State Tax Rebate On Volt Web 1 avr 2020 nbsp 0183 32 The maximum tax credit fell to 3750 at the beginning of April 2019 for GM s qualifying vehicles including the Chevy Bolt and the Chevy Volt which was discontinued back in March 2019

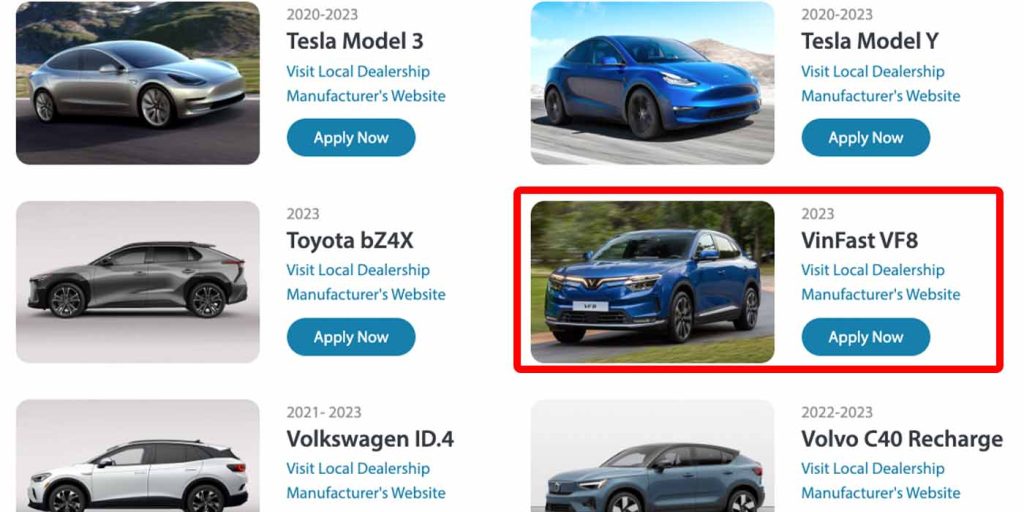

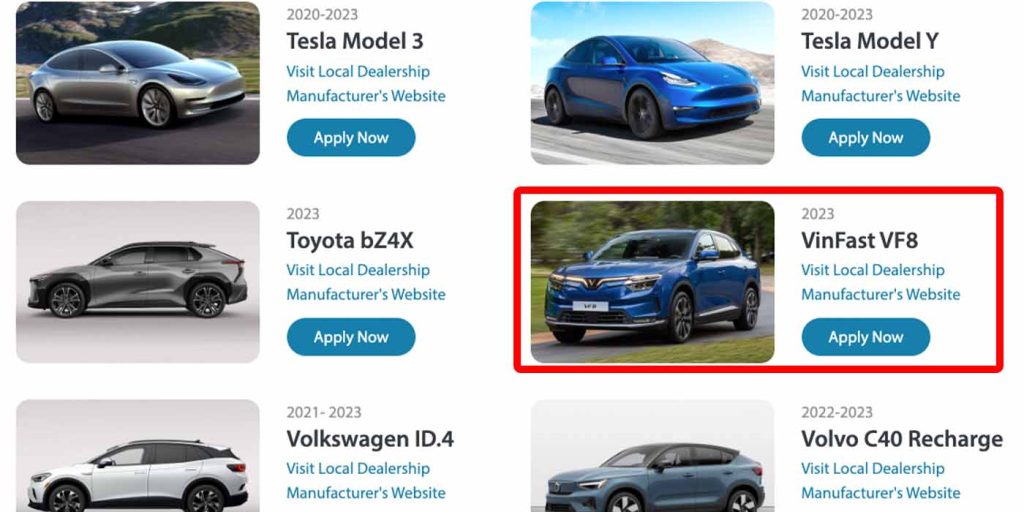

Web 20 mars 2023 nbsp 0183 32 A tax credit reduces the amount you have to pay in state taxes while a point of purchase rebate effectively reduces the price of the car Depending on your state the EV tax credit program may have limits on your income the base price of the new electric vehicle you re buying or the sticker price of the EV The Government of Canada introduced a federal Incentive for Zero Emission Vehicles iZEV program on May 1 2019 Under iZEV the purchaser or lessee is entitled to a rebate of up to CA 5 000 on the after tax cost of an eligible new electric or hydrogen powered vehicle in addition to any provincial incentive programs The amount of the rebate is determined by Transport Canada base

State Tax Rebate On Volt

State Tax Rebate On Volt

https://cdn.topcarnews.info/wp-content/uploads/2023/04/18101611/image-new-and-previous-vinfast-vf-8-customers-now-qualify-for-up-to-7500-in-state-tax-rebates-431265ca37c67f519685d21f4027586e.jpg

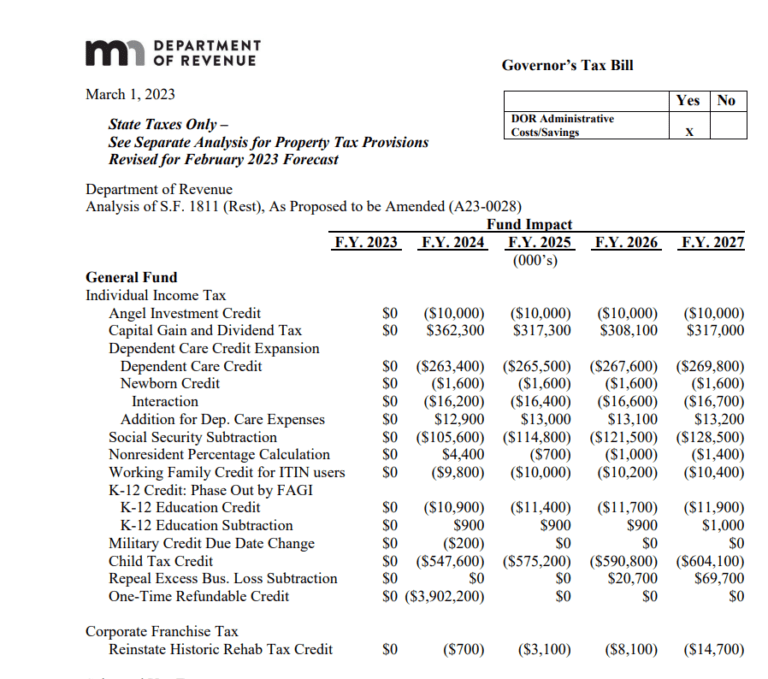

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Idaho State Tax Rebate 2023 Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/05/Idaho-State-Tax-Rebate-2023.jpg

Web 1 sept 2023 nbsp 0183 32 California California offers many incentives rebates and rewards for driving electric hydrogen or hybrid vehicles This list changes regularly As of this writing low income residents may Web 21 juin 2011 nbsp 0183 32 Federal EV tax credits in 2023 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the automakers themselves take a 7 500 tax credit for EV leases but

Web 21 avr 2015 nbsp 0183 32 The state of Massachusetts offers up to 2 500 in state income tax rebates for electric vehicles and plug in hybrids through its MOR EV program an acronym for Massachusetts Offers Rebates for Web Solar Up to 1 000 state tax credit Solar Select utilities may offer a solar incentive filed on behalf of the customer Powerwall Select utilities may offer a storage incentive Local and Utility Incentives Electric Vehicles Braintree offers a 250 rebate for installation of a Level 2 EV charging system as well as reduced rates for EV

Download State Tax Rebate On Volt

More picture related to State Tax Rebate On Volt

IRS Says California Most State Tax Rebates Aren t Considered Taxable

https://assets3.cbsnewsstatic.com/hub/i/r/2022/04/18/bc29efd4-8f27-4c87-90c8-747eac1fcd9e/thumbnail/1200x630/f8794c3cda3ff3cc4a04aac97f532fdb/hypatia-h_0d32f8ab1663c2148ee4151ae6500dae-h_f470ece42eb4c37c3d363bc8cefc94bf.jpg

Smes Rebate Of State Central Taxes And Levies Mumbai ID 26286767133

https://5.imimg.com/data5/SELLER/Default/2022/11/SH/OZ/NJ/14253073/rebate-of-state-central-taxes-and-levies-500x500.jpg

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

https://i0.wp.com/www.gasrebates.net/wp-content/uploads/2023/03/gas-tax-rates-by-state-2020-state-fuel-excise-taxes-tax-foundation.png

Web 2 ao 251 t 2021 nbsp 0183 32 They usually come in the form of a tax rebate to reduce your business s tax bill but they may come in other forms as we ll discuss later Some type of incentive program is available in 44 states and Web 29 mars 2023 nbsp 0183 32 Each state has a slightly different set of rules and regulations for the tax rebates they provide Read through below to see what type of EV friendly tax incentives your state offers 1 Colorado Rebate rates available by year phaseout of tax program in place 2019 5 000 for purchase 2 500 for lease 2020 4 000 for purchase 2 000

Web Here s what to know about claiming tax credits and rebates on electric car purchases New EVs that follow certain qualifications are eligible for a 7 500 credit for now until the Treasury and Web 26 janv 2023 nbsp 0183 32 Unlike a federal tax credit a non refundable amount that reduces your tax burden the rebate amount is paid to you by a check from the program in the amount that you ve qualified for For Battery Electric Vehicles BEVs the rebate offered is worth 2 000

UPDATE GOP Says State Can do Better Than Whitmer s Proposed 500 Tax

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAQJBtp.img?w=2000&h=1125&m=4&q=86

Do You Have To Pay Taxes On A State Stimulus Or Rebate Check From Last

https://www.cnet.com/a/img/resize/e175d8f3242aaa18c0f603970b1333fb106c1f7c/hub/2023/02/13/3fcdf61a-6cf5-4830-8efc-c53b16ebbc24/gettyimages-533920538.jpg?auto=webp&fit=crop&height=675&width=1200

https://www.caranddriver.com/research/a31607786/chevy-volt-tax-credit

Web 1 avr 2020 nbsp 0183 32 The maximum tax credit fell to 3750 at the beginning of April 2019 for GM s qualifying vehicles including the Chevy Bolt and the Chevy Volt which was discontinued back in March 2019

https://cars.usnews.com/cars-trucks/advice/state-ev-tax-credits

Web 20 mars 2023 nbsp 0183 32 A tax credit reduces the amount you have to pay in state taxes while a point of purchase rebate effectively reduces the price of the car Depending on your state the EV tax credit program may have limits on your income the base price of the new electric vehicle you re buying or the sticker price of the EV

Star Rebate Check Eligibility StarRebate

UPDATE GOP Says State Can do Better Than Whitmer s Proposed 500 Tax

When To Expect Tax Refund 2022 With Child Tax Credit Irisamelia

IRS Says California Most State Tax Rebates Aren t Taxable Income

Missouri State Tax Rebate 2023 Printable Rebate Form

Illinois Tax Rebate Tracker Rebate2022

Illinois Tax Rebate Tracker Rebate2022

State Of Indiana Tax Rebate 2023 Printable Rebate Form

Property Tax Rebate New York State Printable Rebate Form

2021 Illinois Property Tax Rebate Printable Rebate Form

State Tax Rebate On Volt - Web 1 sept 2023 nbsp 0183 32 California California offers many incentives rebates and rewards for driving electric hydrogen or hybrid vehicles This list changes regularly As of this writing low income residents may