Tax Benefit For Handicapped Person Disability tax benefits As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found

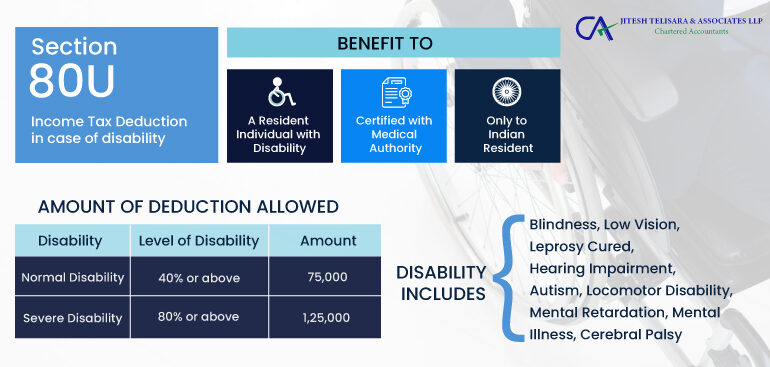

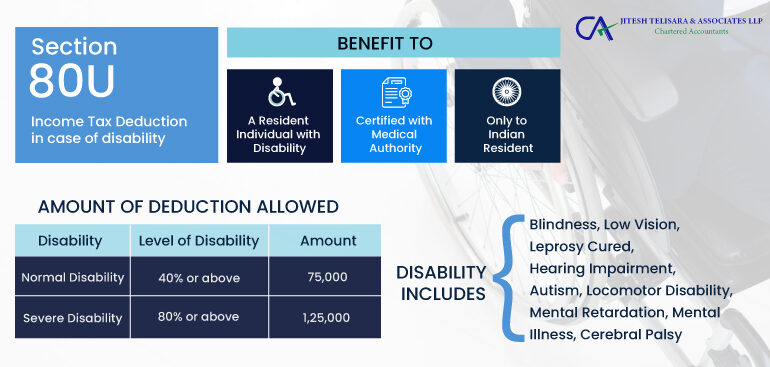

Section 80U offers tax benefits if an individual suffers a disability while Section 80DD offers tax benefits if an individual taxpayer s dependent family member s suffers from a disability This article is A number of tax deductions and exclusions benefit people who are on SSDI or SSI and they can also gain from a few special rules for tax advantaged savings and

Tax Benefit For Handicapped Person

Tax Benefit For Handicapped Person

https://www.lynchfinancialgroup.com/wp-content/uploads/2022/03/Depositphotos_67898957_XL-2048x1556.jpg

Reserved Handicapped Seating Disability Business Commercial Safety

https://i5.walmartimages.com/asr/b194af48-ea06-4d8f-afe9-36ac838d5b3e_1.a1b6c5e6dc03d1fdebf69494872bc1b5.jpeg

How Much Do You Need To Donate For Tax Deduction

https://wealthfit-staging.cdn.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg

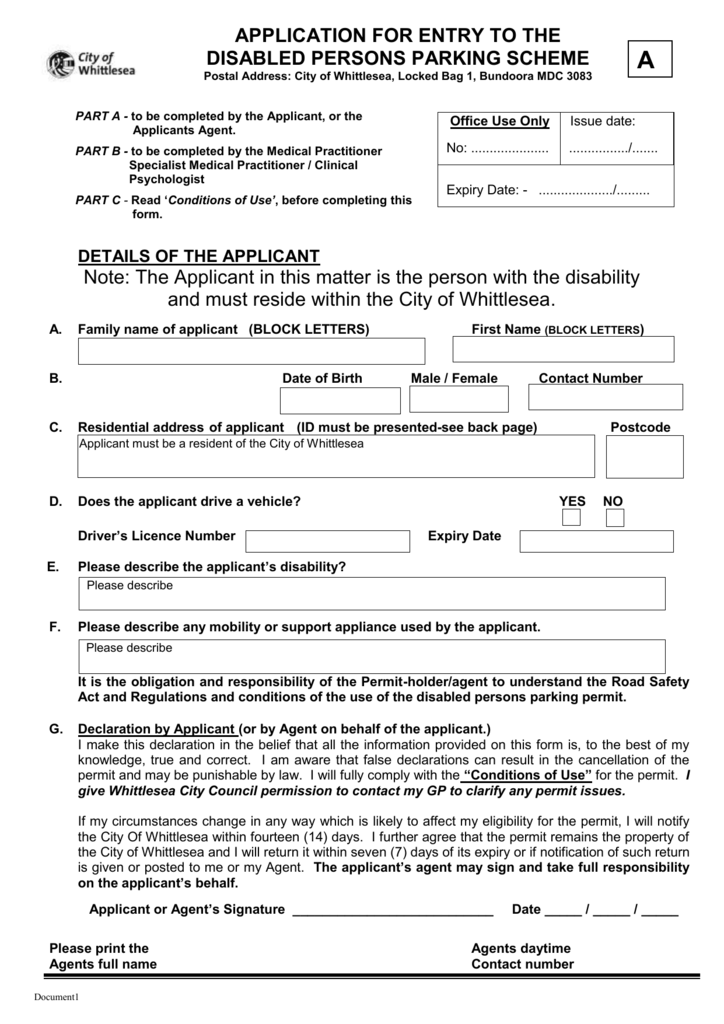

AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found If you re disabled you can apply for the following exemption from paying vehicle tax parking benefits Blue Badge disabled persons bus pass or Disabled Persons Railcard

If you re disabled and receive Social Security disability benefits either SSDI or SSI you can qualify for certain tax credits These credits will reduce the taxes you Achieving a Better Life Experience or ABLE accounts are tax advantaged savings accounts for individuals with disabilities and their families These accounts help

Download Tax Benefit For Handicapped Person

More picture related to Tax Benefit For Handicapped Person

Self employed Individuals Are Allowed To Take A Tax Deduction For Their

http://static1.squarespace.com/static/601c437c854ffc4d9f0aead9/6033c36413e8d937c4d9d497/636d52be324d854ed57020d6/1668797535403/Self+employed+medicare+premium+tax+deduction+.jpg?format=1500w

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

How To Claim Income Tax Deductions BusinessToday

https://akm-img-a-in.tosshub.com/businesstoday/images/story/201302/tax-benefits_505_012913031006_020113040452.jpg?size=948:533

Tax credits and deductions are available for persons with disabilities their supporting family members and their caregivers I want information on Disability tax credit Medical expenses Disability supports deduction With tax season upon us here are 5 things you should know about the different tax credits for a child with a disability plus the deductions and liabilities affecting families with children and adult

Disabled Access Credit This tax benefit allows eligible small businesses to claim a credit of up to 5 000 for expenses related to making their facilities accessible to Federal Tax Deadlines January 29 2024 will begin the IRS s 2024 tax season as they begin accepting and processing 2023 income tax returns Monday April 15 is the last

Tax Benefits For Disabled Individuals Blog

https://cajiteshtelisara.com/blog/wp-content/uploads/2020/08/80U-770x367.jpg

Why Disability Activism Needs To Be More Inclusive Of People Of Color

http://everydayfeminism.com/wp-content/uploads/2016/11/disabledpoc.jpg

https://www.irs.gov/individuals/more-information...

Disability tax benefits As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found

https://cleartax.in/s/section-80u-deduction

Section 80U offers tax benefits if an individual suffers a disability while Section 80DD offers tax benefits if an individual taxpayer s dependent family member s suffers from a disability This article is

Help Disabled Persons Volunteer Work Sports And Rehabilitation

Tax Benefits For Disabled Individuals Blog

Alabama Disability Application Printable

Income Tax Benefits For Salaried Persons A Y 2024 25

Rahul Gandhi Why Tax Products For Physically Handicapped People

Disabled Person Can Claim Up To Rs 1 25 000 Tax Deduction

Disabled Person Can Claim Up To Rs 1 25 000 Tax Deduction

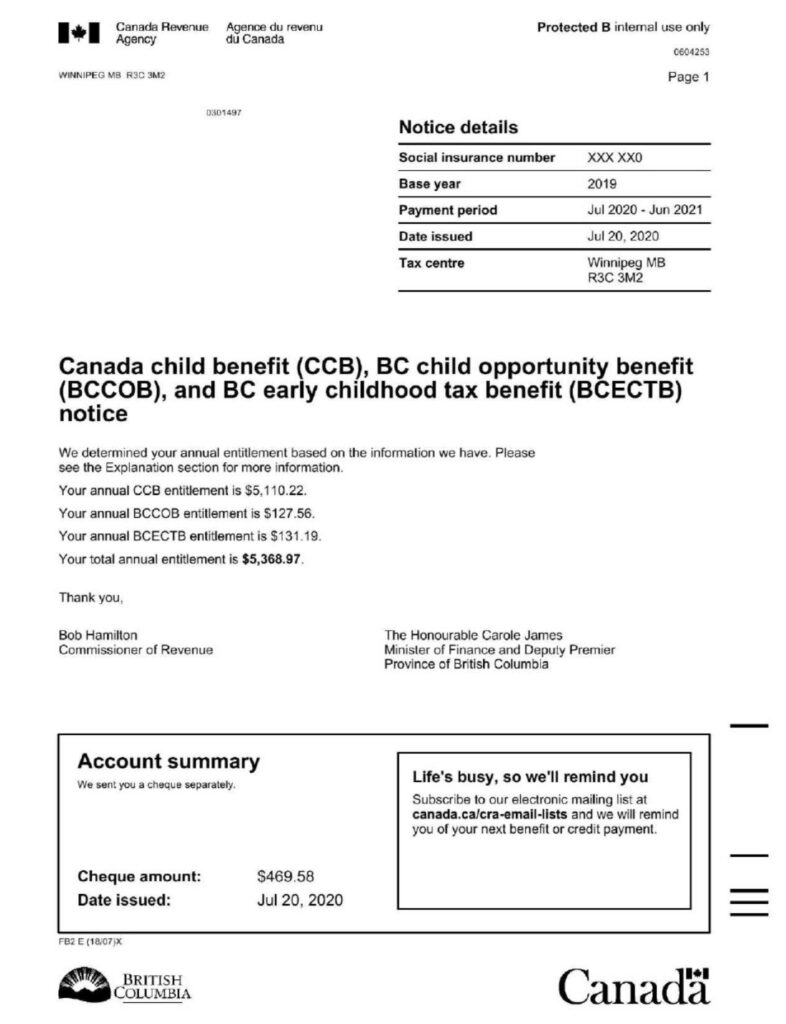

How To Find Out Child Benefit Number Wastereality13

How You Can Get Tax Breaks For Hiring The Handicapped Business

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Tax Benefit For Handicapped Person - If you re disabled and receive Social Security disability benefits either SSDI or SSI you can qualify for certain tax credits These credits will reduce the taxes you