Tax After Rebate Meaning Web 20 mars 2018 nbsp 0183 32 A rebate is an amount by which SARS reduces the actual taxes owing depending on certain circumstances SARS will calculate the amount of tax that you owe to them based on your income and expenses throughout the year then if certain conditions apply they ll reduce the amount due The most common rebate in tax terms is for age

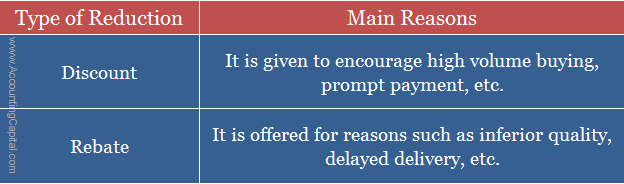

Web noun C TAX FINANCE uk us Add to word list an amount of money that is paid back to you if you have paid too much tax More than 2 million taxpayers will receive checks totaling 1 billion because of the federal tax rebate program a reduction in the amount of tax that has to be paid on something Web 22 janv 2022 nbsp 0183 32 A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the investor who loaned the

Tax After Rebate Meaning

Tax After Rebate Meaning

https://incentiveinsights.com/wp-content/uploads/2022/09/inis-pros-cons-of-rebates-1024x1024.png

What Is Rebate GETBATS Blog

https://blog.getbats.com/uploads/images/202104/image_750x_6076631b4a6c9.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Web 12 f 233 vr 2023 nbsp 0183 32 Refundable tax credits do provide you with a refund if they have money left over after reducing your tax bill to zero As a result they re considered more valuable than nonrefundable tax credits Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds because governments can enact them at

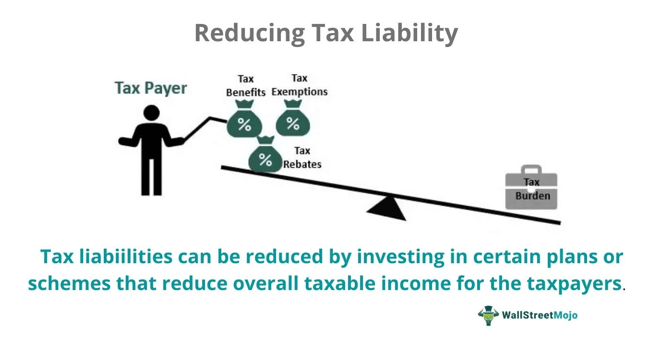

Web 2 mars 2023 nbsp 0183 32 Tax relief is any program or incentive that reduces the amount of tax owed by an individual or business entity Examples of tax relief include the allowable deduction for pension contributions Web a reduction in the amount of tax that has to be paid on something They are negotiating a property tax rebate for elderly home owners Definition of tax rebate from the Cambridge Business English Dictionary 169 Cambridge University Press

Download Tax After Rebate Meaning

More picture related to Tax After Rebate Meaning

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Cash Rebates Stock Photos Free Royalty Free Stock Photos From

https://thumbs.dreamstime.com/b/financial-concept-meaning-tax-rebate-phrase-sheet-229273572.jpg

Web Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilit 233 Web Tax rebate and TDS Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of Rs 2 500 is available for taxpayers with an annual income of up to Rs 3 5 lakh as applicable to the financial year 2018 19

Web 21 sept 2022 nbsp 0183 32 an amount of money that is paid back to you after you have paid too much She thinks she is due a tax rebate Any homeowner who has had a devaluation in their property is eligible for a rebate A good number of senior citizens across the state have still not applied for their rebates Web When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money is refunded at the end of the fiscal year For claiming a tax refund one needs to file an

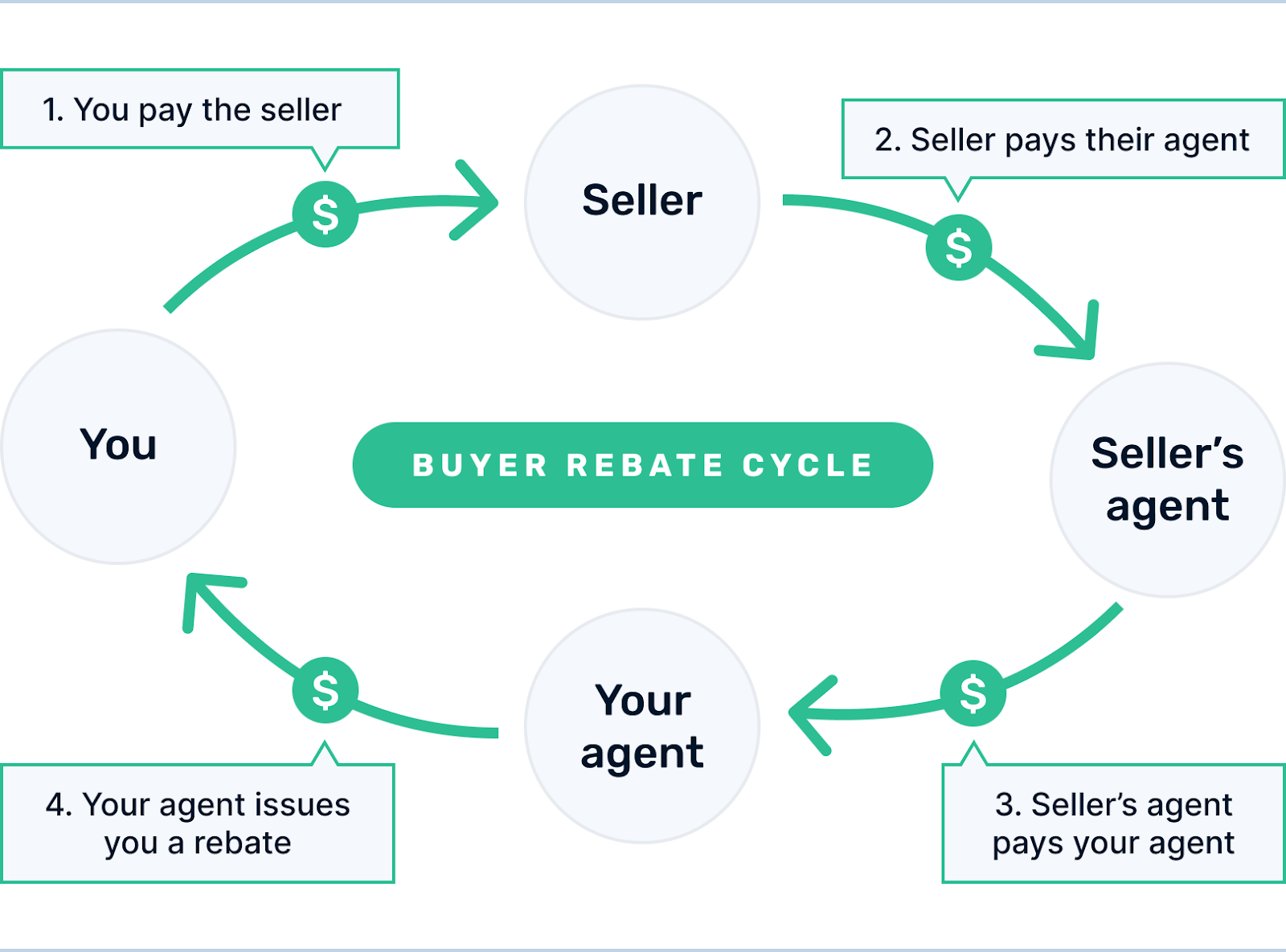

Home Buyer Rebates Get Cash Back When You Buy

https://cosmic-s3.imgix.net/463c8790-7c97-11eb-abfb-1b324c629d39-RebateCycle2.png?auto=format&w=430px&q=20

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

https://www.taxtim.com/za/blog/the-3-rs-returns-rebates-and-refunds...

Web 20 mars 2018 nbsp 0183 32 A rebate is an amount by which SARS reduces the actual taxes owing depending on certain circumstances SARS will calculate the amount of tax that you owe to them based on your income and expenses throughout the year then if certain conditions apply they ll reduce the amount due The most common rebate in tax terms is for age

https://dictionary.cambridge.org/dictionary/english/tax-rebate

Web noun C TAX FINANCE uk us Add to word list an amount of money that is paid back to you if you have paid too much tax More than 2 million taxpayers will receive checks totaling 1 billion because of the federal tax rebate program a reduction in the amount of tax that has to be paid on something

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

Home Buyer Rebates Get Cash Back When You Buy

Tax Liability Meaning Formula Calculation How It Works

Difference Between Discount And Rebate with Example

Difference Between Rebate And Discount Difference Between

How To Choose Between The New And Old Income Tax Regimes Chandan

How To Choose Between The New And Old Income Tax Regimes Chandan

Tax Rebates Stock Photos Free Royalty Free Stock Photos From Dreamstime

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

FREE AFTER REBATE Tax Software Freebie Depot

Tax After Rebate Meaning - Web 1 sept 2023 nbsp 0183 32 tax rebate in British English t 230 ks ri be t noun tax money paid back to a person or company when they have paid too much tax Thousands of people have been sent scam emails suggesting that they are due a tax rebate and requesting bank and credit card details Collins English Dictionary