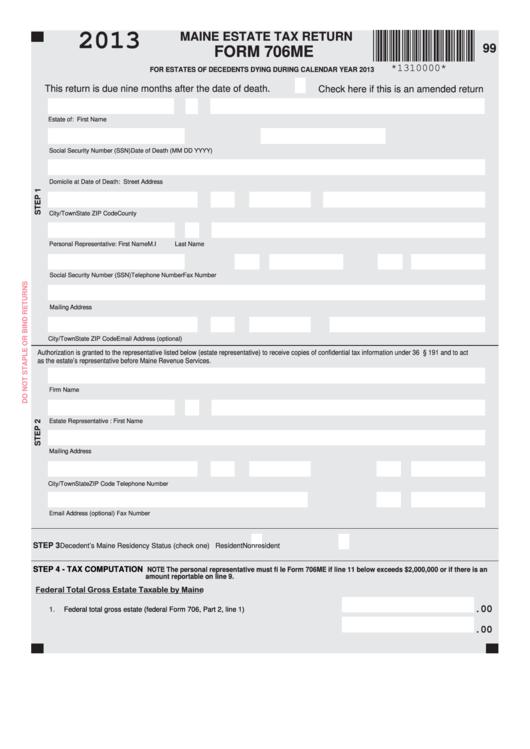

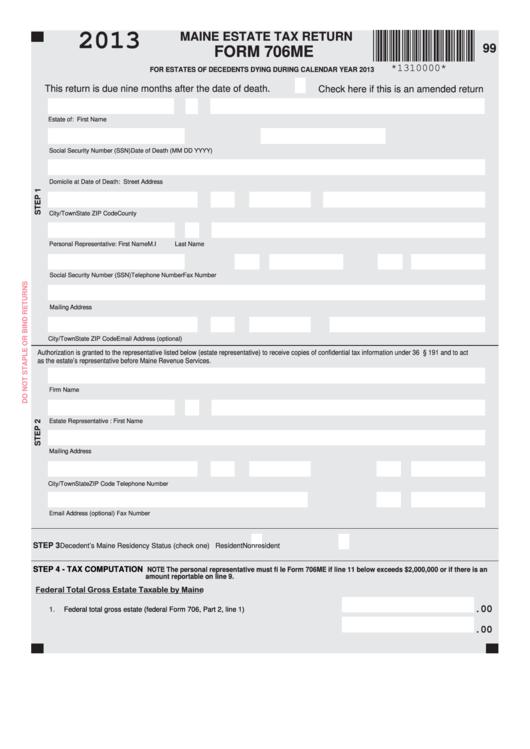

Fillable Form 706me Maine Estate Tax Return 2013 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/327/3273/327345/page_1_thumb_big.png

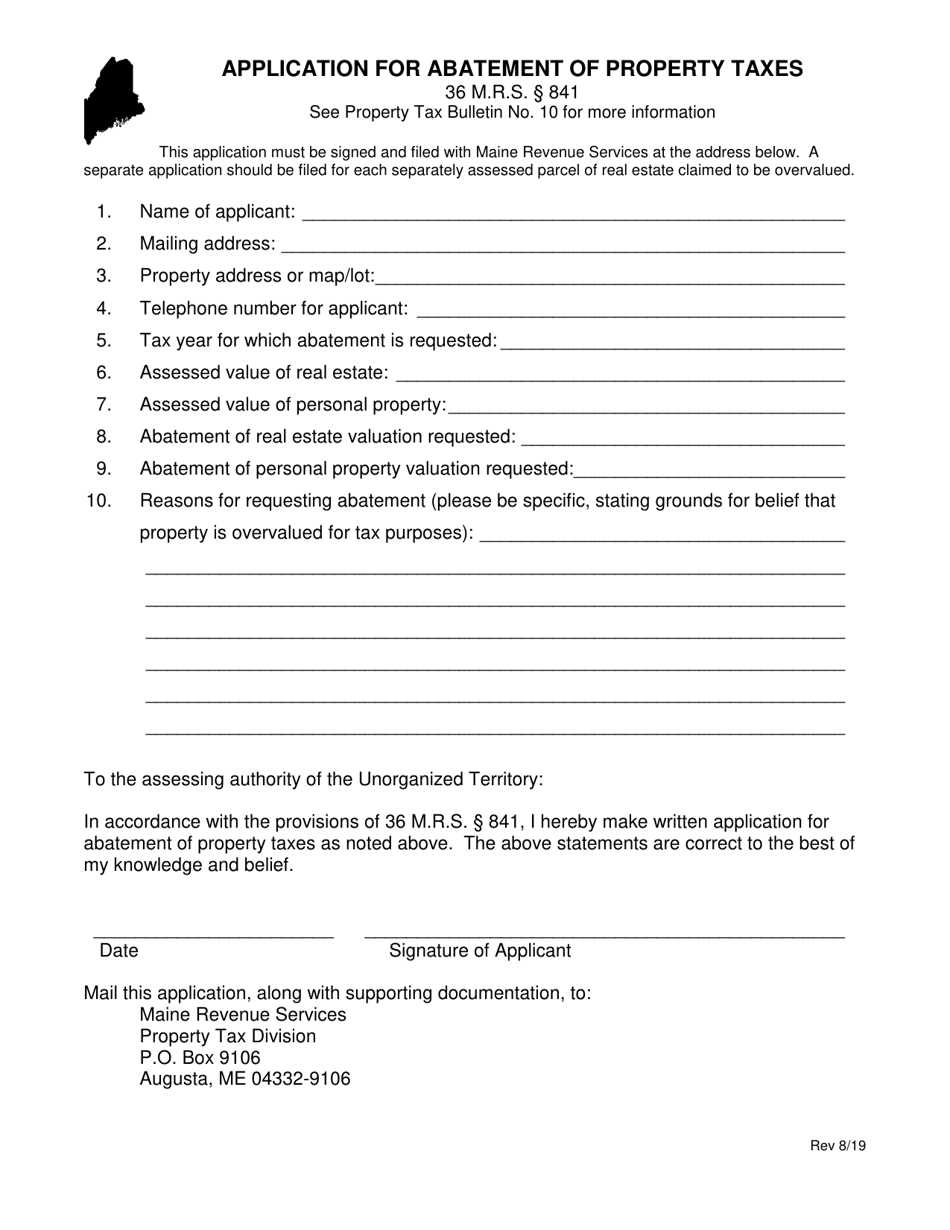

Maine Application For Abatement Of Property Taxes Download Printable

https://data.templateroller.com/pdf_docs_html/2008/20084/2008454/application-for-abatement-of-property-taxes-maine_print_big.png

https://www.maine.gov/.../property-tax-relief-programs

Web The State of Maine provides a measure of property tax relief through different programs to qualified individuals While some are applied at a local level others may be applied for

https://www.maine.gov/revenue/taxes/tax-relief-credits-programs

Web Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief Income Tax Credits Individual income tax credits provide a

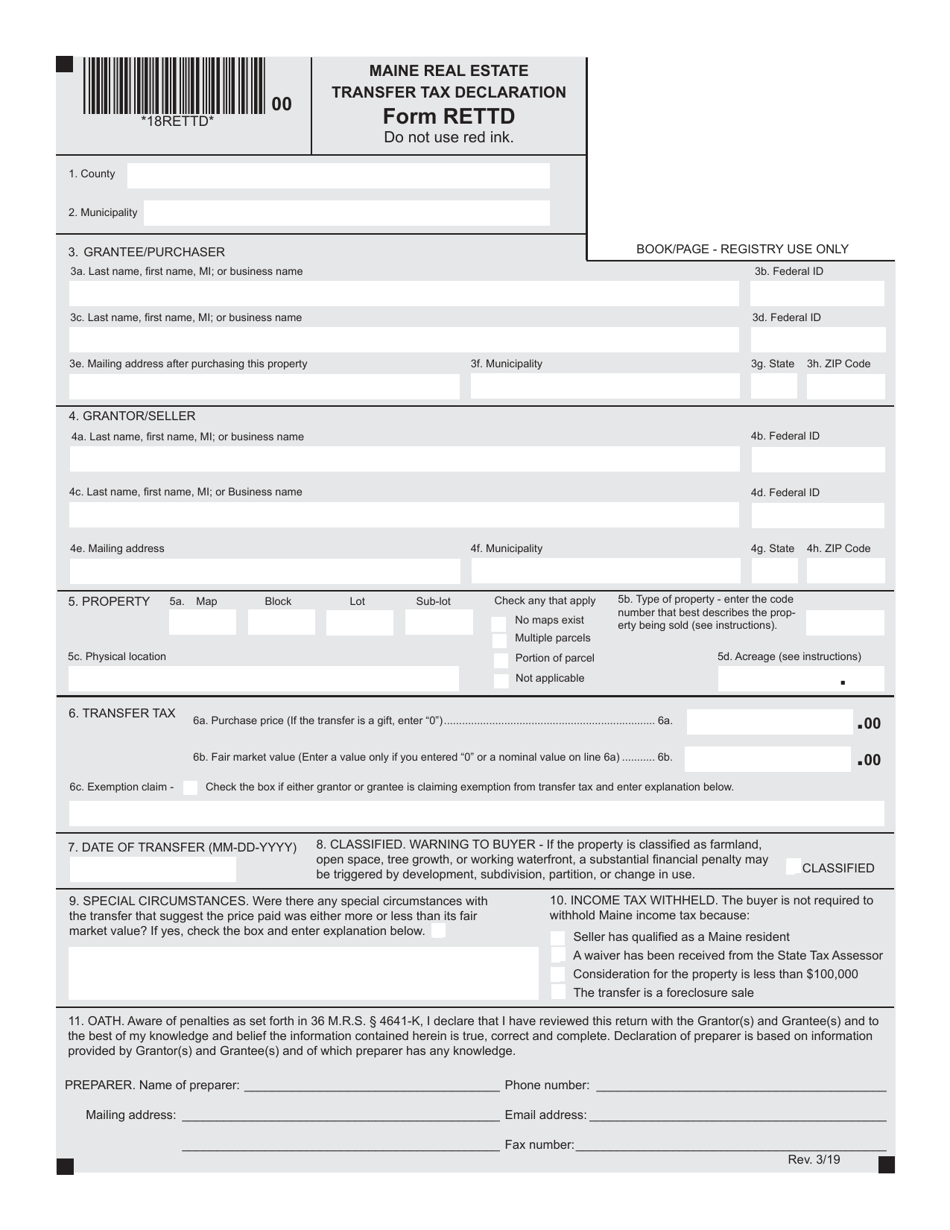

Form RETTD Download Fillable PDF Or Fill Online Maine Real Estate

Fillable Form 706me Maine Estate Tax Return 2013 Printable Pdf Download

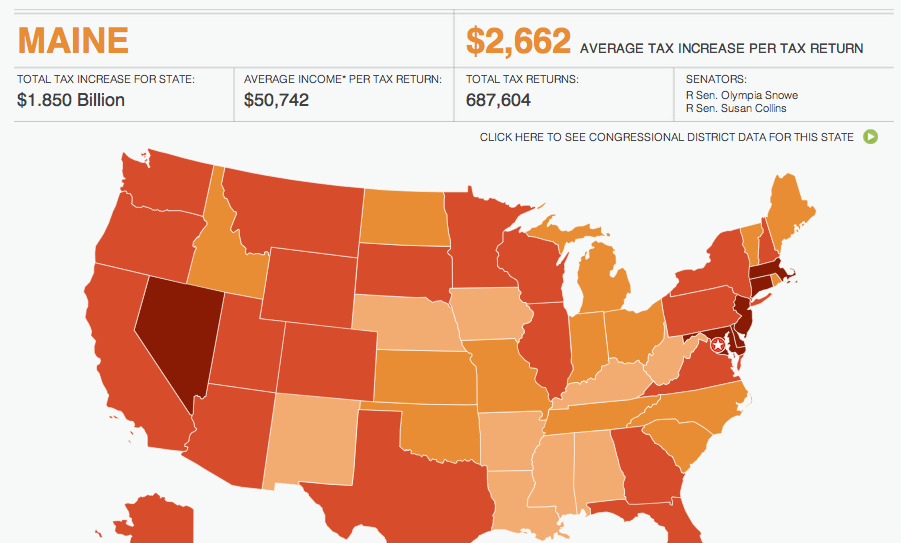

Taxmageddon Will Add 2 662 In Taxes To Each Maine Tax Return In 2013

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

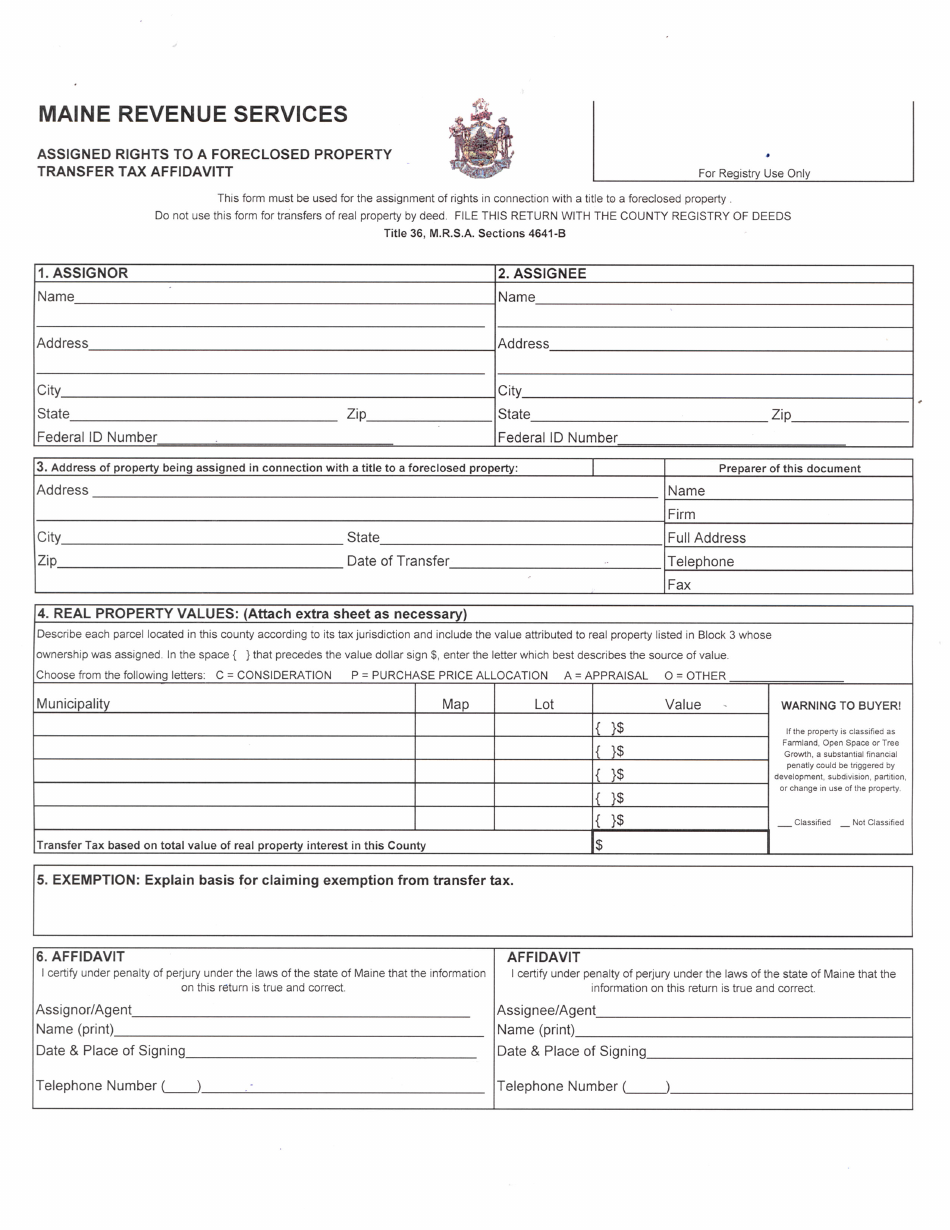

Maine Assigned Rights To A Foreclosed Property Transfer Tax Affidavitt

Maine Tax Rates By Town Well Developed Blawker Image Database

Maine Tax Rates By Town Well Developed Blawker Image Database

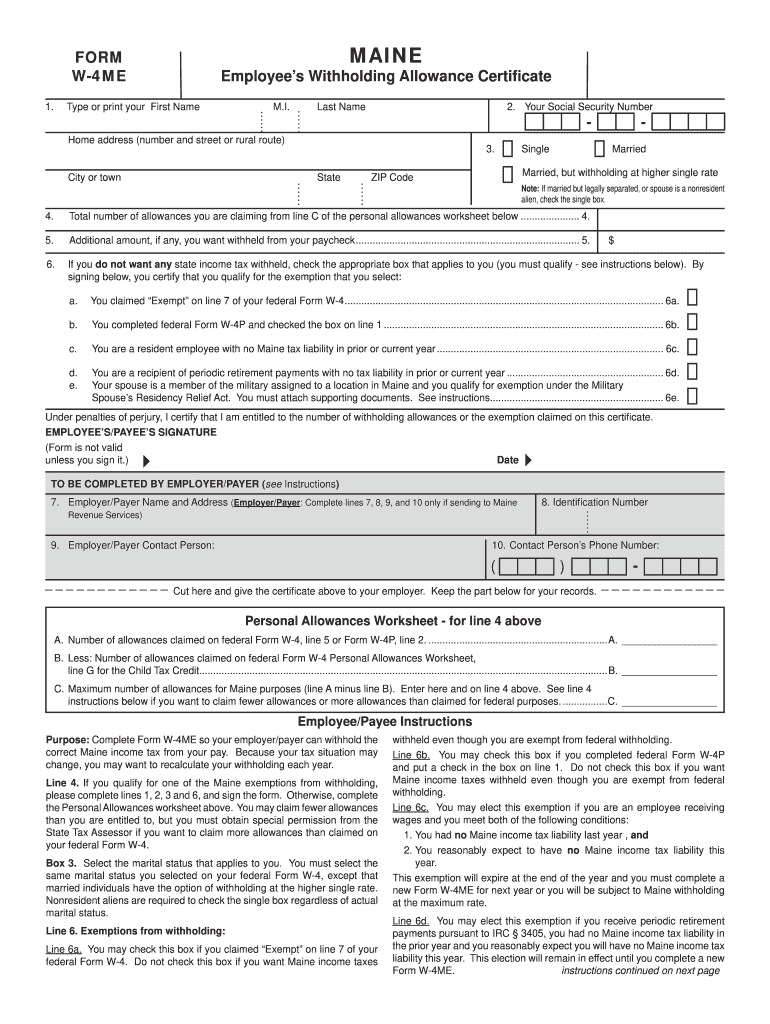

W4me Fill Out Sign Online DocHub

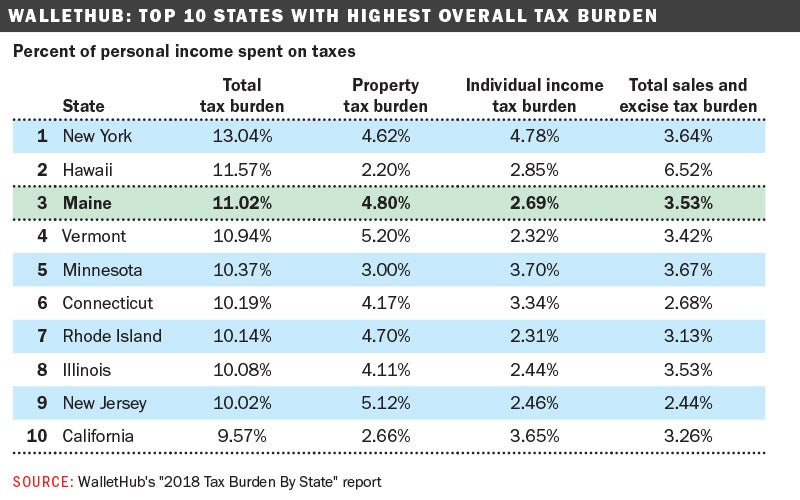

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz biz

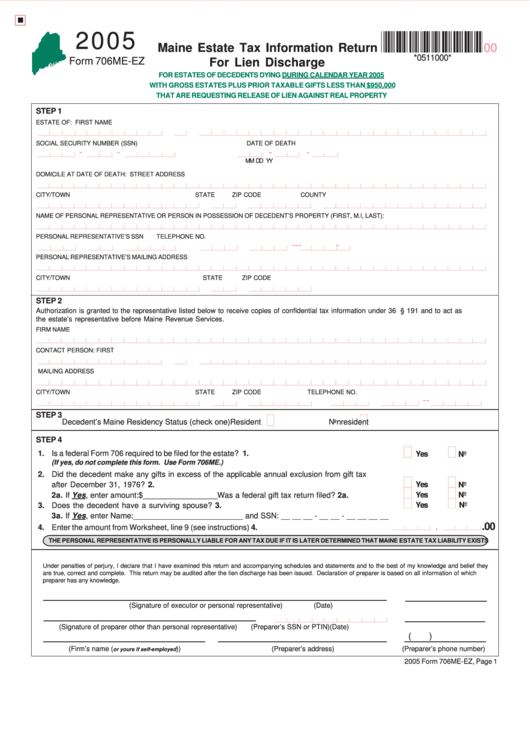

Form 706me Ez Maine Estate Tax Information Return For Lien Discharge

State Of Maine Property Tax Rebate - Web 21 juil 2021 nbsp 0183 32 Legislation that Gov Janet Mills signed into law Monday will provide property tax relief to thousands of Mainers who are 65 or older and earn less than 40 000 per year The property tax