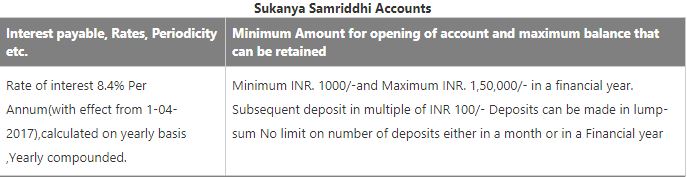

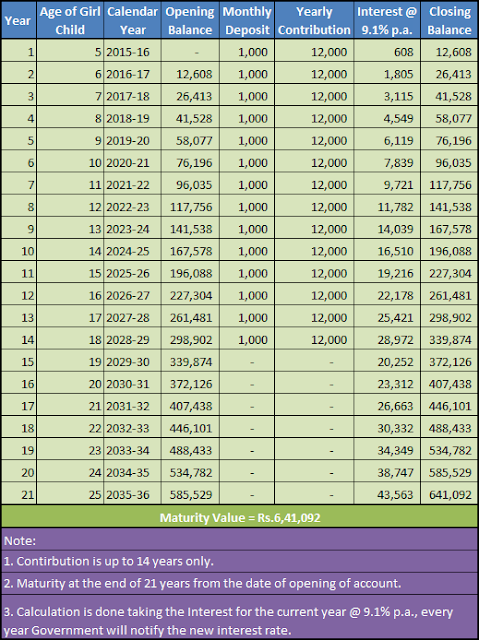

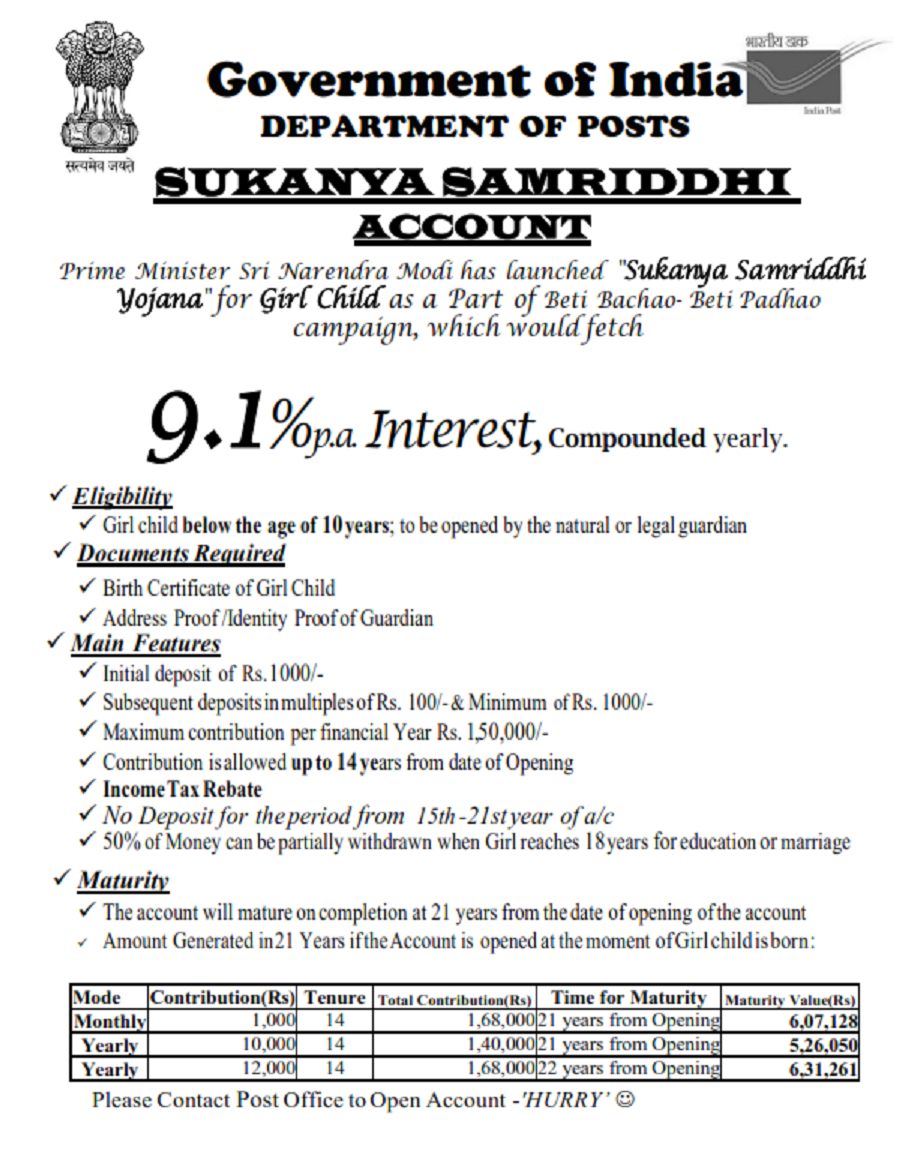

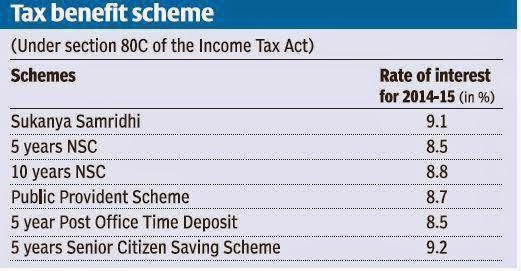

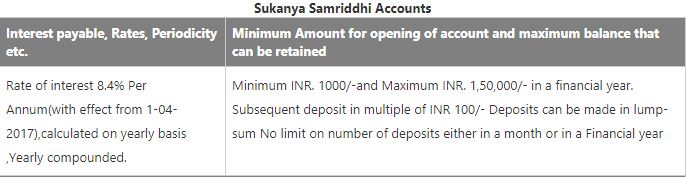

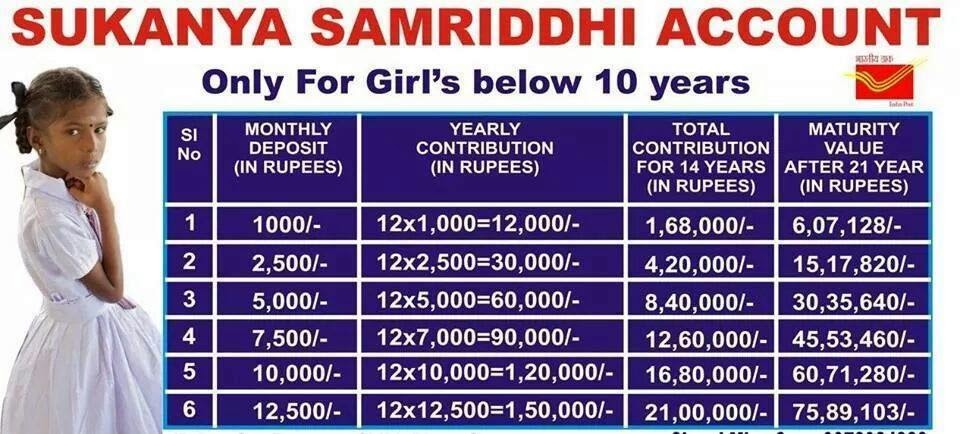

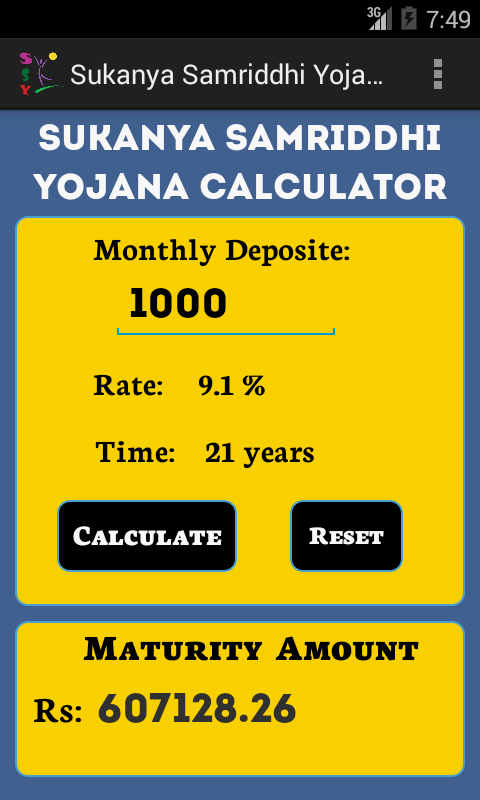

Sukanya Samriddhi Account Tax Rebate Web 24 sept 2021 nbsp 0183 32 1 Investment made under Sukanya Samriddhi Yojana Scheme is eligible for deduction under Section 80C conditional on maximum of Rs 1 5 lakh 2 The interest

Web 21 sept 2022 nbsp 0183 32 Your investments towards Sukanya Samriddhi Yojana are eligible for tax deductions under Section 80C of the Income Tax Act Deductions of up to 1 5 lakhs are allowed Should you choose to invest Web On 23 July 2018 the criteria for minimum annual deposit for the Sukanya Samriddhi Yojana account has been revised to Rs 250 from the earlier amount of Rs 1 000 Also

Sukanya Samriddhi Account Tax Rebate

Sukanya Samriddhi Account Tax Rebate

https://4.bp.blogspot.com/-ObHG6RBXwqE/WWSZDWenI3I/AAAAAAAABT4/GkyJeS9HrwYQkGxEvz0vGkoygYKXH1i9wCLcBGAs/s1600/sukanya-samriddhi-accounts-details.jpg

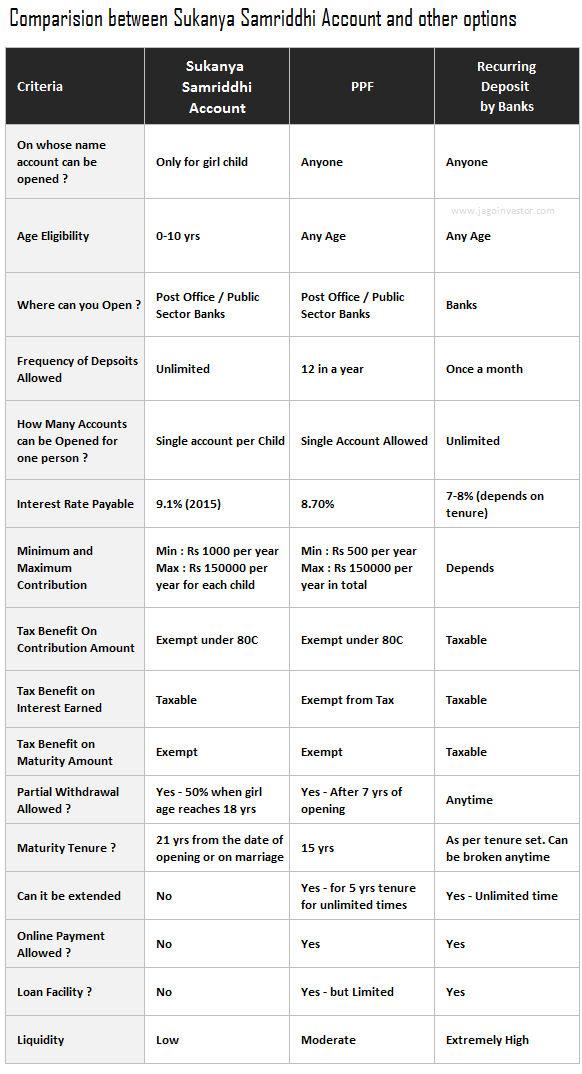

Sukanya Samriddhi Yojna How To Open SSY Account Tax Benefits Tax2win

https://emailer.tax2win.in/assets/guides/ssy/sukanya-samriddhi-yojana.jpg

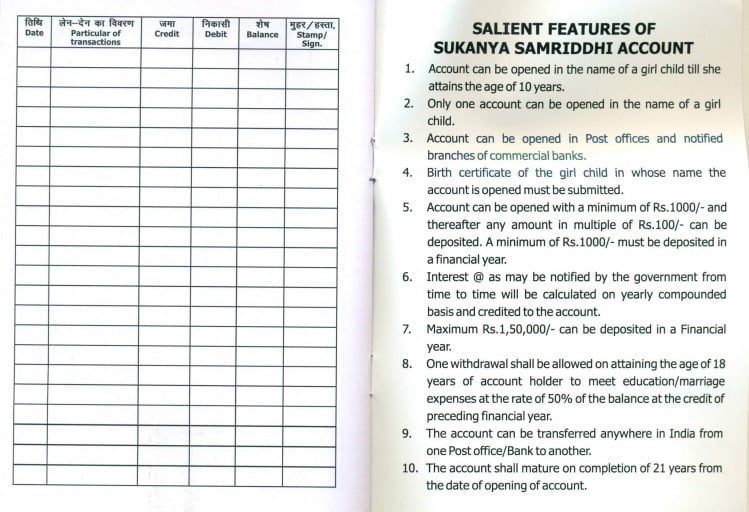

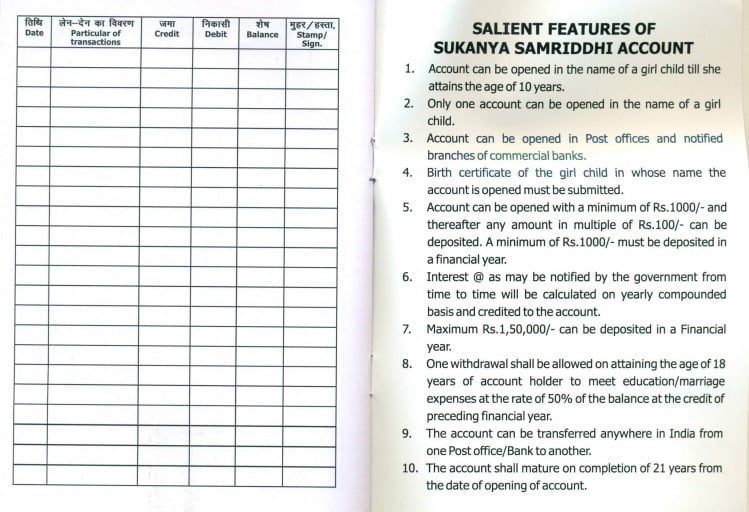

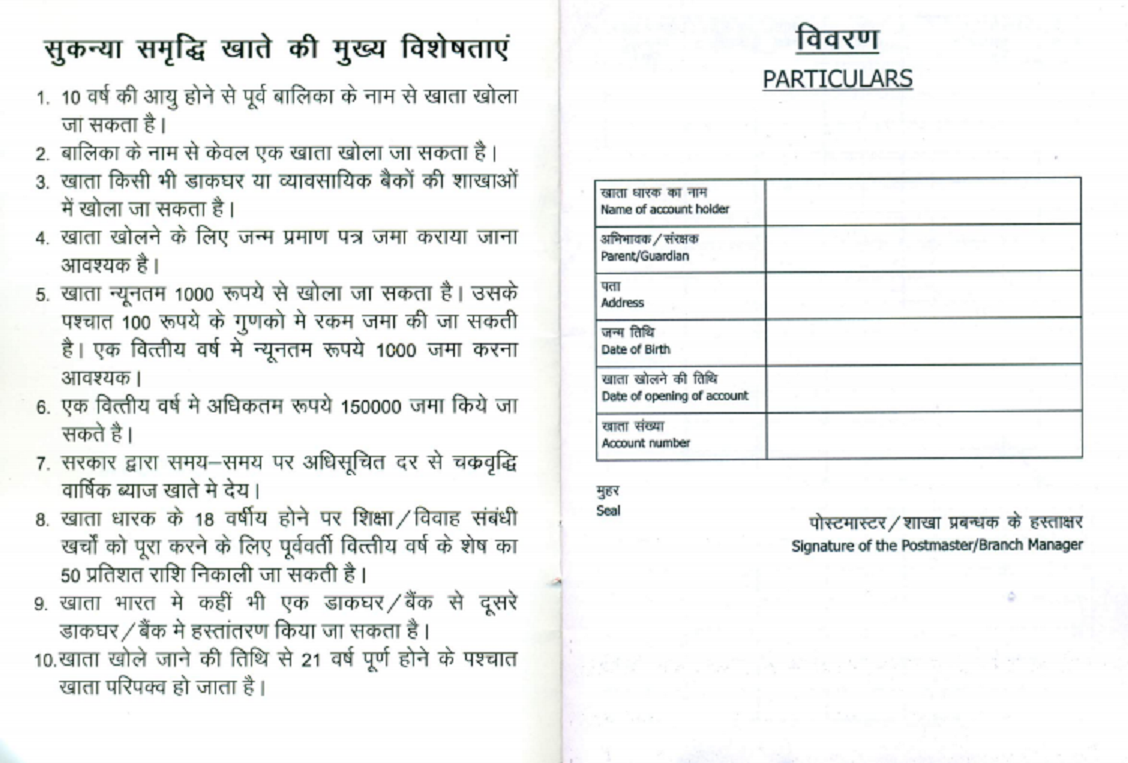

Sukanya Samriddhi Account Yojana At A Glance PSD NASHIK

http://3.bp.blogspot.com/-5whq9s2u6pE/VMnXBFRf7gI/AAAAAAAACPQ/x5lmwCBNCm8/s640/sukanya-samriddhi-yojna-interest-calculation.png

Web 17 f 233 vr 2022 nbsp 0183 32 The Sukanya Samriddhi Yojana scheme is currently offering 7 6 for the quarter ending September 30 2022 The scheme comes with various tax benefits For Web 13 juin 2020 nbsp 0183 32 Latest News Date 20 May 2021 The Income Tax Department extends the following due dates Income Tax Return filing date extended to 31st Dec 21 from 30th

Web 3 mars 2022 nbsp 0183 32 The amount received on maturity or withdrawal from the Sukanya Samriddhi Account is also tax exempt u s 10 11A Investments made in Sukanya Samriddhi Web 30 juin 2023 nbsp 0183 32 The Sukanya Samriddhi Yojana a Centre backed scheme was introduced in 2015 by Prime Minister Narendra Modi to support this cause It is a corpus building scheme that enables you to secure your child s financial future You can contribute a minimum of 250 per year for 15 years This fund will mature when your child turns 21

Download Sukanya Samriddhi Account Tax Rebate

More picture related to Sukanya Samriddhi Account Tax Rebate

Eligibility Criterion To Open Sukanya Samriddhi Yojna Account NRI

http://1.bp.blogspot.com/-YSmuWvGtfmY/Vemrc_66fNI/AAAAAAAADs4/d4yYmMCZlmY/s1600/Sukanya%2BSamriddhi%2BAccount%2BEligiblity%2BCriterion.png

Sukanya Samriddhi Account Yojana At A Glance SA POST

http://4.bp.blogspot.com/-Pm2s4SuGVJ8/VN43JvF7K4I/AAAAAAAAS-E/PUcDWu5cvE0/s1600/TAX%2BBenefit.jpg

Sukanya Samriddhi Account Tax Benefits By Investing For Girl Child

http://www.jagoinvestor.com/wp-content/uploads/files/Sukanya-Samriddhi-Scheme-comparision.png

Web 3 mars 2020 nbsp 0183 32 The investment earns tax rebate under Section 80C and the interest earned under this scheme is also tax free The minimum amount that can be deposited in this scheme is Rs 1 000 monthly and the Web 4 ao 251 t 2023 nbsp 0183 32 Sukanya Samriddhi Yojana is a government backed small savings scheme for the benefit of a girl child It is a part of the

Web 1 sept 2023 nbsp 0183 32 The Minimum Investment is 250 per annum The Maximum Investment is 1 50 000 per annum The Maturity Period is 21 years At present SSY has several tax Web 5 avr 2015 nbsp 0183 32 Let s begin with Sukanya Samriddhi Yojana interest rates 2023 The current interest rate for Sukanya Samriddhi Account is 8 2023 and it provides tax benefits

Sukanya Samriddhi Account Circular By RBI Official Notification

https://bank.caknowledge.com/wp-content/uploads/2017/02/Sukanya-Samridhi-Yojana-Pass-Book-Back-page.jpg

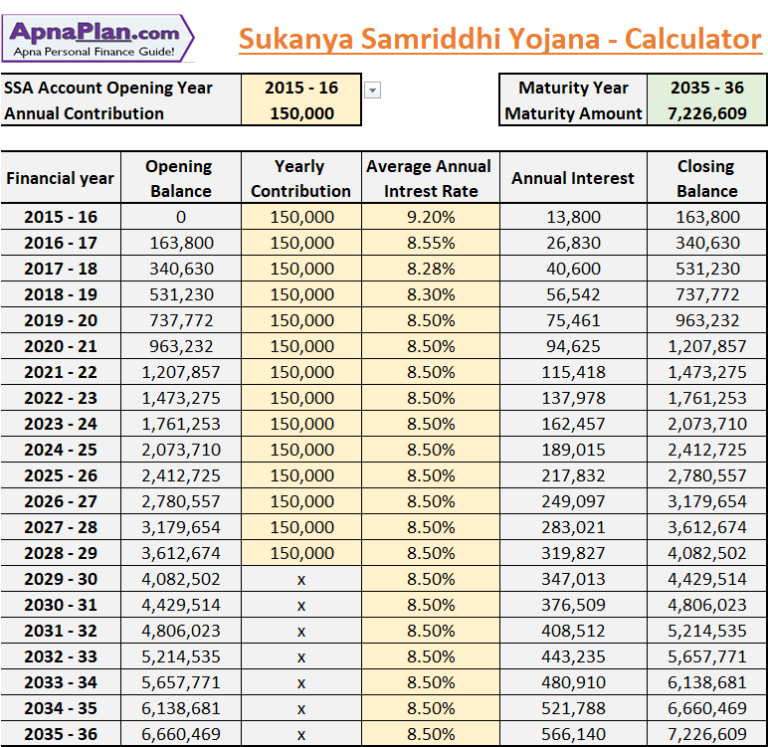

Sukanya Samriddhi Account Calculation 64

https://www.mppeb.org/wp-content/uploads/2023/05/Sukanya-Samriddhi-Account-Calculation.jpeg

https://taxguru.in/income-tax/sukanya-samriddhi-yojana-tax-benefits.html

Web 24 sept 2021 nbsp 0183 32 1 Investment made under Sukanya Samriddhi Yojana Scheme is eligible for deduction under Section 80C conditional on maximum of Rs 1 5 lakh 2 The interest

https://www.etmoney.com/learn/saving-schem…

Web 21 sept 2022 nbsp 0183 32 Your investments towards Sukanya Samriddhi Yojana are eligible for tax deductions under Section 80C of the Income Tax Act Deductions of up to 1 5 lakhs are allowed Should you choose to invest

Sukanya Samriddhi Account Details Guide Updated 2023 With Tax

Sukanya Samriddhi Account Circular By RBI Official Notification

Eligibility Criterion To Open Sukanya Samriddhi Yojna Account NRI

Sukanya Samriddhi Account Yojana At A Glance SA POST

Sukanya Samriddhi Yojana Calculator 2020 72 Lakhs On Maturity

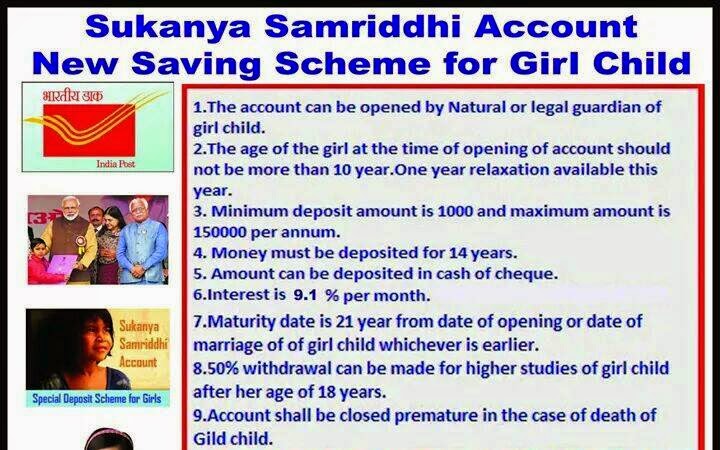

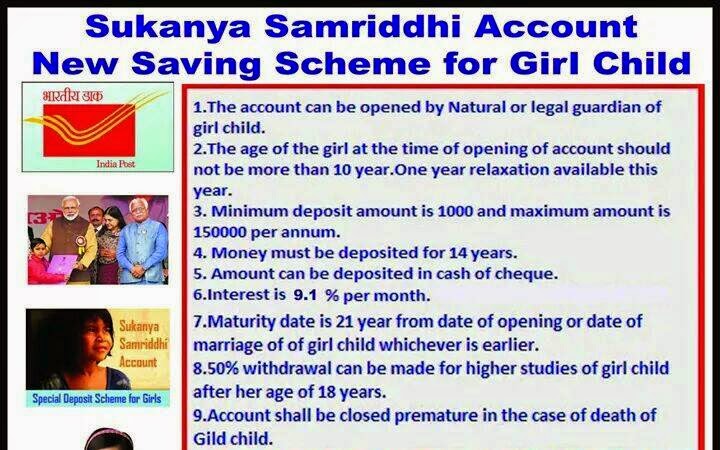

Sukanya Samriddhi Account Saving Scheme For Girl Child SA POST

Sukanya Samriddhi Account Saving Scheme For Girl Child SA POST

Sukanya Samriddhi Account Tax Benefits PPT

Sukanya Samridhi Account Sukanya Samridhi Yojana Poster 3 SA POST

33 Sukanya Samriddhi Yojana Calculator HarjeetJosiah

Sukanya Samriddhi Account Tax Rebate - Web 13 juin 2020 nbsp 0183 32 Latest News Date 20 May 2021 The Income Tax Department extends the following due dates Income Tax Return filing date extended to 31st Dec 21 from 30th