State Tax Rebate Update 2024 Sacramento The California Franchise Tax Board FTB kicked off the 2024 tax filing season by providing taxpayers with important information on cash back tax credits disaster loss relief and the advantages of filing electronically Taxpayers must pay any taxes owed by April 15 to avoid penalties The FTB started accepting state tax returns this month

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need

State Tax Rebate Update 2024

State Tax Rebate Update 2024

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-768x994.png

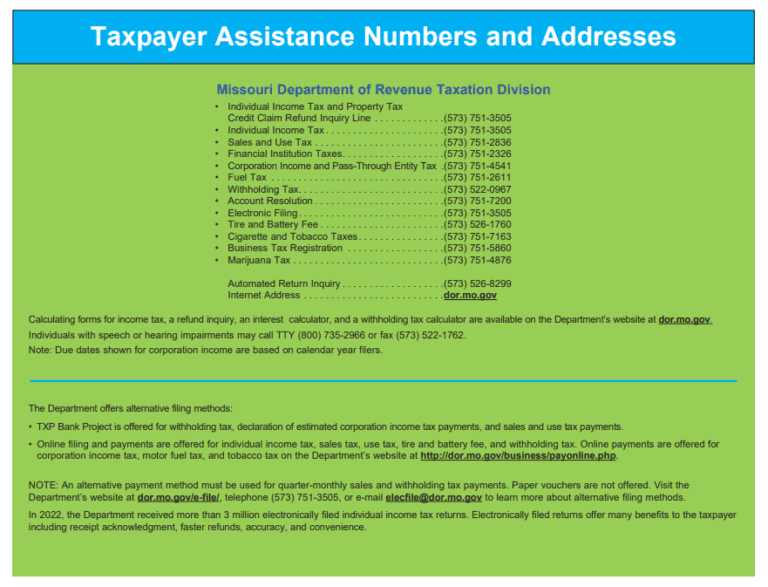

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Impact Of Biden Tax Plan By State District Tax Foundation

https://files.taxfoundation.org/20210629120806/The-impact-of-the-Biden-tax-plan-by-state-and-congressinal-district-2021-01.jpg

State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both Several states are expected to send out stimulus checks to residents in 2024 with payments ranging from a few hundred dollars to over 1 000 Many are issuing property tax rebates or using money

Five states are sending out direct payments in 2024 but there are specific criteria you must meet to get the cash Some of the payments are courtesy of state budget surpluses while others are WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Download State Tax Rebate Update 2024

More picture related to State Tax Rebate Update 2024

2023 State Tax Reform And Relief Trend Continues Tax Foundation

https://files.taxfoundation.org/20230609183102/2023-state-tax-reform-and-relief-trend-continues-cor.png

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/468/470/468470575/large.png

Arizona As part of the state s 2024 fiscal budget an estimated 743 000 Arizona residents can expect to benefit from a new stimulus check program The Arizona Families Tax Rebate announced in Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season We estimate on a conventional basis the tax deal would be roughly revenue neutral raising about 40 million from 2024 through 2033 The revenue losses from retroactively changing bonus depreciation R D expensing the interest limitation and the child tax credit amount to 110 billion and are reflected in 2024 in the table below because that is when tax revenues would change

Income Tax Rates 2022 Vs 2021 Caroyln Boswell

http://thumbor-prod-us-east-1.photo.aws.arc.pub/r-5-lDAfA7hx2qRoVpXX6UhZ43k=/arc-anglerfish-arc2-prod-advancelocal/public/U5MVCZVZI5COTCDGVU3MWDQABQ.png

P55 Tax Rebate Form By State PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

https://www.ftb.ca.gov/about-ftb/newsroom/news-releases/2024-16-january-what-california-taxpayers-need-to-know-for-2024-filing-season.html

Sacramento The California Franchise Tax Board FTB kicked off the 2024 tax filing season by providing taxpayers with important information on cash back tax credits disaster loss relief and the advantages of filing electronically Taxpayers must pay any taxes owed by April 15 to avoid penalties The FTB started accepting state tax returns this month

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Income Tax Rates 2022 Vs 2021 Caroyln Boswell

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Income Tax Rebate Under Section 87A

State Of New Mexico Rebate Checks 2023 Printable Rebate Form

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

One time Tax Rebate Checks For Idaho Residents KLEW

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

State Tax Rebate Update 2024 - New Jersey The New Jersey Child Tax Credit Program gives families with an income of 30 000 or less a refundable 500 tax credit for each child under 6 years old Households earning up to 80 000