State Premium Tax Premium Taxes by State All insurance companies pay a state tax based on their premiums Other payments are made to states for licenses and fees income and

State premium taxes in the six states that charge this type of tax CA ME NV SD WV WY generally apply to annuitized premiums That means if you were to buy an immediate annuity with new money or State insurance premium tax is levied on insurance companies by every state generally as a substitute for the state corporate income tax being imposed on insurance companies

State Premium Tax

State Premium Tax

https://www.realmprotection.co.uk/realm-resources/images/blogs/Insurance-Premium-Tax-Final-Version/Insurance-Premium-Tax-Final-Version.jpg

National Tax Preparation Company Dearborn MI

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100069332370607

Check Your Eligibility For A Premium Tax Credit EZ Insure

https://www.ez.insure/wp-content/uploads/2019/01/TaxCredits-jpg.webp

States have changed premium tax legislation for 2021 compliance and the 2022 estimated tax payments season Get this update on some impactful changes Life insurance premium tax rates vary from state to state and they can have a significant impact on the cost of life insurance The premium tax rate is the percentage of the

However states typically charge insurers a tax on the premiums they collect You cannot deduct life insurance premiums from your income taxes If your employer pays for a life insurance the Premium Tax refers to a state imposed tax on insurance premiums including those paid for Indexed Universal Life IUL policies This tax is typically a percentage of the

Download State Premium Tax

More picture related to State Premium Tax

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

EZ Tax Services LLC

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063607508926

States usually apply premium taxes on annuities when you purchase a new immediate annuity or when you annuitize an existing deferred annuity Premium taxes can reduce the value of your annuity if Since at least the mid 19th century premiums have been subject to state taxation in the United States In addition to premium taxes insurance companies are obligated to pay certain statutory fees for services

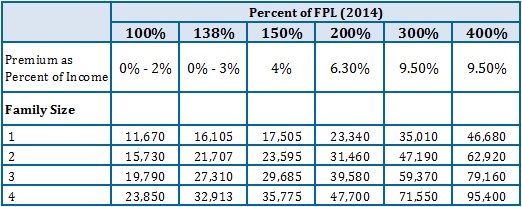

The premium tax credit www healthcare gov is based on income estimates and household information Income between 100 and 400 of the Federal Poverty Level qualifies for A premium tax is a tax that insurers often have to pay on the premiums that they receive from their policyholders The tax varies from state to state so the exact

Contact AAA Tax Service

https://www.aaataxnow.com/wp-content/uploads/2023/01/redredred-7-5-16-copy.png

Democratic Plan Would Close Tax Break On Exchange traded Funds

https://image.cnbcfm.com/api/v1/image/106893978-16231756852021-06-08t180456z_448255199_rc2cwn98an38_rtrmadp_0_usa-tax.jpeg?v=1676577042&w=1920&h=1080

https://www.iii.org/.../state-by-state

Premium Taxes by State All insurance companies pay a state tax based on their premiums Other payments are made to states for licenses and fees income and

https://www.immediateannuities.com/state-…

State premium taxes in the six states that charge this type of tax CA ME NV SD WV WY generally apply to annuitized premiums That means if you were to buy an immediate annuity with new money or

Tax App

Contact AAA Tax Service

FAQ Am I Eligible For Premium Tax Credits

National Income Tax Service Newark DE

Irs Gov Printable Tax Forms TUTORE ORG Master Of Documents

2023 Indiana Tax Form Printable Forms Free Online

2023 Indiana Tax Form Printable Forms Free Online

Premium Tax Credit Form Free Download

Tax Corporate Solutions Lahore

What Is The Income Limit For Aca Subsidies 2022 2022 Top Virals

State Premium Tax - States have changed premium tax legislation for 2021 compliance and the 2022 estimated tax payments season Get this update on some impactful changes