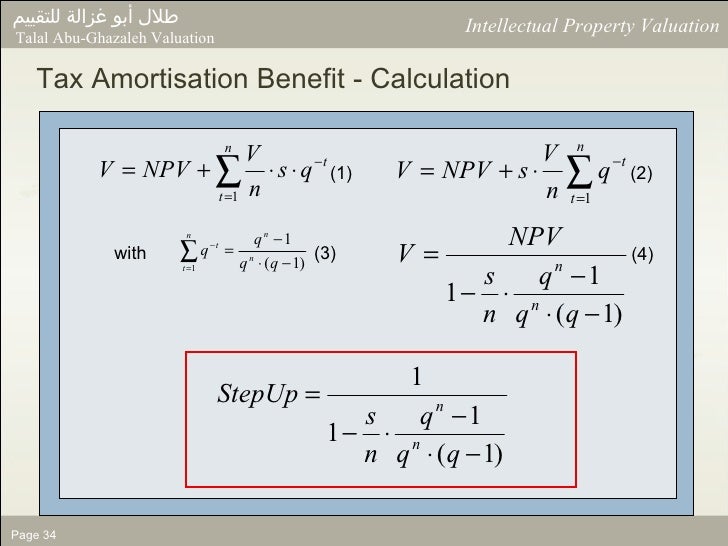

Tax Amortization Benefit Formula What is the Tax Amortisation Benefit TAB Tax amortisation benefit TAB refers to the net present value of income tax savings resulting from the amortisation of intangible assets Amortisation of assets decreases the net taxable income and thereby the corporate income tax to be paid as cash

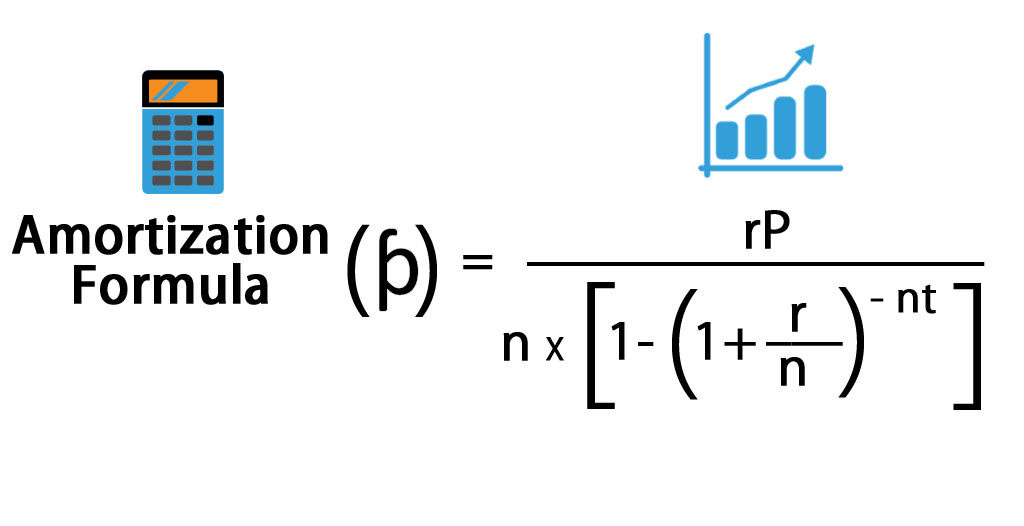

Tax Amortization Benefit TAB in accounting refers to the tax savings a company enjoys by eliminating amortization expenses associated with intangible assets The sole purpose of TAB is to deduct amortization expenses incurred on intangible assets Calculate the tax amortization benefit AB using the following formula AB PVCF n n PVA T 1 For example AB 61 45 10 10 6 14 30 1 Therefore AB 85 85

Tax Amortization Benefit Formula

Tax Amortization Benefit Formula

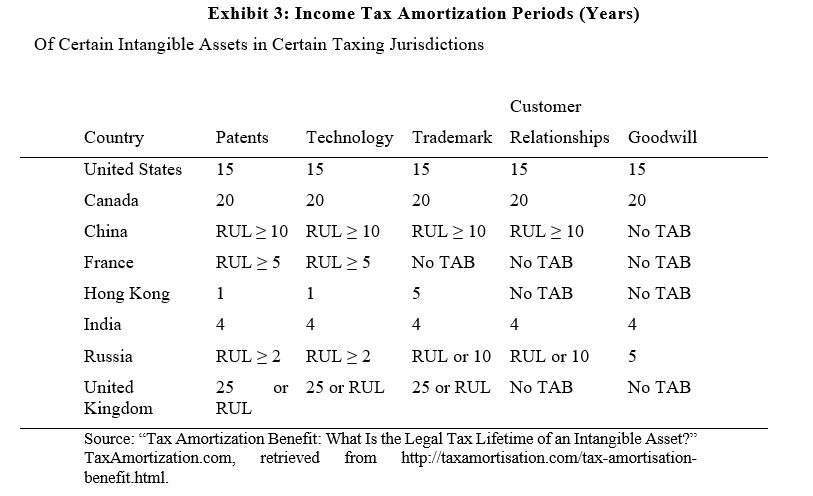

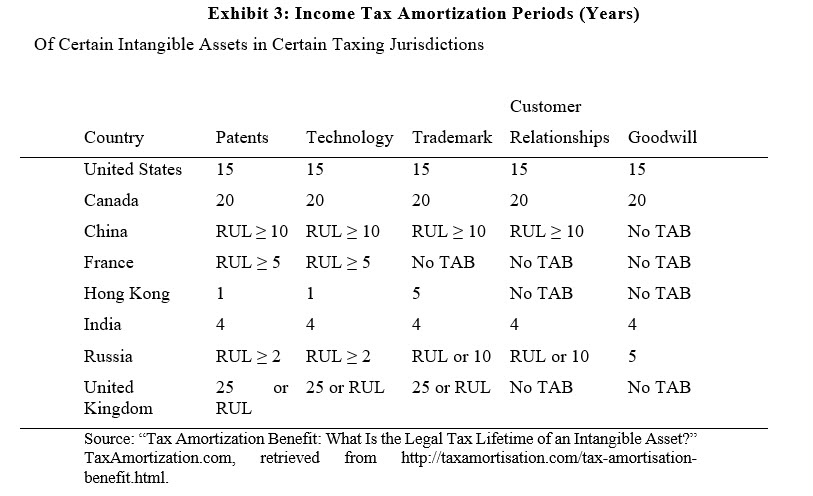

https://quickreadbuzz.com/wp-content/uploads/2021/05/TAB-Exhibit3.jpg

Amortization Formula Calculator With Excel Template Good Idea

https://cdn.educba.com/academy/wp-content/uploads/2019/01/Amortization-Formula-1.jpg

Application Of The Tax Amortization QuickRead News For The

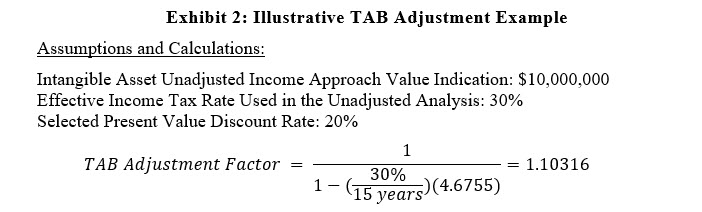

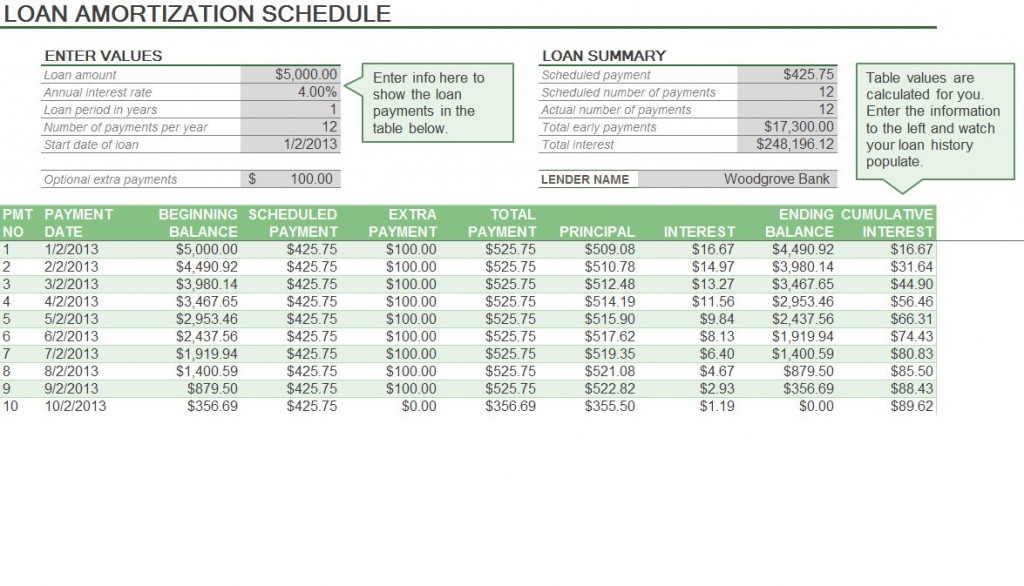

https://i0.wp.com/quickreadbuzz.com/wp-content/uploads/2021/05/TAB-Exhibit1.jpg?ssl=1

The TAB relates to the benefit arising from an hypothetical amortisation of an acquired asset if the amortisation would be or is recognisable as expense in the tax statement In consequence the size of the tax benefit will depend on the applicable tax rate Enter the tax rate discount rate and useful life of the asset into the calculator to determine the Tax Amortisation Benefit Factor

The TAB Tax Amortisation Benefit Factor is a crucial metric for understanding the tax savings that a company can achieve due to the tax deductible depreciation of an asset This factor is important for financial modeling and determining the net present value of investments Tax amortisation benefit TAB refers to the net present value of income tax savings resulting from the amortisation of intangible assets

Download Tax Amortization Benefit Formula

More picture related to Tax Amortization Benefit Formula

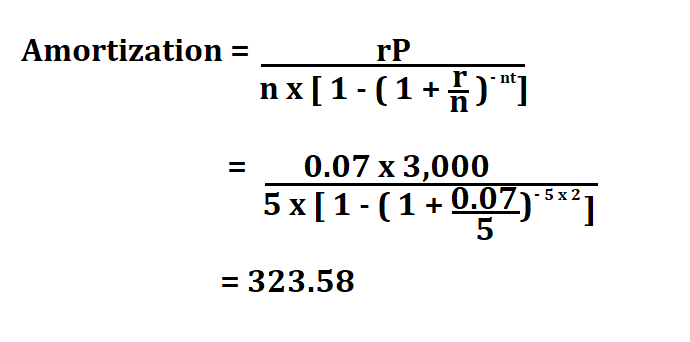

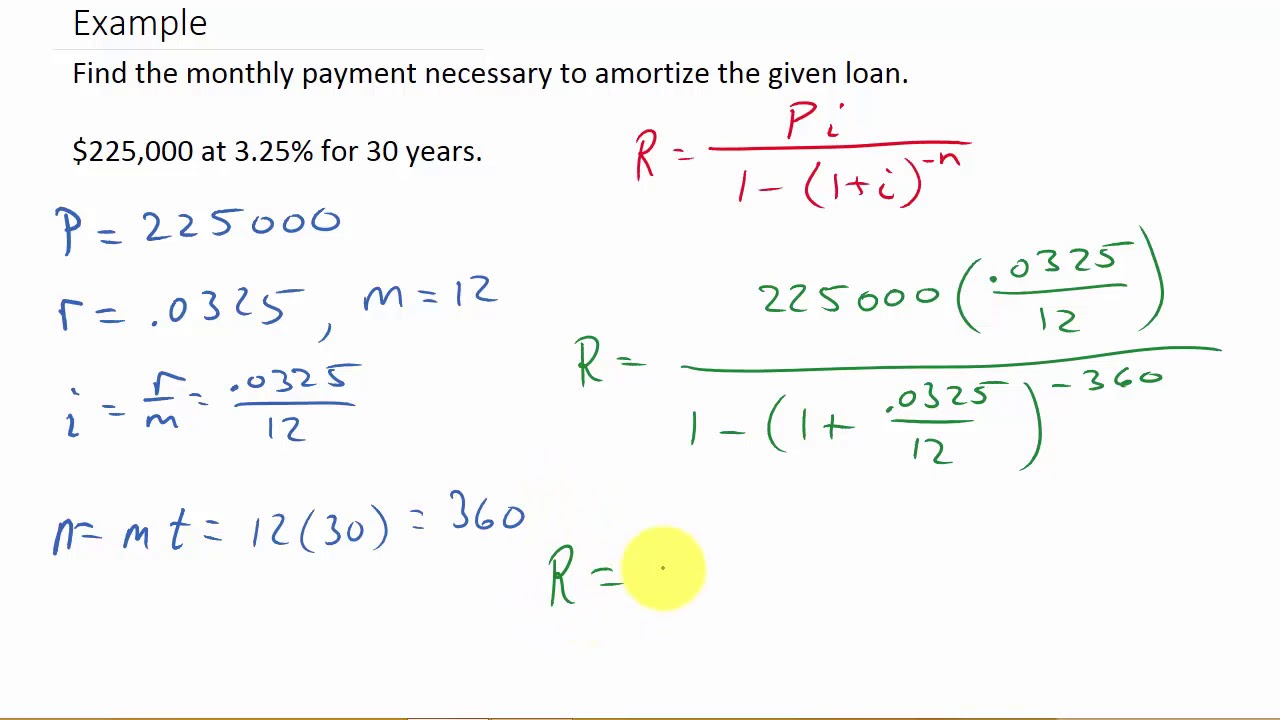

How To Calculate Amortization

https://www.learntocalculate.com/wp-content/uploads/2021/03/amortization-2.png

Application Example Of Tax Amortisation Benefit Factor Tax

http://www.taxamortisation.com/typo3temp/pics/1_Value_before_f4b8925713.png

Application Of The Tax Amortization QuickRead News For The

https://quickreadbuzz.com/wp-content/uploads/2021/05/TAB-Exhibit2.jpg

To calculate the tax amortization benefit TAB in a specific example we need the following information Intangible asset Let s assume we have a patent with a value of 1 000 000 Amortization period The patent has an amortization period of 10 years Tax rate The applicable tax rate is 30 The Tax Amortization Benefit TAB in the UK refers to the tax relief obtained by spreading the cost of intangible assets like intellectual property patents and goodwill over their useful life

[desc-10] [desc-11]

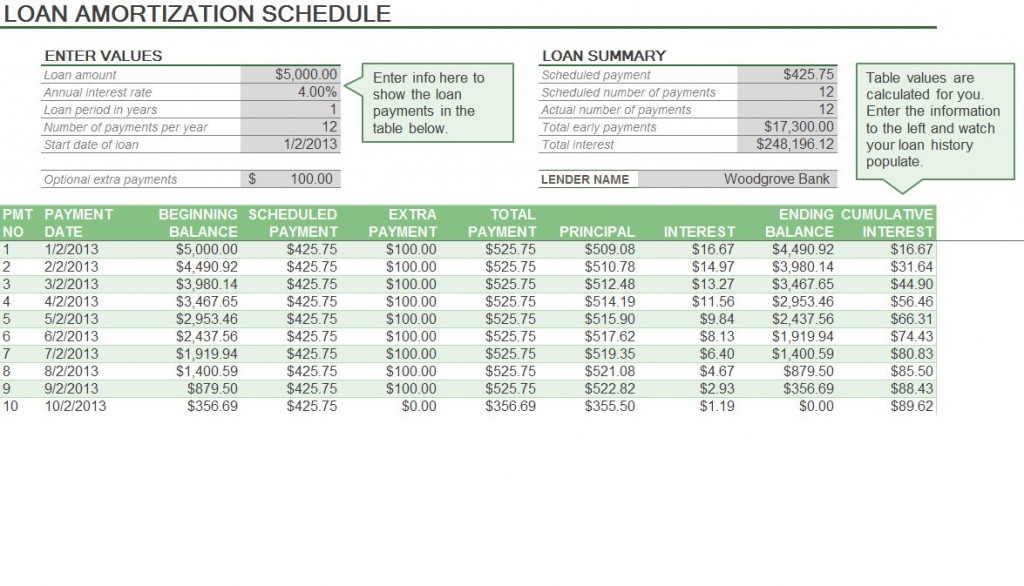

Amortization Schedule Formula Amortization Schedule

http://exceltemplates.net/wp-content/uploads/2014/02/Amortization-Schedule-Formula-1024x586.jpg

Calculate Amortization Automatically Manager

https://global.discourse-cdn.com/business5/uploads/manager1/original/3X/c/9/c95ef74951f6072822276addea0cad25febc7ab9.png

http://www.taxamortisation.com › theoretical-background.html

What is the Tax Amortisation Benefit TAB Tax amortisation benefit TAB refers to the net present value of income tax savings resulting from the amortisation of intangible assets Amortisation of assets decreases the net taxable income and thereby the corporate income tax to be paid as cash

https://www.wallstreetmojo.com › tax-amortization-benefit

Tax Amortization Benefit TAB in accounting refers to the tax savings a company enjoys by eliminating amortization expenses associated with intangible assets The sole purpose of TAB is to deduct amortization expenses incurred on intangible assets

Mozer Methods Of Valuation

Amortization Schedule Formula Amortization Schedule

How To Calculate Amortization Payments YouTube

Tax Amortization Benefit Maximizing Tax Savings For Your Business

What Is Tax Amortization Benefit Remote Books Online

Tax Amortization Benefit

Tax Amortization Benefit

Did You Know Amortization Is The Schedule Of Your Monthly Mortgage

What Is Deferred Tax Liability DTL Formula Calculator

What Is Amortization Of Intangible Assets Formula Calculator

Tax Amortization Benefit Formula - [desc-14]