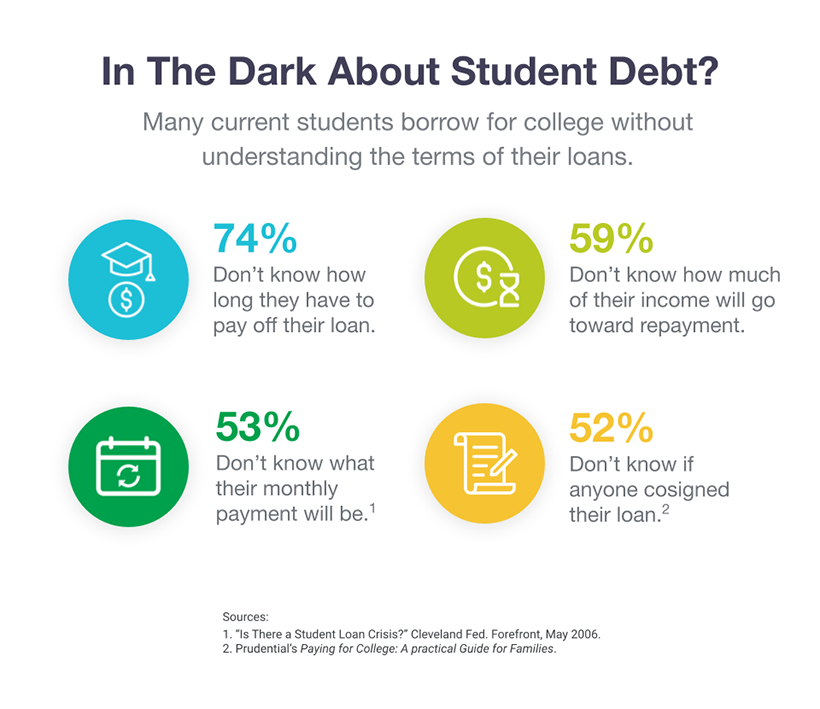

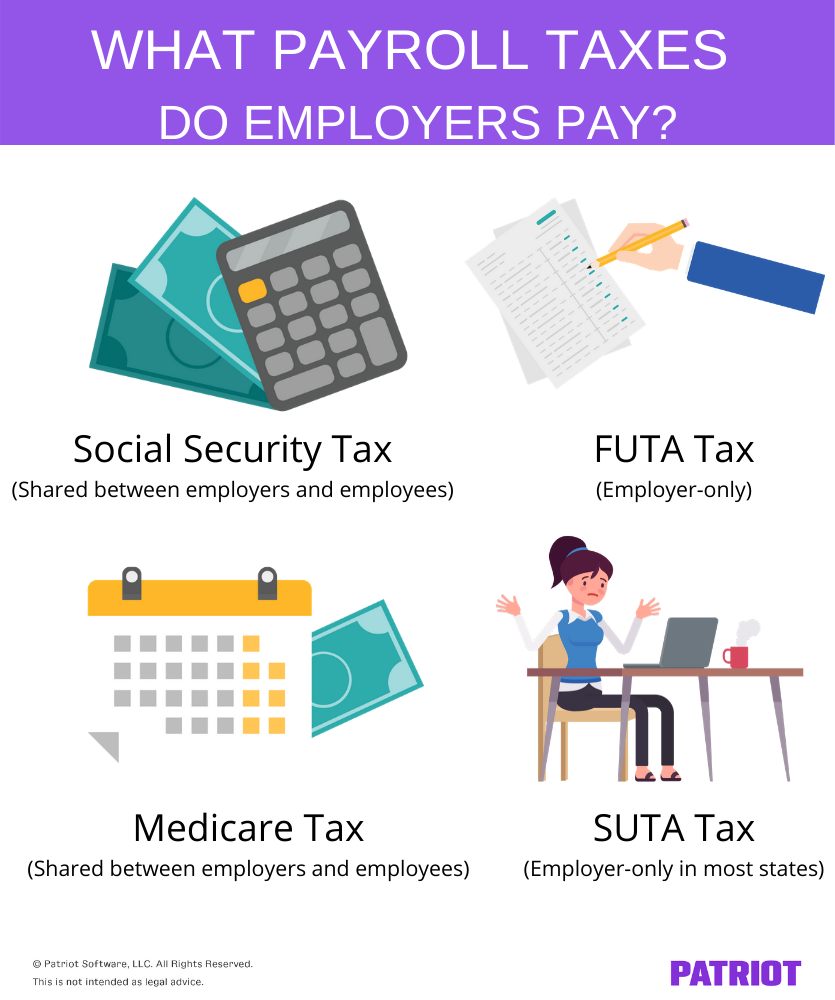

Tax Benefit For Employers Paying Student Loans You can give each employee up to 5 250 per year toward student loan payments Do not include this amount in the employee s income Keep in mind that the

By law tax free benefits under an educational assistance program are limited to 5 250 per employee per year Normally assistance provided above that level The Consolidated Appropriations Act 2021 CAA signed into law by President Donald Trump on Dec 27 extends for five years COVID 19 relief that allows

Tax Benefit For Employers Paying Student Loans

Tax Benefit For Employers Paying Student Loans

https://i.ytimg.com/vi/8dkTyZBmAjk/maxresdefault.jpg

Student Loans The Burden For Employers And Employees AccountingWEB

https://www.accountingweb.co.uk/sites/default/files/istock_39949292_medium.jpg

Pin On Writers Blog Posts

https://i.pinimg.com/originals/3c/87/1d/3c871d96ee1e3ce7733501b5e1dc3347.jpg

Until the end of 2020 employers can contribute up to 5 250 toward an employee s student loan balance and the payment will be free from payroll and income tax under a Through January 1 2026 up to a total of 5 250 annually in eligible education expenses including student loans can be paid by employers and excluded from an

By law tax free benefits under an educational assistance program are limited to 5 250 per employee per year Normally assistance provided above that level is taxable as wages Employees could get a tax free break on student loans if employers offer a benefit plan at the getty Student debt has more than tripled since 2006 That

Download Tax Benefit For Employers Paying Student Loans

More picture related to Tax Benefit For Employers Paying Student Loans

This Is Why You Should Pay Minimum Student Loan Payments Student Loan

https://i.pinimg.com/originals/6d/c4/dd/6dc4ddcaab532620035db11add7d21ef.jpg

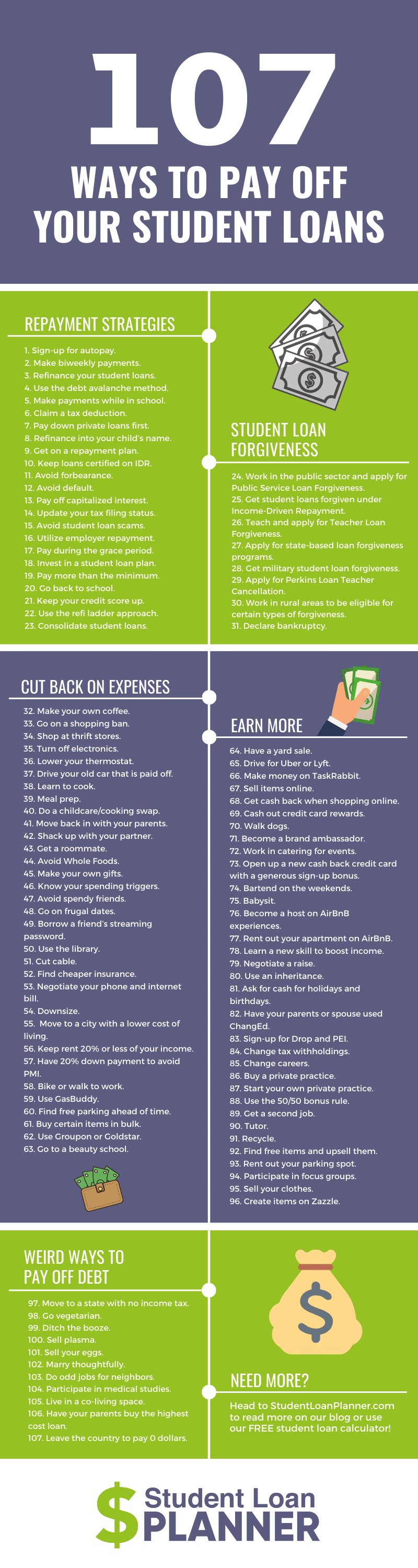

12 Strategies To Pay Off Student Loans Fast Reddit Beat Student Loans

https://i.pinimg.com/originals/6c/28/c2/6c28c266bf061fb371e66bbb360a2242.jpg

What Happens If You Don t Pay Student Loans MyBankTracker

https://d187qskirji7ti.cloudfront.net/news/wp-content/uploads/2014/10/student-debt.jpg

Any amount an employer pays to a student loan held by an employee up to 5 250 is qualified for the income and payroll tax exclusion if the payments are made Currently employers can provide up to 5 250 in student loan repayment annually as a tax free benefit for employees Understanding how these programs work and how to qualify can bring

Employers can offer employees up to 5 250 annually in student loan repayment benefits tax free through 2025 That provision was included in pandemic The employer student loan repayment benefit is double tax exempt What does this mean Employers and employees both do not have to pay income tax on up

U S Average Student Loan Debt Statistics In 2019 Credit

http://www.credit.com/wp-content/uploads/2019/06/payment-status-of-student-loans-by-race.png

Pros And Cons Of Refinancing Federal Student Loans Purefy

https://www.purefy.com/wp-content/uploads/2021/03/Pros-and-Cons-of-Refinancing-Student-Loans-1.png

https://www.patriotsoftware.com/blog/payroll/...

You can give each employee up to 5 250 per year toward student loan payments Do not include this amount in the employee s income Keep in mind that the

https://www.irs.gov/newsroom/reminder-to-employers...

By law tax free benefits under an educational assistance program are limited to 5 250 per employee per year Normally assistance provided above that level

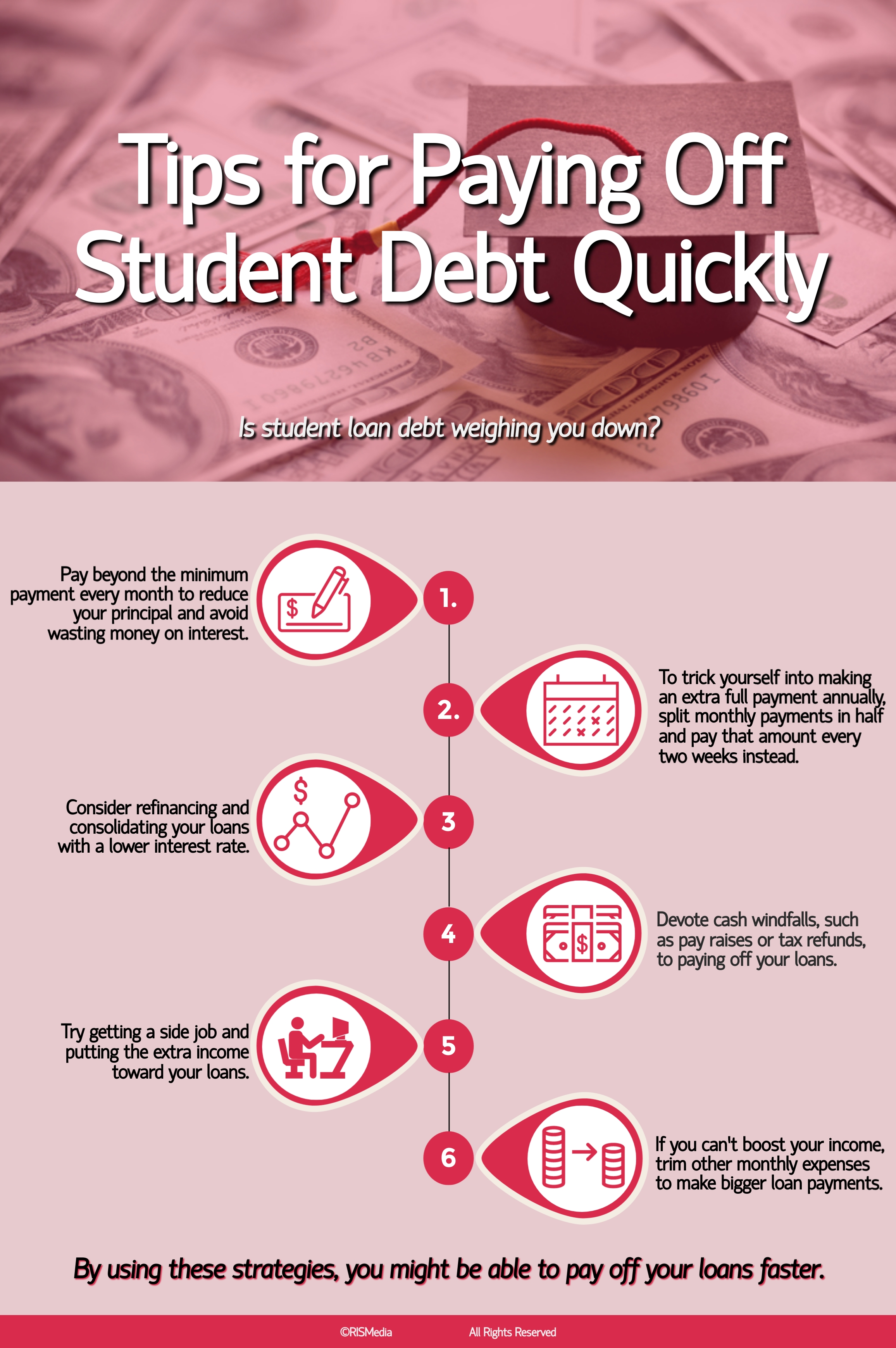

Tips For Paying Off Student Debt Quickly RISMedia

U S Average Student Loan Debt Statistics In 2019 Credit

This Is Why You Should Pay Minimum Student Loan Payments Student

How To Pay Off Your Student Loans More Quickly Student Loans Student

How To Pay Off Your Student Loan Debt Faster Student Loans Student

7 Ways To Pay Off Student Loans When You Can t Afford The Payments In

7 Ways To Pay Off Student Loans When You Can t Afford The Payments In

Payroll Taxes Paid By Employer Overview For Employers

107 Ways To Pay Off Student Loans Faster and Save Money MyDegree info

How To Pay Off Your Student Loans Student Loans Paying Student Loans

Tax Benefit For Employers Paying Student Loans - Until the end of 2020 employers can contribute up to 5 250 toward an employee s student loan balance and the payment will be free from payroll and income tax under a