State Tax Credits For Charitable Donations Maximum state local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of March 2024 State and local

The taxpayer must reduce the 1 000 contribution deduction by the 700 state tax credit leaving a federal charitable contribution deduction of 300 The For additional information about these items contact Ms Grais at 202 327 8788 or susan grais ey Unless otherwise noted contributors are members of or

State Tax Credits For Charitable Donations

State Tax Credits For Charitable Donations

https://i.ytimg.com/vi/swRobMRG4fw/maxresdefault.jpg

Guide To Arizona Charitable Tax Credit AZ Tax Credits

https://childrenscareaz.org/wp-content/uploads/2022/03/Guide-to-Arizona-Charitable-Tax-Credit.jpg

The Complete Charitable Deductions Tax Guide 2023 Updated

https://daffy.ghost.io/content/images/size/w2000/2022/05/Daffy-Donor-advised-funds-Tax-Deductions-2022-2.png

For example if a state granted a 90 percent tax credit on contributions to the state then only 10 percent of the donation would be deductible a 100 percent credit would States Offering Tax Incentives for Charitable Giving This federal tax change shifted incentives and created a situation where charitable giving by non wealthy donors

In light of recent federal legislation further limiting the deductibility of state and local taxes states may expand their use of charitable tax credits in this manner 20 100 credit on state income tax up to specified threshold for charitable donations Donations to approved funds out of tax refunds or liability directly on tax form 30 Yes

Download State Tax Credits For Charitable Donations

More picture related to State Tax Credits For Charitable Donations

Charitable Tax Deductions By State Tax Foundation

https://files.taxfoundation.org/20181217150305/charitable-18-1024x902.png

Charitable Contributions Guide

https://www.accountingservicesofhhi.com/images/Streamlabs-charity-fundraising-donation.jpg

Tips On Tax Deductions For Donations

https://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

2020 2059 IRS issues final regulations on donations to charities in exchange for SALT credits The IRS issued final regulations TD 9907 under IRC Sections 162 164 and The IRS has released final regulations updating guidance on cases when a payment to a charity will be treated as a payment of an ordinary and necessary

Four states had average charitable deductions greater than 10 000 in 2016 Wyoming 12 991 Arkansas 10 935 Utah 10 165 and South Dakota The Bottom Line Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form 1040 The limit on charitable cash

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

https://fthmb.tqn.com/WTZF3eXFhZ0fX5VLuL9VwzDfneY=/1500x1000/filters:fill(auto,1)/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg

Arizonans Who Want To Claim Charitable Donations Tax Credit For 2019

https://fwiw.imgix.net/wp-content/uploads/2020/04/TaxDay.jpg?w=1200

https://www.uscharitablegifttrust.org/tax...

Maximum state local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of March 2024 State and local

https://home.treasury.gov/news/press-releases/sm705

The taxpayer must reduce the 1 000 contribution deduction by the 700 state tax credit leaving a federal charitable contribution deduction of 300 The

Charitable Deductions For 2020

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

Which Donations Matter For Taxes

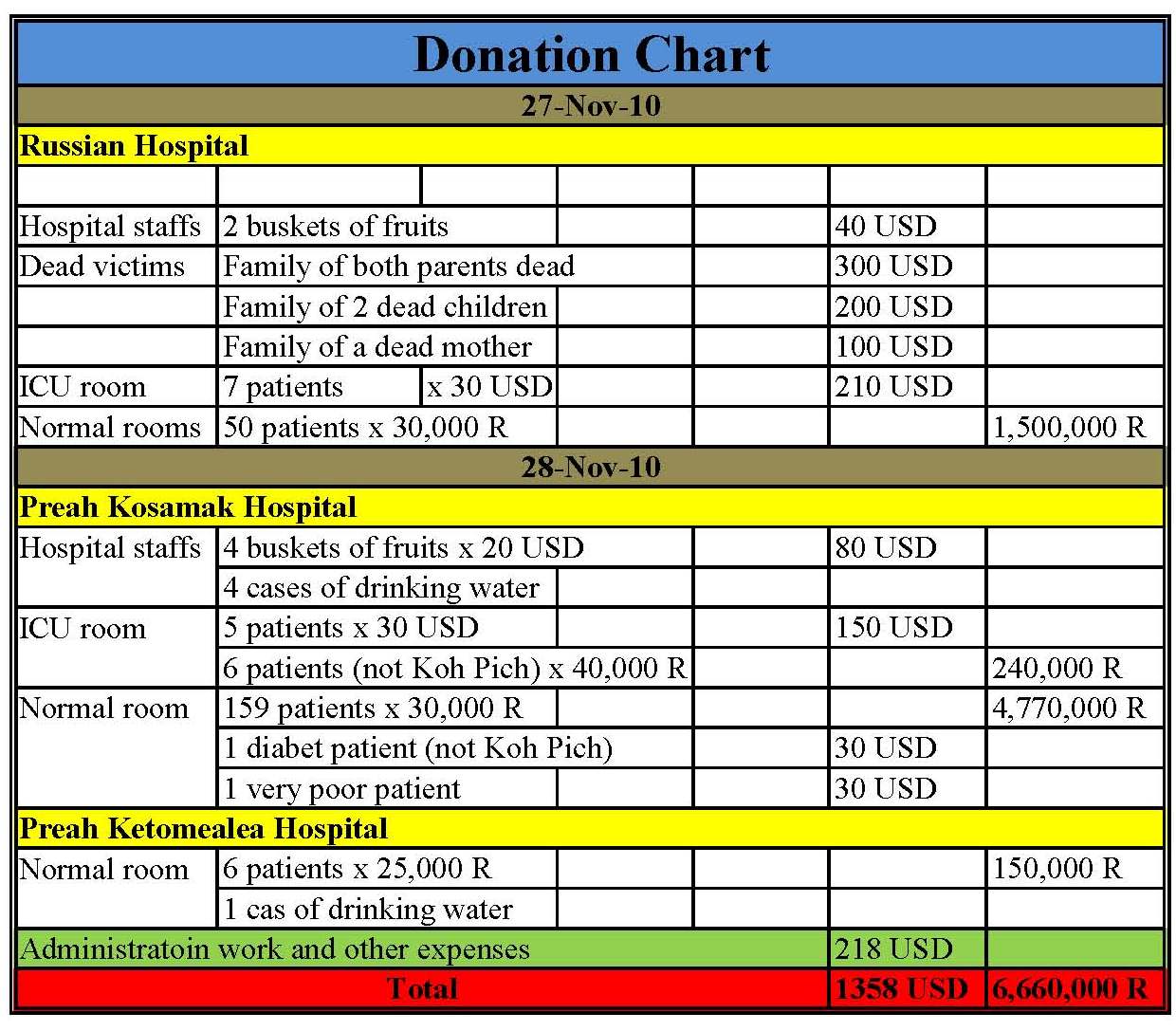

Donation Chart Template

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

State Tax Credits And Incentives Updates To Know Scott M Aber CPA PC

State Tax Credits And Incentives Updates To Know Scott M Aber CPA PC

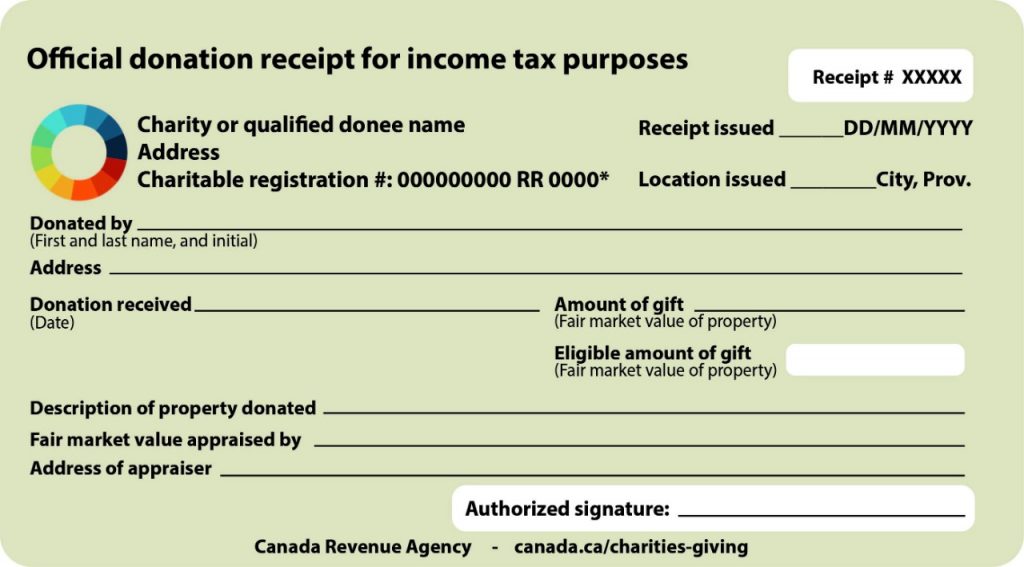

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

MI Lawmakers Propose Tax Credits For Blood Donations Wzzm13

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

State Tax Credits For Charitable Donations - 2024 Application for Charitable Credit Allocations Applications must be submitted online You can access the application by clicking the Apply for a Charitable Contribution