State Of Montana Tax Rebate 2024 The Individual Income Tax Rebate amount depends on a taxpayer s 2021 filing status and the amount of tax paid for 2021 which can be found on line 20 of the 2021 Montana Form 2 For those whose filing status was single head of household or married filing separately the rebate will be either 1 250 or the line 20 amount whichever is less

The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online The Home Electrification and Appliance Rebate Program rebates are tiered based on your gross household income and eligibility is capped at 150 AMI Appliances and HVAC systems must also meet certain efficiency standards Both programs can be utilized for single family multi family and manufactured housing

State Of Montana Tax Rebate 2024

State Of Montana Tax Rebate 2024

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

Montana Tax Rebate Checks Up To 2 500 Coming In July

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1csa1K.img?w=1920&h=1080&m=4&q=79

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-768x994.png

The governor s budget provides Montanans with 2 000 in property tax rebates for their primary residence over 2023 and 2024 The 500 million proposal represents the largest state administered tax rebate in the country the governor announced yesterday with the Montana Board of Investments the State of Montana has reaffirmed its Montana homeowners eligible for 675 rebates in both 2023 and 2024 Governor s Office July 14 2023 HELENA Mont Joining Representative Tom Welch R Dillon Governor Greg Gianforte this week celebrated a new law which provides Montana homeowners up to 1 350 in property tax rebates over the next two years

This comes after the Montana Legislature signed two tax rebate bills pulling hun 18 Jan 2024 22 48 27 GMT 1705618107587 What that means for full time Montana residents who paid state The governor s budget provides 500 million in property tax relief for Montanans for their primary residence with a 1 000 property tax rebate in both 2023 and 2024

Download State Of Montana Tax Rebate 2024

More picture related to State Of Montana Tax Rebate 2024

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

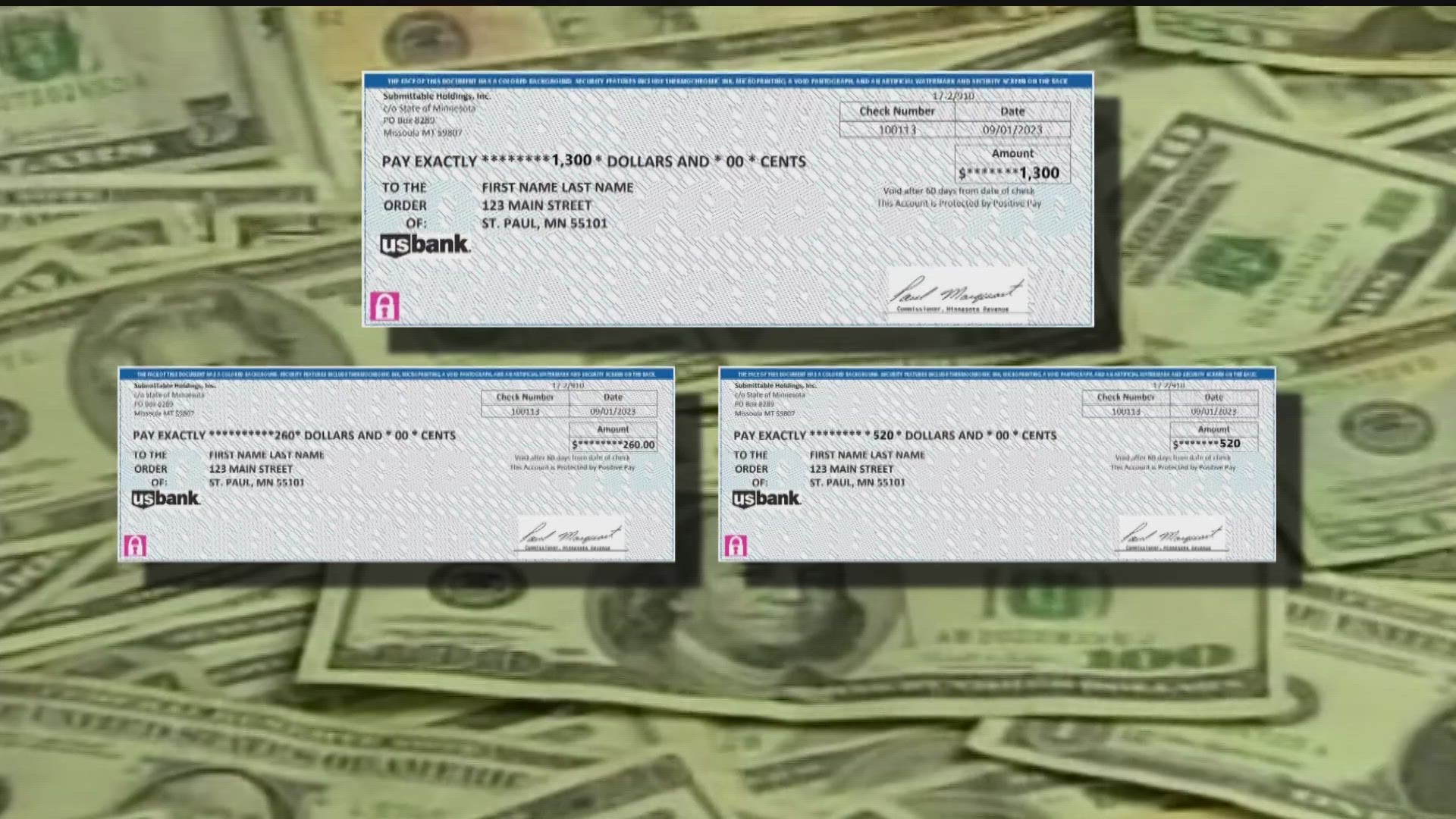

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

https://media.kare11.com/assets/KARE/images/c6c0f926-4792-46a8-9d55-d297c077d911/c6c0f926-4792-46a8-9d55-d297c077d911_1920x1080.jpg

Montana s legislature has passed bills totaling over 1 billion in tax relief and rebates for state residents 22 Jan 2024 00 14 34 GMT 1705882474210 the surplus in his State of the In its current form it would provide rebates of up to 500 per homeowner for taxes paid in 2022 and 2023 The Montana Department of Revenue estimates that about 292 000 households would be eligible each year House Bill 192 as amended Friday would put 480 million into income tax rebates Individual taxpayers would qualify for up to 1 250 in

The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 2023 to Oct 1 2023 To apply through the TransAction Portal you ll need the following information Your home address January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

Montana Tax Rebate Package Muscled Through Initial House Votes

https://montanafreepress.org/wp-content/uploads/2021/08/Montana-Capitol_Eliza-Wiley_1200x675.png

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

https://mtrevenue.gov/taxes/montana-tax-rebates/individual-income-tax-rebate-house-bill-192/

The Individual Income Tax Rebate amount depends on a taxpayer s 2021 filing status and the amount of tax paid for 2021 which can be found on line 20 of the 2021 Montana Form 2 For those whose filing status was single head of household or married filing separately the rebate will be either 1 250 or the line 20 amount whichever is less

https://mtrevenue.gov/all-montana-property-tax-rebates-will-be-sent-by-paper-check-tax-news-you-can-use/

The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online

The Montana Income Tax Rebate Are You Eligible

Montana Tax Rebate Package Muscled Through Initial House Votes

Farmer Finishers Somber School News Montana Tax Rebate Flakes Trip 2024

Montana Sends 260 Tax Rebate Checks To Minnesota Taxpayers Blogging Big Blue

This US States Property Tax Rebate For Residents How To Qualify

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

Printable 2022 Montana Substitute Form W 9 Request For Taxpayer Identification Number TIN

Unraveling The Montana Tax Rebate 2023 Your Comprehensive Guide USRebate

State Of Montana Tax Rebate 2024 - This comes after the Montana Legislature signed two tax rebate bills pulling hun 18 Jan 2024 22 48 27 GMT 1705618107587 What that means for full time Montana residents who paid state