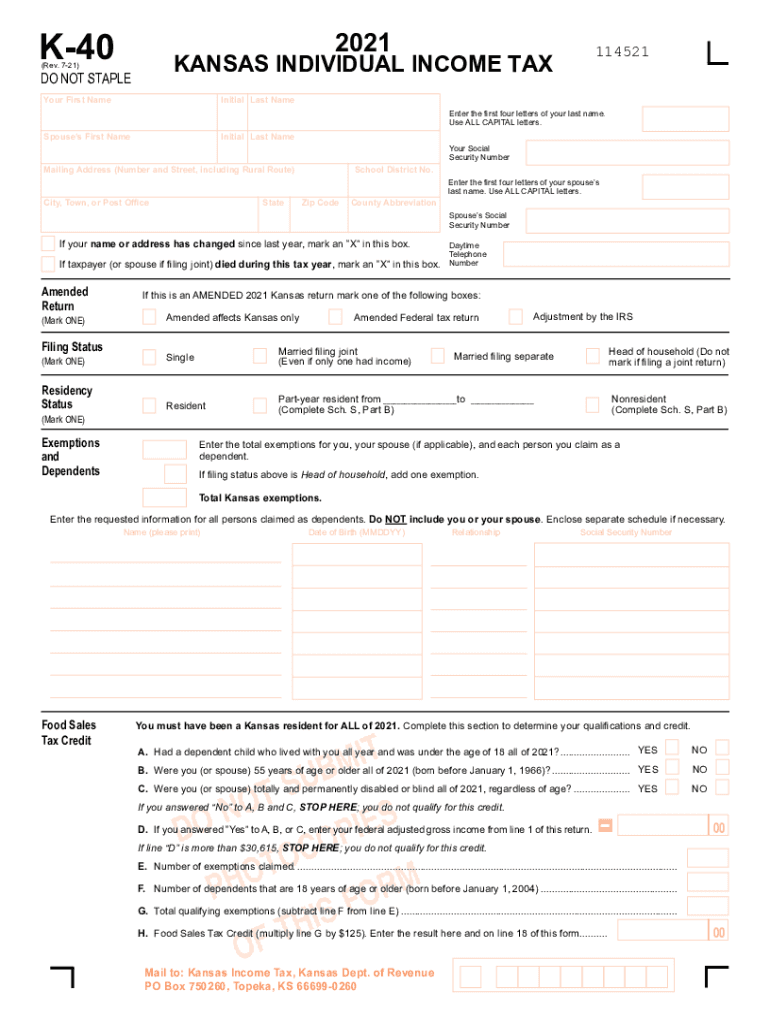

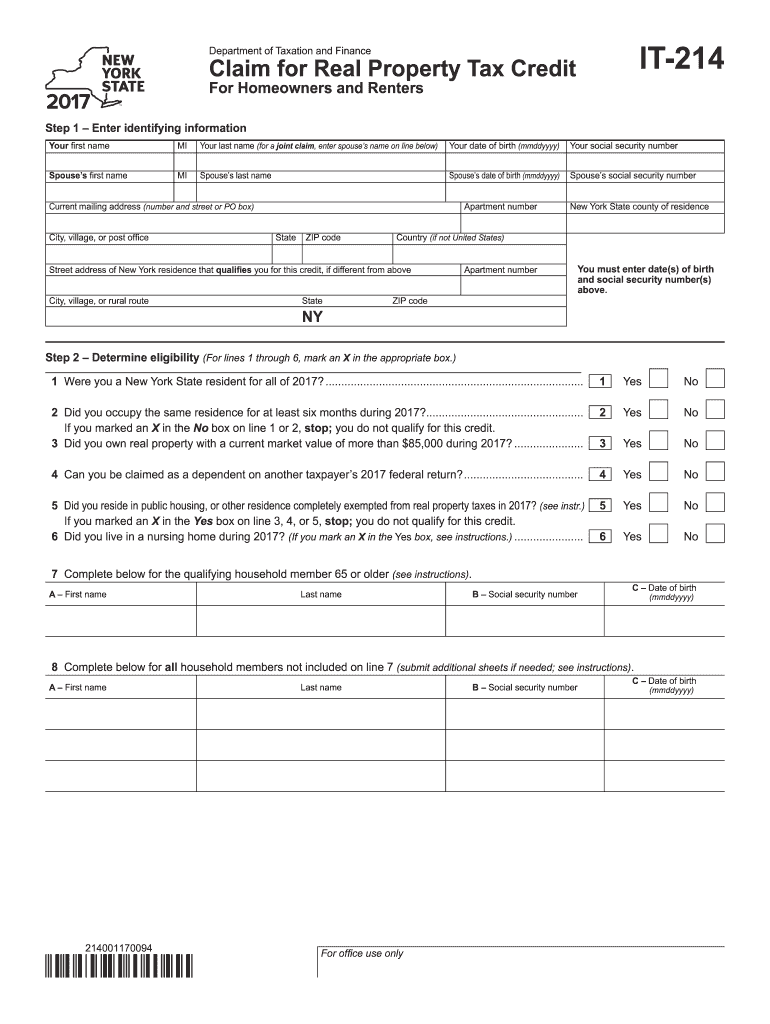

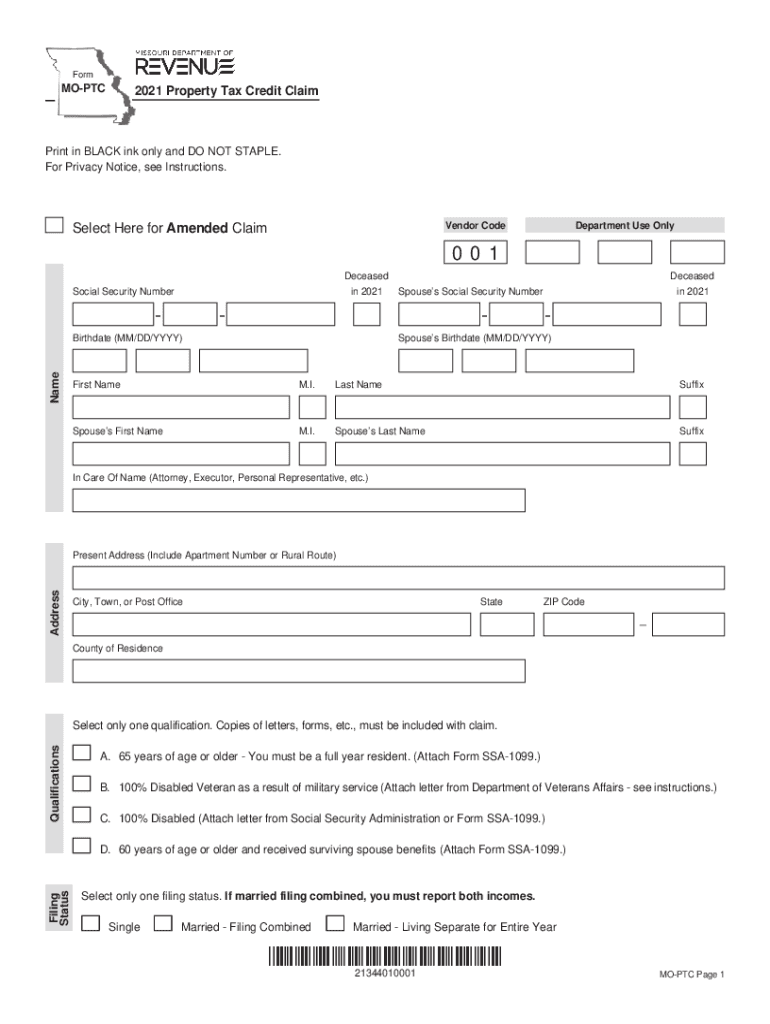

State Property Tax Credit Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under

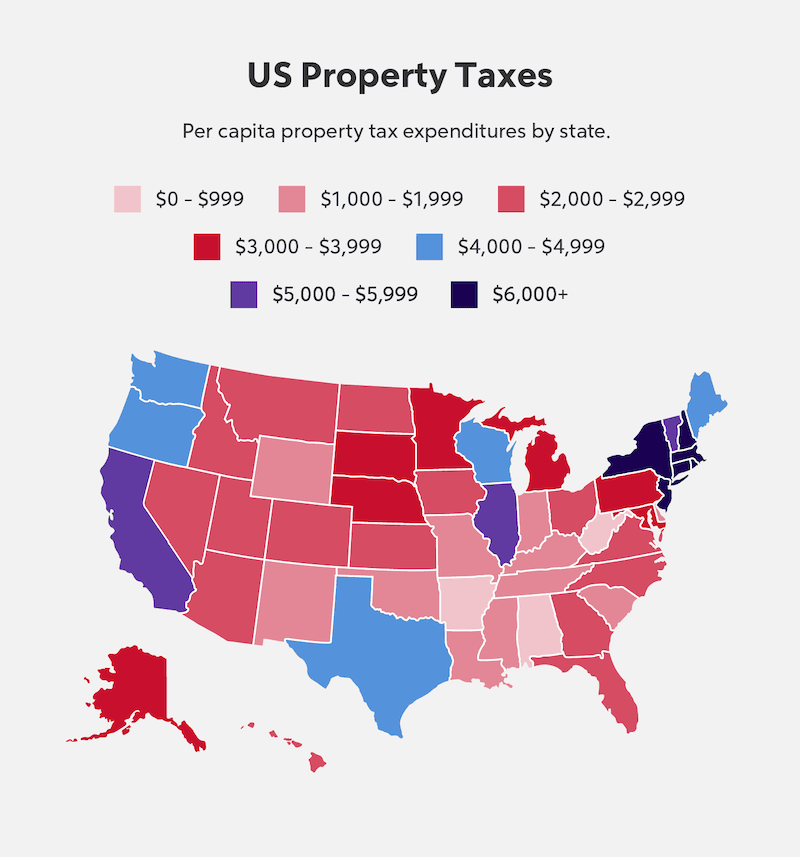

The state and local income tax SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of Your property tax bill is based on the value of your home land or building and your state s tax rate You will want to factor local property tax rates into your retirement

State Property Tax Credit

State Property Tax Credit

https://www.signnow.com/preview/586/478/586478135/large.png

It 214 Form 2023 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/413/363/413363260/large.png

Missouri Property Tax Credit Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/579/959/579959492/large.png

The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the state How to report your property tax credit If you received a check for the School Tax Relief STAR credit you do not need to do anything on your New York State income tax

The newly approved 212 billion state budget includes relief for qualifying homeowners in New York who pay among the highest tax levies in the country But not everyone will qualify for the relief as part of the state budget As part of an approved 2 2 billion tax relief program in New York s Budget 2 5 million eligible New York homeowners will receive checks in the mail for a one time property tax credit titled the Homeowner Tax Rebate Credit

Download State Property Tax Credit

More picture related to State Property Tax Credit

CA Parent Child Transfer California Property Tax NewsCalifornia

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg?resize=2048%2C1192&ssl=1

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

Missouri Property Tax Credit Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/623/237/623237583/large.png

Surviving spouses may be eligible to retain the Enhanced STAR benefit See Surviving spouse eligibility Income 500 000 or less for the STAR credit 250 000 or The authors present an overview of targeted measures including homestead credits circuit breakers and deferrals offering an essential resource for state legislators governors

The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own The Property Tax Rent Rebate Program supports homeowners and renters across Pennsylvania This program provides a rebate ranging from 380 to 1 000 to eligible older adults and

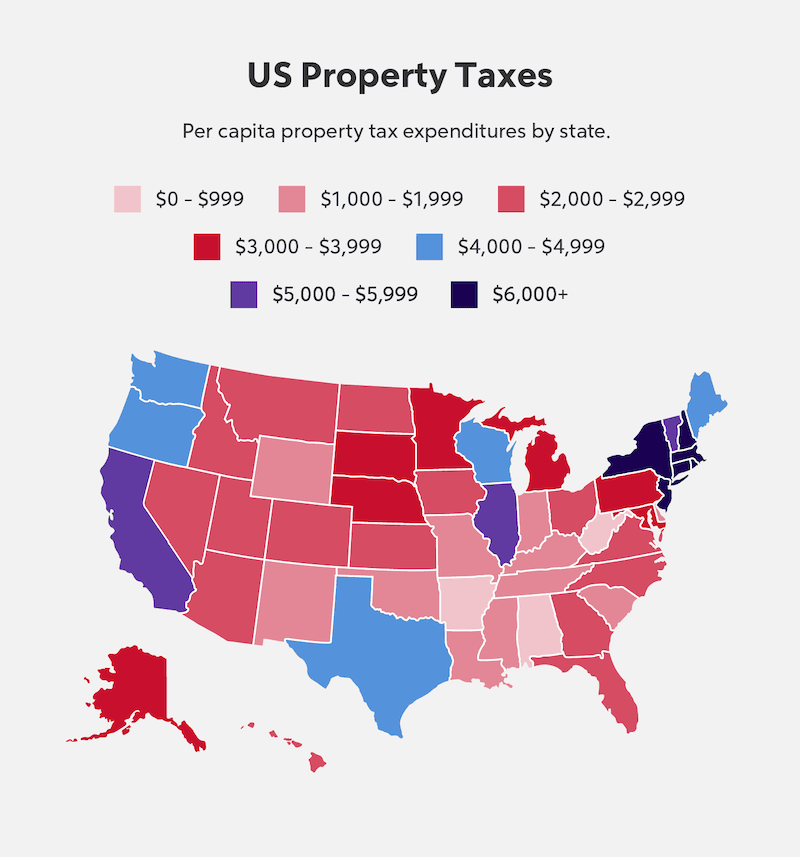

Property Tax By State From Lowest To Highest Rocket Homes

https://www.rockomni.com/glc/assets/Rocket Homes/ArticleImages/2023 Images/Property Tax By State/Wf-US-Property-Taxes-Infographic-copy.png?im=1&imwidth=2048

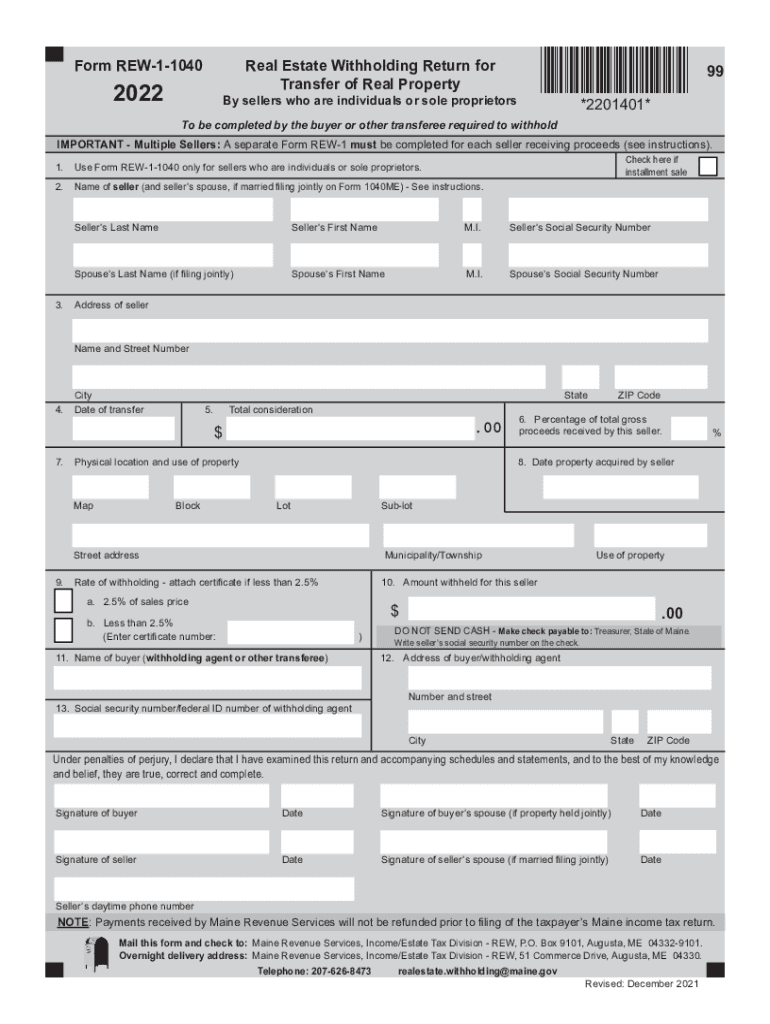

Maine Withholding Property 2022 2024 Form Fill Out And Sign Printable

https://www.signnow.com/preview/581/270/581270703/large.png

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under

https://www.nerdwallet.com/article/tax…

The state and local income tax SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of

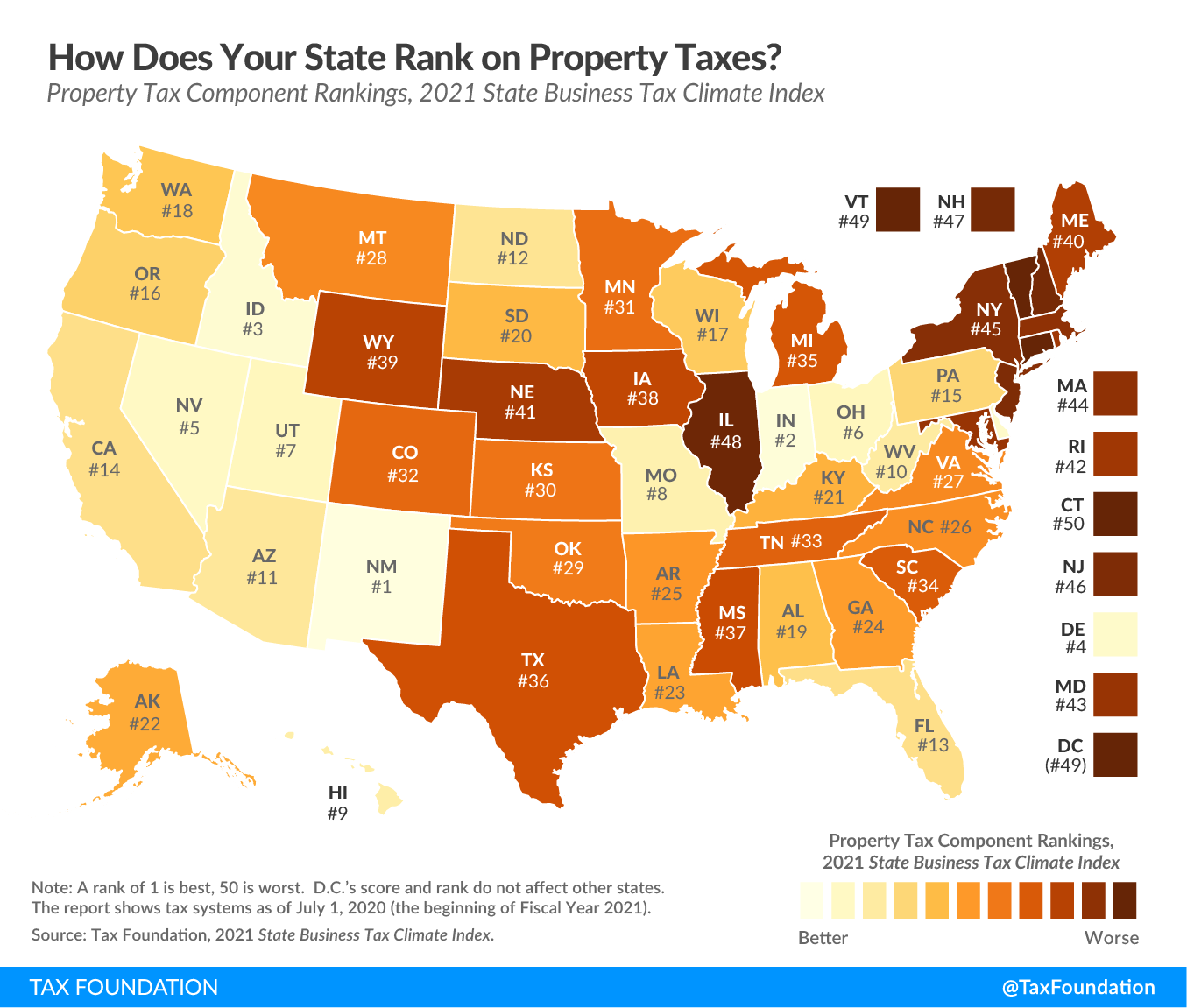

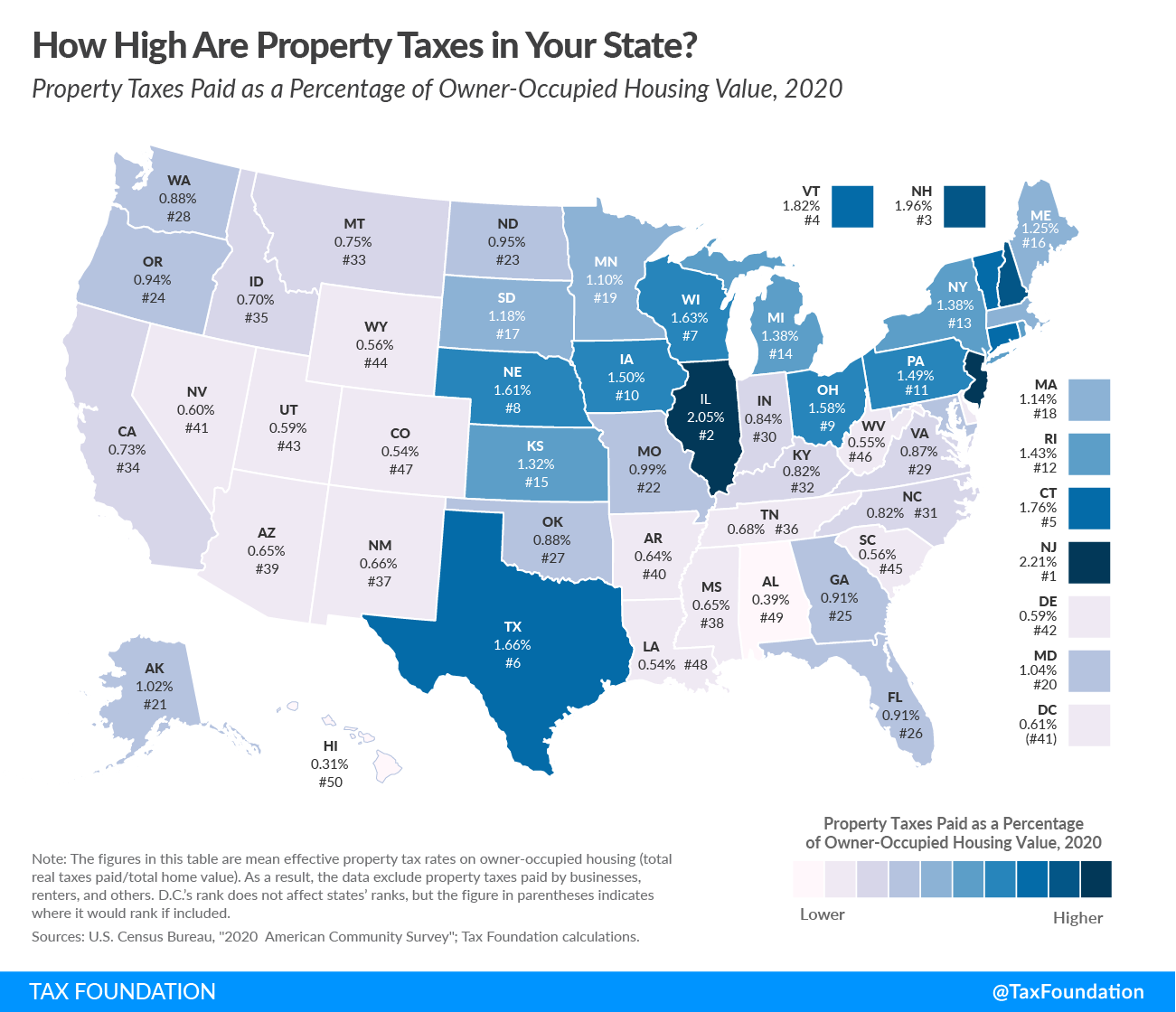

Best Worst State Property Tax Codes Tax Foundation

Property Tax By State From Lowest To Highest Rocket Homes

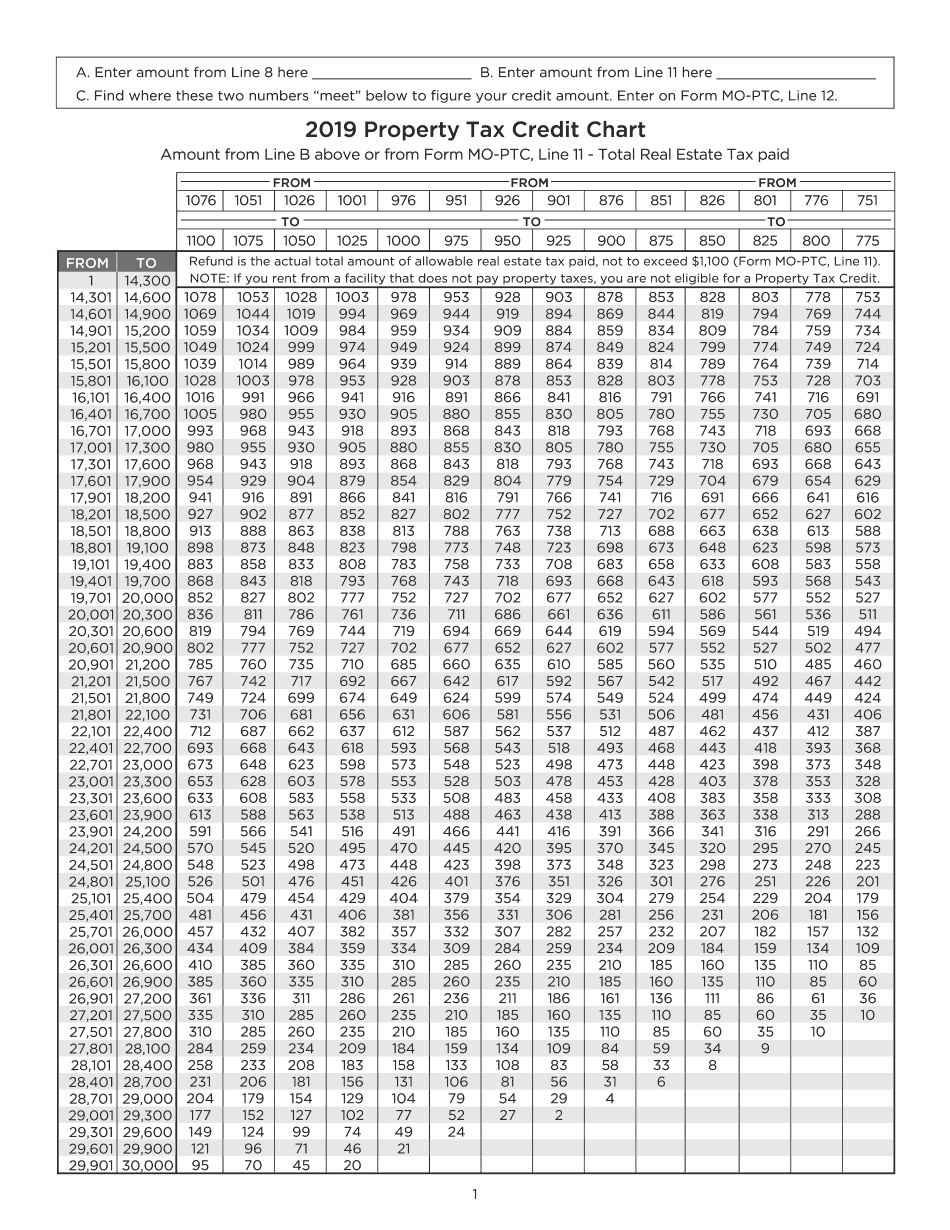

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form

2019 2024 Form NY NYC 208 Fill Online Printable Fillable Blank

Democratic Plan Would Close Tax Break On Exchange traded Funds

House Lawmakers Scrutinize Pandemic era Employee Retention Tax Credit

House Lawmakers Scrutinize Pandemic era Employee Retention Tax Credit

Property Tax Appeal Math And Supporting Documentation Page Design Web

Property Taxes By State County Median Property Tax Bills

Property Tax In Kakinada Online Payment Rates

State Property Tax Credit - In the median state 19 6 of homeowners are eligible for the programs but eligibility rates vary greatly across states depending on whether there is an income ceiling In the seven states