Tax Back On Rent Paid There are two alternative ways to report rental income and pay tax on it in advance before the year has ended One option is to ask for a revised tax card on

You can now claim your Rent Tax Credit for the 2023 tax year on your Income Tax Return If you have Pay As You Earn PAYE income you can do this through In general we recommend that you report the rental income you receive and the expenses of renting in advance This way your taxes are kept up to date and you

Tax Back On Rent Paid

Tax Back On Rent Paid

https://www.carunway.com/wp-content/uploads/2022/05/Rent-Paid-JE.png

The Best Way To Collect Rent From Tenants Millionacres

https://m.foolcdn.com/media/millionacres/images/paying_rent_contract.width-1440.jpg

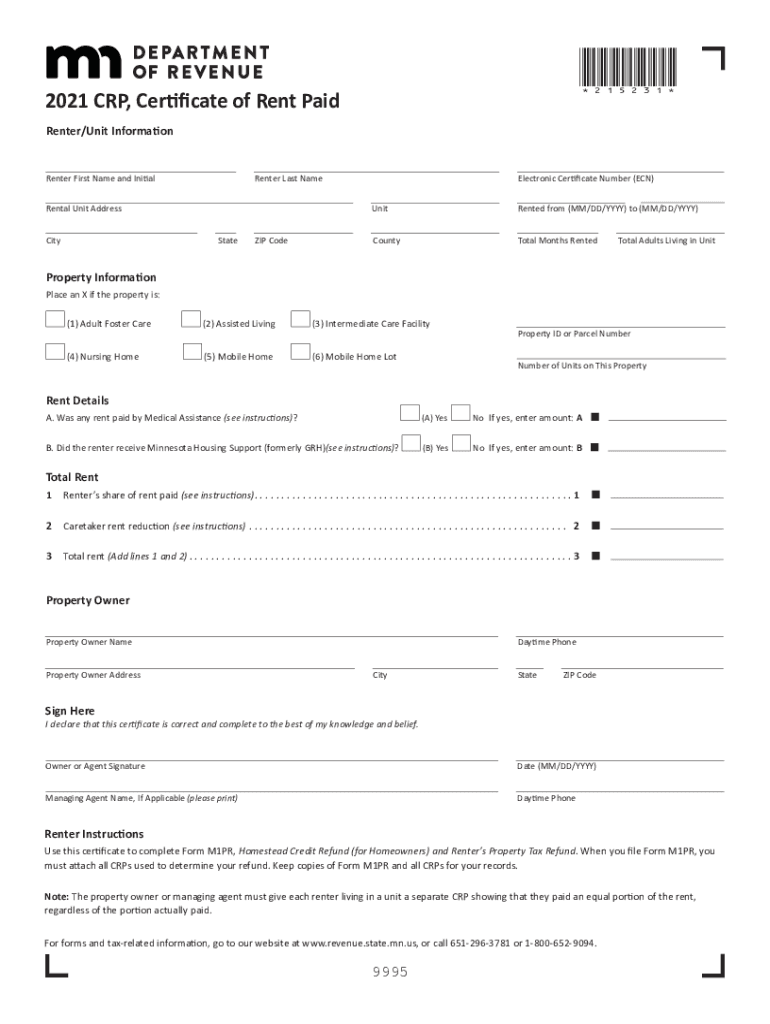

As A Landlord Making A Certificate Of Rent Paid Every Time For A

https://i.pinimg.com/originals/aa/99/64/aa9964ee47fd3aabcdef4371f997d18c.jpg

The tax credit reduces the income tax you owe by the amount of the credit You can claim the tax credit for rent payments you made in 2022 or 2023 by making an There are three provinces that offer tax benefits or credits that you can claim your rent within Ontario Manitoba and Quebec Second self employed individuals may be able

You can claim back tax and personal allowances as a UK non resident on any UK income you receive in the current tax year or in the last 4 tax years Before you The new rent tax credit is worth 500 per year from 2023 and 750 from 2024 for a single individual and 1 000 in 2023 and 1 500 from 2024 for a married couple Currently anyone who meets the criteria

Download Tax Back On Rent Paid

More picture related to Tax Back On Rent Paid

Renters Rebate Mn 2021 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/578/948/578948407/large.png

How To Get Your Tax Back Tax Refund Tax Return Tax Rebate

https://accountinglogic.co.uk/wp-content/uploads/2022/10/38-1.png

Can I Claim Back Tax Paid In The US

https://static.wixstatic.com/media/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg/v1/fill/w_1000,h_667,al_c,q_90,usm_0.66_1.00_0.01/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg

To claim the tax credit for rent paid in 2022 you must make a tax return for 2022 You can claim the tax credit during the year for other years You can avail of the tax credit if in If you are a PAYE taxpayer you are able to claim the credit in year through myAccount for rent paid in 2024 You will need to Sign into myAccount Go to the

Anyone paying rent on private rental accommodation is entitled to claim the 500 rent tax credit this month that was introduced in Budget 2023 including parents You can claim the tax credit for rent paid in 2022 by making a tax return for 2022 You can claim the tax credit during the year for other years How much is the Rent Tax Credit

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/c/ca/Claim-Tax-Back-Step-15-Version-2.jpg

Monthly Rent Hilltop Vista Mobile Home Park

https://ozarkhilltopvista.com/wp-content/uploads/2018/07/pay-rent-1524670592.jpg

https://www.vero.fi/en/individuals/property/rental...

There are two alternative ways to report rental income and pay tax on it in advance before the year has ended One option is to ask for a revised tax card on

https://www.revenue.ie/en/personal-tax-credits...

You can now claim your Rent Tax Credit for the 2023 tax year on your Income Tax Return If you have Pay As You Earn PAYE income you can do this through

80GG Tax Benefit For Rent Paid

3 Ways To Claim Tax Back WikiHow

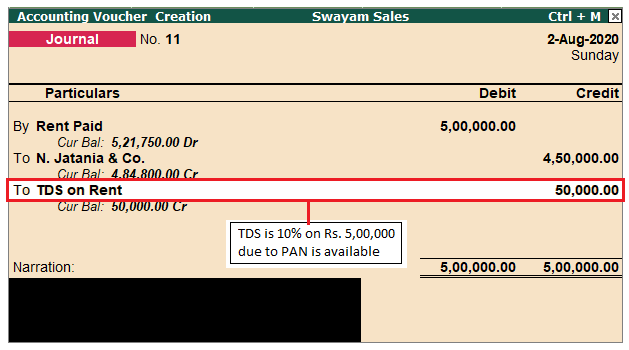

How To Record TDS Payment Entry In Tally ERP 9

Fillable Online Claim Income Tax Back On A Pension Death Benefit

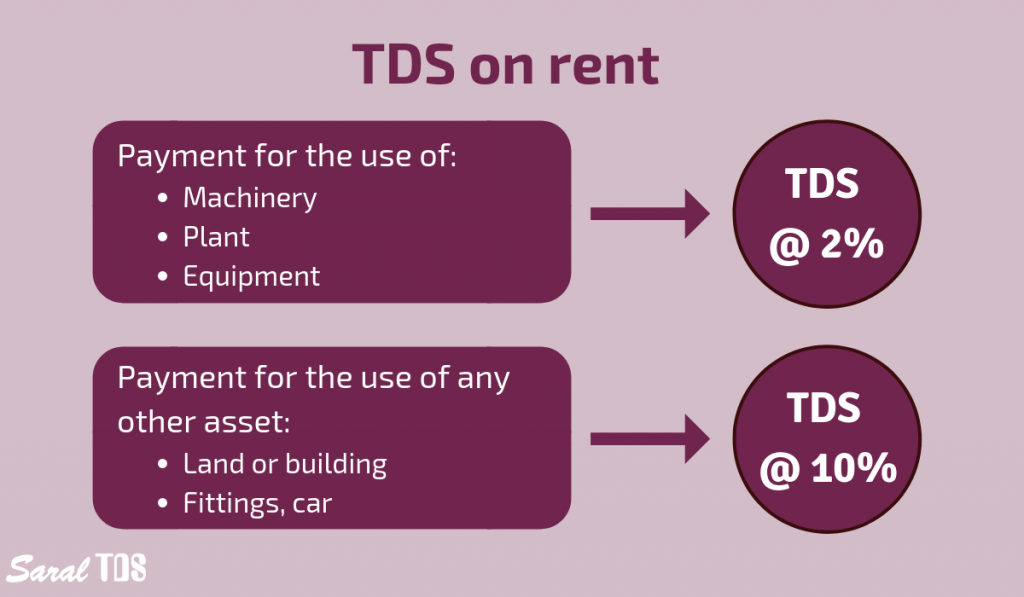

TDS On Rent Detailed Explanation On Section 194I

Balance Due Letter KathleenOlivarez Blog

Balance Due Letter KathleenOlivarez Blog

TDS Applicability On Rent Paid Under Income tax Act

Payment Request Template

Section 80GG Deduction On Rent Paid

Tax Back On Rent Paid - You can claim back tax and personal allowances as a UK non resident on any UK income you receive in the current tax year or in the last 4 tax years Before you