State Of Minnesota Tax Rebate 2024 The Minnesota Department of Revenue has finished processing one time tax rebate payments for eligible Minnesota taxpayers We issued nearly 2 1 million rebates totaling nearly 1 billion under a law passed in May We used previously filed 2021 income tax or property tax refund returns to determine who is eligible and payment amounts

Depending on Minnesotans income and the size of their rebate check the federal tax could take between 26 and 286 of the rebate The Minnesota Department of Revenue says it will be January 12 2024 2 22 PM Gov Tim Walz announces details of the rebate program providing up to 1 300 for Minnesota families during a press conference at the State Capitol in St Paul on

State Of Minnesota Tax Rebate 2024

State Of Minnesota Tax Rebate 2024

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U.jpg

Who Will Get A Tax Rebate In Minnesota And When Will They Get It MinnPost

https://www.minnpost.com/wp-content/uploads/2023/05/MNStateCapitolSunset940.jpg?fit=940%2C685&strip=all

3 States Trying To Lower Taxes On Social Security Income

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1bDWWD.img

Michael J Bologna Minnesota taxpayers who banked nearly 1 billion in rebate checks earlier this year are required to pay federal income taxes on the payments in 2024 the state Department of Revenue confirmed Wednesday Revenue officials had hoped the rebates sent to 2 4 million taxpayers would enjoy tax free treatment at the federal level Minnesota EV Tax Rebate Program Duration Deadlines The State of Minnesota has limited funds to provide rebates for electric vehicles When the program launches completed applications will be reviewed on a first come first served basis The program will continue until funds are fully disbursed or June 30 2027 whichever occurs first

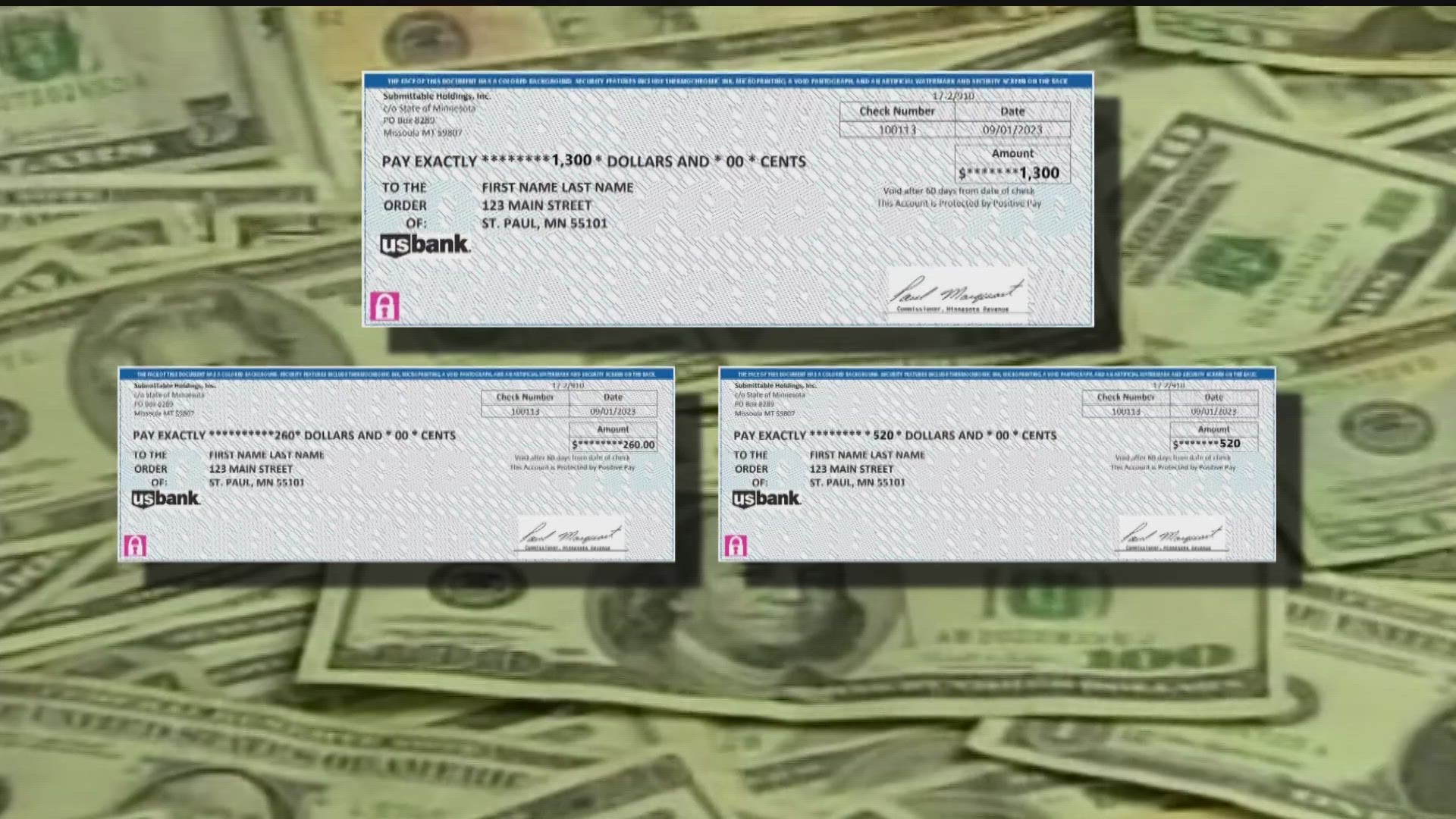

While Minnesota won t tax the rebates so you won t pay state taxes on the amount you received the federal tax on these rebates could reportedly range from 26 to 286 for Minnesota Here are the check totals 260 for individuals with adjusted gross income of 75 000 or less 520 for married couples who filed a joint return with an adjusted gross income of 150 000 or less An additional 260 added for each dependent filed on the tax return with a maximum of three dependents totaling 780

Download State Of Minnesota Tax Rebate 2024

More picture related to State Of Minnesota Tax Rebate 2024

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

https://media.kare11.com/assets/KARE/images/c6c0f926-4792-46a8-9d55-d297c077d911/c6c0f926-4792-46a8-9d55-d297c077d911_1920x1080.jpg

260 Minnesota Tax Rebate All You Need To Know

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1bzGvG.img?w=2000&h=1000&m=4&q=75

The Minnesota Department of Revenue announced Monday it s finished processing the one time tax rebate payments It sent just over 2 million direct deposits and paper checks totaling nearly The bill also extends sunset date of the credit from tax year 2024 to tax year 2031 partnership level audit must report adjustments and file a new PTE tax return to account for the changes State itemized and standard deduction phase out not file a 2021 Minnesota individual income tax return or a property tax refund return under

Clouds float over the Minnesota State Capitol in St Paul on May 23 2022 Minnesotans can expect 260 per filer tax rebates by fall Brainerd s 2024 Ice Fishing Extravaganza looks to The rebate checks are part of the latest tax bill approved by lawmakers in May The one time rebates will cost the state about 1 1 billion that will come from Minnesota s historic 17 5 billion

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-768x994.png

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

https://www.revenue.state.mn.us/direct-tax-rebate-2021

The Minnesota Department of Revenue has finished processing one time tax rebate payments for eligible Minnesota taxpayers We issued nearly 2 1 million rebates totaling nearly 1 billion under a law passed in May We used previously filed 2021 income tax or property tax refund returns to determine who is eligible and payment amounts

https://kstp.com/kstp-news/local-news/minnesotas-rebate-checks-will-be-taxed-federally-irs-decides/

Depending on Minnesotans income and the size of their rebate check the federal tax could take between 26 and 286 of the rebate The Minnesota Department of Revenue says it will be

The Minnesota EV Rebate Explained

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

Tax Rebate Checks Come Early This Year Yonkers Times

Check In The Mail Minnesota Tax Rebate Considered YouTube

Minnesota Tax Rebate 2023 Your Comprehensive Guide PrintableRebateForm

Minnesota Tax Rebate 2023 Your Comprehensive Guide PrintableRebateForm

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

P55 Tax Rebate Form By State PrintableRebateForm

New Walz Plan For Surplus Includes Bigger Tax Rebate Checks Fox21Online

State Of Minnesota Tax Rebate 2024 - Michael J Bologna Minnesota taxpayers who banked nearly 1 billion in rebate checks earlier this year are required to pay federal income taxes on the payments in 2024 the state Department of Revenue confirmed Wednesday Revenue officials had hoped the rebates sent to 2 4 million taxpayers would enjoy tax free treatment at the federal level