State Property Tax Credit Connecticut Web The bill 1 increases from 70 500 to 80 000 the AGI threshold above which the credit begins to phase out for married individuals filing jointly and 2 beginning in the 2023 tax year requires the thresholds for all filing statuses to be annually adjusted by the increase in inflation and rounded to the nearest dollar

Web 2021 Property Tax Credit Calculator You may use this calculator to compute your Property Tax Credit if You are a Connecticut resident Paid qualifying property tax on your PRIMARY RESIDENCE AND OR MOTOR VEHICLE during 2021 One or both of the following statements apply Web must complete Lines 60 through 63 of Schedule 3 Property Tax Credit found on Form CT 1040 Page 4 or your credit will be denied The credit is limited to Connecticut residents who paid qualifying property tax on their residence and or motor vehicle The maximum property tax credit allowed is 300 per return regardless of filing status

State Property Tax Credit Connecticut

State Property Tax Credit Connecticut

https://files.americanexperimentnd.org/wp-content/uploads/2024/01/Prop-tax-credit-ND-FREE.jpg?v=1704484510

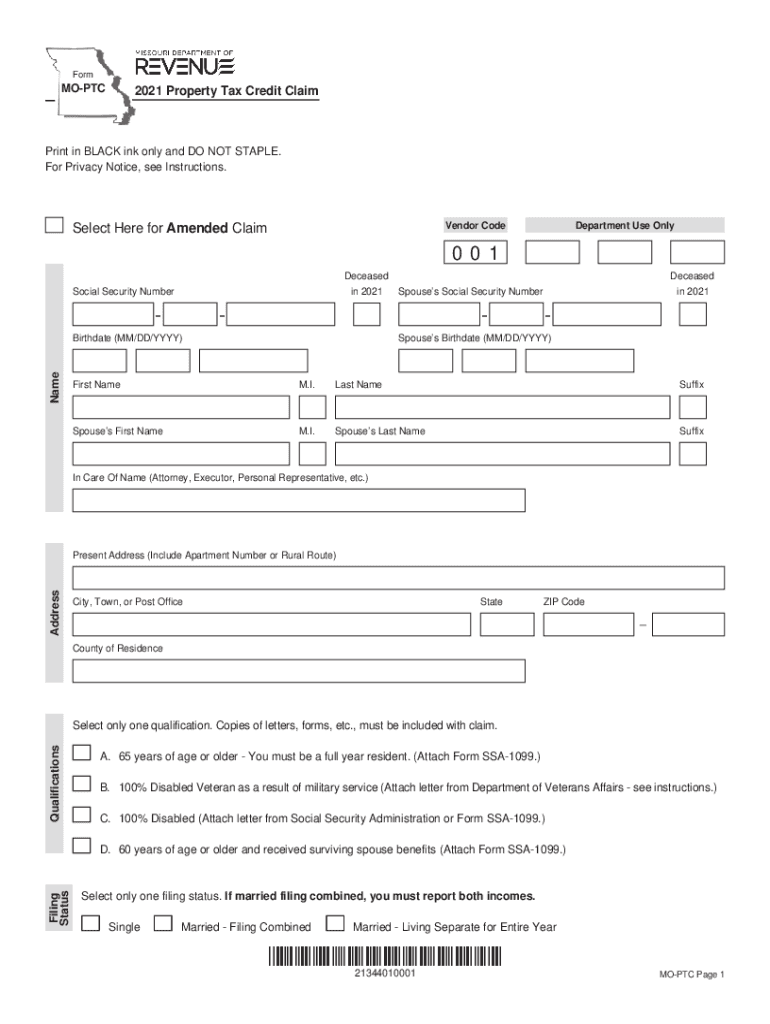

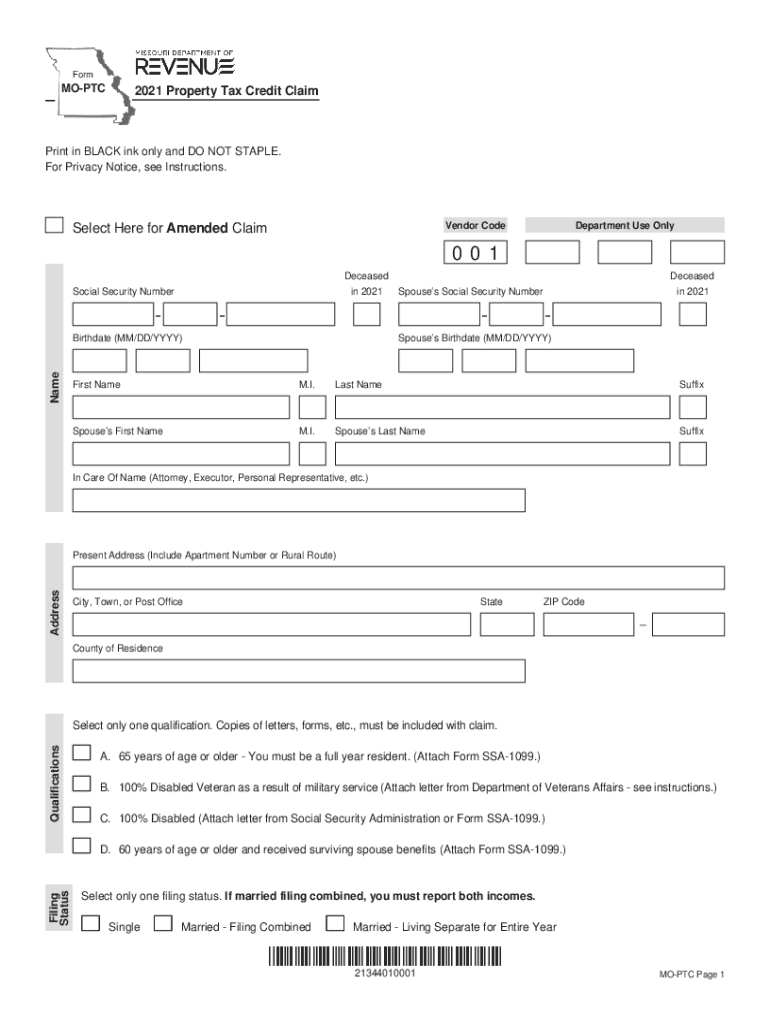

Missouri Property Tax Credit Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/579/959/579959492/large.png

Why New York State Property Tax Credit Checks Are Arriving Early

https://www.democratandchronicle.com/gcdn/presto/2022/06/22/PROC/39af950b-688c-4f38-b978-a5cdeaaad77d-GettyImages-1270111816.jpg?crop=6330,3561,x0,y322&width=3200&height=1801&format=pjpg&auto=webp

Web 2 Feb 2022 nbsp 0183 32 Under current state law the property tax credit is limited to those over the age of 65 or those with dependents Expanding the credit to all adults within the current income limits 109 500 for single filers 130 500 for joint filers will have an estimated fiscal impact to the state of 53 million Web homes in Connecticut will receive a property tax credit of up to 300 which is increased from the prior credit of 200 Conn Gen Stat 167 12 704c as amended by Conn Pub Act No 22 118 167 408 effective May 26 2022 In addition eligibility for the property tax credit is expanded to all adults within current income limits 109 500 for

Web To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1 000 There are different mill rates for different towns and cities Agency Office of Policy and Management Real and Personal Property Tax Inquiries Web Property Tax Credit The maximum amount of property tax credit that a taxpayer may claim and the eligibility requirements both of which currently apply to taxable year 2020 have been extended to taxable years 2021 and 2022 Specifically the maximum amount of property tax credit is 200

Download State Property Tax Credit Connecticut

More picture related to State Property Tax Credit Connecticut

Why New York State Property Tax Credit Checks Are Arriving Early

https://www.gannett-cdn.com/presto/2022/04/28/PWES/27d53a0e-ed83-44ea-9d50-dd61a605b136-mv042822educationbudget01.JPG?width=1320&height=976&fit=crop&format=pjpg&auto=webp

Gov Justice Signs Bill To Clarify Property Tax Credit

https://gray-wsaz-prod.cdn.arcpublishing.com/resizer/v2/6L35IQ27X5C6FDUDKLRGX6AO2A.jpg?auth=0ffc387c18dde5289699fe4a4654ca28f5d5b049c1c23b222d1abc3551c76b5f&width=1600&height=900&smart=true

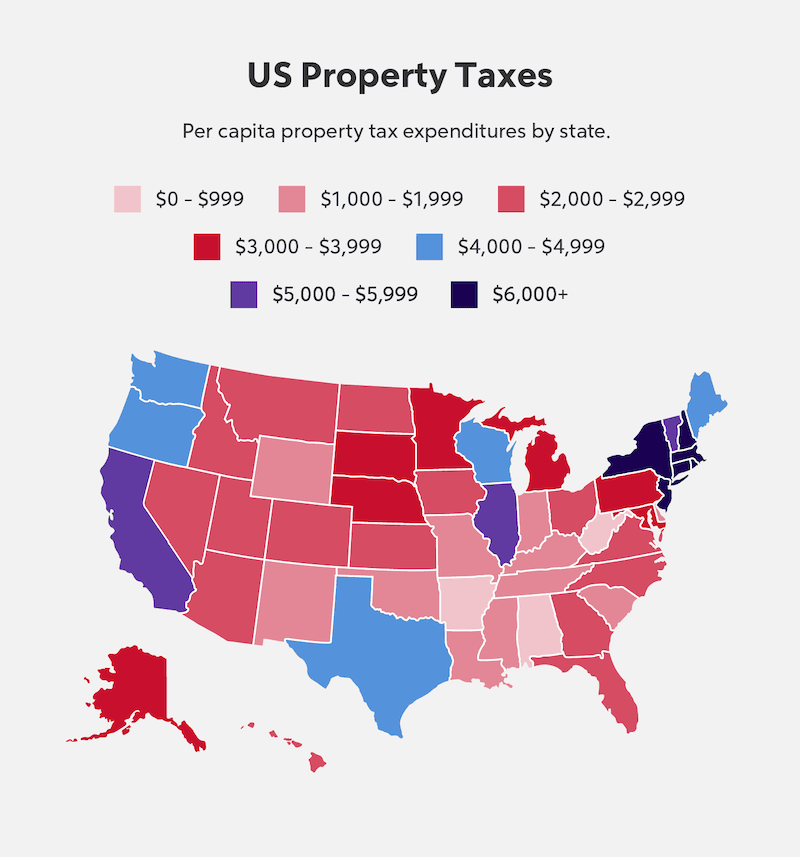

Property Tax By State From Lowest To Highest Rocket Homes

https://www.rockomni.com/glc/assets/Rocket Homes/ArticleImages/2023 Images/Property Tax By State/Wf-US-Property-Taxes-Infographic-copy.png?im=1&imwidth=2048

Web Connecticut laws require municipalities to provide property tax relief for specific groups of homeowners such as those who are seniors veterans or have a disability Additionally some homeowners are eligible for an exemption for using certain renewable energy sources and an income tax credit for paying property taxes Web 16 Mai 2022 nbsp 0183 32 The budget provides for an increase in the personal income tax property tax credit Starting in 2022 the credit will be increased from 200 to 300 The credit will be available to more individuals and will no longer be limited to individuals over age 65 or those who claim dependents on their federal return

Web Property tax credits are available to income eligible elderly and totally disabled homeowners the State of Connecticut reimburses local taxing jurisdictions for their tax losses due to such credits Chapter 204a Sec 12 170aa Web This report has been updated by OLR Report 2018 R 0228 Property Tax Credit Connecticut residents who made qualifying property tax payments on eligible property during the tax year can claim a tax credit against their Connecticut income tax liability for that year The maximum credit amount is 200 per tax return

Connecticut s R D Tax Credit Is The Best In The US FML CPAs

https://www.fmlcpas.com/wp-content/uploads/2021/09/Screen-Shot-2021-10-13-at-10.14.28-AM.png

Rethinking Texas Taxes Final Report Of The Select Committee On Tax

https://texashistory.unt.edu/ark:/67531/metapth638722/m1/368/high_res/

https://www.cga.ct.gov/2022/ba/pdf/2022HB-05487-R000604 …

Web The bill 1 increases from 70 500 to 80 000 the AGI threshold above which the credit begins to phase out for married individuals filing jointly and 2 beginning in the 2023 tax year requires the thresholds for all filing statuses to be annually adjusted by the increase in inflation and rounded to the nearest dollar

https://www.dir.ct.gov/drs/proptxcalc/ptc2021.htm

Web 2021 Property Tax Credit Calculator You may use this calculator to compute your Property Tax Credit if You are a Connecticut resident Paid qualifying property tax on your PRIMARY RESIDENCE AND OR MOTOR VEHICLE during 2021 One or both of the following statements apply

How To Apply For 500 ND Property Tax Credit KX NEWS

Connecticut s R D Tax Credit Is The Best In The US FML CPAs

As Inflation Soars To 40 year Highs Connecticut Lawmakers Are

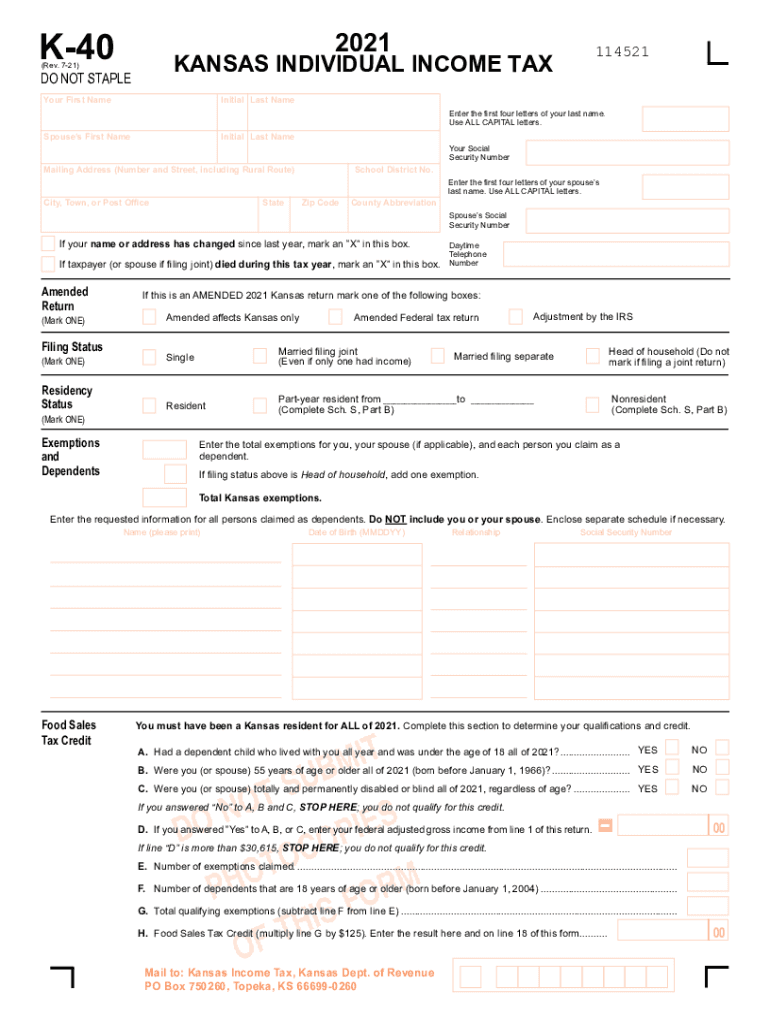

Kansas Tax S 2021 2024 Form Fill Out And Sign Printable PDF Template

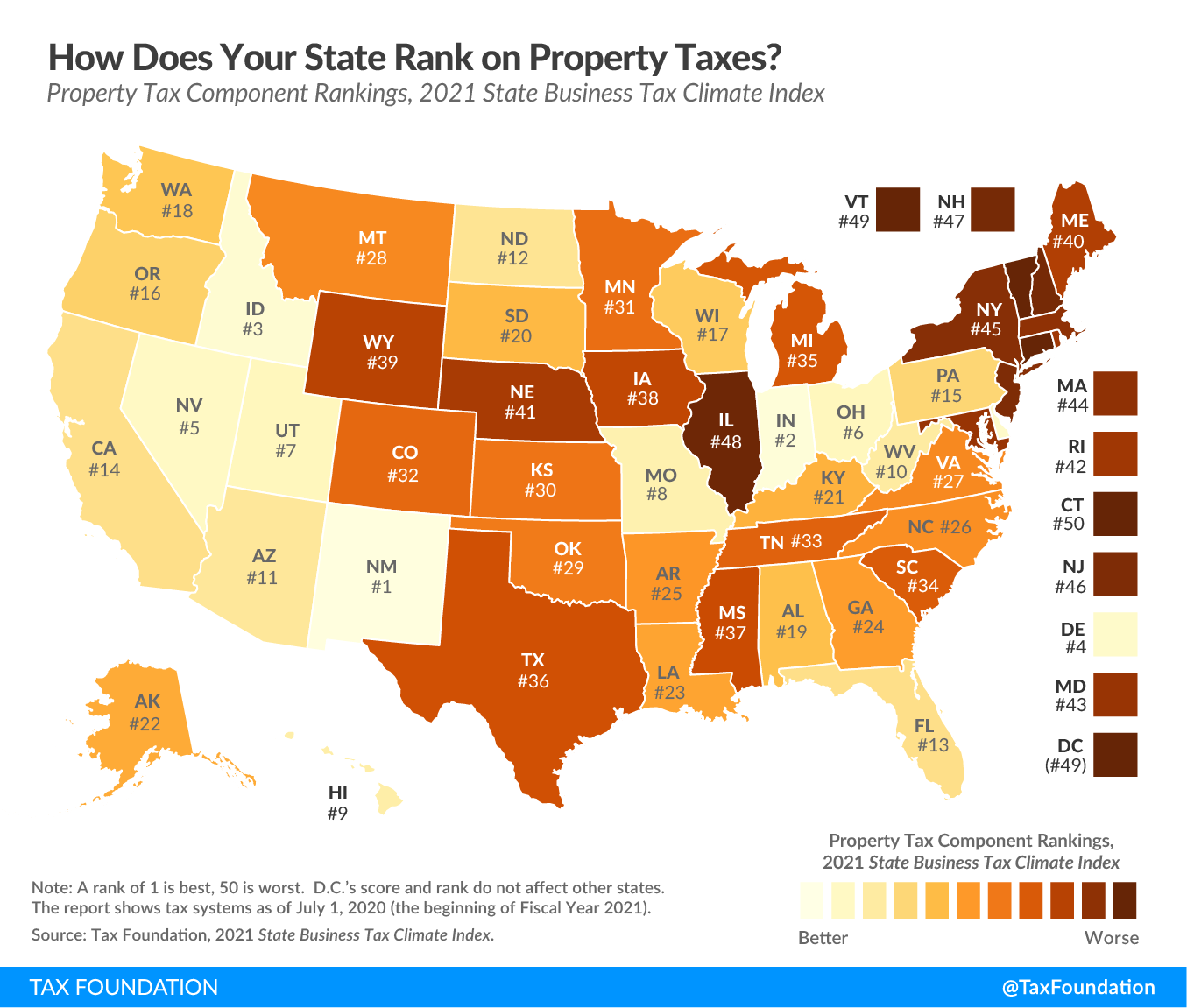

Best Worst State Property Tax Codes Tax Foundation

2019 2024 Form NY NYC 208 Fill Online Printable Fillable Blank

2019 2024 Form NY NYC 208 Fill Online Printable Fillable Blank

Connecticut State R D Tax Credit

Connecticut 2023 State Income Tax Form And Instructions Printable

One State Property Tax Credit Rises Slightly In 2023 While Another

State Property Tax Credit Connecticut - Web Program Description State law provides a property tax credit program for Connecticut owners in residence of real property who are elderly 65 and over or totally disabled and whose annual incomes do not exceed certain limits The credit amount is calculated by the local assessor and applied by the tax collector to the applicant s real