Subcontractors Tax Rebate Web Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue and Customs HMRC The

Web 15 nov 2021 nbsp 0183 32 As a subcontractor the easiest figure to calculate for your tax return is probably your income it s the sum of the monthly CIS statements you have received throughout the year from your contractors Web Subcontractors that don t register for CIS will pay a tax deduction rate of 30 Those that do register as subcontractors will be charged 20 a saving of 10

Subcontractors Tax Rebate

Subcontractors Tax Rebate

https://data.formsbank.com/pdf_docs_html/203/2033/203353/page_1_thumb_big.png

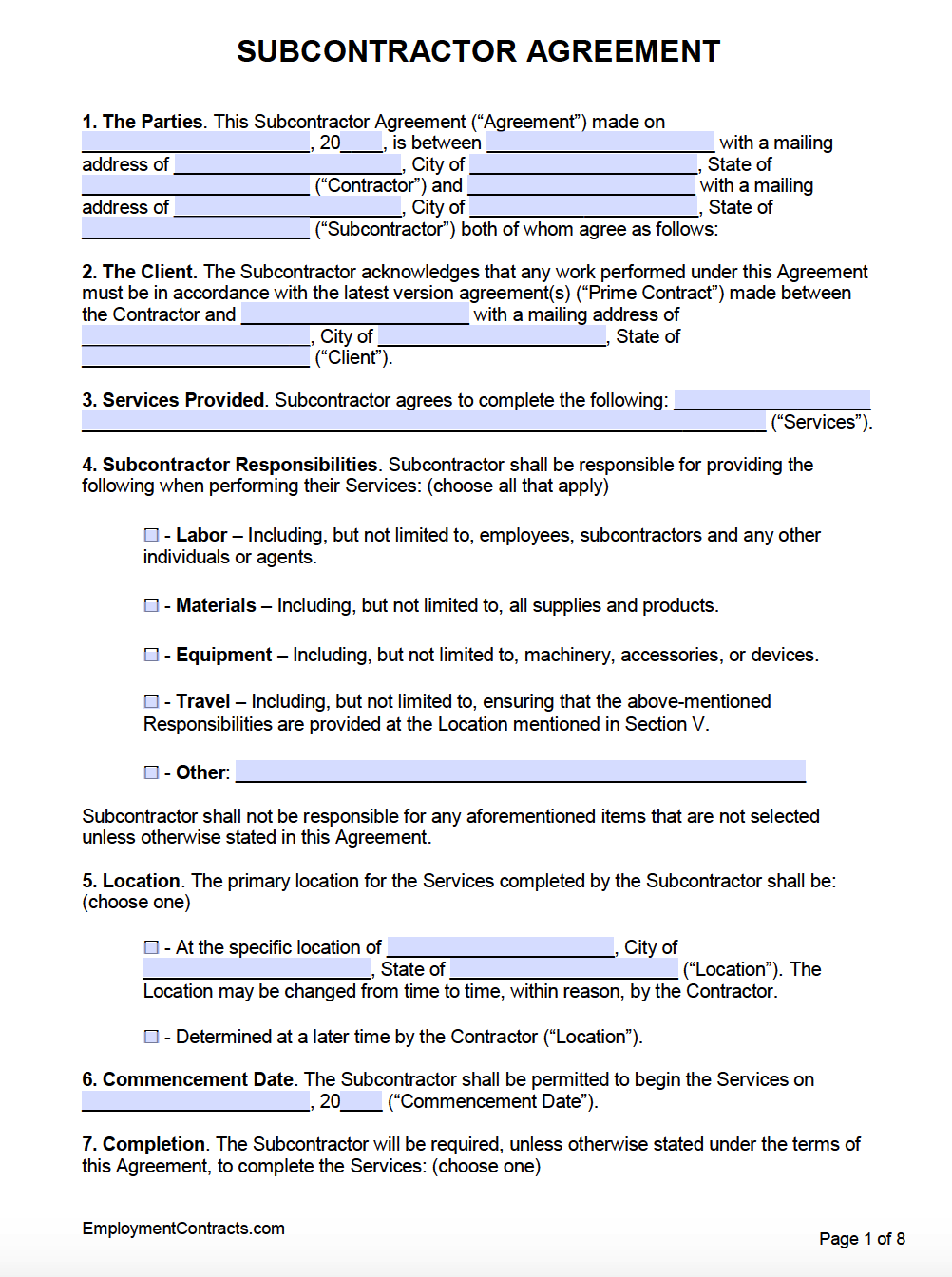

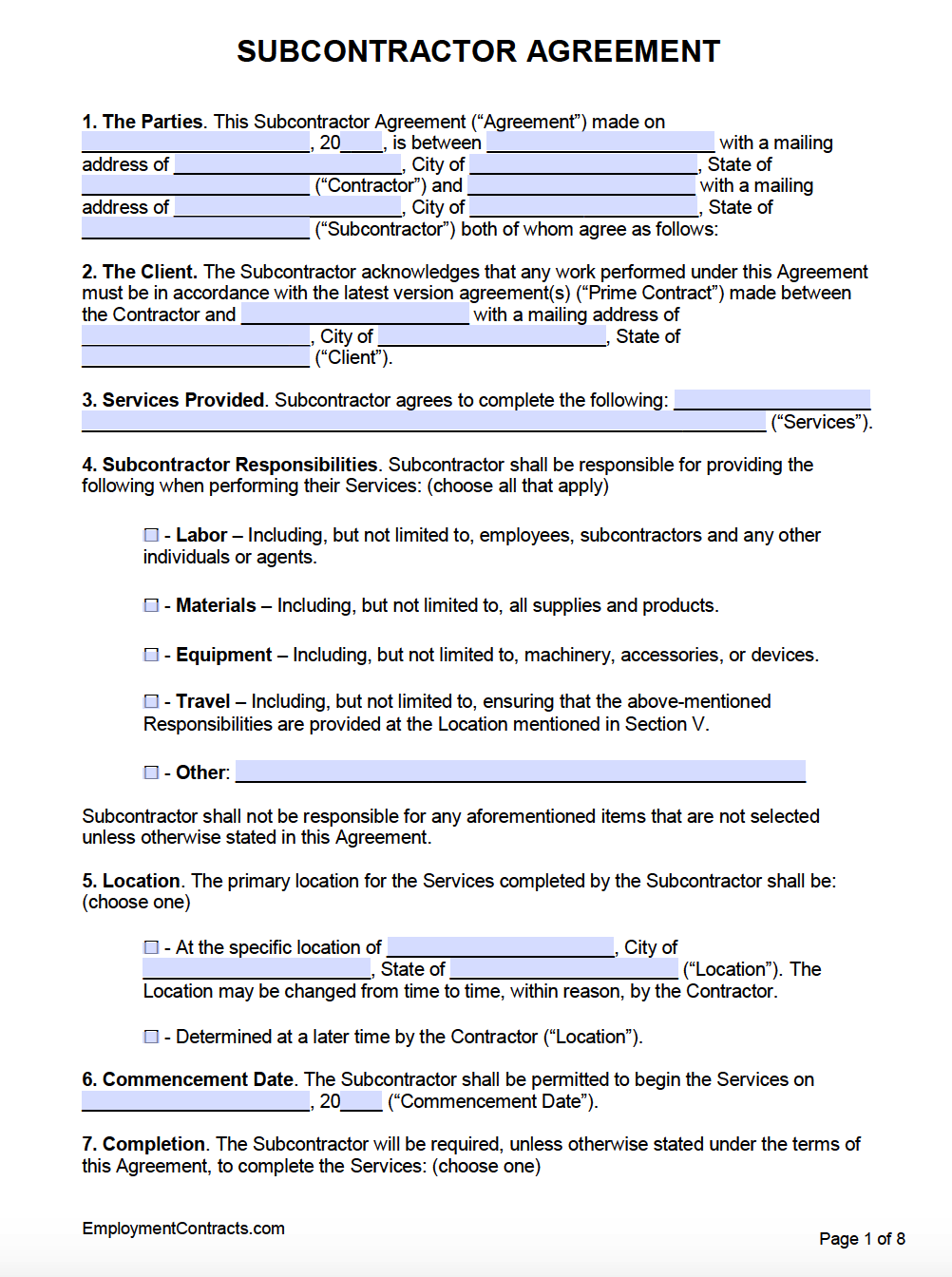

Subcontractor Agreement Template Free Agreement Templates

https://employmentcontracts.com/wp-content/uploads/2019/05/Subcontractor-Agreement.png

Subcontractor Qualification Form1 Embree Group Fill Out Sign

https://www.pdffiller.com/preview/251/837/251837325/large.png

Web 9 f 233 vr 2023 nbsp 0183 32 Due a tax refund You can get your CIS tax return filed by an accredited accountant for just 163 149 all in We ll take payment from your rebate for 163 239 if you Web Payment after deduction of tax at 20 most labour only subcontractors will have tax deducted at a flat rate of 20 This means that HMRC has found your UTR on their list

Web 28 mai 2015 nbsp 0183 32 HMRC will inform the contractor of how much to deduct from a subcontractors payment when they verify the subcontractors status This will be 30 Web The CIS for limited company subcontractors works much like it does for sole traders but with a key difference If you work through your own limited company CIS deductions can

Download Subcontractors Tax Rebate

More picture related to Subcontractors Tax Rebate

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

P55 Tax Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

CIS Tax Refund In London The CIS Tax Rebate Is A Refund Of Tax To

https://i.pinimg.com/originals/c0/19/d1/c019d12b2a7aa190a708df72cf5913b2.jpg

Web 1 Under CIS subcontractor workers normally have 20 tax deducted from the income 2 The definitions of contractor and construction industry are quite complex but you Web CANALITIX ACCOUNTANTS help CIS subcontractors to recover an average of 163 1 500 in overpaid income tax which is referred to as CIS tax rebate CIS rebates take approximately 2 weeks to recover after filing

Web Totalpayment exclusive of VAT 600 Lesscost of materials exclusive of VAT 200 Amountliable to deduction 400 Amountdeducted at 20 80 Netpayment to Web 29 sept 2020 nbsp 0183 32 Subcontractors can apply for CIS rebates on their Self Assessment tax returns HMRC will refund any overpaid tax where the CIS deductions were greater than

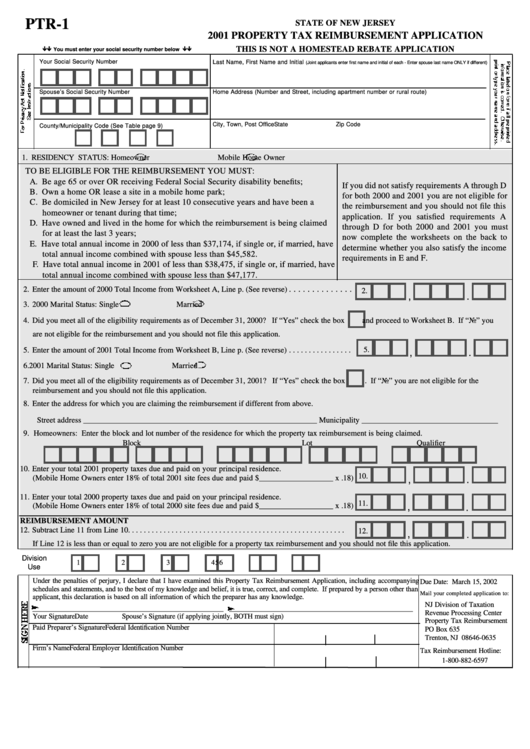

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Have You Received Your 150 Council Tax Rebate

https://s3-eu-west-1.amazonaws.com/creditladder-cdn/images/c459b3e3-4982-464e-8b4b-dd006b127354/Council_Tax_rebate.JPG

https://www.gov.uk/what-is-the-construction-industry-scheme

Web Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue and Customs HMRC The

https://www.taxrebates.co.uk/tax-guides/cis-s…

Web 15 nov 2021 nbsp 0183 32 As a subcontractor the easiest figure to calculate for your tax return is probably your income it s the sum of the monthly CIS statements you have received throughout the year from your contractors

Pin On Tigri

Property Tax Rebate Application Printable Pdf Download

Subcontractors Tax Return Makesworth Accountants

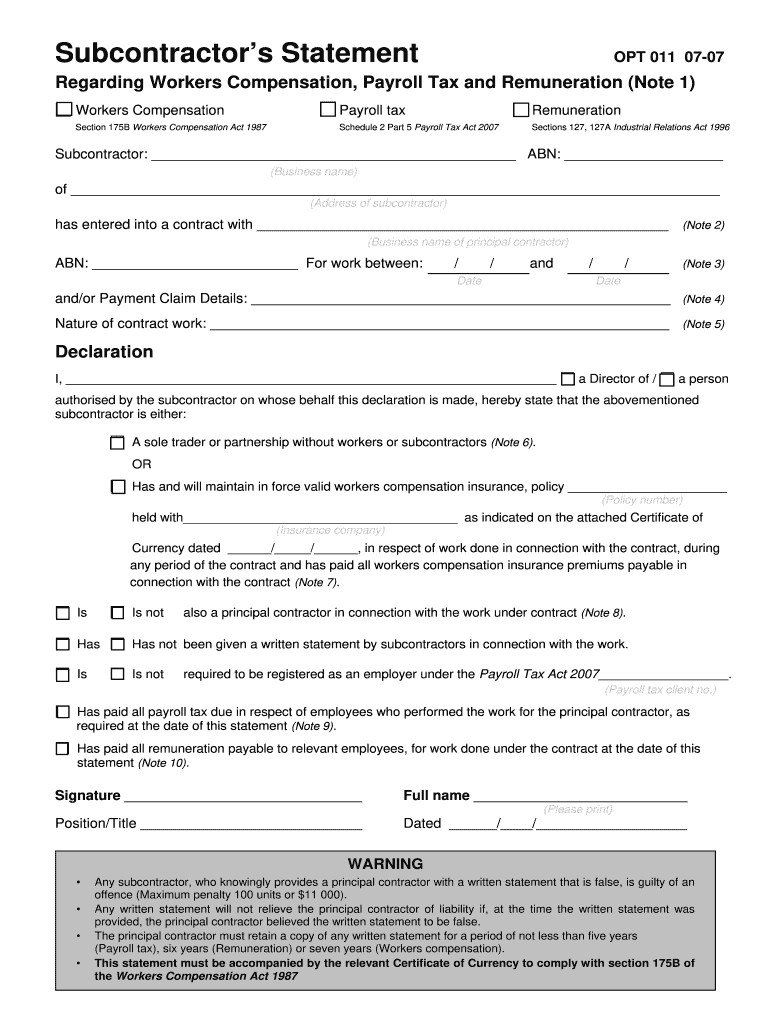

Subcontractor Statement Fill Out And Sign Printable PDF Template

Illinois Tax Rebate Tracker Rebate2022

Printable Free Subcontractor Agreement Template Word Printable Templates

Printable Free Subcontractor Agreement Template Word Printable Templates

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Section 87A Tax Rebate Under Section 87A

Subcontractors Tax Rebate - Web Payment after deduction of tax at 20 most labour only subcontractors will have tax deducted at a flat rate of 20 This means that HMRC has found your UTR on their list