Superannuation Contributions Tax Rebate Web You typically pay 15 tax on your super contributions and your withdrawals are tax free if you re 60 or older The investment earnings on your super are also only taxed at 15

Web Super contributions too much can mean extra tax There are limits to the amount you can contribute to your super each year If you exceed these contribution caps you Web Unlike the Division 293 tax which reduces the net tax benefit achieved by higher income earners for contributing to super the Low Income Super Tax Offset provides an effective

Superannuation Contributions Tax Rebate

Superannuation Contributions Tax Rebate

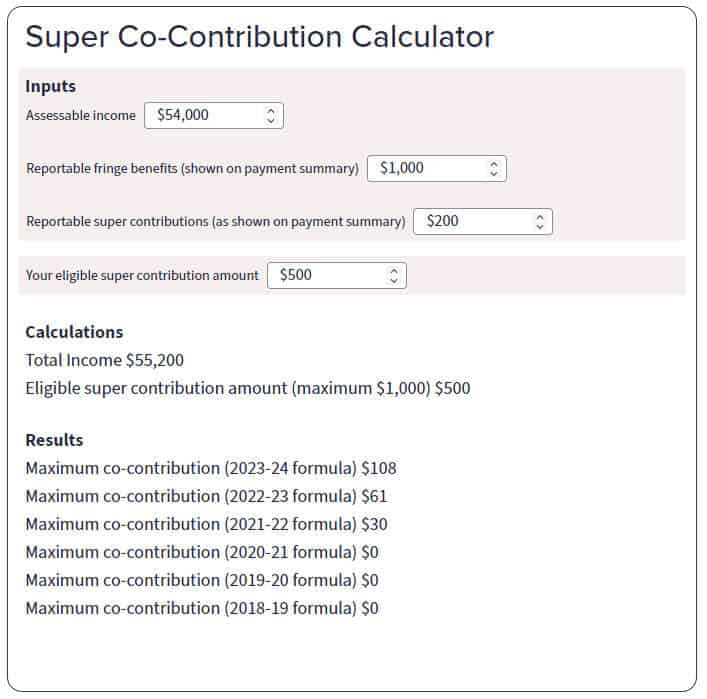

https://atotaxrates.info/wp-content/uploads/2023/06/super-co-contribution-calculator-upto-2023-24.jpg

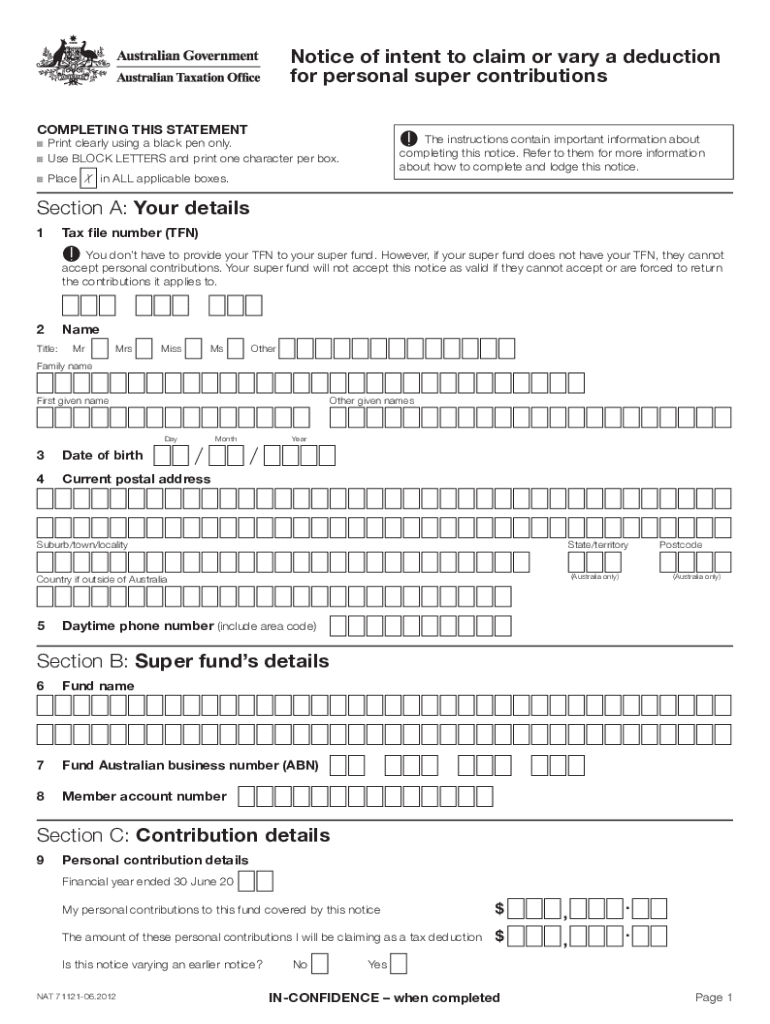

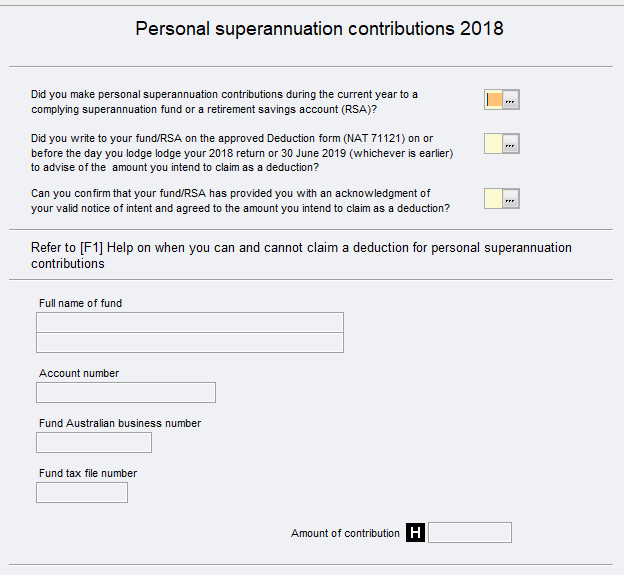

Deduction For Personal Super Contributions Australian Taxation Office

https://www.pdffiller.com/preview/40/87/40087362/large.png

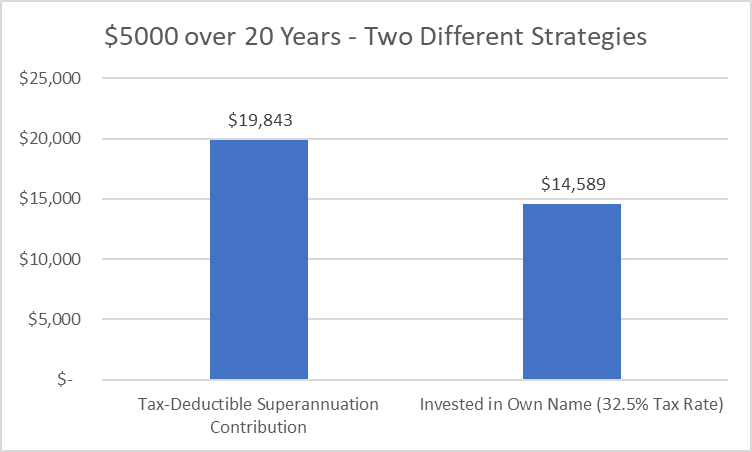

The Newest Tax Effective Superannuation Contribution Eureka Report

https://cdn-blob.investsmart.com.au/public/ckbunker/images/image-20210621092304-1.png

Web If your taxable income is less than 37 000 your contributions tax is refunded back to your super account under the low income super tax offset LISTO scheme If your combined taxable income and concessional Web 30 juin 2021 nbsp 0183 32 You are entitled to a tax offset of up to 540 for 2021 22 if the sum of your spouse s assessable income excluding any assessable First home super saver released

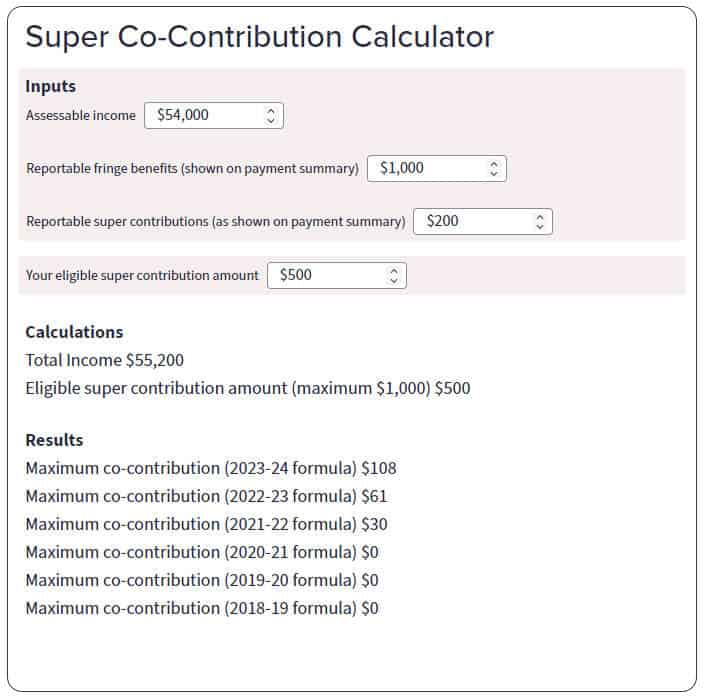

Web 1 juil 2023 nbsp 0183 32 The concessional contributions cap remains at 27 500 for the 2023 24 financial year Web If you are a low or middle income earner and make personal after tax super contributions to your super fund the Government also contributes to your super called super co

Download Superannuation Contributions Tax Rebate

More picture related to Superannuation Contributions Tax Rebate

Superannuation Contributions Australia Have A Question

https://support.planwithvoyant.com/hc/article_attachments/4409581327259/mceclip2.png

Non Concessional Superannuation Contributions Post Tax

https://desk.zoho.com/DocsDisplay?zgId=42995508&mode=inline&blockId=2pzk9e35fd51fa1df48699055f3069f4ba508

Non Concessional Superannuation Contributions Post Tax

https://desk.zoho.com/DocsDisplay?zgId=42995508&mode=inline&blockId=bwqpa88d77522d24046e0b2b49c6ecf5f749d

Web How to save for retirement via superannuation your entitlements and obligations when you can withdraw your super What is super If you re new to Australia s superannuation Web 30 juin 2021 nbsp 0183 32 You are entitled to a tax offset of up to 540 for 2021 22 if the sum of your spouse s assessable income excluding any assessable First home super saver released

Web If you earn 37 000 or less the tax is paid back into your super account through the low income super tax offset LISTO If your income and super contributions combined are Web If you earn an adjusted taxable income up to 37 000 you may be eligible to receive a refund into your superannuation account of the tax paid on your eligible concessional

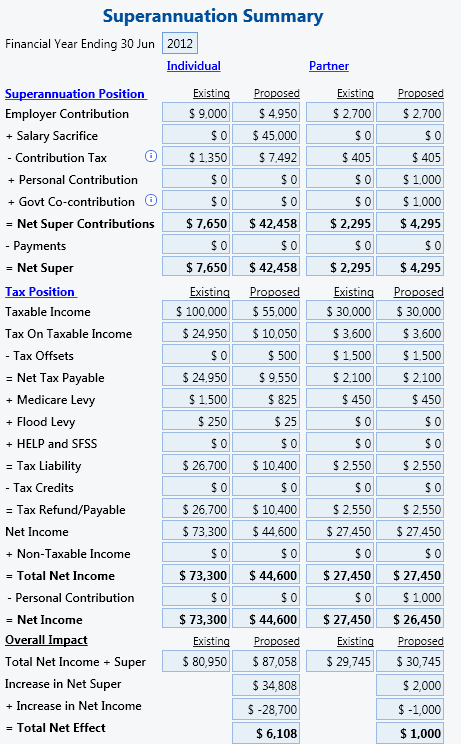

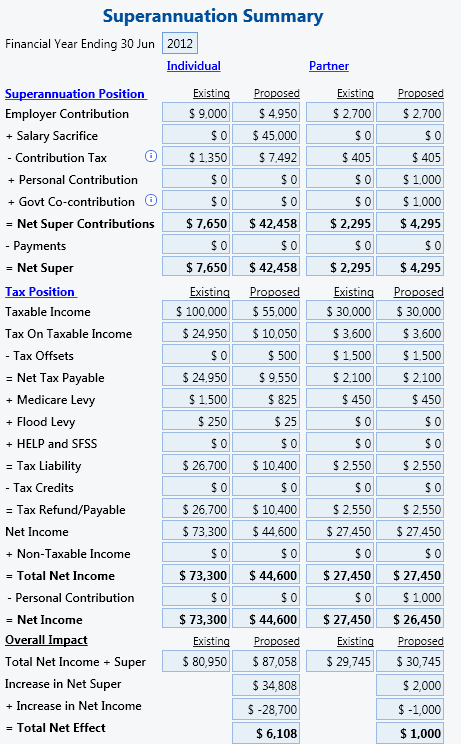

Plansoft Calculator Features Superannuation Contributions

http://www.plansoft.com.au/images/screenshots/SuperannuationSummary1.png

Super Contributions Tax Needs Rethink

https://media-exp1.licdn.com/dms/image/C5612AQHMJAHHFhhgng/article-cover_image-shrink_720_1280/0/1629429602935?e=2147483647&v=beta&t=djm2aMFby8fHiRz0f8rtgTWxzXcjJLHKBV-PLeMNL2M

https://aware.com.au/member/super/understand-super-basics/how-super-i…

Web You typically pay 15 tax on your super contributions and your withdrawals are tax free if you re 60 or older The investment earnings on your super are also only taxed at 15

https://www.ato.gov.au/.../2022/In-detail/Personal-super-contributions

Web Super contributions too much can mean extra tax There are limits to the amount you can contribute to your super each year If you exceed these contribution caps you

Non Concessional Superannuation Contributions Post Tax

Plansoft Calculator Features Superannuation Contributions

Superannuation Employer Contributions Your Payroll AU

Superannuation Form Fill Online Printable Fillable Blank PdfFiller

Personal Superannuation Deductions In Individual Tax Return ITR LodgeiT

Superannuation Guarantee 2023 Atotaxrates info

Superannuation Guarantee 2023 Atotaxrates info

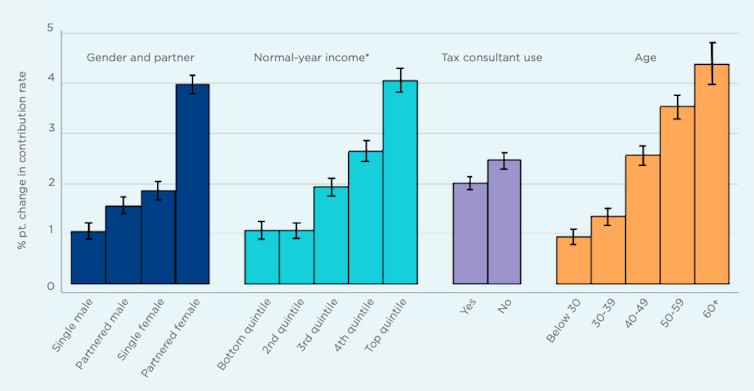

Deakin Business School Super Co contribution Has Cost 10 Billion To

V letlen l Szemafor Hossz Super Fund Personal Visszan z Sz n szn

New Superannuation Contribution Limits For 2017 18

Superannuation Contributions Tax Rebate - Web Todd s superfund acknowledges that Todd will claim a 15 000 deduction and taxes the contribution at 15 2 250 Todd is eligible to claim a deduction for 15 000 and does