Tax Benefit On Car Loan For Salaried Employees According to the rule salaried professionals cannot get tax benefits on car loans Only business owners and self employed individuals can get those benefits and exemptions Cars for personal use are luxury products whereas the cars

Is there any tax benefit on car loans for salaried employees Salaried employees usually cannot claim tax benefits on car loans unless the vehicle is an electric vehicle EV Tax benefits on the car lease facility provided by the employer can be claimed depending on the ownership of the car and expenses incurred Read more here

Tax Benefit On Car Loan For Salaried Employees

Tax Benefit On Car Loan For Salaried Employees

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/itr-for-salaried-person.jpg

Tax Planning For Salaried Employees Deductions Available Based On

https://vakilsearch.com/advice/wp-content/uploads/2019/02/Tax-Planning-for-Salaried-Employees-Deductions-available-based-on-investment.jpg

Top 5 Tax Saving Instruments And Investment For Salaried Employees In

https://2.bp.blogspot.com/-PyXH8Ttcicg/VjShW4g1vfI/AAAAAAAAEEI/tvYGo751Eog/s1600/TaxSavingFixedIncome%2BInvestment%2Bunder%2B80C.JPG

As salaried individuals cannot treat loan interest payments as an expense no tax benefit on a car loan for salaried employees is available As a salaried person you can only get a tax benefit Salaried employees cannot claim tax benefits on a car loan However self employed individuals or business owners can avail of tax benefits on the interest payment of

If the car is used for personal purposes by the employee whether it s owned by the company or personally the expenses incurred against fuel car maintenance and driver s salary is fully taxable How To Claim Car Loan Tax Benefit Since automobiles are regarded as luxury goods car loans are not exempt from taxes for salaried employees Therefore obtaining a car loan will not help

Download Tax Benefit On Car Loan For Salaried Employees

More picture related to Tax Benefit On Car Loan For Salaried Employees

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

Features Benefits Of Taking Car Loan Bank Of Baroda

https://www.bankofbaroda.in/-/media/project/bob/countrywebsites/india/blogs/loansborrowings/images/cluster/features-and-benefits-of-car-loan.jpg

Financial Planning For Salaried Employee Things To Know Merrymind

https://merrymind.in/wp-content/uploads/2020/05/59.jpg

Therefore there would no treatment of the interest paid on Car Loan by the Salaried Employee In such cases where the Car is being used for Business purposes the interest paid on Car Loan There are no Car Loan tax benefits for salaried employees However you can claim deductions when filing tax returns if you re a self employed professional or business owner The interest

Yes a Car Loan can help you save on tax if you are a self employed professional or business owner and use the car for business purposes But a salaried employee cannot claim tax Claiming Car Loan Tax Benefits for Salaried Employees Salaried employees can claim tax deductions on two components of their car loan repayment Here s how to claim

Income Tax Exemptions For Salaried Employees Sqrrl

https://wp.sqrrl.in/wp-content/uploads/2021/03/Income-Tax-Exemptions-for-Salaried-Employees.png

PERSONAL LOAN FOR SALARIED EMPLOYEES YouTube

https://i.ytimg.com/vi/QVxpG4GtslQ/maxresdefault.jpg

https://www.idfcfirstbank.com/finfirst-blogs/c…

According to the rule salaried professionals cannot get tax benefits on car loans Only business owners and self employed individuals can get those benefits and exemptions Cars for personal use are luxury products whereas the cars

https://pkcindia.com/save-tax-when-buying-a-car

Is there any tax benefit on car loans for salaried employees Salaried employees usually cannot claim tax benefits on car loans unless the vehicle is an electric vehicle EV

How To Get An Instant Loan For Salaried Employees InstaMoney

Income Tax Exemptions For Salaried Employees Sqrrl

Personal Loan For Salaried Employees Interest Rates 2023 Apply Online

Personal Loan For Salaried Employees

Income Tax Benefits For Salaried Persons A Y 2024 25

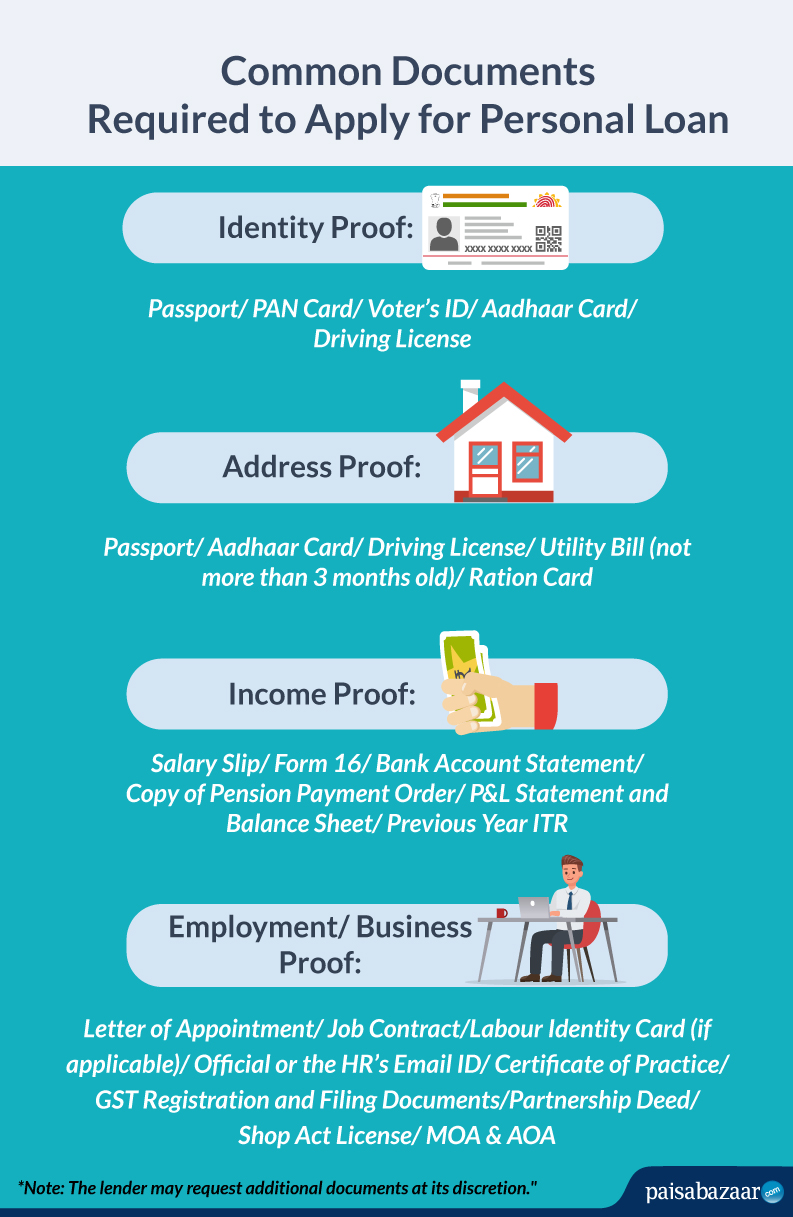

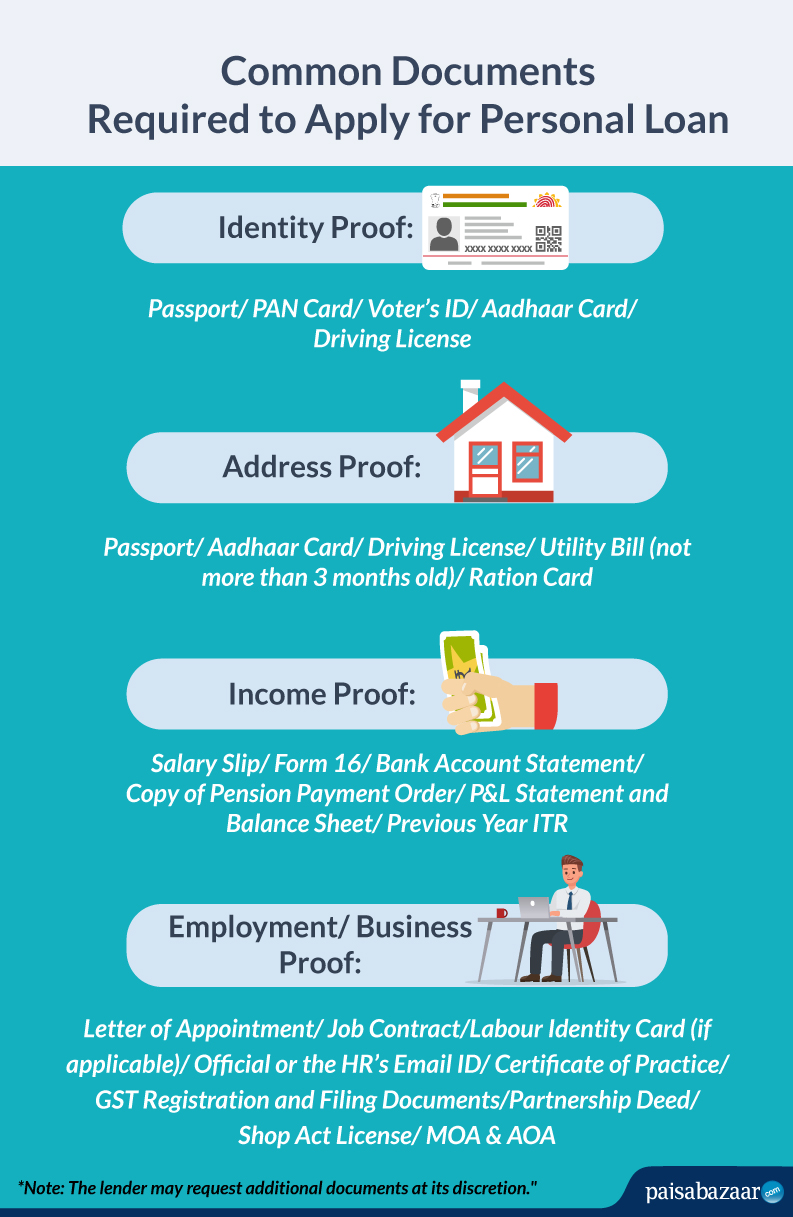

Personal Loan Documents Required For Salaried Self Employed

Personal Loan Documents Required For Salaried Self Employed

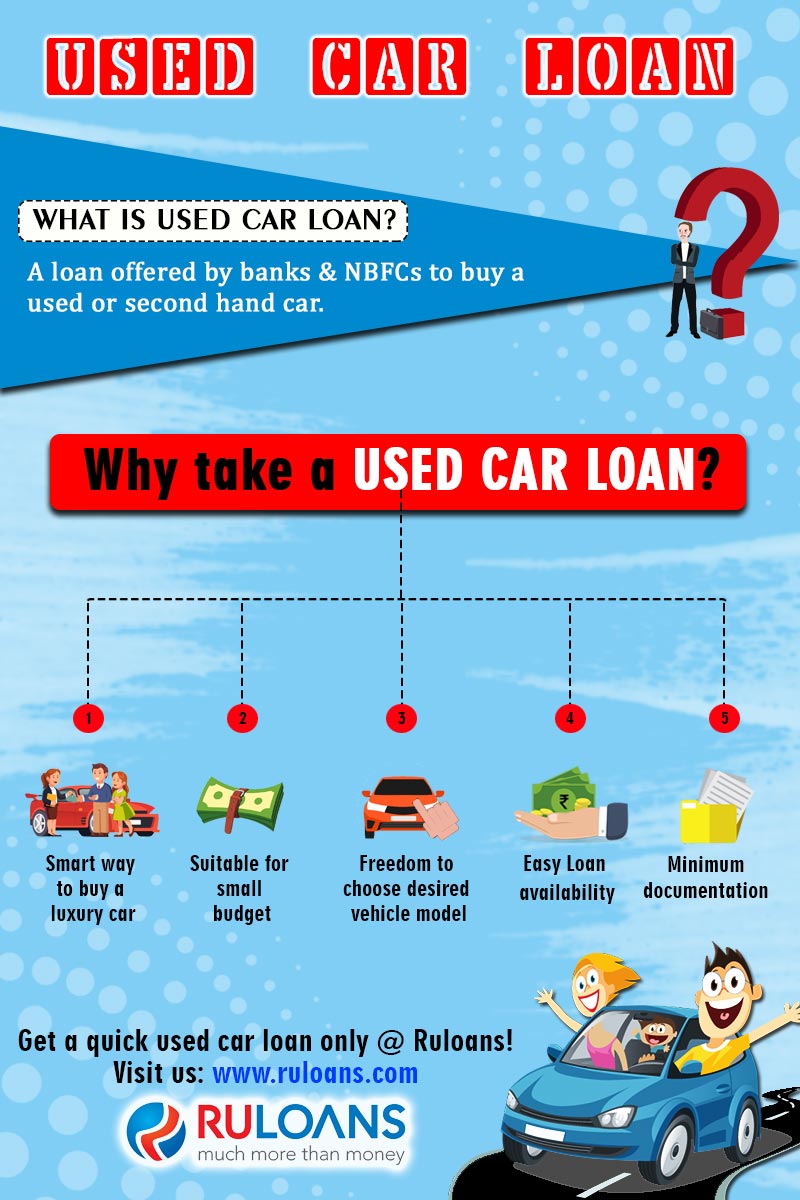

Used Car Loan Car Loan Ruloans

Home Loan Apply Online For Housing Loan With HHFL

How To Save Income Tax On Salary In India 2020 Income Tax Income Tax

Tax Benefit On Car Loan For Salaried Employees - There are tax benefits on loans to buy electric cars And these tax benefits are for everyone Does not matter whether you are salaried or self employed or you use the car for