State Tax Rebate Web 24 juil 2023 nbsp 0183 32 February 13th update On Friday evening the IRS announced that rebates in most states would not be taxed but that payments from Georgia Massachusetts South

Web 10 f 233 vr 2023 nbsp 0183 32 If you received a state tax rebate or payment in 2022 it s unclear whether the funds are taxable on your federal return The IRS last week told affected taxpayers to Web 21 sept 2022 nbsp 0183 32 Sometime quot between October 2022 and January 2023 quot millions of Californians will receive a tax rebate paid out in cash either as a direct deposit or

State Tax Rebate

State Tax Rebate

https://5.imimg.com/data5/SELLER/Default/2022/11/SH/OZ/NJ/14253073/rebate-of-state-central-taxes-and-levies-500x500.jpg

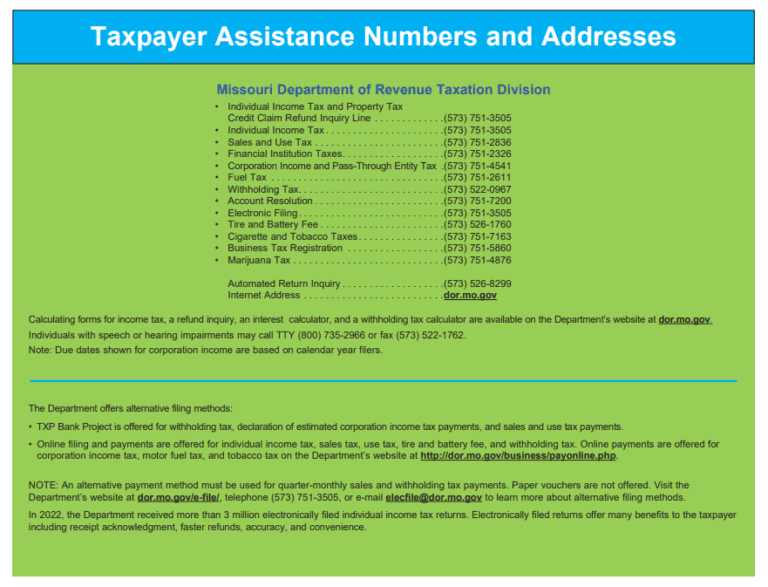

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/759130d/2147483647/strip/true/crop/758x413+0+0/resize/880x479!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

Web 11 mars 2023 nbsp 0183 32 Because the rebates in those four states were for state taxes paid if a taxpayer took the standard deduction in 2022 or did not receive a tax benefit from state Web 26 ao 251 t 2021 nbsp 0183 32 First round 1 600 payment to taxpayers with a Social Security Number who qualified for CalEITC making 30 000 or less 2 600 payment to qualified ITIN filers making 75 000 or less 3

Web 10 f 233 vr 2023 nbsp 0183 32 This means that people in the following states do not need to report these state payments on their 2022 tax return California Colorado Connecticut Delaware Web 1 d 233 c 2022 nbsp 0183 32 Federal state and local legislatures frequently issue tax rebates to encourage taxpayers to make certain types of purchases or to stimulate a flagging economy quickly by getting cash into consumers

Download State Tax Rebate

More picture related to State Tax Rebate

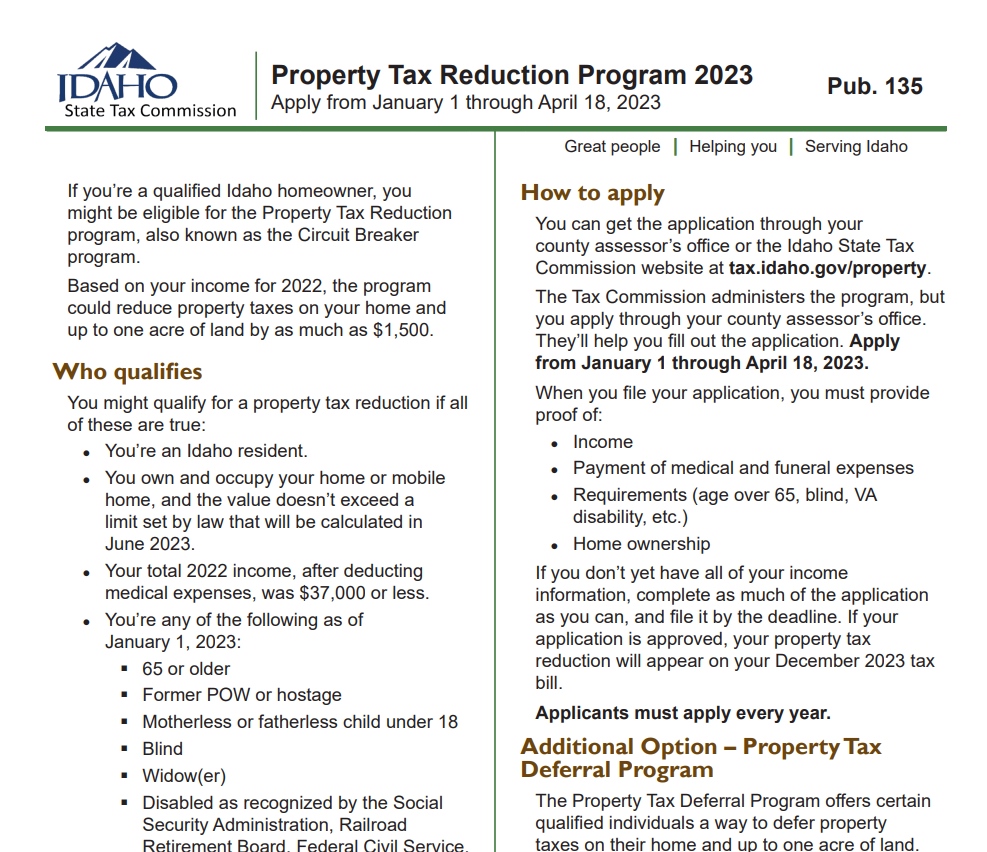

Idaho State Tax Rebate 2023 Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/05/Idaho-State-Tax-Rebate-2023.jpg

IRS Says California Most State Tax Rebates Aren t Considered Taxable

https://assets3.cbsnewsstatic.com/hub/i/r/2022/04/18/bc29efd4-8f27-4c87-90c8-747eac1fcd9e/thumbnail/1200x630/f8794c3cda3ff3cc4a04aac97f532fdb/hypatia-h_0d32f8ab1663c2148ee4151ae6500dae-h_f470ece42eb4c37c3d363bc8cefc94bf.jpg

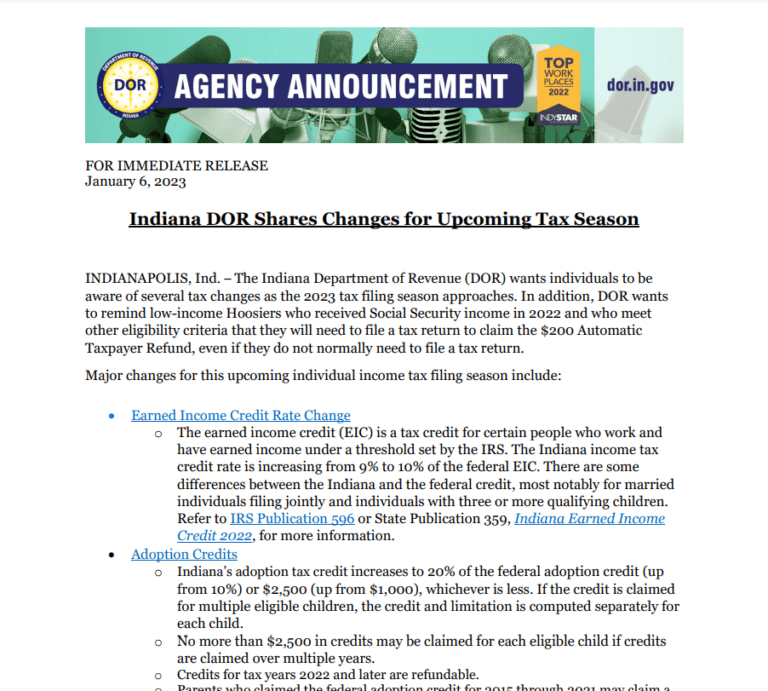

State Of Indiana Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Indiana-Tax-Rebate-2023-768x691.png

Web 16 ao 251 t 2023 nbsp 0183 32 ST PAUL Minn The one time tax rebate payments of up to 1 300 per family will start going out this week The legislation signed in May provides payments to Web 15 ao 251 t 2023 nbsp 0183 32 If you were a full year Montana resident who paid your state taxes on 2020 and 2021 income on time you should receive a rebate of up to 1 250 for your 2021

Web Based on the 2020 tax return the rebate is the greater of 75 per taxpayer and per each dependent or 12 of the tax amount Form 40 Line 20 or Form 43 Line 42 for eligible Web 10 f 233 vr 2023 nbsp 0183 32 How Do I Report State Tax Rebates U of I Tax School Tax School Blog How Do I Report State Tax Rebates February 17th 2023

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Which States Have Property Tax Rebates PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/north-central-illinois-economic-development-corporation-property-taxes-1.png

https://taxfoundation.org/blog/state-tax-rebates-inflation-relief-checks

Web 24 juil 2023 nbsp 0183 32 February 13th update On Friday evening the IRS announced that rebates in most states would not be taxed but that payments from Georgia Massachusetts South

https://www.cnbc.com/2023/02/10/tax-pros-await-irs-guidance-on-state...

Web 10 f 233 vr 2023 nbsp 0183 32 If you received a state tax rebate or payment in 2022 it s unclear whether the funds are taxable on your federal return The IRS last week told affected taxpayers to

Property Taxes By State Map Map Vector PropertyRebate

Property Tax Rebate Application Printable Pdf Download

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

Nystate Property Tax Rebates PropertyRebate

Star Rebate Check Eligibility StarRebate

Star Rebate Check Eligibility StarRebate

Smes Rebate Of State Central Taxes And Levies Mumbai ID 26286767133

Property Tax Rebate New York State Printable Rebate Form

When To Expect Tax Refund 2022 With Child Tax Credit Irisamelia

State Tax Rebate - Web 10 f 233 vr 2023 nbsp 0183 32 February 10 2023 6 34 PM MoneyWatch Taxpayers in more than 20 states who received tax rebates last year got some guidance from the IRS after the