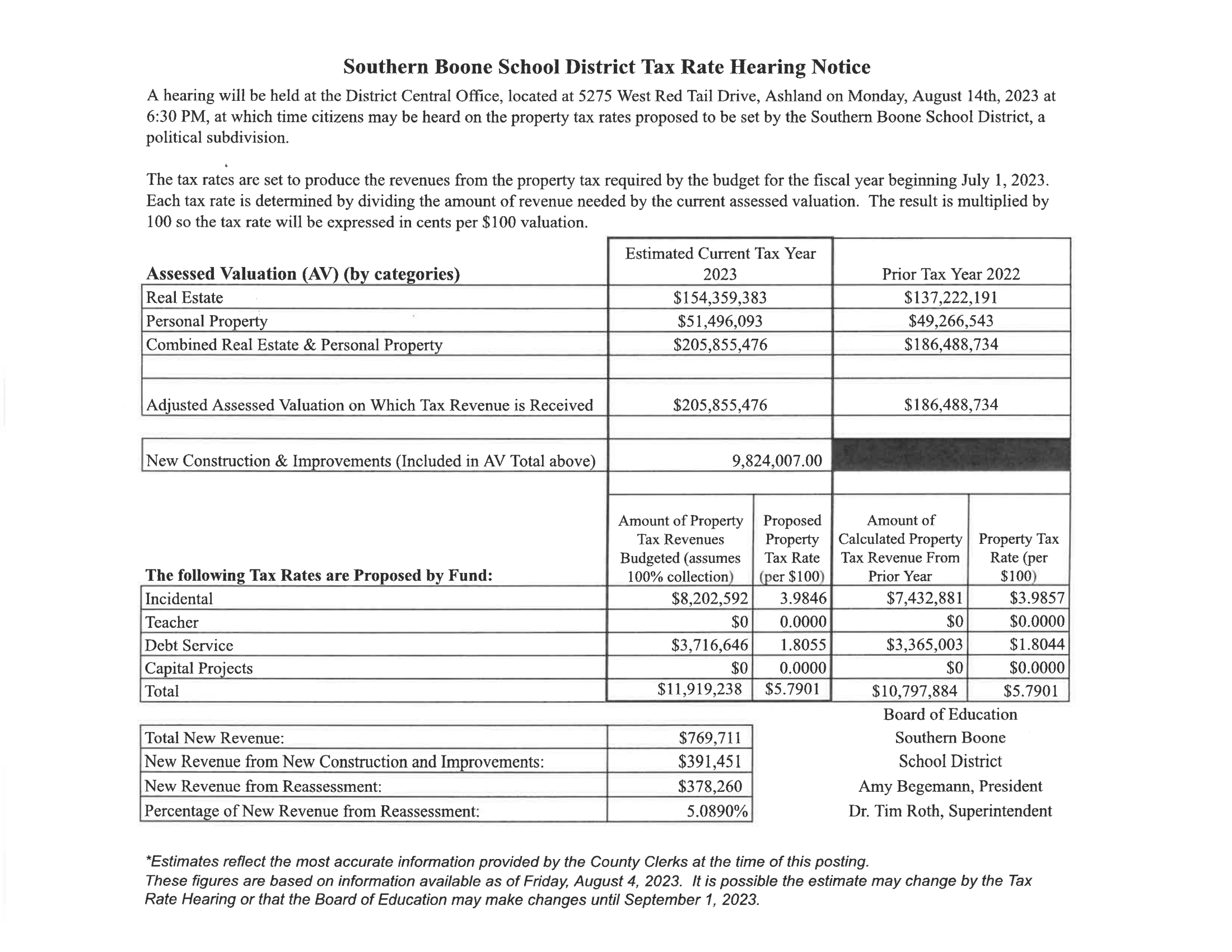

Suffolk Property Tax Rate All real estate tax rates are based on 100 per assessed value The Citywide real estate tax rate applies in the Downtown Business Overlay Taxing District and the Route 17 Taxing District

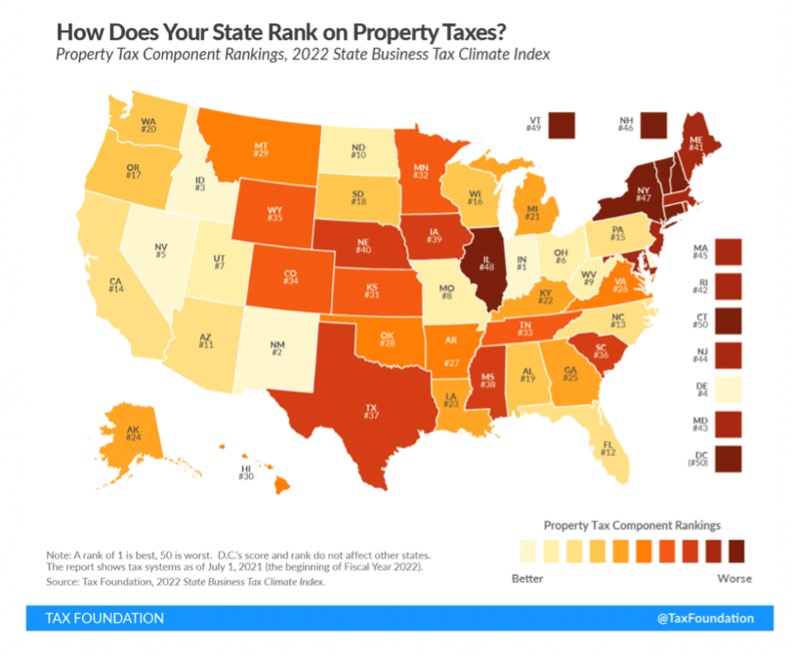

Personal Property Tax Rates for 2022 Per 100 of Assessed Value Machinery Tools 3 15 based on 20 of cost first 5 years and 3 15 based on 10 of cost after 5 years Motor Vehicles The median property tax in Suffolk County New York is 7 192 per year for a home worth the median value of 424 200 Suffolk County collects on average 1 7 of a property s assessed fair market value as property tax

Suffolk Property Tax Rate

Suffolk Property Tax Rate

https://i0.wp.com/hellertaxgrievance.com/wp-content/uploads/2022/11/suffolk-county-property-taxes-2023.png

Mid Suffolk Council Tax Rise And 25 Million In Property Investment

https://www.suffolknews.co.uk/_media/img/BSJ95XL1FFV71CHEUUOS.jpg

LLC Tax Rate Tentho

https://tentho.com/hubfs/LLC Tax Rate .png#keepProtocol

Calculate how much you ll pay in property taxes on your home given your location and assessed home value Compare your rate to the Virginia and U S average Most of the services provided by the Agency are at its Riverhead location where there is an owner index and tax map information with a pleasant staff to assist you on your quest

In Suffolk County the average tax rate is 2 37 according to SmartAsset If your market value is 500 000 the local assessment office will assess your property value at a percentage of market value If assessments in the community are at 90 market value then the house is assessed at 450 000 Suffolk County Sign up online or download and mail in your application Get the facts about the COVID 19 vaccine Become an organ donor today

Download Suffolk Property Tax Rate

More picture related to Suffolk Property Tax Rate

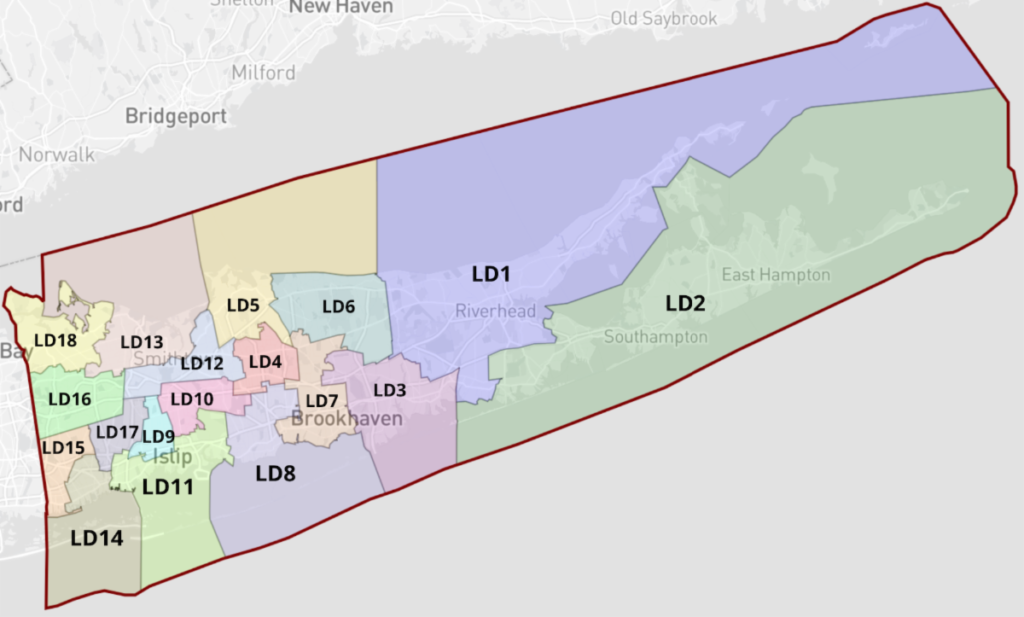

Sign The Petition To Support The Suffolk County Redistricting Maps

http://isliptowndemocrats.com/wp-content/uploads/sites/5/2022/01/district-map-1024x617.png

UK Government Relinquishes Top Spot As Biggest Property Tax Collector

https://www.radionewshub.com/_media/images/news/categories/2.64562265-1d2ee2.jpg

Property Tax What It Is And How To Save Property Tax Grievance

https://i0.wp.com/hellertaxgrievance.com/wp-content/uploads/2018/12/reduce-property-taxes.jpg

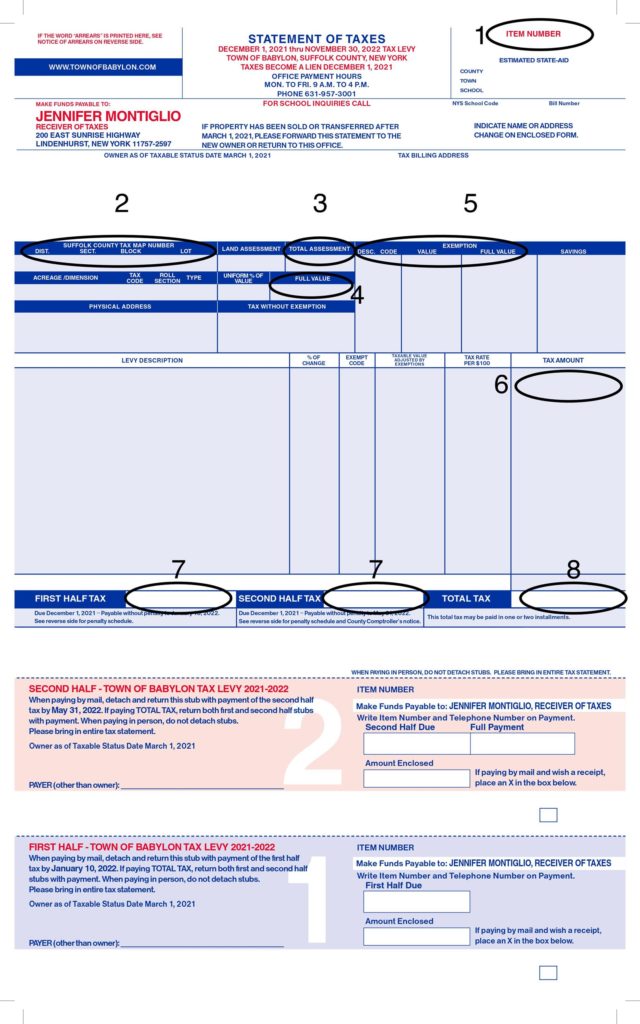

The median property tax also known as real estate tax in Suffolk County is 7 192 00 per year based on a median home value of 424 200 00 and a median effective property tax rate of 1 70 of property value Real Property is the sole authority responsible for maintaining the official Suffolk County Tax Map for ad valorem purposes Each parcel on a tax map is identified by a District Section Block and Lot number

How to pay Council Tax Each Council Tax year runs from 1 April to 31 March Before the start of each Council Tax year your district or borough council will send you a single bill which The tax rates set in the budget is 1 09 per 100 assessed value with council granting the additional 2 cent reduction This makes the rate property owners will pay this year 1 07 per 100 assessed value

Appealing Your Property Tax Bill In Nassau And Suffolk NY Property

https://i0.wp.com/hellertaxgrievance.com/wp-content/uploads/2015/11/Suffolk-Nassau-Property-Tax.jpg

90k Salary Effective Tax Rate V s Marginal Tax Rate BJ Tax 2024

https://bj.icalculator.com/img/og/BJ/100.png

https://www.suffolkva.us/180

All real estate tax rates are based on 100 per assessed value The Citywide real estate tax rate applies in the Downtown Business Overlay Taxing District and the Route 17 Taxing District

https://www.suffolkva.us/963

Personal Property Tax Rates for 2022 Per 100 of Assessed Value Machinery Tools 3 15 based on 20 of cost first 5 years and 3 15 based on 10 of cost after 5 years Motor Vehicles

Complete Guide For 2023 Property Taxes In Suffolk County Property Tax

Appealing Your Property Tax Bill In Nassau And Suffolk NY Property

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Suffolk County NY Property Taxes 2022 Ultimate Guide What You

Twenty four Counties Due For Property Tax Reassessments This Year

82 5k Salary Effective Tax Rate V s Marginal Tax Rate CO Tax 2024

82 5k Salary Effective Tax Rate V s Marginal Tax Rate CO Tax 2024

Property Tax Or Stamp Duty The Best Choice For Your NSW Home

Suffolk Treasurer Department Merger Should Help Speed Up Property Tax

Public Notice Southern Boone School District

Suffolk Property Tax Rate - In depth Suffolk County NY Property Tax Information Get in depth information on all of the factors that affect your targeted property s taxes with a free account Access a rundown of its value tax rates and tax exemptions like in the sample below