Student Loan Tax Credit Income Limit You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated by

The Student Loan Interest Deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest up to The income limit is 80 000 for single filers or 170 000 for joint filers for the student loan interest deduction The educator expense deduction covers expenses up to

Student Loan Tax Credit Income Limit

Student Loan Tax Credit Income Limit

https://www.zrivo.com/wp-content/uploads/2021/07/How-to-opt-out-of-child-tax-credit-payments-1024x576.jpg

8 Incredible Tips What Is Dependent Care Credit Outbackvoices

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Child Tax Credit 2023 Income Limit Eligibility Calculator APSBB

https://apsbb.org/wp-content/uploads/2023/05/Child-Tax-Credit-1.png

That s a maximum annual tax credit of 2 500 However after a certain income level the credit starts phasing out In 2023 and 2024 the credit begins decreasing for Single taxpayers with a modified The maximum student loan interest deduction is 2 500 or the total amount you paid in student loan interest during the 2023 tax year whichever is less The

To be eligible for the maximum student loan interest deduction of 2 500 for tax year 2023 your modified adjusted gross income must be under 75 000 155 000 if Last updated 29 March 2024 If you paid student loan interest last year you could qualify for a tax deduction worth up to 2 500 You won t receive that money back as a refund since

Download Student Loan Tax Credit Income Limit

More picture related to Student Loan Tax Credit Income Limit

How Can You Get Tax Free Interest On Student Loans The European

https://www.europeanbusinessreview.com/wp-content/uploads/2022/11/student-loans-1068x550.jpeg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

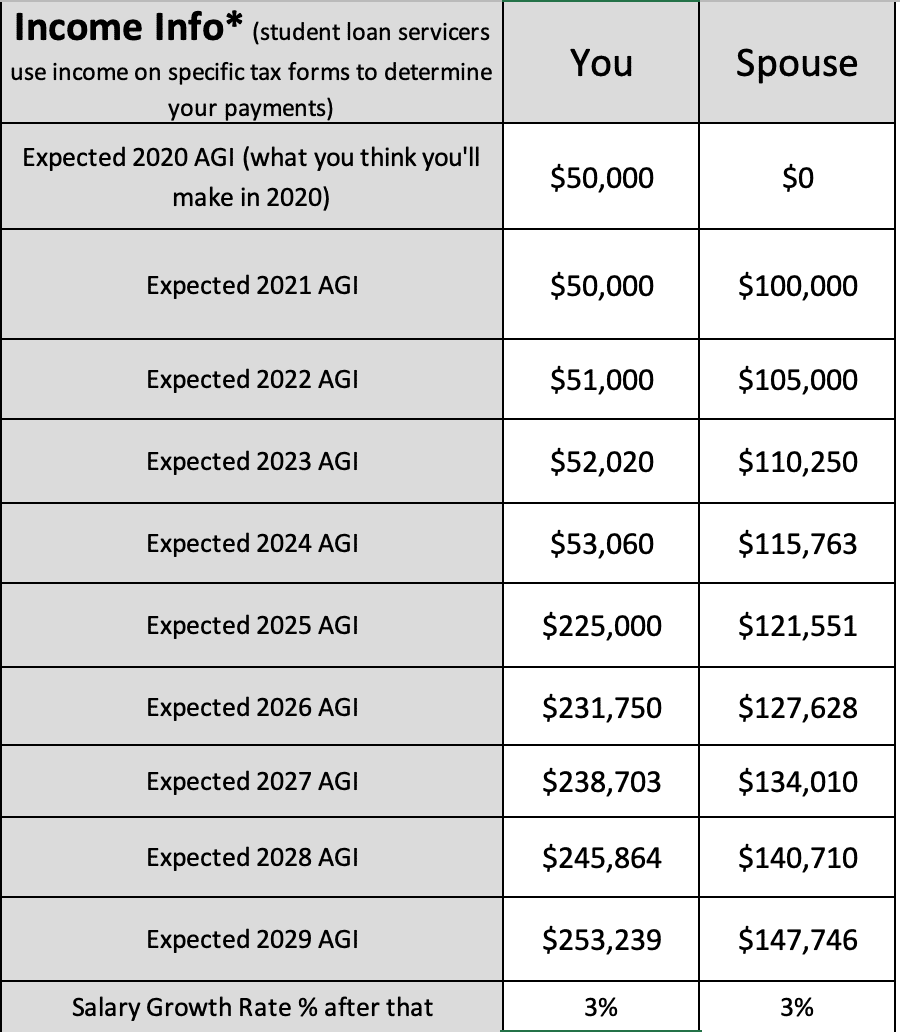

Student Loan Income Based Repayment Calculator Navient EoghainRozaria

https://www.studentloanplanner.com/wp-content/uploads/2021/10/c1f7c2a3-c36d-47c5-895d-36aa0789f8bb_Screen20Shot202021-10-0720at203.23.4220PM.png

You can deduct up to 2 500 depending on how much interest you paid and your modified adjusted gross income Are You Eligible You can deduct interest on student loans paid by you if you use If your MAGI was between 70 000 and 85 000 175 000 if filing jointly you can deduct less than than the maximum 2 500 The student loan interest deduction is

The largest amount you can claim for a student loan interest deductible is 2 500 for 2023 and remains the same in 2024 but that is limited by your income IRS Form 1098 E is the Student Loan Interest Statement that your federal loan servicer will use to report student loan interest payments to both the Internal Revenue Service IRS

Maryland Student Loan Tax Credit YouTube

https://i.ytimg.com/vi/5WHlWRMkYS0/maxresdefault.jpg

Extension Announced For 2021 Maryland Income Tax Filing Payment

https://kubrick.htvapps.com/htv-prod-media.s3.amazonaws.com/images/maryland-taxes-1642611987.jpg?crop=1.00xw:1.00xh;0,0&resize=1200:*

https://www.irs.gov/taxtopics/tc456

You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated by

https://www.fidelity.com/learning-center/smart...

The Student Loan Interest Deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest up to

How The New Child Tax Credit Income Limit Will Affect Families ACT Blogs

Maryland Student Loan Tax Credit YouTube

Maryland Student Loan Tax Credit Save On Education Costs

While Student Loan Forgiveness Won t Be Taxed Federally Minnesota

Child Tax Credit Income Limit And Age Info View Requirements Khou

2024 Student Loan Interest Federal Income Tax Deduction Calculator

2024 Student Loan Interest Federal Income Tax Deduction Calculator

What Is The Student Loan Tax Deduction Tax Deductions Student Loans

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Top 19 Maryland Student Loan Tax Credit In 2022 Blog H ng

Student Loan Tax Credit Income Limit - That s a maximum annual tax credit of 2 500 However after a certain income level the credit starts phasing out In 2023 and 2024 the credit begins decreasing for Single taxpayers with a modified