Stimulus Tax Rebate Web 15 mars 2023 nbsp 0183 32 Most eligible people already received their Economic Impact Payments However people who are missing stimulus payments should review the information below to determine their eligibility to claim a

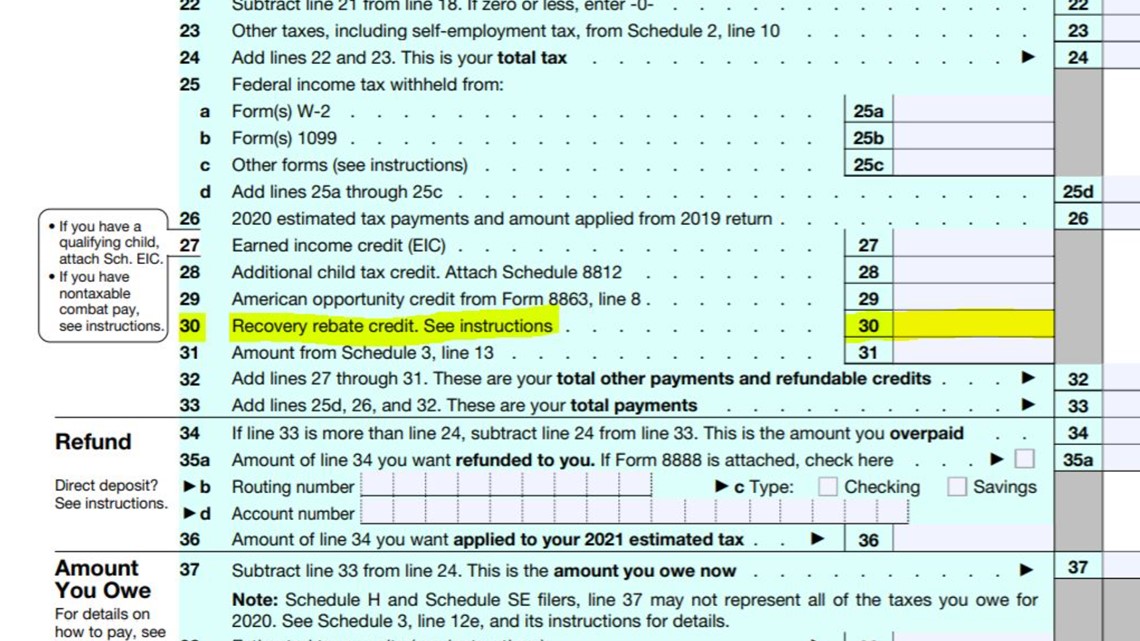

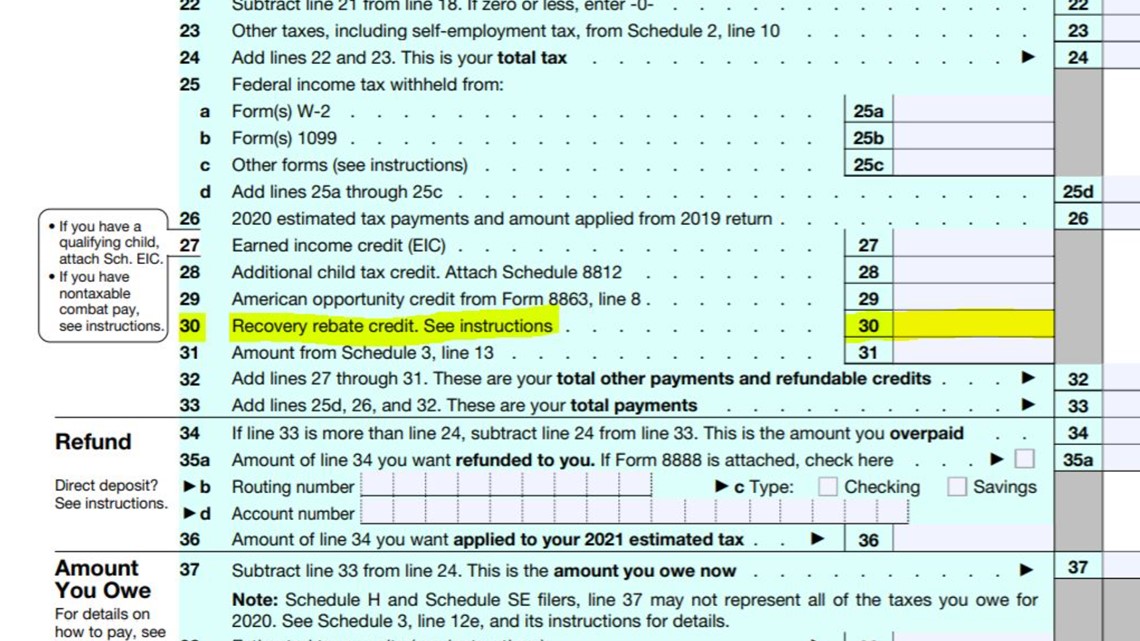

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Stimulus Tax Rebate

Stimulus Tax Rebate

https://preview.redd.it/jw900bok31581.jpg?auto=webp&s=9ee8f8531df7c3ec5f75fc310104e71dedd35209

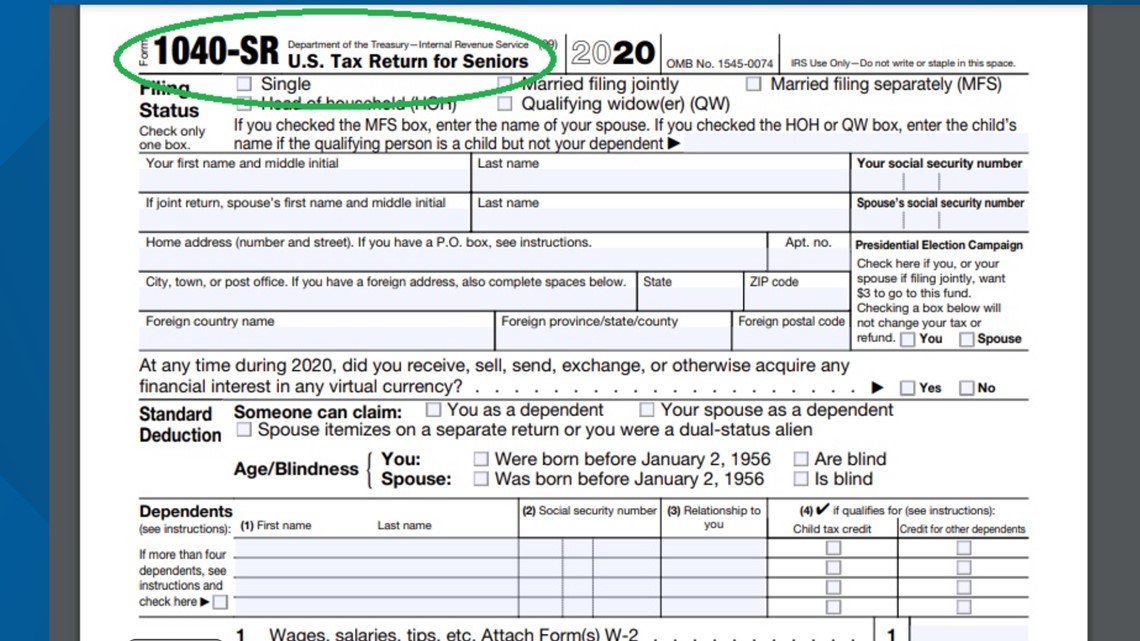

IRS 1040 NonFilers Stimulus Check Recovery Rebate Credit Walk Through

https://i.pinimg.com/736x/18/51/29/185129d90a4f4082ee6490b2462c4166.jpg

4 4 Stimulus Calculator And Everything You Need To Know About The New

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

Web People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early opportunity Web 25 janv 2022 nbsp 0183 32 Stimulus Checks and Your Taxes Are You Eligible for the Recovery Rebate Credit Will you owe more money at tax time because of last year s stimulus payment Find out here

Download Stimulus Tax Rebate

More picture related to Stimulus Tax Rebate

Biden Is Willing To Adjust Income Thresholds For Third Stimulus Check

https://1622179098.rsc.cdn77.org/data/images/full/136640/economic-stimulus-package-tax-rebate-checks-printed.jpg?w=594?w=650

How To File For The Stimulus Check Rebate How To Get Your Missed

https://i.ytimg.com/vi/YOP1SE2Y96s/maxresdefault.jpg

CE Consumer Expenditure Survey Results On The 2008 Economic Stimulus

https://www.bls.gov/cex/chart_rebate.gif

Web 9 f 233 vr 2023 nbsp 0183 32 Anyone eligible for a check who hasn t received their stimulus money from 2020 will receive the cash in the form of Recovery Rebate Credits once they file their Web 30 mars 2022 nbsp 0183 32 There may be people who are eligible for the full 1 400 payments or additional partial payments particularly if their circumstances have changed Parents

Web 15 avr 2021 nbsp 0183 32 Economic Impact Payments EIPs also known as stimulus payments and the related Recovery Rebate Credits RRCs are essentially divided into two tax years Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415864484109/mceclip1.png

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

https://www.irs.gov/coronavirus/economic-im…

Web 15 mars 2023 nbsp 0183 32 Most eligible people already received their Economic Impact Payments However people who are missing stimulus payments should review the information below to determine their eligibility to claim a

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-f...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

How To Claim The Stimulus Money On Your Tax Return 13newsnow

Recovery Rebate Credit Worksheet Explained Support

HVAC Tax Stimulus Rebates Hvac Efficient Energy Use

Irs Stimulus Irs Get My Payment Helps With Direct Deposit But Has

Recovery Rebate Credit stimulus Checks On Draft 1040

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

Let s Talk Stimulus Checks And Taxes By Clare Herceg Let s Get Set

STIMULUS CHECK UPDATE SC REBATE 2022 UP TO 800 STIMULUS CHECK WHO

Tax Rebates As Economic Stimulus Can They Work Businessandfinance Blog

Stimulus Tax Rebate - Web 27 avr 2023 nbsp 0183 32 Taxpayers may claim a missing stimulus payment or qualify for additional stimulus money Here s why and what you need to do when filing your taxes