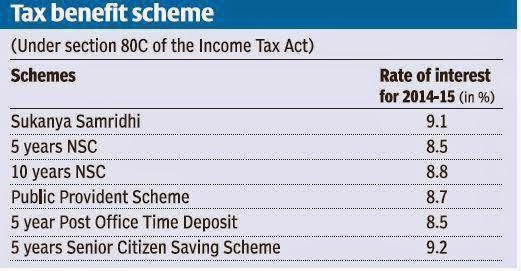

Sukanya Samriddhi Yojana Tax Rebate Web 21 sept 2022 nbsp 0183 32 Tax Benefits Investments made in the sukanya yojana are eligible for a tax deduction You can claim a deduction upto Rs 1 5 lakh under section 80C Also interest earned and maturity amount are also

Web 24 sept 2021 nbsp 0183 32 1 Investment made under Sukanya Samriddhi Yojana Scheme is eligible for deduction under Section 80C conditional on maximum of Rs 1 5 lakh 2 The interest Web 17 f 233 vr 2022 nbsp 0183 32 The Sukanya Samriddhi Yojana scheme is currently offering 7 6 for the quarter ending September 30 2022 The scheme comes with various tax benefits For

Sukanya Samriddhi Yojana Tax Rebate

Sukanya Samriddhi Yojana Tax Rebate

https://www.mppeb.org/wp-content/uploads/2022/07/Sukanya-Samriddhi-Yojana-Tax-Benefit.png

Sukanya Samriddhi Yojana 22 50

https://biharhelp.in/wp-content/uploads/2023/04/Sukanya-Samriddhi-Yojana-3.jpeg

Sukanya Samriddhi Yojana SSY Calculator Your Child May Have 51 Lakh

https://www.livemint.com/lm-img/img/2023/05/20/600x338/Sukanya_Samriddhi_Yojana_SSY_calculator_1684551801758_1684551801959.jpg

Web 30 mars 2020 nbsp 0183 32 Date 20 May 2021 The Income Tax Department extends the following due dates Income Tax Return filing date extended to 31st Dec 21 from 30th Sep 2021 Web 17 juil 2023 nbsp 0183 32 Self employed individuals can claim deduction of maximum 1 50 000 for APY Investments that are up to 20 of their annual income

Web Most of these schemes are eligible for tax rebates under Section 80C for the deposit amount A few schemes like the PPF the Sukanya Samriddhi Yojana etc also have the interest earned amount exempted from Web 10 ao 251 t 2018 nbsp 0183 32 4 Tax rebate The scheme offers a tax benefit of Rs 1 5 lakh under section 80C of the Income tax Act Moreover the accrued interest and maturity amount are also

Download Sukanya Samriddhi Yojana Tax Rebate

More picture related to Sukanya Samriddhi Yojana Tax Rebate

Sukanya Samriddhi Yojana 2023

https://naukaritime.com/wp-content/uploads/2023/01/photo_2023-01-07_11-52-18-1.jpg

Sukanya Samriddhi Yojana How The Scheme Offers Highest Tax free Return

https://i.pinimg.com/originals/a9/f4/ce/a9f4ce5a3f745a63009daadb0626ad05.jpg

Sukanya Samriddhi Yojana How To Accumulate 63 Lakh When Your Girl

https://www.livemint.com/lm-img/img/2023/04/21/600x338/Sukanya_Samriddhi_Yojana_Calculator_1682038093413_1682038093683.jpg

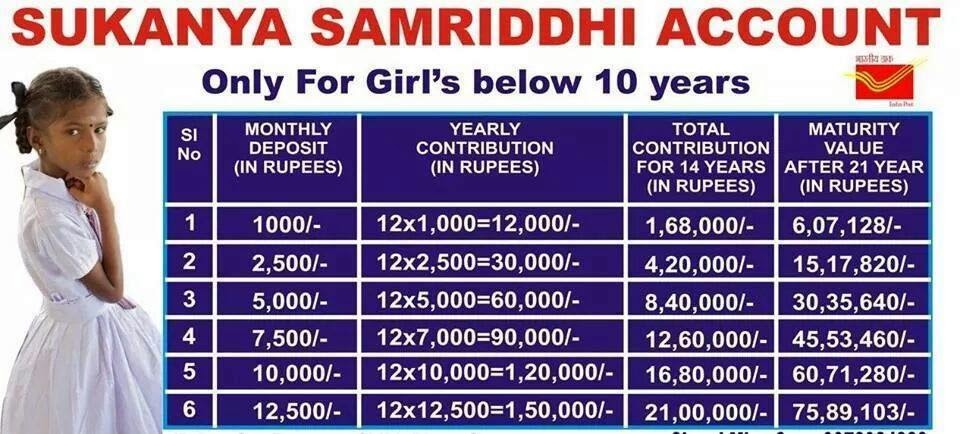

Web On 23 July 2018 the criteria for minimum annual deposit for the Sukanya Samriddhi Yojana account has been revised to Rs 250 from the earlier amount of Rs 1 000 Also Web 4 ao 251 t 2023 nbsp 0183 32 Sukanya Samriddhi Yojana is a government backed small savings scheme for the benefit of a girl child It is a part of the

Web 3 mars 2022 nbsp 0183 32 The amount received on maturity or withdrawal from the Sukanya Samriddhi Account is also tax exempt u s 10 11A Investments made in Sukanya Samriddhi Web 1 sept 2023 nbsp 0183 32 Benefits The Minimum Investment is 250 per annum The Maximum Investment is 1 50 000 per annum The Maturity Period is 21 years At present SSY

Sukanya Samriddhi Yojana 2023 2023

http://skresult.com/wp-content/uploads/2023/03/Sukanya-Samriddhi-Yojana-2023.jpg

Sukanya Samriddhi Yojana

https://studycafe.in/wp-content/uploads/2021/09/SUKANYA-SAMRIDDHI-YOJANA-AND-TAX-BENEFITS-AROUND-IT.jpg

https://www.etmoney.com/learn/saving-schem…

Web 21 sept 2022 nbsp 0183 32 Tax Benefits Investments made in the sukanya yojana are eligible for a tax deduction You can claim a deduction upto Rs 1 5 lakh under section 80C Also interest earned and maturity amount are also

https://taxguru.in/income-tax/sukanya-samriddhi-yojana-tax-benefits.html

Web 24 sept 2021 nbsp 0183 32 1 Investment made under Sukanya Samriddhi Yojana Scheme is eligible for deduction under Section 80C conditional on maximum of Rs 1 5 lakh 2 The interest

SUKANYA SAMRIDDHI YOJANA Save Money For Daughters With TAX Benefits

Sukanya Samriddhi Yojana 2023 2023

Sukanya Samriddhi Yojna How To Open SSY Account Tax Benefits Tax2win

Sukanya Samridhi Account Sukanya Samridhi Yojana Poster 3 SA POST

Sukanya Samriddhi Yojana 66 Lakhs You Will Get Tax Free In This

Sukanya Smrudhi Yojana Full Details Freshgujarat

Sukanya Smrudhi Yojana Full Details Freshgujarat

Sukanya Samriddhi Account Yojana At A Glance SA POST

Sukanya Samriddhi Yojana JMS Concern Pvt Ltd

Sukanya Samriddhi Yojana SSY Eligibility Tax Benefits

Sukanya Samriddhi Yojana Tax Rebate - Web Most of these schemes are eligible for tax rebates under Section 80C for the deposit amount A few schemes like the PPF the Sukanya Samriddhi Yojana etc also have the interest earned amount exempted from