Tax Benefit On Donation To Temple Donations to religious institutions are taxed under Section 80G of the Income Tax Act where upto 50 of the amount donated is deductible

Donors can participate in the construction of the grand temple for Sri Ram at Ayodhya by donating to the Shri Ram Janmabhoomi Teerth Kshetra Trust Donations to the trust are eligible for deduction under section 80G of the income tax act Section 80GGA of the Income Tax Act 1961 provides a significant tax benefit for taxpayers in India It allows for a 100 deduction on donations made towards specific scientific research and rural development initiatives

Tax Benefit On Donation To Temple

Tax Benefit On Donation To Temple

https://images.sampletemplates.com/wp-content/uploads/2017/03/Tax-Donation-Receipt-Letter1.jpg

Tax Deductible Donation Receipt Template Resume Examples

https://www.rudolfbarshai.com/wp-content/uploads/2019/09/donation-letter-template-for-tax-purposes.jpg

Payment Of Donation You Can Get Tax Benefit On The Money You Have

https://img.etimg.com/thumb/msid-74395682,width-640,resizemode-4,imgsize-331487/tax-benefit-under-section-80g.jpg

Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions ranging from 50 to 100 of the amount donated You can claim 50 deduction on your taxable income for donations made for renovation repair of the temple under Section 80G of the Income Tax Act provided you choose the old tax regime while filing your ITR

Taxpayers can avail of tax deduction under Section 80G under the Income Tax Act 1961 if they donate money to the Ram Mandir through the Shri Ram Janmabhoomi Teerth Kshetra Trust You can claim the section 80G deduction only if you have donated for the repair and renovation of the Ram Temple Donations made for other activities such as religious events or welfare programs are not eligible for tax deductions You can claim 50 of the donated amount as a tax deduction

Download Tax Benefit On Donation To Temple

More picture related to Tax Benefit On Donation To Temple

Editable Free Tax Receipt For Donation Templateral Tax Receipt For

https://i.pinimg.com/originals/88/49/6d/88496d91d13bcb909c03ec93216394a1.jpg

Tax Donation Receipt Template DocTemplates

https://printabletemplates.com/wp-content/uploads/2020/07/donation-receipt-template-18-580x751.jpg

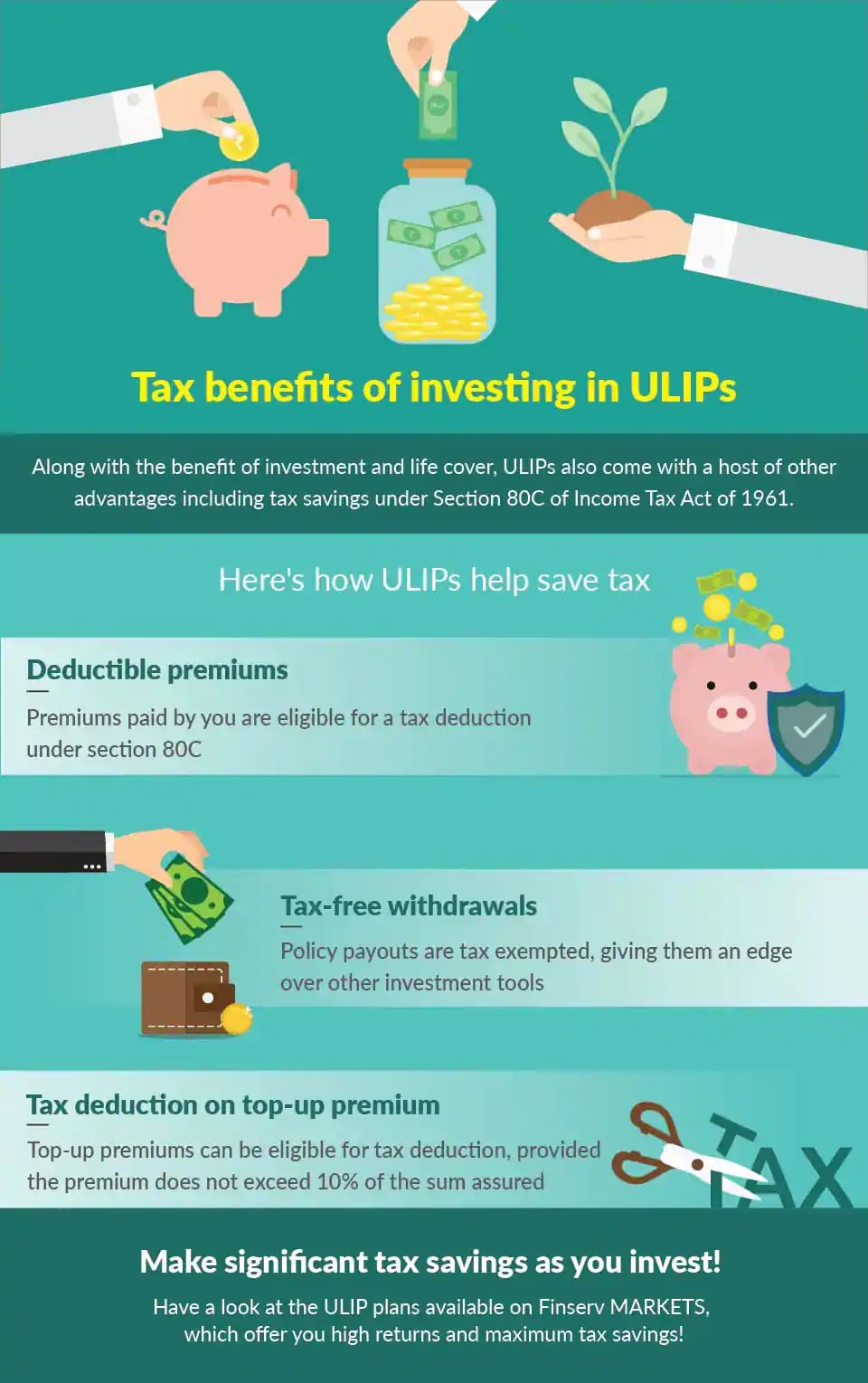

Know Everything About The Tax Benefits Of ULIPs

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/ulip/support-page/ulip-tax-benefits-new.png

You can claim 50 deduction on your taxable income for donations made for renovation repair of the temple under Section 80G of the Income Tax Act provided you choose the old tax regime while This means donation to the temple will get tax exemption The Central Board of Direct Taxes CBDT has issued a notification under section 80G of the Income Tax Act

To calculate temple donation tax exemption you must know that your donation is eligible for a 50 deduction subject to 10 of adjusted gross total income if you donate for repair or renovation of any temple mosque gurudwara church etc that have been notified You can claim a 50 percent deduction from your taxable income on donations made for renovation repair of the temple under Section 80G provided you choose the old tax regime while filing

6 Free Donation Receipt Templates Word Excel Formats

https://www.dailylifedocs.com/wp-content/uploads/2017/02/donation-receipt-template-FFFF-791x1024.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

https://life.futuregenerali.in › life-insurance-made...

Donations to religious institutions are taxed under Section 80G of the Income Tax Act where upto 50 of the amount donated is deductible

https://www.business-standard.com › finance › personal...

Donors can participate in the construction of the grand temple for Sri Ram at Ayodhya by donating to the Shri Ram Janmabhoomi Teerth Kshetra Trust Donations to the trust are eligible for deduction under section 80G of the income tax act

What Are Reuluations About Getting A Home Loan On A Forclosed Home

6 Free Donation Receipt Templates Word Excel Formats

Tax Benefit On Education Loan Sec 80E

OPEX LMD

Why Do People Donate Hair In Temples Is It Auspicious

Three Temples In Panchkula Get Rs 69 96L As Donation In Two Days

Three Temples In Panchkula Get Rs 69 96L As Donation In Two Days

Can I Claim Both Home Loan And HRA Tax Benefits

US Nanny Institute Happy Volunteer Family Holding Donation Boxes

Income Tax Benefits On Home Loan Loanfasttrack

Tax Benefit On Donation To Temple - You can claim the section 80G deduction only if you have donated for the repair and renovation of the Ram Temple Donations made for other activities such as religious events or welfare programs are not eligible for tax deductions You can claim 50 of the donated amount as a tax deduction