Student Loan Tax Benefits India If the taxpayer is earning Children s Education Allowance Hostel allowance the exemption can be claimed up to Rs 100 per

Benefits of Education Loans The other benefits of an Education loan include You do not have to pay any early repayment fees for your student loan Infact interest rates What is Section 80E In India Section 80E of the Income Tax Act 1961 allows you to claim a deduction of the interest on Education Loan from taxable income

Student Loan Tax Benefits India

Student Loan Tax Benefits India

https://img.money.com/2021/01/Student_Loan_Tax_Deduction.jpg?quality=85

Tax Benefits On Business Loan In India Financeseva

https://financeseva.com/uploads/blog/7191033.png

Maximizing Home Loan Tax Benefits In India 2023

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/08/Home-Loan-Tax-Benefits-.jpg

Education loan tax benefits can be a game changer for Indian students and their families providing valuable financial relief during the pursuit of higher An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is available in

Total interest paid The amount an individual needs to pay as interest on Education Loan this will vary as per the interest rate and amount of loan availed by the individual Total A comphrehensive guide on education loan tax benefits under section 80 E of income tax this is over the Rs 1 5 lakh deduction permitted under Section 80C

Download Student Loan Tax Benefits India

More picture related to Student Loan Tax Benefits India

Home Loan Tax Benefits You Need To Know KS Group

https://www.ksgroupindia.com/wp-content/uploads/2022/04/Home-Loan-Tax-Benefits.png

Understanding Home Loan Tax Benefits A Comprehensive Guide

https://margcompusoft.com/m/wp-content/uploads/2023/02/1-3-1024x576.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Here s all you need to know about education loan tax benefits under Section 80E of the Income Tax Act Section 80E of the Income Tax Act of 1961 Top 5 Tax benefits on Education Loan WHO ARE COVERED Under Section 80E of the Income Tax Act 1961 an individual can avail of tax benefit if he she has taken an education loan to support

Section 80C Deduction for Tuition Fees Under Section 80C of the Income Tax Act individuals can claim a deduction for tuition fees paid for the education of up to Education Loan Tax Benefit Pursuing higher education is a dream for many but the cost involved can often be a significant deterrent To ease the financial burden

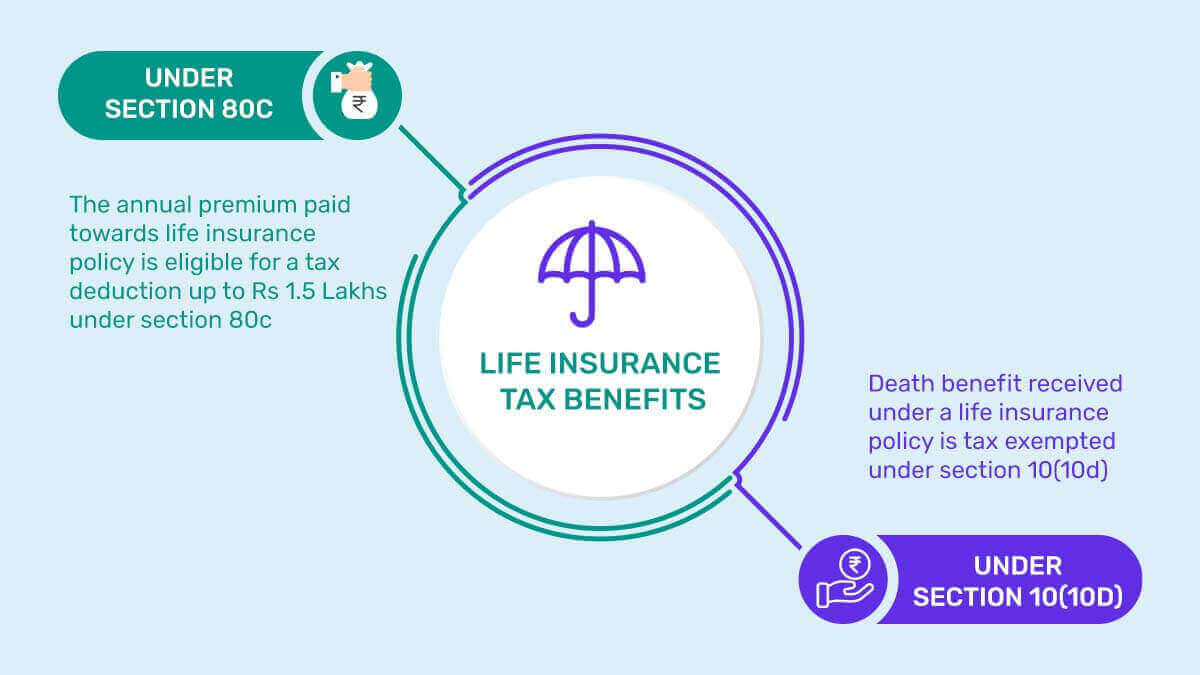

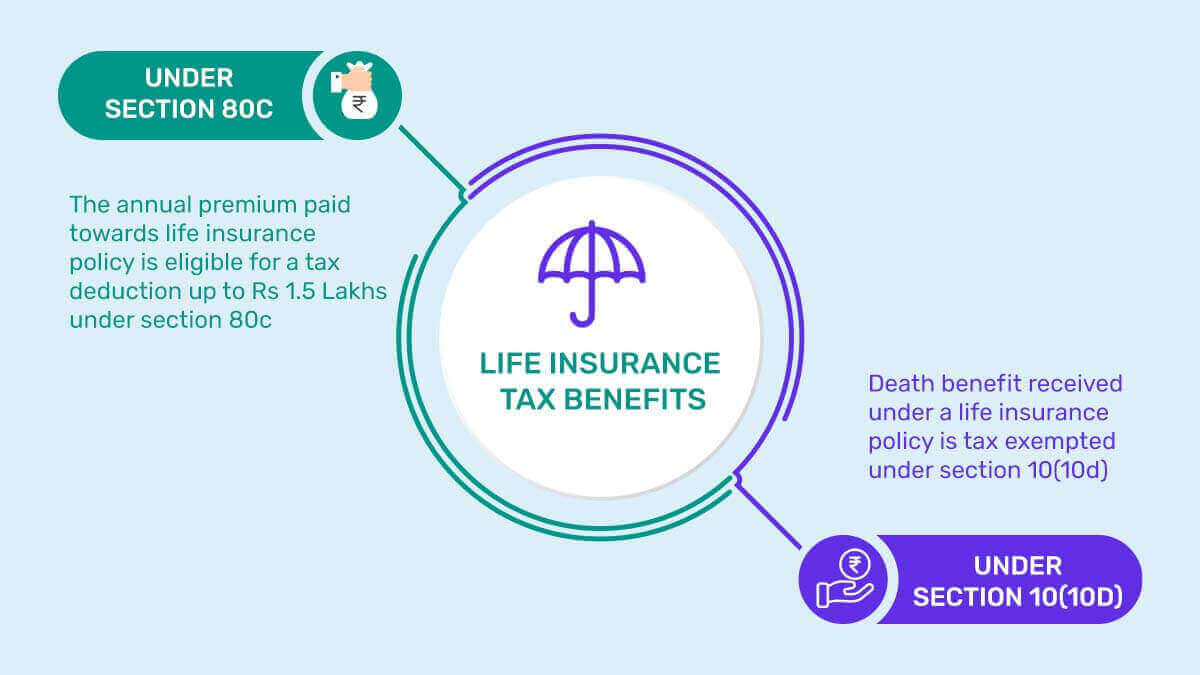

Life Insurance Tax Benefits In India 2024 PolicyBachat

https://www.policybachat.com/ArticlesImages/1165.jpg

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

https://cleartax.in/s/section-80e-deductio…

If the taxpayer is earning Children s Education Allowance Hostel allowance the exemption can be claimed up to Rs 100 per

https://www.bankbazaar.com/tax/tax-benefits-for-education-loan.html

Benefits of Education Loans The other benefits of an Education loan include You do not have to pay any early repayment fees for your student loan Infact interest rates

Income Tax Benefits On Housing Loan In India

Life Insurance Tax Benefits In India 2024 PolicyBachat

Home Loan Tax Benefits

Pin P Home Improvement And Construction Blogs

Home Loan Tax Benefits MeidilighT

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Home Loan Tax Benefits Tax Benefits On Home Loan That You Need To Know

Income Tax Benefits On Home Loan Loanfasttrack

While Student Loan Forgiveness Won t Be Taxed Federally Minnesota

Student Loan Tax Benefits India - An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is available in